So, you are mining now…or you are considering it. But what US taxes apply to Bitcoin Mining? And how can you plan to avoid painful surprises?

First, a Bitcoin miner, whether an individual or a corporate entity, is expected to pay taxes in two cases:

- Income Tax – When one receives BTC mining rewards.

- Capital Gains Tax - When one disposes of or sells these BTC mining rewards

Income taxes

Generally, rewards received from mining are taxed as ordinary income. For individuals, federal, state and local taxes are based on ordinary income. However, for corporate filers, tax is calculated and payable on net income (revenue, less deductible expenses). Therefore, an individual’s tax obligation on mined bitcoin is calculated as the sum total of: the fair market value (FMV) of each bitcoin block reward at the time of receipt.

And for a corporate filer, the revenue for the miner is calculated as the sum total of: the fair market value (FMV) of each bitcoin block reward at the time of receipt, less any deductible expenses.

For example:

If an individual mined (received payout from the pool) 1 BTC on the 15th of August, valued at $50,000, the individual has taxable income of $50,000. And the tax can be estimated using the individual’s specific income tax bracket and associated tax rate.

If that same miner was a corporate filer and mined (received payout from the pool) 1 BTC on the 15th of August, valued at $50,000, then the corporate has a reportable revenue of $50,000. However, they may have deductible expenses (covered in detail later), and a resulting taxable net income of less than $50,000. Note that the applicable tax rate/s is going to depend on other factors outlined later, including the type of entity and its tax classification and domicile of the entity.

The tax rate depends on the income tax bracket applicable to the individual or filing entity, and outlined by the federal income tax brackets and associated rates for the tax year. Miners should ensure their tax planning considers state and local taxes as well. Therefore, ordinary income tax rates and capital gains tax rates will vary based on the filing status of the taxpayer, their location, and even their prior year filing.. For example, an individual operating their own mining business through a single-member LLC will report the taxes on their Form 1040 individual tax return. As such they will incur self-employment tax and their ordinary income and capital gains tax rates will differ from that of a C-Corporation.

Is income from Bitcoin mining double-taxed?

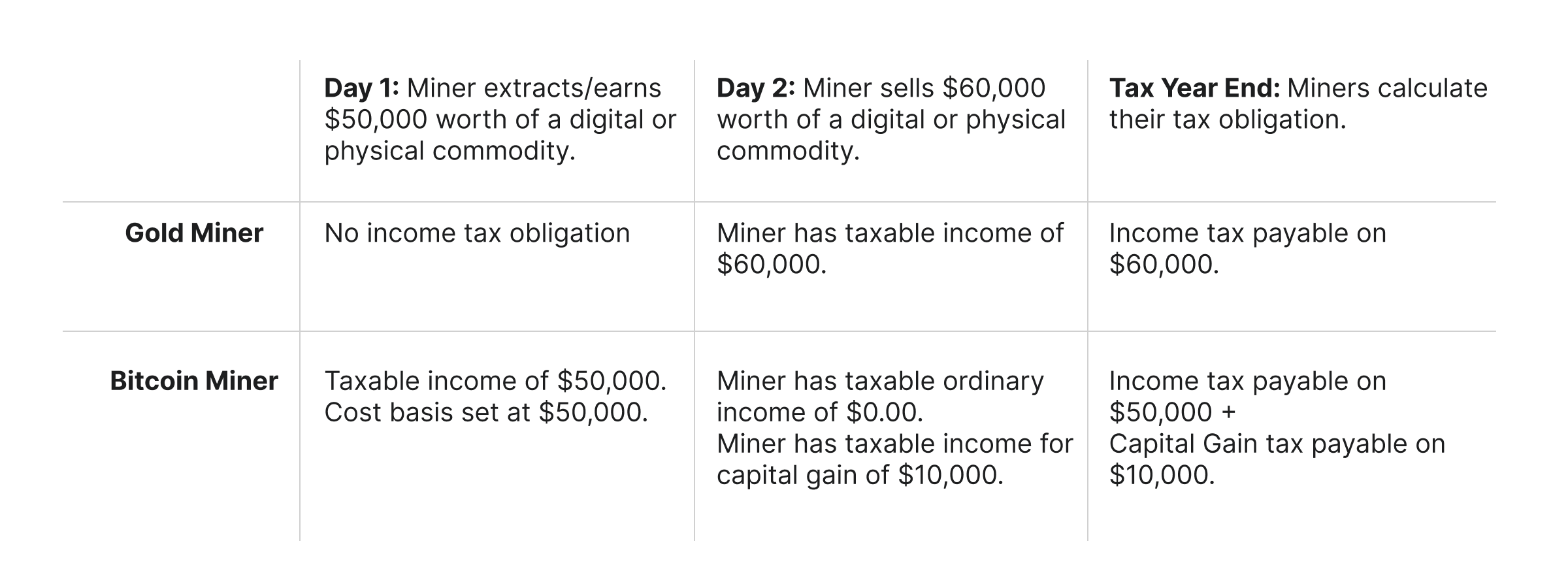

Whether income from mining is double taxed or not is a common debate. In some respects, this gripe is not unfounded. For instance, gold miners do not have to treat extracted gold as income at the FMV at the time of extraction, they only have taxable income at the time of sale. In contrast, bitcoin miners have taxable income at the time of the reward, and also capital gain tax obligations for a later sale of mined coins. While we bitcoiners often use the analogy of mining to the meatspace extractive industry of gold mining, IRS views the mining of bitcoin as the receipt of taxable property in exchange for a service (network security), whereas mining for gold does not provide such a service. However, bitcoin mining is taxed similarly to other productive industries.

So, while frustrating, the income from mining is only taxed once as income. The recognition of this income sets the “cost basis” for your bitcoin, and later sales of bitcoin property are subject to capital gain/loss (the value received for the disposition, less the cost basis for those units disposed of).

Consider the general example of a bitcoin miner, vs. a gold miner.

Capital gains/loss

Capital gains tax is a form of income tax specific to the disposition of property or other assets. Capital gains or losses are recognized at the time one “disposes” of or sells their mined cryptocurrencies. This includes trading, where you exchange your crypto for another crypto or fiat, and other dispositions such as using bitcoin to pay for services or goods.

As noted in the example above, if, on August 15, 2024, you mine BTC worth $50,000 and later sell the BTC at $60,000. You will recognize a capital gain of $10,000, and tax is payable on this amount depending on whether the bitcoin disposed of was held long-term or short-term..

The general capital gain formula is: Capital Gains = Market value at sale - Cost basis

Mining as a business vs. mining as a hobby

The distinction between mining as a business vs. mining as a hobby is determined by whether the activity qualifies as a trade or business under IRS rules, and to some extent whether the activity is organized through a corporate entity. The IRS has a set of factors for taxpayers and Tax CPAs to consider when determining if the activity is “hobbyist” in nature, or a trade or business.

A hobby is an activity that a taxpayer engages in primarily for pleasure, recreation, or sport, not necessarily for profit. Hobby expenses are generally deductible only to the extent of hobby income (ex. You cannot deduct losses to offset other income).

Since deductions are less available and higher risk, when mining as a hobby, you can form an LLC for accounting to take advantage of deductions.

A trade or business is an activity conducted with the intent to make a profit. Under the Internal Revenue Code (IRC) Section 162, a trade or business involves regular, substantial, and continuous activity with the primary motive of making a profit. Under a trade or business the taxpayer can deduct ordinary and necessary expenses incurred in carrying on the business, even if those expenses exceed income. Particularly important here is the ability for an entity to capture net operating losses which can be carried forward to future tax years.

Depreciation, Bonus Depreciation and Section 179 Depreciation

Section 179 Depreciation and Bonus Depreciation are the most discussed deduction provisions, offering advantages on tax but with different restrictions and purposes. Here again, such tax deductions only apply to trade or business activity and corporate filers (LLC, Partnership, C-Corps). This is a complicated area of tax planning and compliance, so miners are encouraged to work with a knowledgeable and experienced professional when planning for and utilizing such deductions. However, here are some basics to consider.

Generally, depreciation for accounting and tax purposes happens over the “useful life” of a business asset. And the IRS has categories of business assets, each including standard useful life. Generally, an asset is depreciated “straight line” over the life of the asset; however, there are myriad ways an asset depreciation can be accelerated (front loaded) for tax planning and compliance. Recent legislation brings yet more in the form of Bonus Depreciation and Section 179 Depreciation.

Section 179 Depreciation allows expenses to be deducted immediately (in the same tax year that the asset is purchased and put to use). However, the expense deduction is limited to a maximum of $1,050,000 per the 2023 requirement.

Bonus depreciation allows for the deduction of a significant percentage of expense on specific business assets within the first year of business. In 2023, the bonus depreciation deduction percentage was 80%. For instance, if you bought equipment for $200,000, you would deduct $160,000. For 2024, the year-1 % drops to 60%.

There are a few differences between section 179 and bonus depreciation. Bonus Depreciation is capped at a percentage, while Section 179 allows for the deduction of an entire expense (up to the cap). While Section 179 has a maximum limit, Bonus Depreciation does not.

With Section 179, the deduction cannot exceed your net income (or create net operating losses). Therefore, the business has to be profitable. This restriction does not apply to Bonus Depreciation.

Both Section 179 Depreciation and Bonus Depreciation can be used within the same tax year. For example, Section 179 will be used until the limit is met, and then Bonus Depreciation will be applied for the remaining asset costs. However, there are additional requirements for use of each of these methods, including the class of assets and the time the assets are placed into operation. Here again, consultation with a knowledgeable pro will help you navigate this complicated area of tax planning and compliance.

Apart from the two options, taxpayers can utilize the other available depreciation methods and deductions. These methods are generally less-accelerated and can result in more predictable net income. More predictable net income in future years may remove the tax surprise, as well as the depreciation recapture that can surprise taxpayers (discussed below).

Tax considerations for selling miners

When an individual filing as a trade or business, or a taxpaying entity, decides to sell mining rigs, there are two types of taxes to consider: depreciation recapture and capital gains.

What is depreciation recapture? If you sell an asset ) that you had been using for the crypto mining business, depreciation recapture allows the IRS to include the depreciation deductions, bonus depreciation deductions, and Section 179 depreciation deductions you benefitted from in prior years. Put simply, if you get a benefit by reducing taxable income in year 1 using accelerated depreciation, but then sell the asset you depreciated in year 2, the IRS requires taxpayers to include the depreciation when calculating realized taxable gains.

And in these cases, the calculation can get a little more complicated. A portion of the gain is considered ordinary income, and where there is an additional gain over the depreciated amount, it is considered a recognized capital gain. While corporations will generally pay the same income tax rate, whether the income arises from business revenue or the capital gain on the sale of business assets, the record-keeping requirements generally require the proper accounting of each.

For example, your business bought mining machinery for $30,000 and put it to use; in the same year, you claimed $5,000 in depreciation deductions. If, in year two, you sell this machinery at $31,000. The adjusted cost at the time you're selling is $25,000 ($30,000 - $5,000). Therefore, you will have recognized $6,000 on the sale ($31,000 - $25,000).

The amount gained ($6,000) exceeds the total depreciation deduction ($5,000). Therefore, $5,000 is recognized as ordinary income. Then, $1,000 ($6,000 - $5,000) is recognized as a capital gain. When the gain from the sale is less than or equal to the depreciation deductions, there is no capital gain.

Prepaid expenses

In mining, some of the expenses that can be prepaid include hosting, rent, electricity, and equipment. This is another area where accounting principles and tax principles require experienced aid. Generally, expenses should be recognized at the time they are actually incurred for accounting purposes, and for tax purposes the general “matching” principle applies such that a business cannot take the benefit of prepaid expenses which are not “matched” to the year the benefit or service is received.

An expense paid for in advance, for example, a two-year lease, can only be deducted in the year the expense applies. If you pay for this two-year lease at $20,000 ($10,000 per year), you can only deduct $10,000 for the current year. Then, the remaining $10,000 will be deducted in the next year.

Year-end Tax Planning

Taking the time for tax planning BEFORE year-end is a must for BTC miners. Assessing the BTC miner's taxable income before year-end will allow for other strategies to be employed during the tax year that would not be available if assessed at the filing date in April of the following year.

The quarterly tax payment is applicable if your expected year-end tax payment exceeds $1,000. Paying your estimated income tax every quarter can help you avoid a large tax bill at year-end. Quarterly estimates also will keep the taxpayer out of penalties and interest which are charged to taxpayers who did not make estimated payments. Most importantly, it will remove a situation many BTC miners undergo when facing a large “surprise” tax bill in April; having to unexpectedly liquidate BTC for USD to make the tax payments.

Some of the considerations that can benefit BTC miners in year-end tax planning include the need for quarterly Bitcoin mining tax and charitable contributions.Making donations in BTC or crypto can help you lower your tax bill due to charitable deductions. Donated crypto is counted as a tax deduction and allows you to avoid capital gains.

Potential tax benefits of Bitcoin Mining to HNWI and high earners with high incomes vs buying spot BTC

Bitcoin mining for HNWI may have more tax benefits than buying Bitcoin on the spot.

Mining as a business is not a simple task and comes with a significant capital requirement. HNWI should consider all of the variables and ensure they understand all that comes with running a mining operation as a trade or business. That being said, the taxpayer can capture deductible expenses, which are not available for BTC buyers. These expenses can be advantageous for HNWI to take advantage of as they accumulate BTC.

LLC vs. non-LLC

Forming an LLC benefits Bitcoin miners but does not alone help with paying less taxes. The benefits of forming an LLC for Bitcoin miners include asset protection and privacy.

If you earn an annual income of $100,000 and above on Bitcoin mining, forming an LLC and turning it into an S-corp election may be a tax-advantageous strategy. S-corp is a tax category, which “passes through” income and expenses to the taxpayer’s personal tax return, while LLC is a type of corporate entity.

As an LLC, you’re still subject to self-employment tax. However, with S-corp, it is possible to be an employee in your business; saving on self-employment tax, and in some cases and your salary can be a deduction. But note, even a salary paid, and a deduction captured will still create income on the taxpayer’s personal return.

There are a number of other issues to consider here, including working with an experienced consultant or Tax CPA that can ensure you are able to capture the benefits of such structuring without creating risks of non-compliance. Issues such as partnerships and your shareholders being corporations and non-US residents are all factors that can make your Bitcoin mining business ineligible for an S-corp election and/or create other compliance risks.

Tracking tax basis on mined coins

The most commonly used methods for tracking cost basis are FIFO, LIFO, HIFO, and Specific ID.

- FIFO (First-In-First-Out) means the assets that were acquired first are sold first.

- LIFO (Last-In-First-Out) means the assets acquired last are sold first.

- HIFO (Highest-In-First-Out) means the assets acquired at the highest price are sold first.

- Specific ID involves meticulous recording of an inventory of token holdings, organized by lot, and by cost basis. While possible this can be very onerous when dealing with fungible tokens and mistakes can create compliance risks, penalties, back taxes and interest.

For example, let's say you receive 2 BTC in mining rewards in January when the market value is $50,000 (total $100,000). You receive 2 BTC rewards in April when BTC is valued at $60,000 (total $120,000). You then receive 2 BTC as rewards in July when the BTC value is $55,000 (total value $110,000). Then you sell 2 BTC in September when the BTC price is at $70,000 (total $140,000).

- With FIFO, the capital gains to be taxed will be $140,000 - $100,000 = $40,000

- With LIFO, the capital gains to be taxed will be $140,000 - $110,000 = $30,000

- With HIFO, the capital gains to be taxed will be $140,000 - $120,000 = $20,000

- With specific ID, the taxpayer could select the most advantageous lot to sell (least capital gain, or highest capital loss capture); however, proper tracking is not feasible in many cases. .

The IRS's updated Form 1099-DA is expected to be issued by crypto brokers, exchanges, and wallet providers to crypto miners and investors from the onset of 2025. The form aims to accurately record each transaction a miner or crypto trader carries out. The associated regulations likely to go into effect will also require taxpayers to track their purchases/earnings and dispositions “by wallet,” not “universally” across all wallets and accounts starting in the tax year 2025. This requirement further increases the complexity of proper cost-basis tracking and reconciliation.

The Network Firm

Crypto accounting, which involves keeping track of data on crypto mining and activities to ensure tax compliance and best possible outcomes, is challenging and time-consuming. The Network Firm makes it easy with specialized crypto basis tracking and crypto accounting services for individuals and corporations.

The Network Firm LLP (TNF) is a U.S. domiciled Certified Public Accounting Firm, specializing in the digital assets and crypto industry, and the only firm 100% focused on the needs of the crypto industry. TNF provides audit, accounting, and advisory services to all digital asset sub-niches, including exchanges, miners, stablecoins, RWA and tokenized assets, token projects, offshore foundations, DAOs, and more. TNF is a leader in Proof of Reserves services but also brings collective decades of experience to clients in crypto bookkeeping, finance, financial reporting, and CFO advisory services through our Outsourced Accounting services. TNF provides a dedicated team to each client account, implements the best-in-class basis tracking and crypto accounting tools, and supports all engagements with experienced senior staff to ensure unparalleled quality.