Poolin – a top five mining pool by hashrate – has suspended wBTC and wETH rewards for its tokenized hashrate contracts pBTC35a and pETH18c “for less than 60 days which correspond [to] the estimated schedule of miners migration,” according to a blog post from the pool last Thursday.

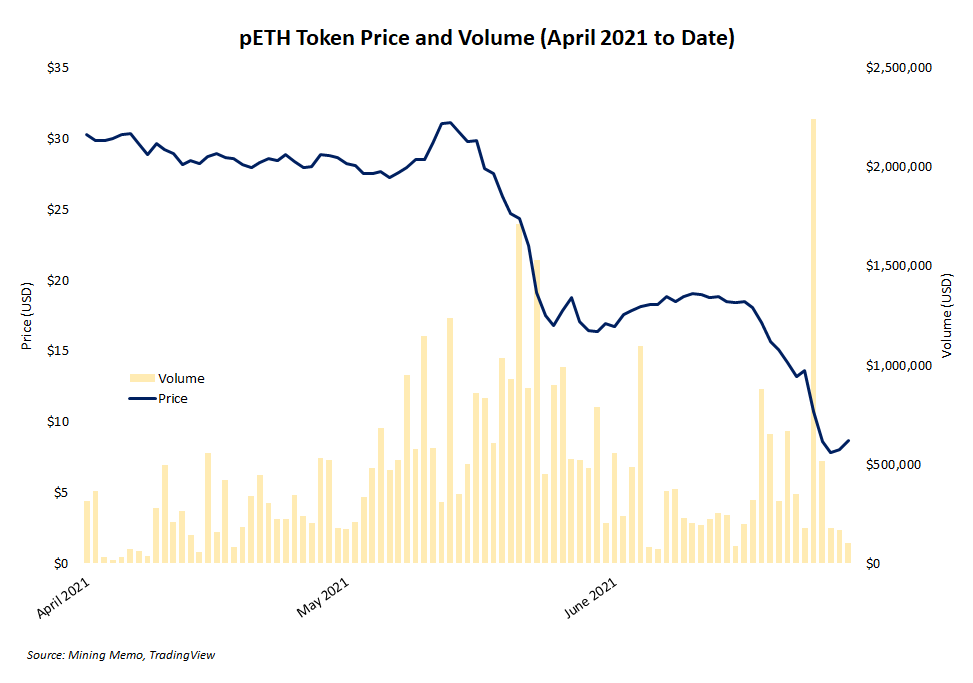

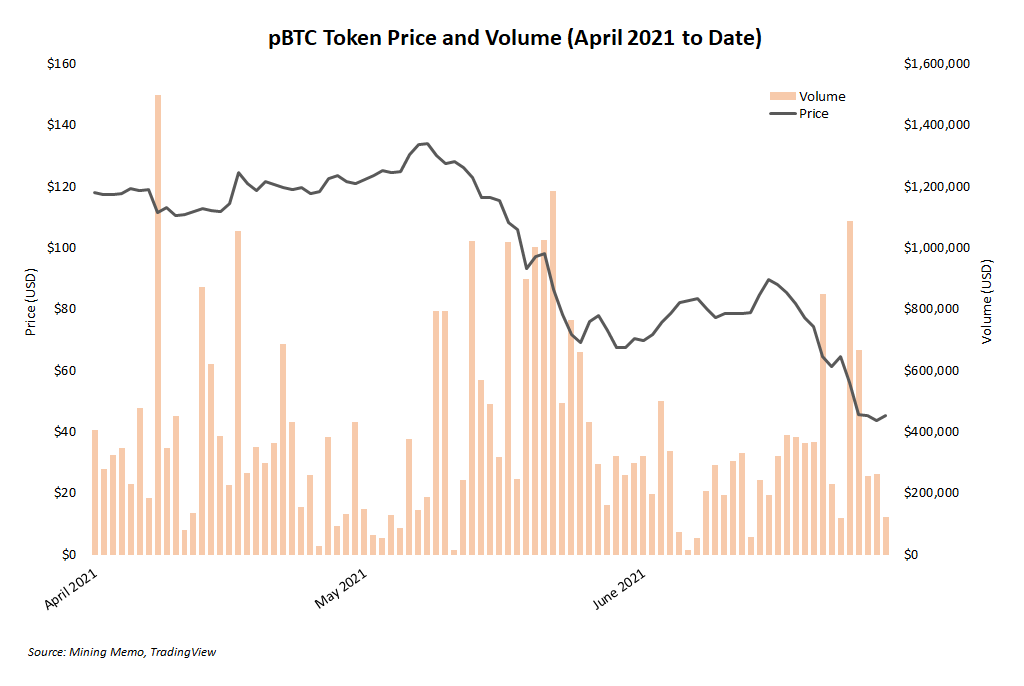

Predictably, the tokens price rapidly corrected as holders offloaded the contracts.

- pETH experienced its highest single daily volume turnover ever at over $2 million.

- pBTC, on the other hand, hit a high for June, but failed to outpace days in April and May corresponding to the first coal mining incident that shutdown Bitcoin miners in Xinjiang and the 21% difficulty adjustment, respectively.

Stepping back, pBTC and pETH equate to 1 TH/s and 1 MH/s of Bitcoin and Ether mining. Payouts are made in wBTC and wETH when staked on the platform, along with a native governance token, Mars.

Want more mining insights like this?

Poolin's decision to shutdown payouts is somewhat predictable given the circumstances, but also draws attention to the difficulties of crafting tokenized hashrate contracts. At some point, some machine needs to be hashing at some physical location under some persons control.

Mining contracts – specifically derivatives useful to miners for bringing hashrate to market more easily – are difficult to make even with all the decentralized finance (DeFi) bells and whistles. For example, no governance decision was initiated by holders of the Mars token on suspending payouts as Poolin made the decision unilaterally.

For now, the perfect hashing contract still eludes mining companies.