Ethereum is set to introduce one of the largest technical changes to any in-production blockchain on Wednesday, and the stakes are high. How EIP-1559 executes will have permanent implications for users, wallets, dapps and miners through a redesign of the network’s transaction fee model.

The change will make the user experience for the vast majority of Ethereum products more friendly. But miners will experience heartache given a projected 20-30% decline in revenue. A drastic decrease in miner extractable value (MEV) rewards since May’s price correction makes a bleak situation look even worse.

Want more mining insights like this?

The basics of EIP-1559

(If you’re up-to-date on this EIP, skip to the next section.)

EIP-1559 is a multifaceted alteration to the traditional ways-and-means of transaction inclusion. Typically, blockchains include transactions on-chain in blocks when a fee is paid. Miners order transactions by highest fee paid before publishing the block to the network.

A strength of this system is the network’s overall responsiveness to a user's time sensitivity. A weakness (as claimed by Ethereum developers) is the block size’s inflexibility leading to fee volatility. For example, 2020’s Black Thursday saw fees reach historic highs as users attempted to exit the same narrow door at once with ether’s price crash. But what if the door could grow wider and narrower based on demand?

EIP-1559 does this with three key features:

- A block can double in size from 15 million gas to 30 million gas depending on demand to settle on the previous block.

- Transaction fees are determined algorithmically based on prior block inclusion demand and burnt to the network (BASEFEE).

- An optional “tip” to miners adds a fast pass for time sensitive transactions.

With the change, users should expect to pay a fairly stable price quote determined by the network while miners should expect a reduction in revenue. The programmatic burning of ether per transaction should also act as a new supply constraint on ether. Of course, to what degree burning ether helps the price is an open question.

What EIP-1559 means for miners

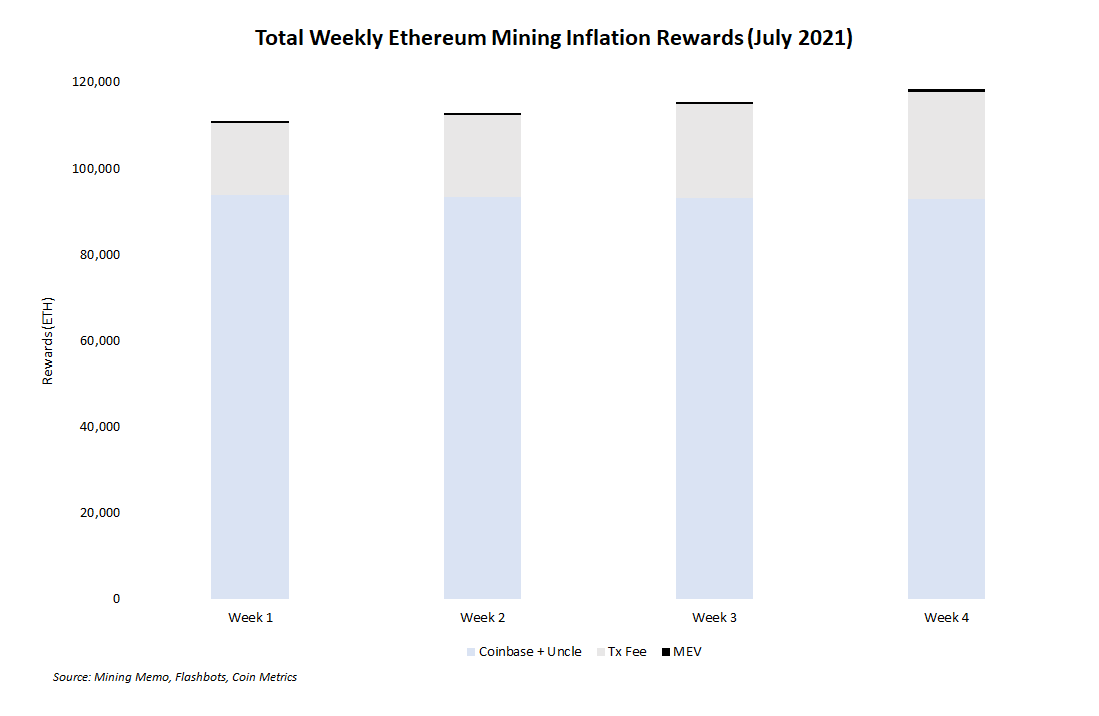

Ethereum miner revenue includes three values:

- Inflation rewards (coinbase + uncle)

- Transactions fees

- MEV rewards

Prior modeling indicated miners would suffer a 20-35% reduction in revenue with transaction fees taken off the table. This value seems consistent with July’s on-chain activity, but as noted further down, one major revenue stream dried up as the ecosystem continued to recover from May’s severe price correction.

EIP-1559 does include an option tip. But both a variable block size soaking up excess demand and maturity of relay networks (Flashbots, MinerDAO, etc,) are expected to reduce the use of any tips dramatically.

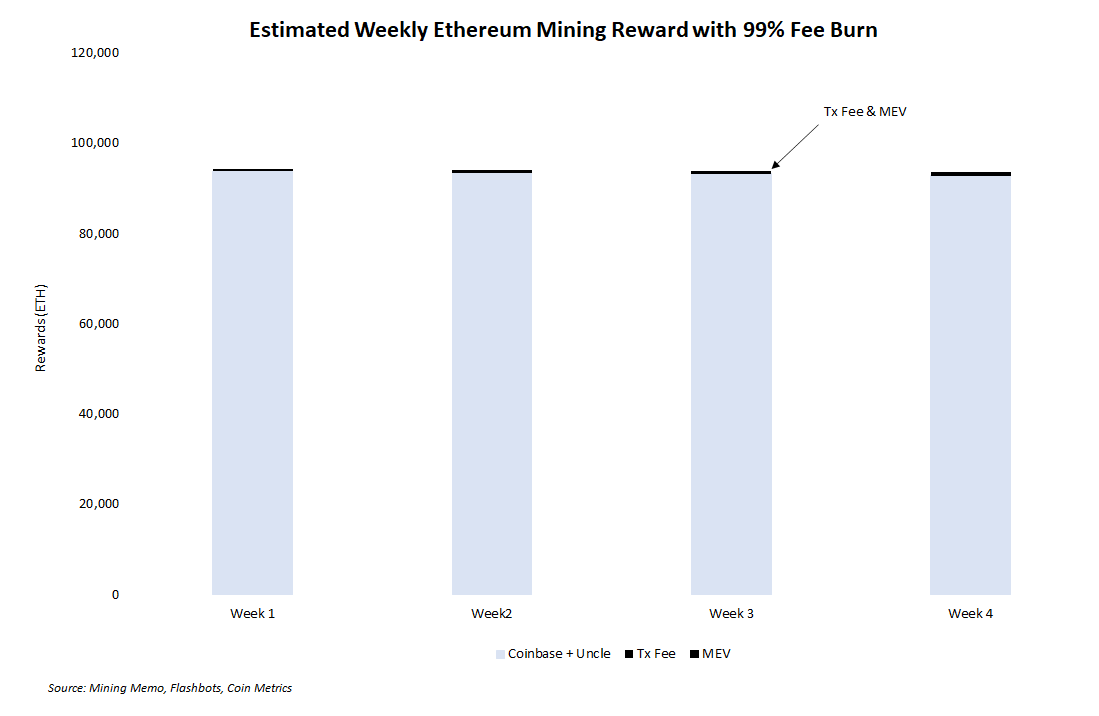

Here's the same revenue projected with the 99% fee burn.

Based on July’s on-chain market, we see that miners should expect inflation rewards to make up a majority of their revenue going forward.

Less MEV than expected?

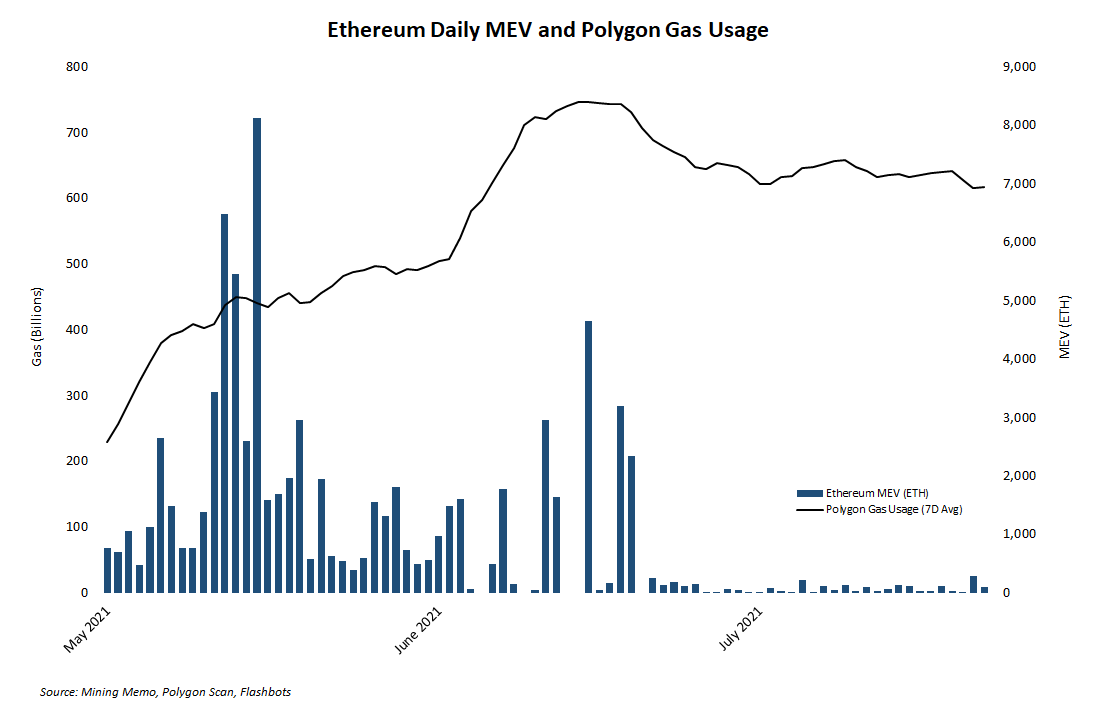

Miners have yet one more disappointment going into EIP-1559: A dramatic drop in the value of MEV in both dollar and ether terms since mid-June. Indeed, over 80% of Ethereum miners altered their clients to take advantage of MEV post-EIP-1559. Now, that value has left the chain. Why?

Two factors seem to be at play here:

- A drop in on-chain activity as indicated in lower gas fees since ether’s May price correction.

- The use of the Polygon Network, a throughput solution for Ethereum transactions, since mid-May as a substitute for settling on Ethereum’s main chain.

The data indicates that much of the MEV that would have otherwise been caught on Ethereum has drifted to Polygon. While good for gas fees and users, its a negative for miners.

The takeaways

July’s data shows that the rise of Layer 2’s is a short term negative for expected mining revenue as MEV may not be the income supplement miners expected. And, like transaction fee revenue in general, there is a cyclicity to MEV revenue miners should be aware of.

Inflation rewards will make up an increasingly large part of a miners revenue stream. On the more positive side, the very technological changes taking fees away from miners may happen to bolster the value of the underlying asset.