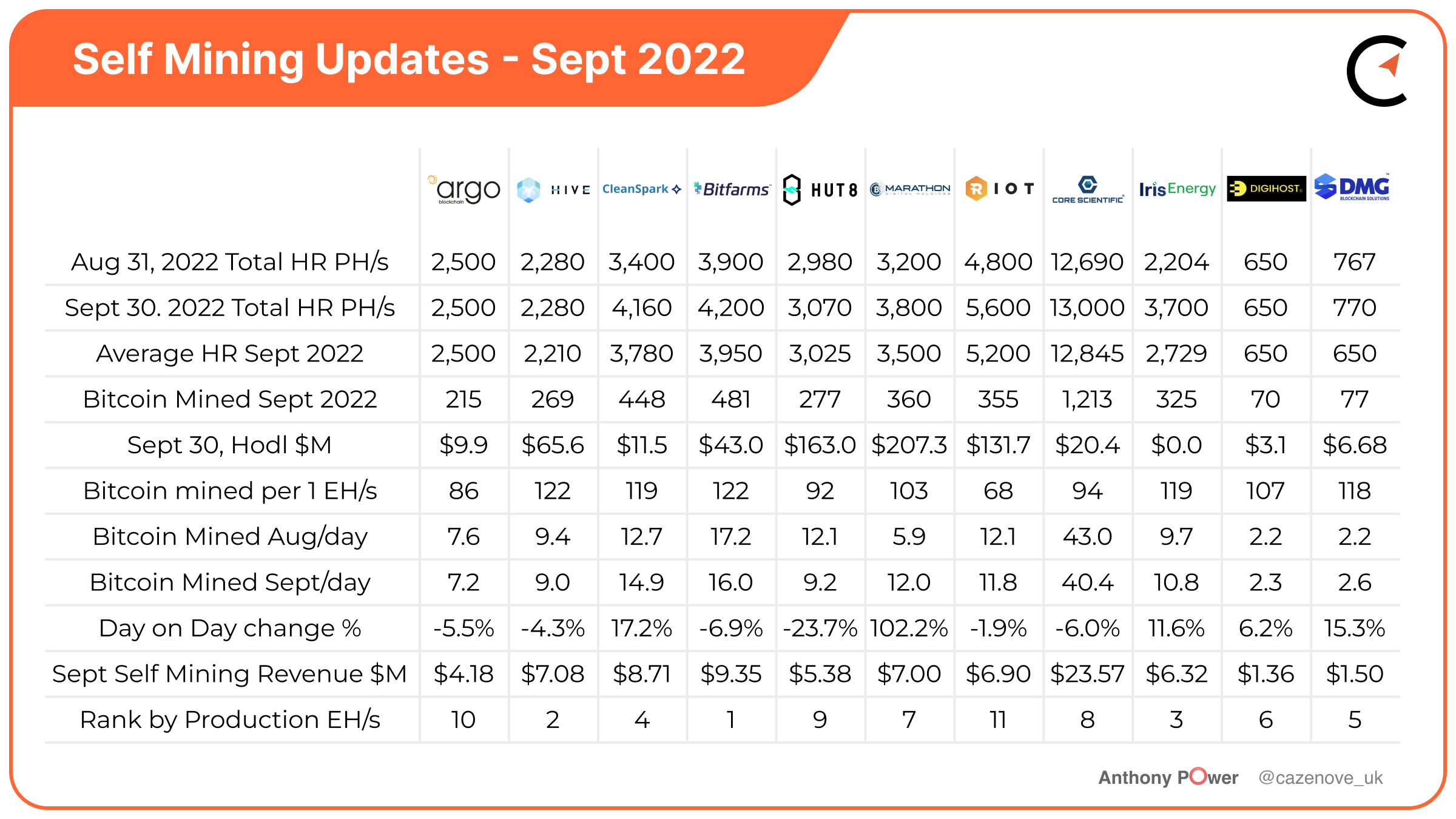

September mining proved to be a challenge for many miners. Not only did miners have to put up with a large increase in Bitcoin’s difficulty, but inflation-goaded energy prices continue to eat into their bottom line.

This article includes updates on 11 publicly listed miners. Scroll below to see a recap of each miner's production.

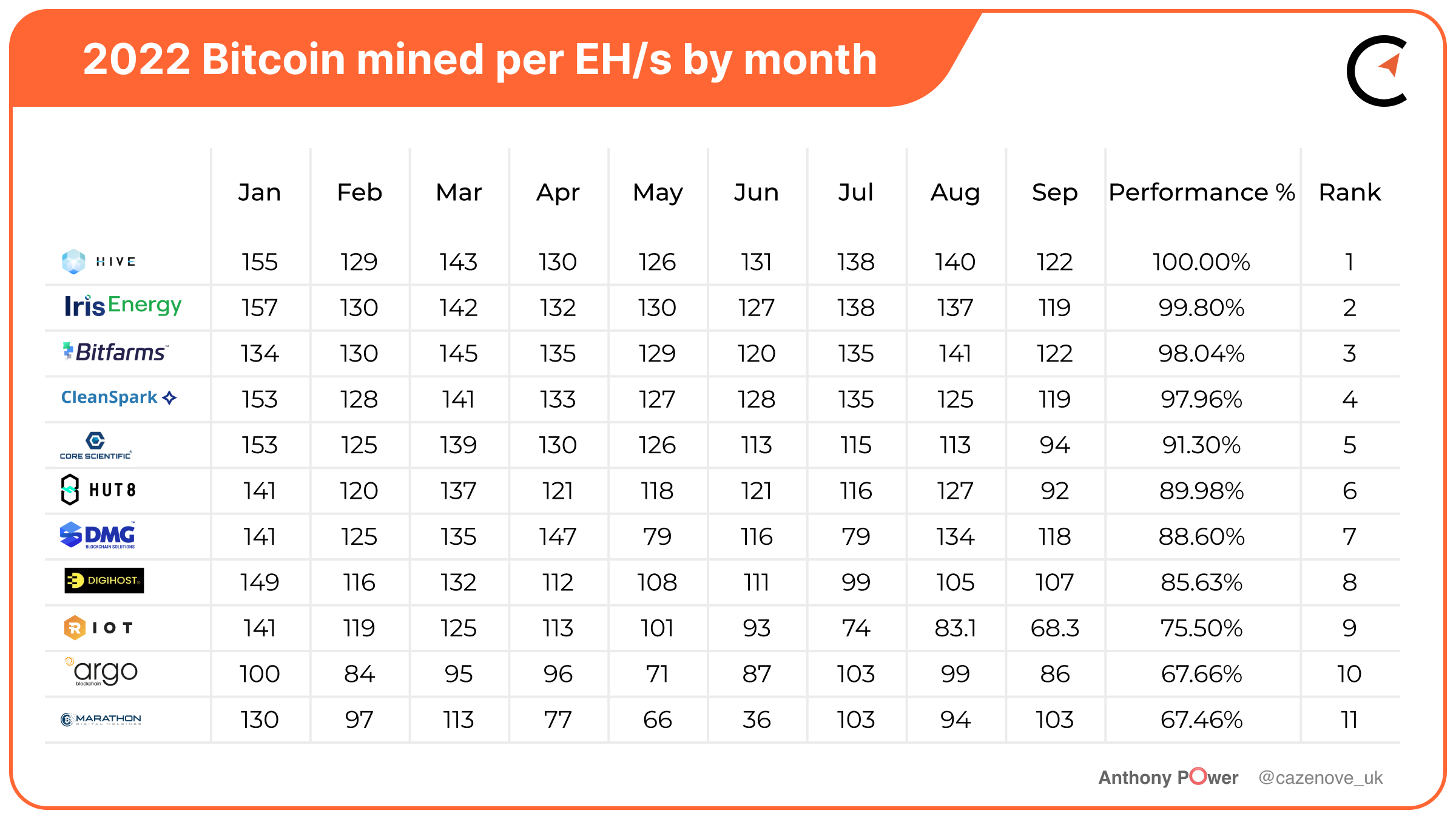

Bitfarms (BITF) beat out Hive Blockchain by the smallest of margins in terms of overall operational mining performance by EH/s, followed by Iris Energy (IREN) and Cleanspark (CLSK). Notable miners include DMG Blockchain, which increased its daily average Bitcoin production by 15.3%, and Marathon Digital, which doubled its daily production rate in September.

Year-to-date, the top position has again changed, with Hive Blockchain now edging out Iris Energy as the most consistent operator by EH/s. Overall, the top four miners appear to be creating a gap with their consistent operational updates.

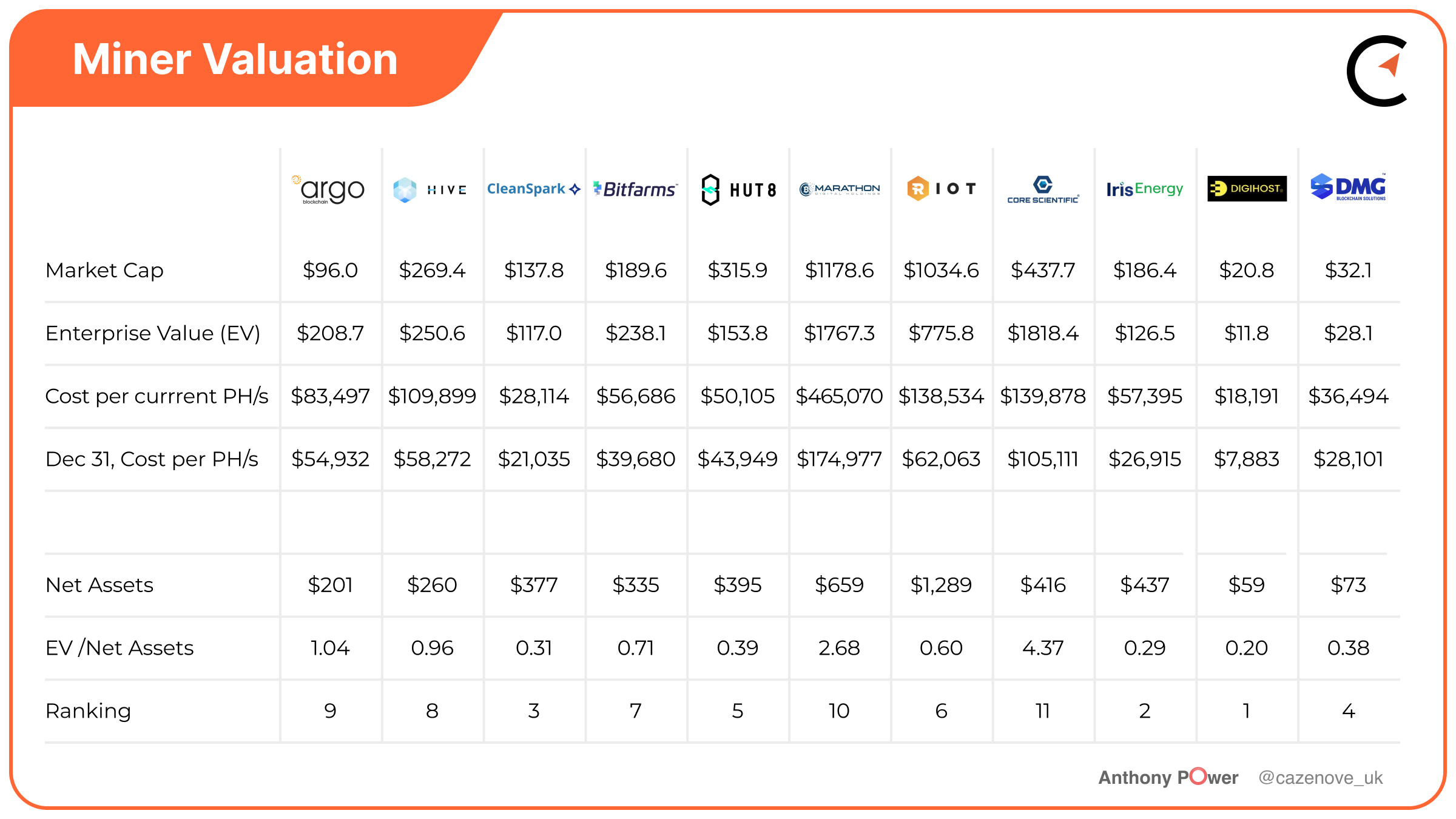

Valuation Metrics

A few more metrics are worth consideration, including the Enterprise Value (EV) of each miner. EV is calculated by taking the total number of outstanding shares (i.e. market capitalization (MCAP)), multiplied by the share price, adding the total debt and lastly deducting the total liquidated cash on the balance sheet. EV provides a fair valuation of a company when comparing it to its peers.

The table below looks at current and future hashrate in terms of cost, or the EV divided by the hashrate (PH/s). Future hashrate based on the end-of-year projections is also included. From the data, Digihost Technology and Cleanspark look to have the best value from a hashrate perspective. Both companies have little or no debt on the balance sheet. While Iris Energy maintains a healthy outlook, it does have a significant amount of debt being serviced over the next 18 months. That being said, Iris's net asset base is currently actually larger than that of Core Scientific, with 23 EH/s under its management.

Finally, looking at the Enterprise Value as a proportion of net assets again provides a good indicator of value. As can be seen from the table above, Digihost Technology has no current debt on the balance sheet. Digihost is closely followed by Iris Energy, Cleanspark and DMG Blockchain. Both Marathon Digital and Core Scientific have significant debt position, as can be seen when you compare their MCAP to their EV.

Core Scientific (CORZ)

With 232,000 managed ASICs, both owned and co-located, Core Scientific is one of the largest publicly traded Bitcoin miners in the world. Core Scientific mined 1,213 Bitcoin in September at a rate of 40.4 Bitcoin per day. The Austin, Texas-based firm mined 43 Bitcoin, lower than August because of curtailment and difficulty, according to the firm’s disclosures.

Core Scientific added 410 PH/s of hashrate to its self-mining operations, taking its total current hashrate to 13.0 EH/s. The company sold 1,576 Bitcoin for a total revenue of $32.2 million. Core Scientific currently holds 1,051 Bitcoin and approximately $29.5 million in cash, providing it with a total liquidity position of $49.9 million.

Core Scientific continues to expand hosting services and in September added 8,400 more servers, taking its total hosted hashrate to 9.5 EH/s, representing 42% of the firm’s total hashrate. Even during this bear period, Core Scientific continues to receive more hosting requests than it has available infrastructure to accommodate.

Digihost Technology (DGHI)

Digihost Technology mined a total of 69.84 BTC in September, representing 2.6 Bitcoin per day or $1.36 million in total monthly revenues. Digihost Technology increased its production 6.2% over August’s daily rate, even accounting for difficulty and curtailment needs.

Its Bitcoin hodl as of Sep. 30, 2022, was 161 Bitcoin and 1,001 Ethereum, totaling $4.46 million. The company holds $3 million in cash, making its total liquidity available $7.46 million. Digihost sold 86 Bitcoin to meet its operational requirements and continues debt-free.

Digihost Technology has a current operating hashrate of 650 PH/s, but developments in Alabama are expected to bring an additional 550 PH/s by the end of Q4. And with the approval by the New York Public Service Commission of the acquisition of a 60 MW power plant in North Tonawanda, New York, also due to be completed in Q4, a further 950 PH/s addition to its hashrate will bring the year-end total to 2.15 EH/s

DMG Blockchain (DMGI)

DMG Blockchain produced 77 Bitcoin in the month of September, an increase of 15.3% per day. The company has a current hodl of 344 Bitcoin as at Sep. 30, 2022, having sold 95 Bitcoin during the month to meet its operational requirements. It remains on track to achieve 1.0 EH/s by the end of Q4, with a current average operational hashrate of 650 PH/s.

DMG Blockchain has now also joined Terra Mining Pool, including the use of the Bosonic Network and Blockseer, according to DMG CEO Sheldon Bennett.

“We are excited about utilizing the Bosonic Network for the operation of our business, particularly the integration of this with our Blockseer product line which focuses on Terra Pool,” Bennett said in a statement. “The Bosonic Network connects our custodian directly to institutional buyers with no intermediaries and offers a unique, real-time clearing and settlement infrastructure for digital asset trading. DMG has tested the exchange with over two million dollars of bitcoin sold over the past few months, and we are very happy with the results.”

Hut 8 (HUT)

Hut 8 mined 277 Bitcoin at an average of 9.2 bitcoin per day, a 23% reduction on its daily mined rate for August. Warm weather and disruptive power throughout the month were the main cause of the reduced mining rate, according to the company.

Hut 8 operated with 3.07 EH/s of ASICs. The Canadian firm was also able to utilize its GPUs for half of the month before the Ethereum merge took place. Hut 8 is now in the process of moving the GPU fleet to its data centers to enable further ASICs to be deployed at its three Bitcoin mining sites. The company plans to fully replace a number of legacy miners by the end of the year, currently not included in the hashrate.

The company continues to hodl all its Bitcoin and has an impressive total of 8,388 Bitcoin as at Sep. 30, 2022.

Marathon Digital (MARA)

Marathon Digital may finally be turning the corner. The Las Vegas-based firm mined 360 Bitcoin, a daily increase of 102% from the previous month. As of Sep. 30, 2022, it had added 3,000 additional miners to achieve a daily operational hashrate of 3.8 EH/s. The total grew 50% by Oct. 4 to 5.7 EH/s after energizing a further 19,000 miners.

Marathon Digital currently hodls 10,670 Bitcoin, the largest of all the North American listed miners, and represents 17.6% of its current market capitalization. It also had $55 million held in cash at the end of the month. The company maintains its hashrate target of 23 EH/s by mid-2023

Iris Energy (IREN)

Iris Energy continued its dominant performance during the month of September, producing a record 325 Bitcoin for $6.2 million in revenue. The total current operational hashrate hit 3.7 EH/s, an increase of 54% over late August values. Iris achieved an average hashrate of 2.73 EH/s throughout the month, as the company was able to fully energize the 1.4 EH/s Prince George facility.

Further increase in hashrate was achieved at both its Canal Flats and Mackenzie sites, now operating at 848 PH/s and 1.58 EH/s respectively. Continued expansion at Mackenzie during the 4th quarter of 2022 will add 30MW of power, increasing the output further from 50MW to 80MW, and hashrate capacity to 2.5 EH/s.

Further development at the Childress site continued in September, with all construction permits now in place as the company plans to build an initial 40 megawatts (MW), delivering a further 1.3 EH/s of mining capacity in Q1 of 2022, at the 600 MW site. Iris is on track to meet its current hashrate target of 6.0 EH/s in the early part of 2023 from a total of 63,246 units.

Iris Energy has sold its Bitcoin on a daily basis, a large benefit considering the drawdown in Bitcoin’s price. It has put the funds to good use in growing its business during this bear cycle, and no listed peer miner can match this seismic growth in 2022.

CleanSpark (CLSK)

Like Iris Energy, CleanSpark has grown rapidly during 2022. September was no exception, with 448 Bitcoin mined. The Las Vegas-based firm was able to grow its hashrate by 21%, having broken past the 4.0 EH/s benchmark. The company increased its Bitcoin production by 17% month-over-month for an average of 14.9 per day compared to 12.7 per day in August. With 42,000 miners, the firm achieved 4.16 EH/s during the month.

CleanSpark sold 380 Bitcoin for $7.5 million to meet its operational and capital requirements. It has a current hodl of 574 coins. The company has made sensible choices over this past 12 months in selling its Bitcoin to grow hashrate and has navigated through the markets without utilizing other capital levers available, i.e. debt and dilution.

On Oct. 11, 2022, the company announced the completion of its acquisition of Mawson Infrastructure Group (MIGI) Sandersville facility. The deal included 6,500 miners, which immediately added 560 PH/s of hashrate, taking its total operational hashrate to 4.7 EH/s. When fully operational, the site should achieve 230 MW of power – an addition that will certainly help the company get closer to achieving its target of 22.4 EH/s by the end of 2023.

Bitfarms (BITF)

Like peer miner CleanSpark (CLSK), Bitfarms broke through another hashrate milestone earlier in the month by hitting its growth target of 4.2 EH/s for September 2022. The company mined 480 Bitcoin at a rate of 16 per day, a drop from the August rate of 17.2 per day. Although the company added 300 PH/s during the month, the mining difficulty, nearly 13%, impacted miner performance.

The company energized the first of five 10 MW modules at its site in Rio Cuarto, Argentina, and installed 1,751 miners. Work has now commenced on a second 50 MW warehouse which should be completed during Q2 2023.

In terms of monthly mining comparison, Bitfarms achieved 122 Bitcoin per EH/s and was the top-performing miner for September, a feat it has achieved in no fewer than five months so far in 2022. From a year-to-date perspective, Bitfarms currently lies third behind Hive Blockchain and Iris Energy by a small margin of less than 2%.

The company sold 544 Bitcoin during the month for $10.66 million to meet its capital and operational requirements, including making further principal payments of $3.8 million during the month – totalling $23 million over Q3 – to reduce its $97.98 million of debt held as at June 30, 2022. The company currently hodls 2,065 Bitcoin with a current valuation of some $40 million.

Argo Blockchain (ARBK)

Argo Blockchain has certainly struggled with its operational performance over the past 12 months, but there were signs that Bitcoin production was starting to move in the right direction Having reached a low of 71 Bitcoin per EH/s in May 2022, it has steadily improved each month, even accounting for the energy curtailment in Texas.

Argo mined 215 Bitcoin in September, compared to 235 Bitcoin in August. An increase in mining difficulty energy curtailment – the latter proving advantageous as the company achieved an increase in its mining margin 20% to 25% over August – were primarily to blame.

Read: Miners face millions in debt payments as revenues dry up

Argo Blockchain has a current Bitcoin and equivalent hodl of 512 coins, having sold 812 coins during the month. Argo Blockchain CEO Peter Wall announced that the current operational hashrate reached 2.5 EH/s and is expected to rise to 2.9 EH/s by the end of October.

As for the financial books, Argo went through a number of equity raises during 2021, including the initial public offering (IPO) in May, and has since diluted the number of outstanding shares during the year by 54%, or 165 million shares. The firm took another step this past week by raising $27 million of shares to an undisclosed third-party, in addition to selling 3,400 Antminers.

Read: Argo Blockchain takes action to strengthen its balance sheet

Riot Blockchain (RIOT)

Riot Blockchain produced 355 Bitcoin last month, at an average of 11.8 Bitcoin per day, a drop of 2% per day. However, the company actually increased its hashrate from 4.8 EH/s to 5.6 EH/s, having installed 9,070 new S19j Pro miners. The number mined is equivalent to 68 Bitcoin per EH/s, a struggling value in comparison with the likes of Cleanspark (CLSK) and Bitfarms, which produced 119 and 122 Bitcoin per EH/s respectively.

Riot has a further 6,900 miners, including the latest S19 XP, staged for deployment, taking the hashrate to 6.4 EH/s. With a further shipment of 5,000 miners on route from Bitmain, the company is on track to achieve 12.5 EH/s during Q1 2023.

Riot Blockchain sold 300 Bitcoin last month for $6.1 million to cover operational expenses and currently has a hodl of 6,775 Bitcoin valued at $131.7 million.

Hive Blockchain (HIVE)

Hive Blockchain produced 268.9 Bitcoin, equating to 9 Bitcoin per day, a small reduction from the 9.4 mined per day in August. The firm also utilized its 6.59 TH/s of GPUs to mine 1,394 Ethereum. The firm mined alternative proof-of-work coins after The Merge, earning 15.8 Bitcoin after converting into Bitcoin. GPU revenues have dropped 77% since the Merge.

With a production equivalent to 122 Bitcoin per EH/s, Hive Blockchain was second to Bitfarms (BITF) by 0.1% in the monthly operational statistics. From a year-to-date perspective, it replaced Iris Energy (IREN) to go back to the top of the rankings – a place the company been rather familiar with for the majority of the last 18 months.

The company was able to operate at an average of 2.21 EH/s and achieved operating capacity of 2.28 EH/s at the end of September. It is due to receive approximately 140 PH/s of new generation MicroBT ASICs, primarily M30S++ models, in the coming month. The firm has also been operating and evaluating prototype ASIC miner units using the Intel Blockscale ASIC chips, expecting its first shipment during October 2022. Hive is expected to grow its ASICs hashrate by over 1 EH/s during the next three to four months, taking it to 3.4 EH/s.

Hive Blockchain sold 177 Bitcoin and 4,260 Ethereum during the month of September to cover operational and capital expenditures. It currently has a hodl of 3,350 Bitcoin and 356 Ethereum with a value of $65.6 million as of the end of September.