Hash price is a critical metric that bitcoin miners use to measure their current and potential revenue. Hash price is the amount of bitcoin a miner can expect to earn per TH/s or PH/s (1PH/s = 1,000 TH/s) per day. Miners can denominate hash price in USD (or local currency) for an alternate revenue metric. By denominating revenue per hash, miners can uniquely assess the earning potential of a particular ASIC, a warehouse filled with different hardware, or even an entire company fleet of ASICs. By better exploring how the various inputs contribute to hash price miners can anticipate and adjust their operations with greater efficacy and precision.

Hash price inputs

Hash Price is revenue per amount of TH/s, where revenue is a function of the current block subsidy, transaction fees and mining difficulty. Block subsidies and transaction fees are also subject to bitcoin’s fiat exchange rate. As BTC’s USD price increases more than the cost of electricity, new hashrate tends to come online, affecting block times and thus hashrate. The new hashrate online means blocks are mined faster than the desired 10 minute average, triggering the mining difficulty level to adjust and make mining a block more difficult and thus require more time, on average. To better understand how hash price dynamically interacts with changes in BTC’s price and average transaction fee amounts, let’s assume the hashrate and difficulty level remain constant.

Exploring hash price changes

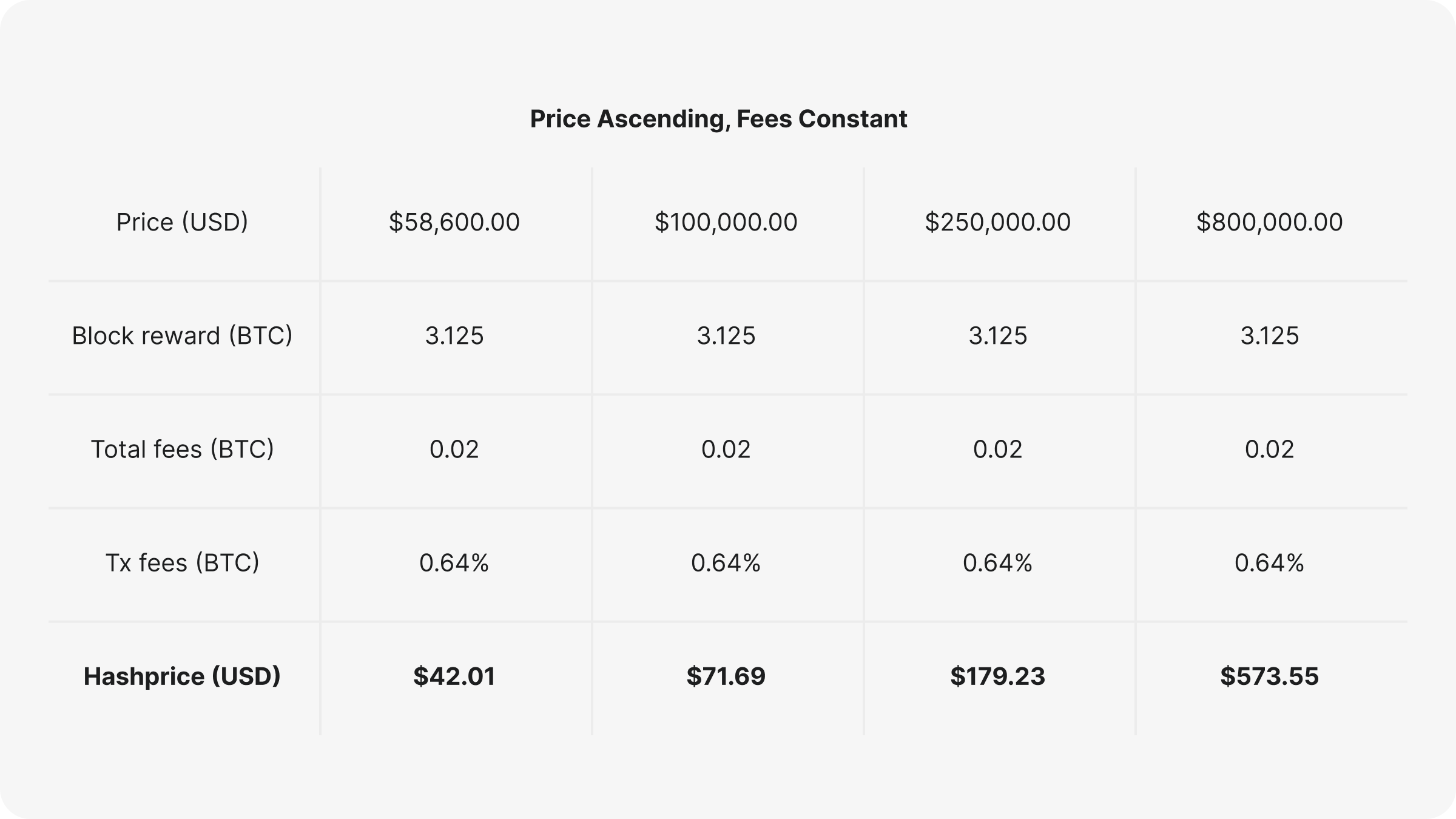

The table above shows how hash price responds to changes in BTC’s price as it approaches the market capitalization of gold (~$800k per bitcoin). Assuming all other variables remain unchanged, for every 1% increase in BTC’s USD price, bitcoin miners can expect a 1% increase in hash price or miner revenue.

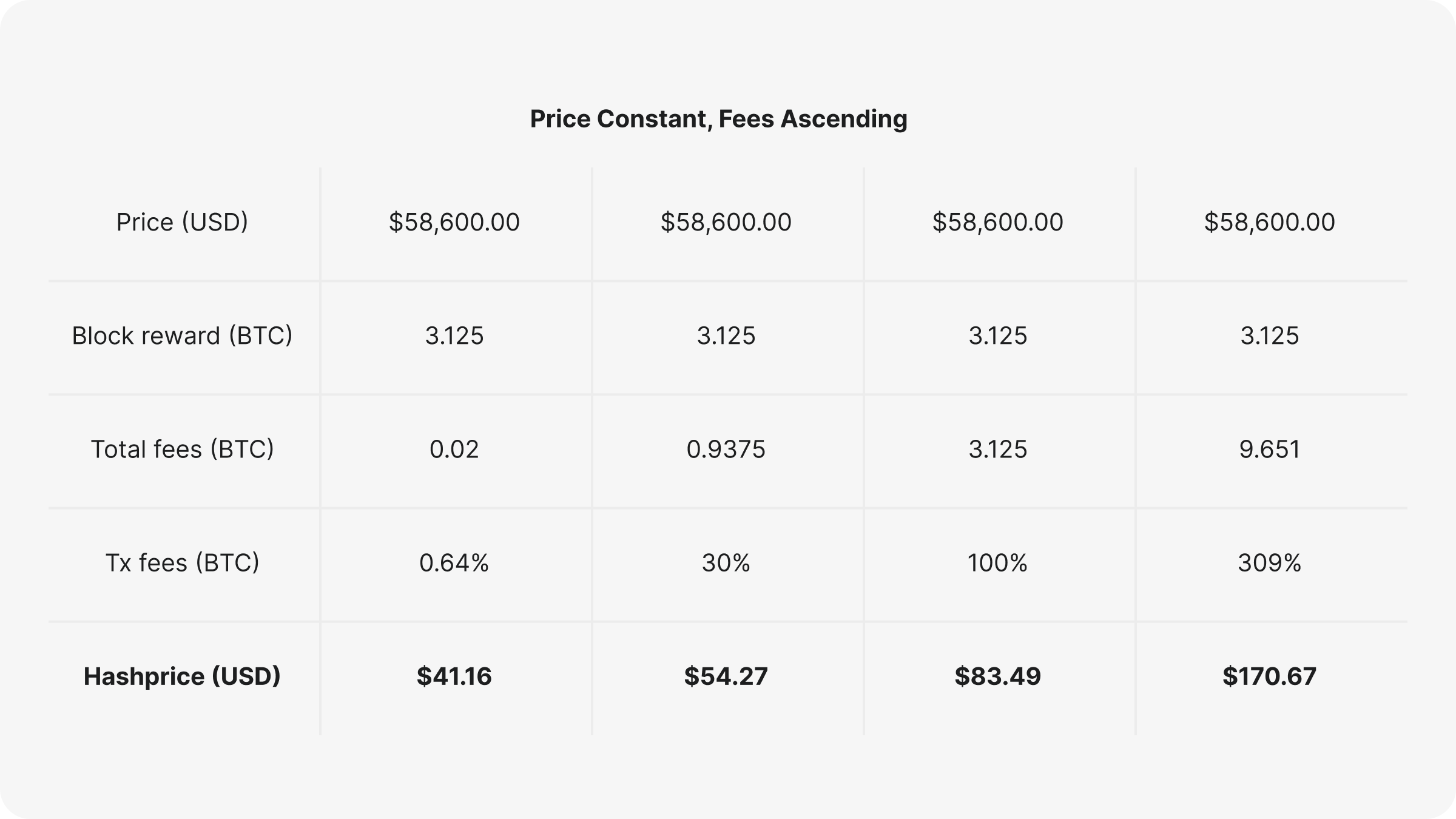

Next, let’s explore how hash price responds when BTC’s price remains constant, but transaction fees ascend towards the highest block fee daily average recorded on mempool - 9.651 BTC on December 22nd, 2017 around block height 500535.

As bitcoin miner revenue ascends from the current state of lean blocks with small fees to the largest fees (BTC denominated) in bitcoin history, the important role transaction fees play in bitcoin miner revenue comes into focus. In 2017 and late 2023, transaction fees increases were met by a large appreciation in BTC price, clouding the independent impact of rising transaction fees. The table above shows how incremental increases to average transaction fees raise hash price and miner revenue. Like BTC’s price, average transaction fees linearly impact hasprice, thus a 1% increase in average tx fees, assuming all else remains equal, has a 1% increase on hash price.

In the future, many Bitcoiners agree that transaction fee levels will likely sustain much higher averages than we have seen historically in bitcoin mining. It isn’t hard to imagine a world with increased demand for block space, especially if blockspace continues to gain additional utility in future epochs. Thus, it is worth exploring how a higher sustained average transaction fee, much greater than the summer of 2024’s average transaction fees per block (~0.02 BTC), would impact hash price in an ascending price environment.

To little surprise, a bitcoin market cap equaling gold, with elevated transaction fees, would yield a tremendous hash price with today’s block subsidy. We are unlikely to reach a $800k BTC price and near 1 BTC average tx fees this epoch, but if we were to reach those levels, hash prices would rise to a whopping $740.87.

Even as BTC prices are currently near and will eventually surpass all time highs, continuous declines in hash price are to be expected due to the rising global hashrate and competition among miners. Instead of waiting for future soaring hash prices, bitcoin miners can counter the lower hash prices by obtaining newer, more efficient machines today. For example, the latest S21 Pro ASIC boasts higher levels of efficiency than any ASIC before. Even with a hosting fee of $0.08 USD/KWh, the S21 Pro can buy a petahash at $35, which is still well below the lowest hash price levels of 2024, while the S19J Pro is buying a petahash at around $60, well above today’s hash price of ~$42.

As hash price continues to fall, the pressure to increase operational efficiency remains stronger than ever for miners who one day hope to see an $800k bitcoin with hundreds of dollars worth of hash price. Until that day, miners who upgrade their fleets, acquire competitive energy pricing and take advantage of increased transaction events, like the Runes launch post Halving, will stay above water until the rising tide of Bitcoin adoption and global hash price lift all bitcoin mining boats.