Last week saw the start of the reporting season for the North American listed Bitcoin mining companies, with six of the largest public miners issuing their quarterly earnings.

Core Scientific (CORZQ) was the first to release, closely followed by Bitfarms (BITF), Cipher Mining (CIFR), Marathon Digital (MARA), CleanSpark (CLSK), and Riot Platforms (RIOT).

With the price of Bitcoin having recovered by 57% since the start of the year, there was optimism from retail investors that this reporting period would finally break the cycle of period losses, stretching back over the last 18 months.

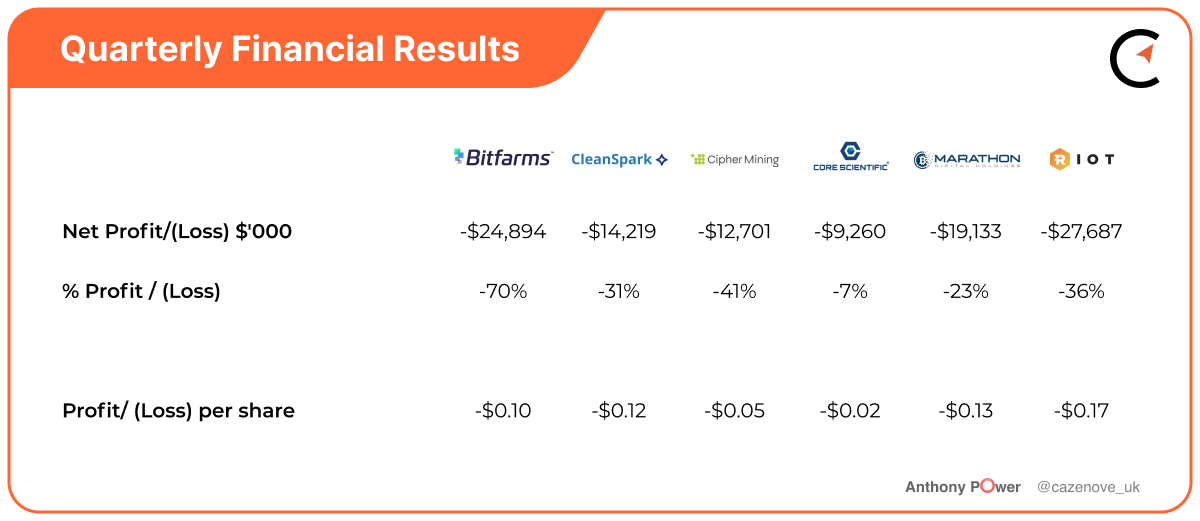

However, just to be clear, all six companies recorded a net loss position in their accounts, for the reporting period April 1, to June 30, 2023, as highlighted in the table below:

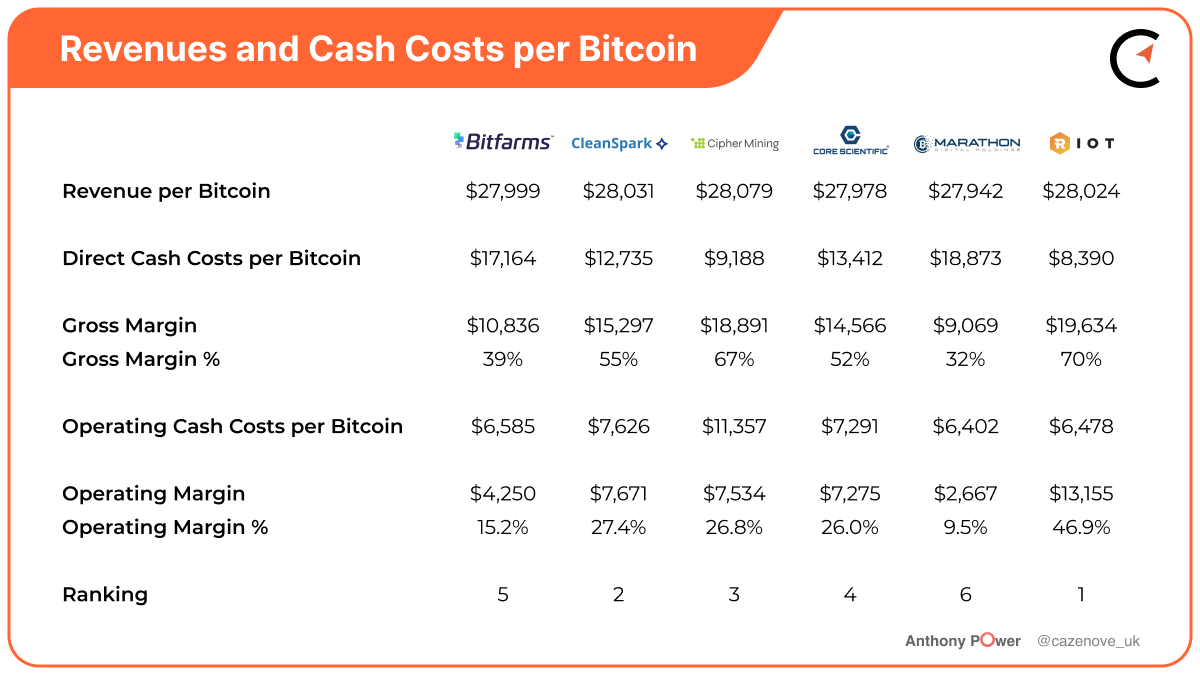

For this article, though, I have chosen to ignore the following costs in my analysis of determining the cost of producing 1 Bitcoin:

- Depreciation

- Impairment to assets

- Stock compensation.

Although all are important and real costs, they are non-cash costs, and I have chosen to base my comparison on the ‘cash costs’ incurred in Bitcoin mining.

I will cover stock compensation separately, in more detail, later in the article.

Bitfarms

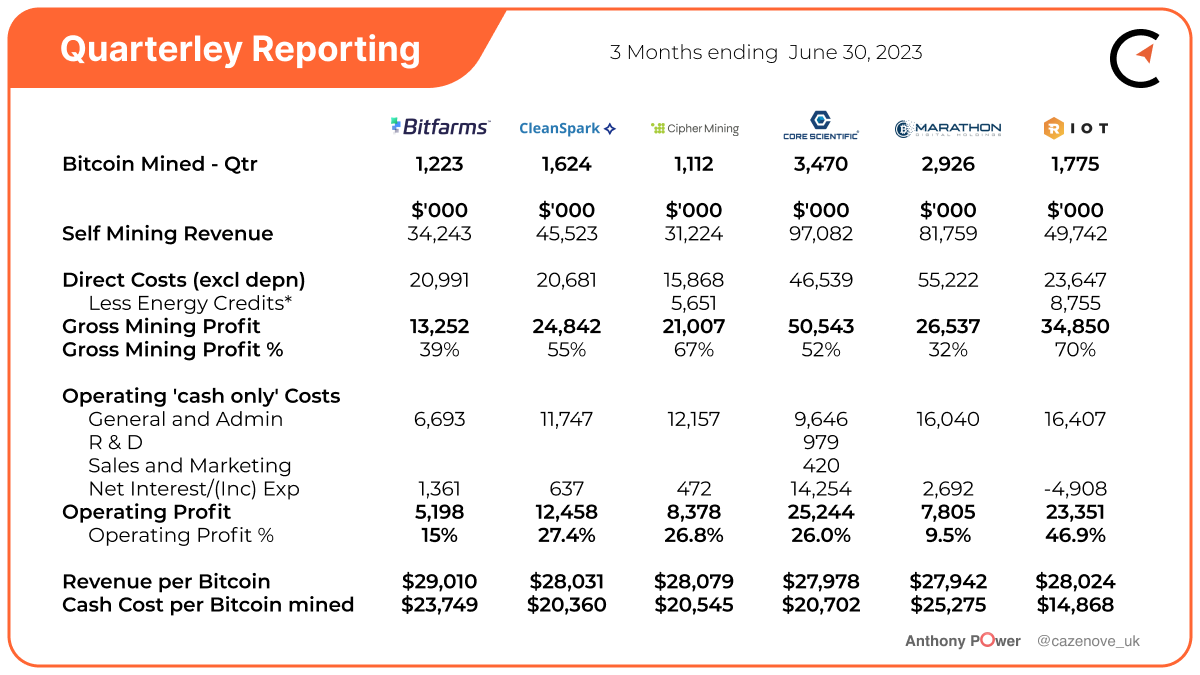

During the reporting period, Bitfarms produced a net loss of $24.9 million, equivalent to a loss of $0.10 per share. If you remove the non-cash items, their gross mining margin is 39%, with an operating margin of 15.2%.

The company has made great efforts to reduce debt on the balance sheet over the past 12 months, with investors witnessing the $160 million of debt on the balance sheet 12 months ago, now reduced to a manageable level of $13.7 million on July 31, 2023. The current plan will be to reduce this debt to zero by February 2024, positioning themselves well for the next halving, due to occur in April 2024

Bitfarms has been the star performer in year-to-date production in 2023, regularly featuring at the top of the Bitcoin mining monthly tables. The company has also started adding to its hodl with a total of 594 Bitcoin, equivalent to $17.3 million at the end of the previous month.

Bitfarms is growing operations at 11 sites in 4 countries, with a total operational hash rate of 5.3 EH/s utilizing 212 MW of operating power. The company, having produced 1,223 Bitcoin during the reporting period, plans to grow to 6.3 EH/s during the current quarter and reach 7.0 EH/s by March 31, 2024.

Cipher Mining

Cipher Mining has had an impressive journey so far as a Bitcoin miner. The company achieved a loss of $12.7 million, equivalent to a loss of $0.05 per share for the reporting period. Once the non-cash costs are removed, the company, with one of the lowest energy costs available in North America, achieved a gross mining margin of 67% and an operational margin of 26.8% over the period. They were able to mine each Bitcoin during the period at a cost of $20,545.

The company has a current operation hash rate of 6.8 EH/s, expected to rise to 7.2 EH/s in the current quarter, and has a near-term plan to achieve 8.7 EH/s. The company produced 1,112 Bitcoin in the last quarter and has a current hodl of 518 Bitcoin on July 31, 2023, valued at $15.1 million.

Cipher Mining has been selling Bitcoin to fund operational costs and capital growth without having to dilute shares in the reporting period. The company is looking to sell up to $250 million in stock occasionally in what is known as an "at-the-market” (ATM) offering.

CleanSpark

CleanSpark achieved a net loss of $14.2 million representing $0.12 per share, during the reporting period. However, once the depreciation and other non-cash items were stripped out, the company made a gross mining margin of 55% and an operating margin of 27.4%.

2023 has been a good year for the company, and growth towards their current end-of-year operational hashrate target of 16 EH/s is well underway, with all mining machines ordered and delivery dates in place.

CleanSpark achieved an operational hash rate total of 9/0 EH/s as of July 31, which will continue to increase monthly, as planned deliveries are installed and energized. The company has continued to sell Bitcoin and utilize their ATM share offering to pay for this expansion, which on completion, firmly puts them in Tier 1 of the North American Bitcoin Miners, along with Marathon Digital and Riot Platforms. They have navigated their growth without increasing debt on the balance sheet, a strategy that impacted many miners in 2022.

In August 2023, the company’s market capitalisation reached $1 billion, and when you consider they have already fully financed their growth to 16 EH/s, that puts their Equitable Value / Hash Rate at $59.2 million per EH/s, which is considerably lower than Marathon Digital at $118.9 million per EH/s

Core Scientific

What is interesting to note from the quarterly financial results is that Core Scientific produced the most Bitcoin and the smallest loss and when you consider the journey they have taken over the last 12 months, posting a net loss of $435 million for the quarterly period ending September 30, 2022, having in excess of $1Billion in debt with costs spiraling, and then filing for Chapter 11 on December 22, 2022.

If you then consider the company made a net loss of $9.26 million, an earnings per share loss of $0.02 per share, while including professional fees and other bankruptcy-related costs of Chapter 11, totaling $18.4 million.#

During the quarter, the company self-mined 3,470 Bitcoin, achieving $97 million in revenues, the highest total of all the listed miners in North America. With energy costs accounting for $46.5 million, a mining margin of 52% was achieved.

The operating cash costs split between self-mining and hosting services, including General and Administration (G&A), R&D, Sales and Marketing, and interest charges, totaled $25.2 million for self-mining, providing an operational profit of $25.2 million (26%), equating to a total cash cost of $20,702, per Bitcoin.

With the recent announcement of the appointment of Adam Sullivan as Chief Executive Officer after previously serving as President of Core Scientific, there is an expectation that the financial plan presented to lenders should help the company emerge from Chapter 11. With the majority of the debt to be exchanged for equity in the company, and you consider the current valuations of Marathon Digital and Riot Platforms, it suggests that Core Scientific, with 15.2 EH/s of self-mining hash rate and a significant amount of hosted miners, appears at first glance, to be undervalued.

Marathon Digital

It looks like in 2023, we are finally starting to see the real potential of Marathon Digital. Having focused on the asset-lite strategy and opted for using third party hosts has meant the company has had the ability to use all its capital levers available to grow its hash rate.

The company announced that it had energized 18.8 EH/s of the installed 22.8 EH/s, and it is reasonable to assume that the next monthly mining update will highlight that they have achieved their target 23.0 EH/s with the remaining installed hash rate due to be energized, imminently.

In CEO Fred Thiel’s recent podcast with McNallie Money he did actually indicate that Marathon Digital, having reached its growth for 2023, would start to also consider building infrastructure options for Bitcoin mining.

The recent Q2 Earnings highlighted a bigger net loss than Q1 2023, although the company did achieve a cash operating profit of $7.8 million, representing 9.5%. As the company already maintains one of the most efficient mining fleets, it is necessary that they strive to achieve the best energy deals available as the halving approaches.

Riot Platforms

Although, on first reflection, the results provided by Riot Platforms provided a net loss of $27.7 million, equating to a $0.17 loss per share, were disappointing, on further review, there are a number of positives to consider.

Operational issues associated with Buildings F & G, housing the immersion cooling technology, damaged during the severe weather in late 2022, effectively reducing their operational hash rate over the reporting period by 1.9 EH/s, are now close to being fully operational again.

The other significant point to note is that Riot Platforms have implemented an energy strategy, which enables them to curtail their power under their power load of 345 MW and gain on their hedged price versus the market price of power, effectively providing the company with a cost of power equal to the cost of their hedge.

Riot Platforms makes the economic decision as to when it is more profitable to sell power than to mine Bitcoin, an especially useful tool when power prices increase during high demand. Any sales made during the month will offset that month’s power bill. For example, if the company is billed $10 million in power but has sold power worth $3 million, they are only required to pay the balance of $7 million for that particular month.

During the quarter, the company achieved $8.8 million in energy credits associated with self-mining, effectively achieving the highest self-mined (70%) and operating (49.6%) margins of all the companies listed in the table above.

The company recently purchased 33,280 miners, for total consideration of $162.9 million, to increase their self-mining capacity to 20.1 EH/s upon full deployment in 2024. The agreement also includes an option to purchase up to 66,560 additional miners at the same terms.

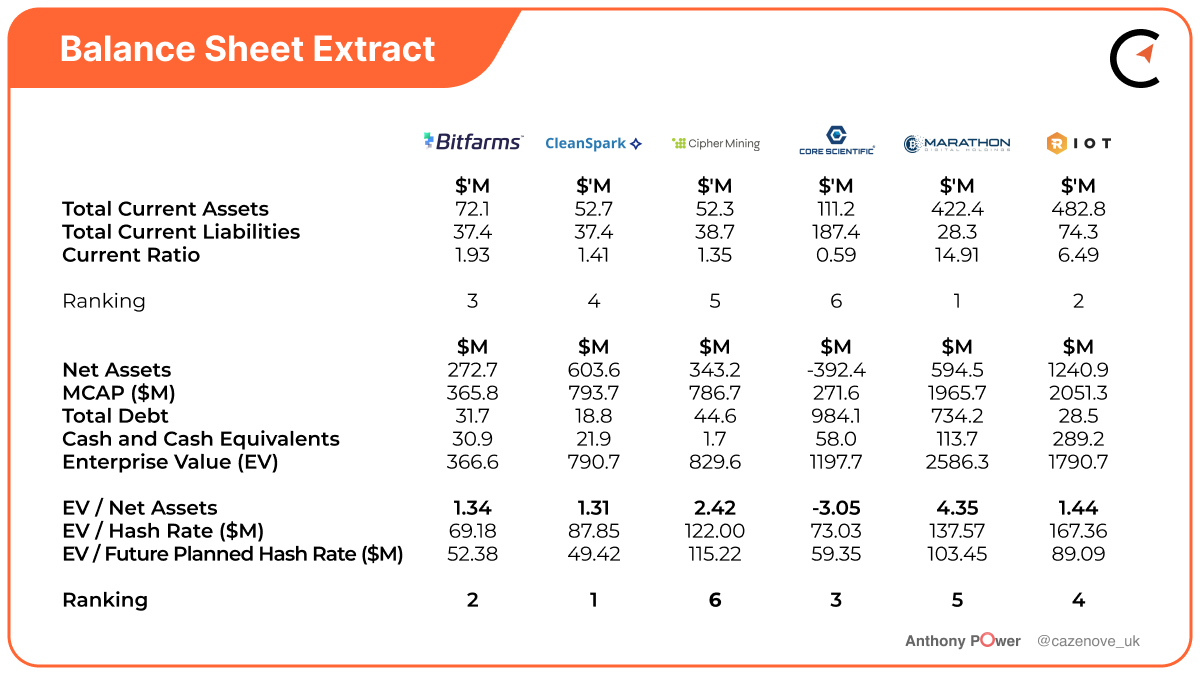

Balance Sheet Strength

With less than nine months until the next halving, Bitcoin miners should be reviewing and ensuring their balance sheets are strong with sufficient cash flow to provide them the opportunity to operate if the Bitcoin price fails to gain quickly enough once rewards drop from 900 Bitcoin per day to 450 per day. This additional ‘cash runway’ will ensure that energy costs and wages are continued to be paid should the price of Bitcoin, as in previous cycles, remain flat at the time of the halving.

The current ratio allows for easy comparison between companies in the same industry. It helps investors and analysts assess how well a company manages its short-term resources in relation to its peers. A score above 1.0 suggests there are sufficient current assets that can be liquidated over the next 12-month period to meet all short-term liabilities.

Except for Core Scientific, for reasons already stated, the remaining five miners have a strong current ratio, with both Marathon Digital and Riot Platforms having significant cash and cash equivalents and Bitcoin on the balance sheet.

The Enterprise Value (EV) is another critical financial metric used for comparing and valuing companies primarily in the same industry, by illustrating and incorporating a company's overall financial structure, providing a more comprehensive view of a company's value compared to using just its market capitalization (Market Capital). The EV ratio considers not only the equity value but also the debt and other obligations. It provides a more holistic view of the total value of the company, including its cash and cash equivalents, debt and other liabilities.

The EV divided by the net assets provides an interesting outlook into how efficiently a company uses its net assets to generate value for its stakeholders. A lower EV/Net Assets ratio suggests that the company is generating more value relative to its net assets. This could indicate efficient use of its assets to generate revenue, profitability, and cash flow.

With nearly $1 billion recorded debt on the Balance Sheet as of June 30th, Core Scientific appears to be generating greater value than the other Bitcoin miners in the table above. This is understandable as the company is currently in Chapter 11, and the share price had dropped by over 98% during 2022.

In terms of valuation, it would also appear that Bitfarms and CleanSpark look good value when compared to peer miner Cipher Mining. When you consider that CleanSpark is going to increase its operational hash rate by a further 7.0 EH/s, already funded, this valuation will only improve.

Hash Rate Growth 2023

It’s important to note that if a company does not grow its hash rate, it won’t just stand still, it will effectively move backward. As the mining difficulty increases in correlation with more mining machines going online, the rewards per TH/s effectively reduce, so it is really important for Bitcoin miners to implement a growth strategy effectively, to keep up.

The table below highlights the growth in hash rate over the reporting period, and it highlights that Marathon Digital and CleanSpark have managed to install and energize 79% and 34.3%, respectively. Both companies still have a significant amount of hash rate to energize by the end of the year which will see Cleanspark achieve 16 EH/s and Marathon Digital, with the first new partnership in Abu Dhabi providing the company with a total close to 25 EH EH/s.

Bitfarms have been gradually expanding their operations in South America and expect to be at 7.0 EH by the end of Q1 2024. Cipher Mining also expects to be in excess of 7 EH/s by the end of the year.

Riot Platforms should have Building G back online imminently and with a further order of 7.6 EH of the most efficient MicroBT machines, due to be fully installed in the first half of 2024, at the new Corsicana site, in Texas, that will provide 20.1 EH/s. The company has the option to add a further 15 EH/s of miners at the same price as their current order.

Bitmain has pledged to support Core Scientific, in its hour of need, by providing 27,000 of the latest S19 XP miners for the price of $77m. The transaction, a mixture of cash and shares, will help the immediate financial needs of Core Scientific while sealing a strong alliance between one of the largest Bitcoin Miners and one of the largest mining machine producers.

Stock Compensation

Stock compensation aligns the interests of management with those of shareholders. When executives own company stock, they have a vested interest in driving the company's performance and increasing its stock value, as this directly impacts their personal wealth.

Stock compensation can encourage management to take calculated risks and drive innovation. Knowing that their rewards are tied to the company's growth, managers may be more willing to pursue ambitious projects that could lead to significant gains.

The table above highlights the amount of compensation that has been awarded in the quarter as a % of the total revenues achieved. A recent study of some of the largest technology companies highlighted that the levels of compensation being awarded were close to 7% for Alphabet Inc (GOOG), Meta Platforms (META), and Microsoft Corp (MSFT).

The levels of stock compensation awarded to the management of CleanSpark, Cipher Mining, and Core Scientific are all in excess, providing 13%, 29%, and 15%, respectively.

Share Dilution 2023

With 2022 the year where many Bitcoin miners sought and focused on the debt markets to raise much-needed capital to grow, to then watch the price of Bitcoin fall and the value of leveraged assets also drop, placing a few miners into financial difficulty, 2023 has witnessed a more focused move to raising capital through selling equity. Most North American listed miners now have shareholder approval to raise capital, up to an agreed limit, for example, $200m or $500m, over an agreed period, via an ATM offering.

This ATM offering is a tool to raise capital quickly by incrementally selling new shares into the stock market. These offerings are more flexible and cheaper than traditional secondary stock offerings, and they can allow companies to raise money by leveraging company milestones, planned news releases, as well as upward trends in the company’s share price or a broader bull market.

From the table below, CleanSpark has aggressively utilized its ATM, diluting nearly 81 million shares and increasing its total number of shares on the market by 113% in 2023 alone. Matthew Schultz, Chairman of CleanSpark, has made no secret of their growth plans and how they will achieve them. In 2022 they grew over 200% in hash rate and were the only publicly listed miner to achieve its hash rate target for the year. Their revised 2023 target of 16 EH/s has all been fully funded by the capital raised through their ATM, and considering the fact they only commenced self-mining two and a half years ago, it’s been an impressive journey so far.

Except Cipher Mining, all the other miners in the table below have used equity to raise capital. However, they have recently announced a $250 million ATM to fund future operational and capital growth.

Bitfarms have reduced its debt to a more manageable level of $13.3 million, and diluting 48.8 million shares (22%) in the last four months has helped them achieve this reduction whilst at the same time expanding its presence in South America, increasing its hash rate with more efficient miner machines.

Stock Performance in 2023

From the graph below, it is evident that the share price performance of Bitcoin mining companies has outperformed the price of Bitcoin. However, when you consider that in 2022 many of these companies saw their share price drop by over 90%, it starts to highlight the volatility that Bitcoin mining stocks have in relation to the price of Bitcoin itself.

As already highlighted in this article Core Scientific had a challenging time in 2022, which saw the stock price plummet by over 98% as the company entered Chapter 11. There have been positive updates in the last few months with a comprehensive plan to exit Chapter 11, and the share price has started to show signs of recovery.

Just over one month ago the average year-to-date increase in share price of all the North American listed miners was approximately 400%. As the price of Bitcoin has slowly pulled back from $31,000 to its current level of $26,187, the Bitcoin miners have seen much larger falls in their share price.