A bitcoin mining pool’s payout structure determines when and how much a miner gets paid. There are over 10 different types of payout structures used across all pools. Miners should carefully consider payout structure before joining a pool. This article highlights the most common payout structures and breaks down the nuances among them.

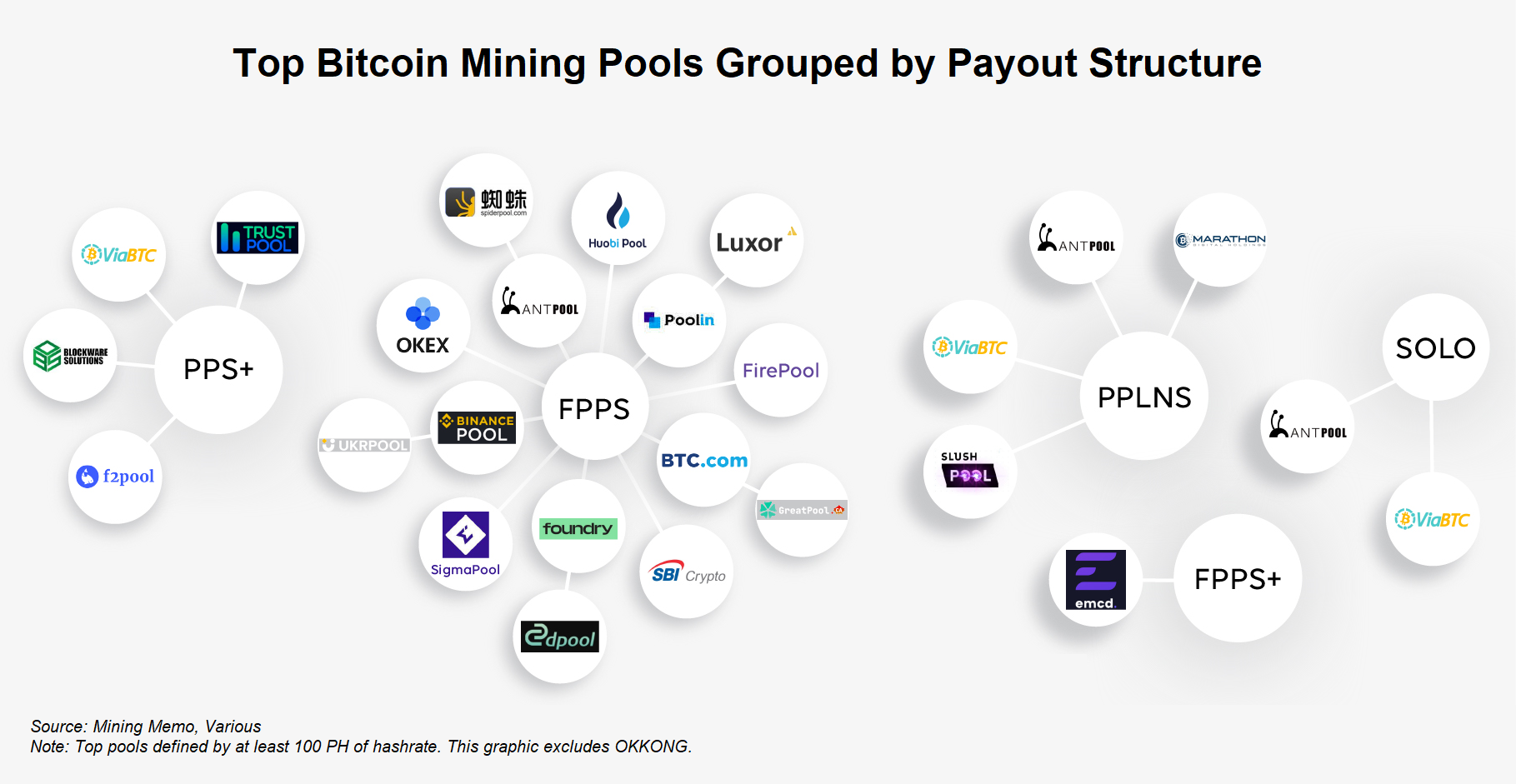

The most common payout systems among the top pools with at least 100 PH at the time of writing are:

- Pay Per Share Plus (PPS+)

- Full Pay Per Share (FPPS)

- Full Pay Per Share Plus (FPPS+)

- Pay Per Last N Shares (PPLNS)

- Solo.

Want more mining insights like this?

The data below groups the top bitcoin mining pools by reward payout systems. FPPS is the most common structure. Some mining pools offer more than one type of payout system.

It’s important to understand that the risks and benefits per payout system differ for miners and mining pool operators. Miners should familiarize themselves with the trade-offs associated with each system before deciding which pool to join.

Read: How are pool miners paid?

The “luck” factor

“Luck” is the short term variance in a miner’s collected rewards. In mining, being “lucky” means finding and collecting a block reward before expected or collecting a larger reward in comparison to your hashrate.

On the other hand, being “unlucky” means collecting less rewards than expected in relation to your hashrate. This luck (variance) only matters in the short term. In the long term, miners collect rewards proportional to their share of the overall hashrate and the variability of good and bad luck events will even out. Luck averaged over more blocks means fewer extremes.

Payout options overview

To mitigate the uncertainty that comes with luck, miners can join a PPS or FPPS pool. These pools eliminate income variations for miners; the miner will always know what their expected payout will be. The pool operator takes on the variance risk. However, if pool operators don’t deploy strategic risk management, they will become insolvent. In this event, the miner is left with lost income. The key distinction between PPS pools and FPPS pools is the inclusion of a transaction fee payout in FPPS pools.

Very few pools offer PPS payouts due to the risk. PPS and FPPS pools typically come with higher fees with FPPS pools carrying the highest fees vs other payout systems.

The opposite is true for PPLNs pools. PPLNs pools will typically offer lower fees to compensate miners for assuming luck (variance) risk. Miners get paid only when the pool solves a block and collects the reward. The miner’s payout is determined by the amount of shares that they contributed in the time period before winning the block. This system rewards loyal pool members and discourages pool hopping. If a miner disconnects from a PPLNS pool, all shares that they contributed before a block find are lost.

Solo mining pools mine independently, this is only feasible for large scale miners.

While the payout system is a key factor in deciding which pool to join, miners should also consider a pool’s reputation, software services, UI/UX, and customer service quality.