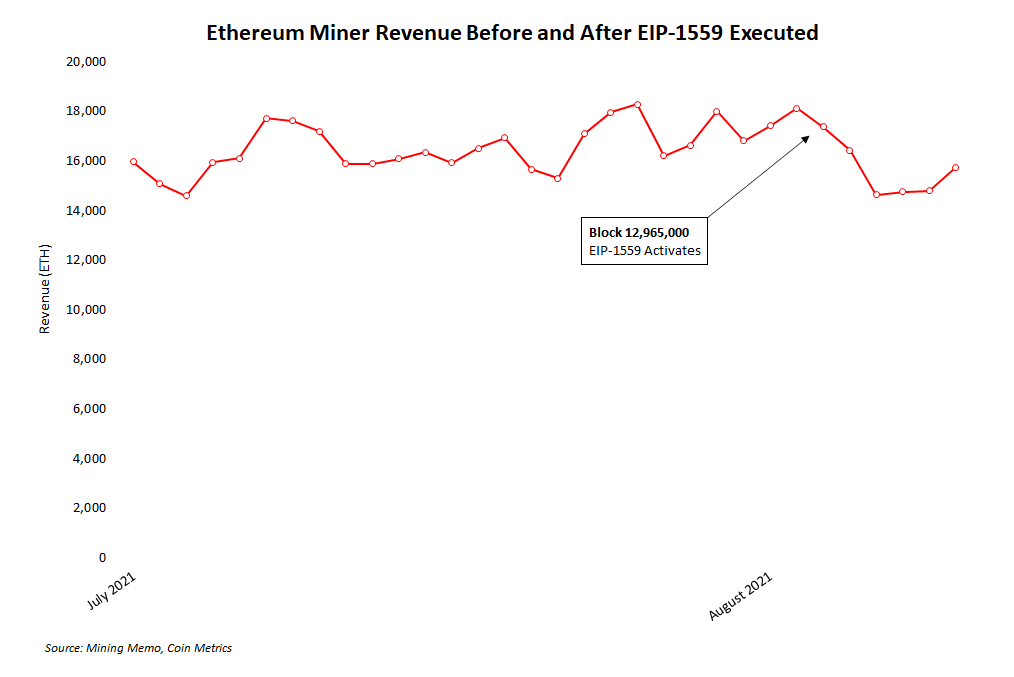

EIP-1559 executed on-chain last week. And although only a fraction of dapps are actively using the new transaction method, early data gives better insights into what miners can expect in terms of revenue compared to previous projections.

According to Etherscan, some 24,000 ether have been burnt since August 5. All that ether would have gone to miners as the majority of the transaction fee, but instead is burnt to the network, resulting in an estimated 13% drop in revenue versus the previous week when not including miner extractable value (MEV).

Want more mining insights like this?

Miners now only receive a fraction of their previous transaction revenue as a “tip.” Data from Dune Analytics shows miners getting about 10-15 gwei per block, which generalizes to anywhere between 10-20% of the burnt fee per block (a.k.a., basefee).

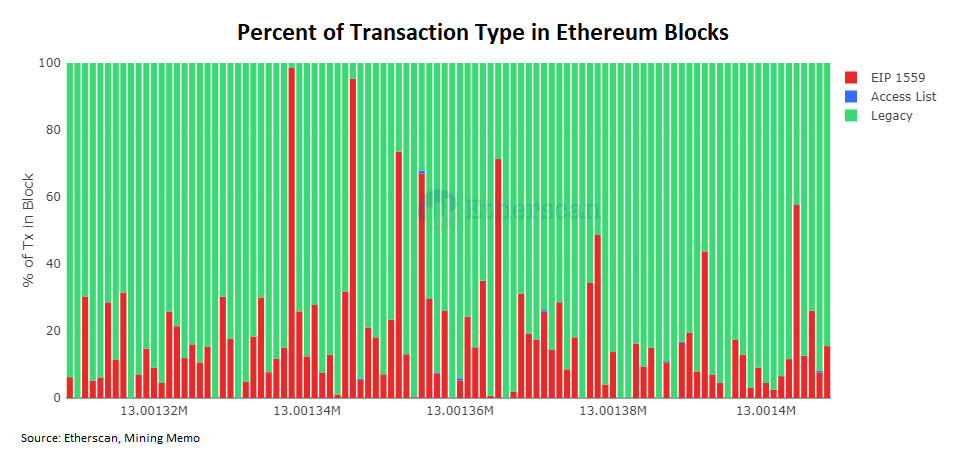

The tip could certainly sink lower going forward, as only a handful of applications have updated to the new transaction type. Wallets and other products are often using the legacy format which lets users specify a maximum gas fee per transaction as opposed to the new format which gives an encouraged estimate based on the demand to transact.

Many dapps and exchanges like as Coinbase or Argent are playing it safe to see how EIP-1559 performs on-chain and sticking with the legacy format. This practice likely leads to “over-tipping.”

Indeed, the tip mandates a 1 gwei fee to compensate miners for extra uncle risk (the risk of stale blocks resulting from larger block sizes). At 10-12 gwei tips, users are paying 10x over the protocol’s minimum tip.

Miners may be focused on revenue, but developers and investors are eyeing the burn rate of ether to find deflationary events spurred on by burnt transaction fees. For this to occur, burns have to be greater than both the coinbase and uncle reward, or about 2 ether. So far only a few have happened amounting to about 2-3% of total blocks since the swap.

Although a low percentage, more on-chain activity helps boost miner revenue not only through tips, but also asset appreciation through ether burns. Depending on how tips and burns shake out, both could be a revenue patch for ether miners.