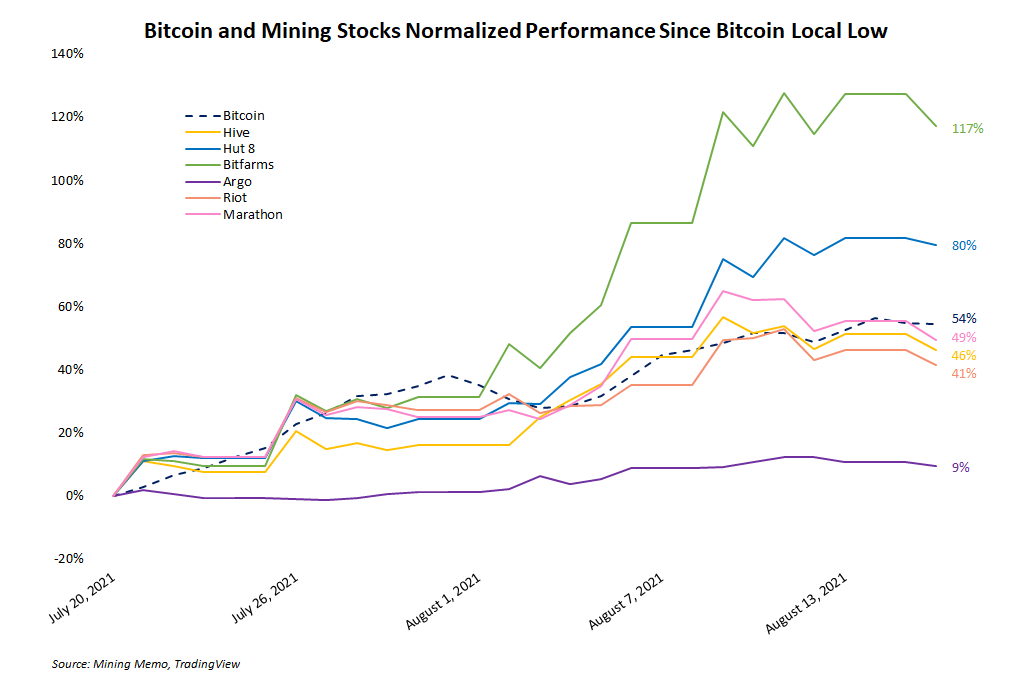

Public bitcoin mining companies typically outperform bitcoin during bullish cycles. But only a few top mining stocks have appreciated more than bitcoin as the entire cryptocurrency market has rallied off the market’s low almost a month ago.

Want more mining insights like this?

After July 20, 2021, the entire cryptocurrency market started to pare its losses from mid April. Since then, only Bitfarms and Hut 8 have outperformed bitcoin. The other top mining companies – Hive, Riot and Marathon – have kept pace with bitcoin, but they have not outperformed. Argo has trailed significantly behind the entire group.

Hut 8’s CEO and Bitfarm’s Chief Mining Officer both appeared on a recent Compass livestream to share their insights and predictions about the bitcoin mining industry. Both companies have enjoyed tremendous growth as they, along with every other mining company, are eager to expand aggressively in the wake of China’s crackdown on mining.

Watch the full livestream with Hut 8 and Bitfarms here.

If bitcoin and other top cryptocurrencies continue a strong upward trend, it won’t be surprising to see market tailwinds boost the stock prices of nearly all public cryptocurrency mining companies. Investors often view these equities as an indirect and leveraged opportunity to gain exposure to the cryptocurrency market knowing that if bitcoin goes up, mining stocks typically go up more.

In fact, nearly all top mining companies have outperformed bitcoin. Since New Year's Day 2021, all top companies except Argo have appreciated faster than bitcoin on a percentage basis. Hive shares to date are neck and neck with bitcoin’s price.

Where bitcoin’s price goes from here – about $46,000 at the time of writing – is anyone’s guess. But mining stocks will almost certainly continue to follow it.