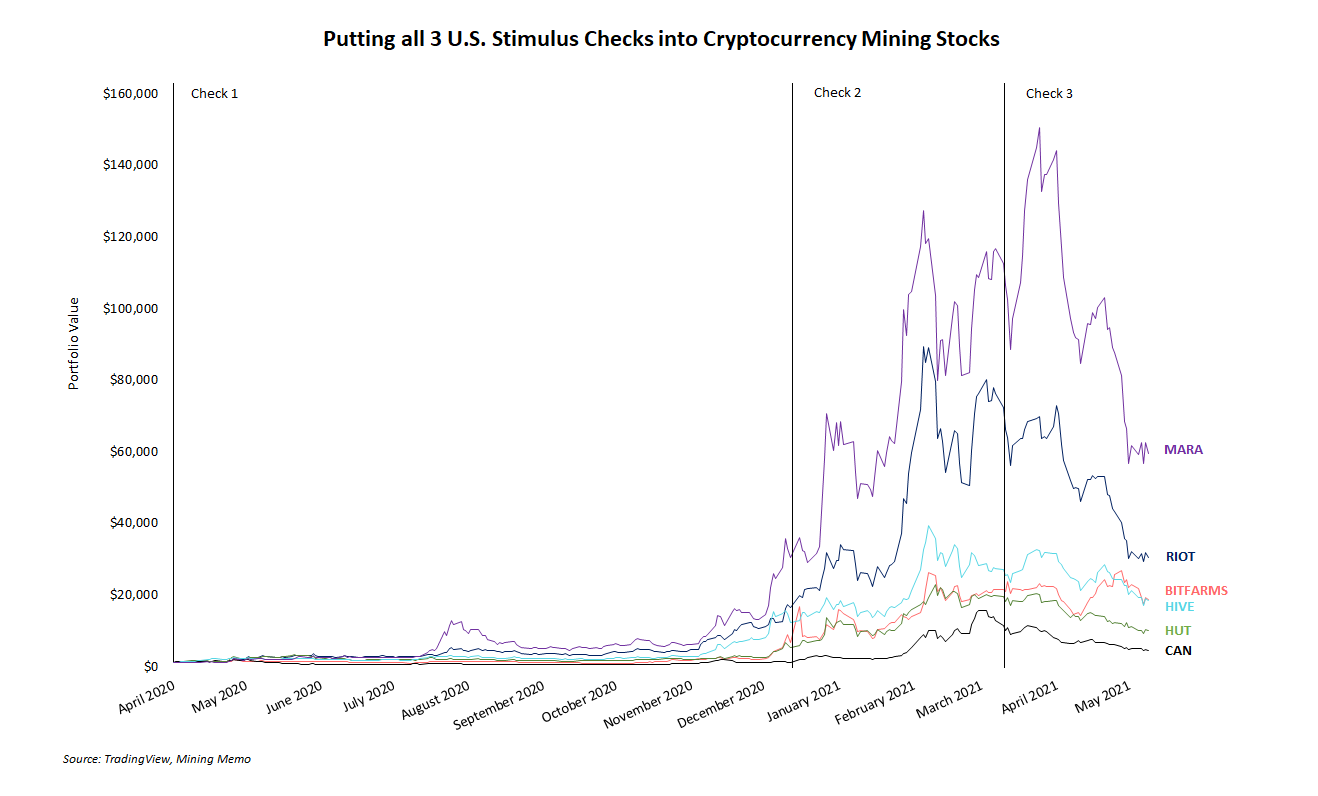

Cryptocurrency mining stocks exploded in price and popularity in late 2020 as shareholders of public bitcoin and ether mining companies rode the tailwinds of bitcoin’s parabolic rally. Mining stock investors didn’t need a lot of money to make a lot of money from these investments.

In fact, dumping each stimulus check sent from the US Treasury into mining stocks over the past year would have returned a very handsome profit. Here’s some data.

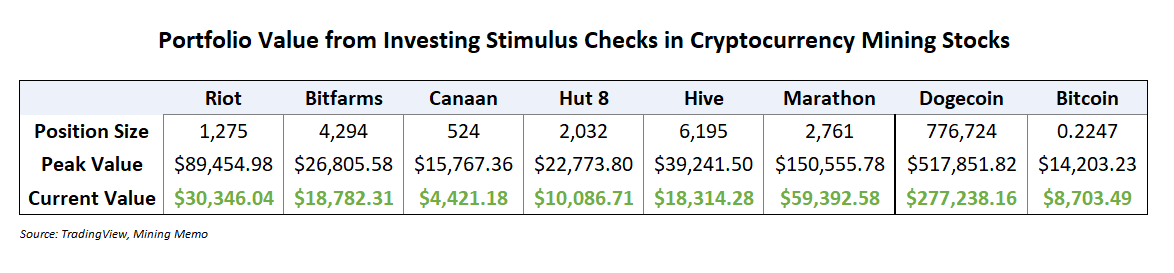

To date, Americans have received three rounds of stimulus checks for a total of $3,200. Here’s how investments of that amount in Riot, Bitfarms, Canaan, Hut 8, Hive, or Marathon would look over the past year.

For fun and a bit of perspective, dogecoin and bitcoin investments were added to this data set. All of the companies in this set except Canaan have outperformed bitcoin to date.

Lots of cryptocurrency traders and traditional investors used mining stocks as a portfolio diversifier and a means of having exposure to the mining industry without buying and running ASICs themselves. And at different points during bitcoin’s climb to nearly $65,000, these investors were handsomely rewarded with triple- and quadruple-digit percentage returns. Not bad.

Now the picture is a bit different though. As bitcoin and nearly all other cryptocurrencies sit well below their recent record highs, public mining companies have also taken a hit. Prices for shares of Marathon, Riot, Hut 8, and Hive are all down between 30% and 60% in the past 90 days, according to TradingView data.

Regardless of where the market goes next, stimulus check investors who bought cryptocurrency mining stocks are still up a decent amount of money on paper.