China has had a tough 2020. COVID-19 was served up for starters and severe flooding has followed. With a huge share of the Bitcoin mining industry based in China, we cover how the flooding has been impacting mining.

Despite reports surfacing of some mining facilities being impacted, hashrate has been near record highs. We analyse some of the potential reasons behind this and also show how equities have responded to damage inflicted on Chinese infrastructure and cities.

We will be transitioning away from Substack next week. For subscribers, nothing will be changing on your end. You will still receive the best mining insights weekly. Newcomers will be able to subscribe on the HASHR8 website.

Each year, the rainy season in China takes place from roughly April to October. This is typically a lucrative time of the year for many Chinese miners as lower electricity rates can be secured due to the excess hydropower which is produced. Regions such as Sichuan and Yunnan typically observe a significant inflow of miners moving to benefit from the advanced hydropower infrastructure in these regions.

However, the rainy season also comes with increased risks. Heavy downpour can result in rivers overflowing and cities being flooded. Mining facilities can end up in the firing line as the flooding can cause mudslides in the mountainous regions where many set up. Here’s a video shared by Poolin during the rainy season in September 2019.

A local mining farm based in Sichuan, China was DEVASTATED by the recent heavy rainfall in the region, video attached 1/2 pic.twitter.com/CvdEAUeq3x

— Poolin (@officialpoolin) August 21, 2019

This year’s rainy season has already brought far greater destruction than 2019. It has been accompanied by the worst flooding since 1998 and both individuals and industries far beyond mining have been feeling the impact. Cities throughout China are being impacted as several rivers overflow. The flooding is causing severe damage to residential areas and infrastructure. A 500-year old bridge in Anhui collapsed. It is estimated that the economic damage has reached $3.6 billion and over 106 are confirmed dead or missing.

One centre point of the devastation is the Three Gorges Dam. The Three Gorges Dam is the largest hydropower project in the world. Spanning the Yangtze river, the power station generates a power capacity of ~22.5 GW. The dam is located upstream from the town of Yichang in Hubei province. The dam recently opened its sluice gates to relieve pressure on the infrastructure. The opening wreaked havoc on the several cities downstream. China Daily described the opening of sluice gates as an organized discharge to “ensure enough storage capacity for flood control.”

However, some claim that the discharge was carried out secretly and that inhabitants of nearby cities were not notified. Residents of towns upstream and downstream from the Three Gorges Dam have taken to posting videos on social media of the destruction the discharge has caused. One social media user posted that authorities in Chongqing city made it illegal to post content related to the flooding.

This was not the only report of censorship which has surfaced. A French journalist who traveled to Chengdu to speak with a longstanding critic of the Three Gorges Dam found out that national security police had pressurized him not to speak with foreign journalists.

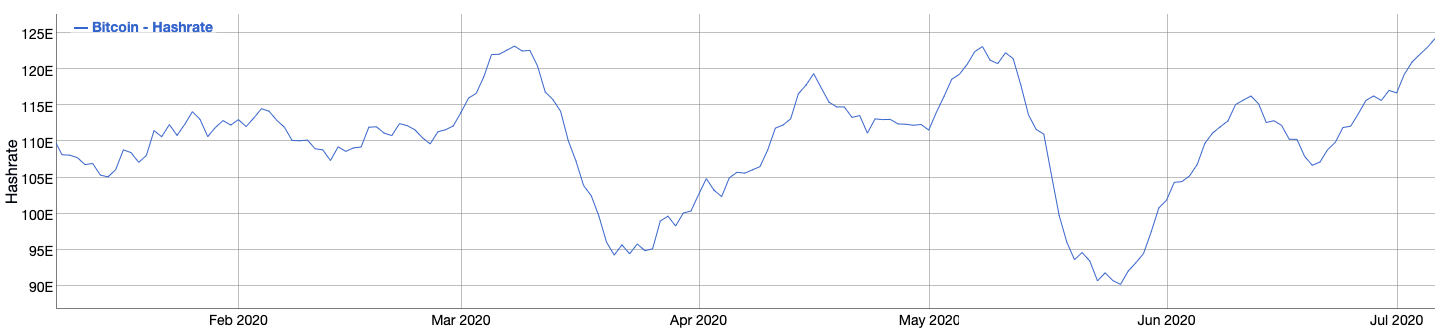

With roughly 65-75% of the Bitcoin hash rate estimated to be in China during rainy season months, the flooding would typically be expected to impact the network hashrate. Mudslides commonly wipe out mining farms as a result of the floods during the rainy season. However, as it stands, hashrate estimates are currently close to record highs. At the time of writing, the difficulty is estimated to increase ~9.7% at the next adjustment indicating that there has been more hashrate online since the latest adjustment on the 1st of July.

Despite hashrate estimates being near record highs, reports have surfaced of mining farms being impacted by the floods. One source in China notified us that some mining farms in Sichuan have been impacted. A news report by Chinese media also mentioned that Bitcoin mining farms in Sichuan have been affected and that one power station in the Ganzi prefecture has been wiped out by the floods.

On paper, hashrate estimates should be dropping. Apart from facilities being at risk due to the floods, mining has also become less profitable for miners due to falling Bitcoin price.

During the previous difficulty epoch, price traded at an average price of $9300. Since the latest adjustment on July 1st, the price has mostly traded at levels below $9300. With difficulty unchanged, this makes conditions for miners less lucrative. Bitinfocharts estimates that average profitability for miners dropped from $0.0862 daily per TH on July 1st to $0.074 at the time of writing.

The fact that hashrate estimates are near record levels highlights the secretive nature of the Bitcoin mining industry. With a dominant share of the industry based in China, its inner workings are often shielded from the Western world. Latest-generation hardware coming online may be one factor playing into the growing hash rate. Western miners will struggle to secure latest-gen miners but there is a strong possibility that several Chinese farms have been turning on these rigs in recent months.

Hashrate is not the only thing which has been growing recently. Despite the $3.6 billion in estimated damage to Chinese infrastructure, equities in the country have been on a tear. The CSI-300 has increased by over 13% this month. Other equity indices are also seeing significant upside movement with the Shanghai Composite increasing over 12% and the CN50 up over 15%. There has been some suspicion that state authorities are encouraging retail to invest in the domestic stock market. A recent front-page editorial from the state-owned China’s Securities Journal noted that fostering a healthy bull market post-pandemic is of extreme importance to the Chinese economy.

The true impact the flooding will have on Bitcoin mining is likely not yet seen. With several months of the rainy season remaining, flooding could get more severe. Mining facilities will be at risk and we may see a corresponding impact on hashrate. In the meantime, we also need to consider that more latest-gen mining rigs could be distributed to Chinese miners. Despite conditions being less lucrative than the previous mining epoch, hashrate continues to rise which indicates that some miners may be turning on the latest gen rigs from Bitmain and MicroBT.

What Miners are Monitoring

China crackdown on OTC traders. Chinese authorities have ramped up anti-money laundering investigations after detaining a number of OTC traders. One of the largest OTC traders in China, Zhao Dong, has been held by police in Hangzhou. Furthermore, an entire OTC team in Beijing was reported to be taken away by police. This is the latest development in a crackdown by Chinese authorities on money laundering through the Chinese crypto OTC market. Recently, over 1,000 bank accounts were frozen after being suspected of being complicit in illegal activities. A source told Coindesk reporter Wolfie Zhao that this latest crackdown is more of a systematic effort on the part of Chinese authorities. The action is reported to be led by bodies including the PBOC, Ministry of Public Security, and Central Administration of Customs.

Ethereum miners have been earning more from transaction fees than Bitcoin miners since the 6th of June. This marks the longest streak that Ethereum fees have been higher than Bitcoin fees in terms of USD value. The previous streak lasted for 25 days between mid-May and mid-June in 2018. From transaction fees, Ethereum miners have earned in the range of $479k to $744k daily since the start of July. By comparison, Bitcoin miners have earned in the range of $227k to $573k.

HASHR8 Pods

Owning the Entire Bitcoin Stack with Alex Liegl –Layer1 have made headlines. Between setting up in West Texas, funding rounds with high profile investors, and manufacturing ASICs, the company has caught the attention of the Bitcoin mining masses. CEO Alex Liegl details the implications of owning the entire mining stack. Liegl further details how Layer1 can sell energy back to the grid at times of peak demand.

Debunking the Bitcoin Stock-to-flow Model with Jesse Proudman –The Bitcoin stock-to-flow (S2F) model has long been the centre of critique among Bitcoin analysts. The model has also attracted the optimism of retail investors with its simple takeaway of “third halving – $55k Bitcoin”. Jesse Proudman, CEO of Strix Leviathan, recently released research to highlight the flaws in the model. Proudman joins the podcast to discuss his findings and shine a light on the impact this model has had on institutional investors entering the industry.

About HASHR8

HASHR8 is a community-driven bitcoin and crypto mining company focused on providing honest content, excellent products, and unparalleled customer service. HASHR8 produces weekly podcasts, videos, newsletters, and articles, as well as creating premium software products for bitcoin and cryptocurrency miners around the world. HASHR8 is Mining As It Should Be. Follow us on Twitter for all updates and new releases.