Are we in the clear yet?

While Bitcoin miners suffered two consecutive, large-difficulty increases during the month of January, the price of Bitcoin closed for the month 40% higher than December at $23,139 per coin. Hashprice, a measurement of revenue per hash contributed to the Bitcoin network, also rose during the month, up 27% year-to-date.

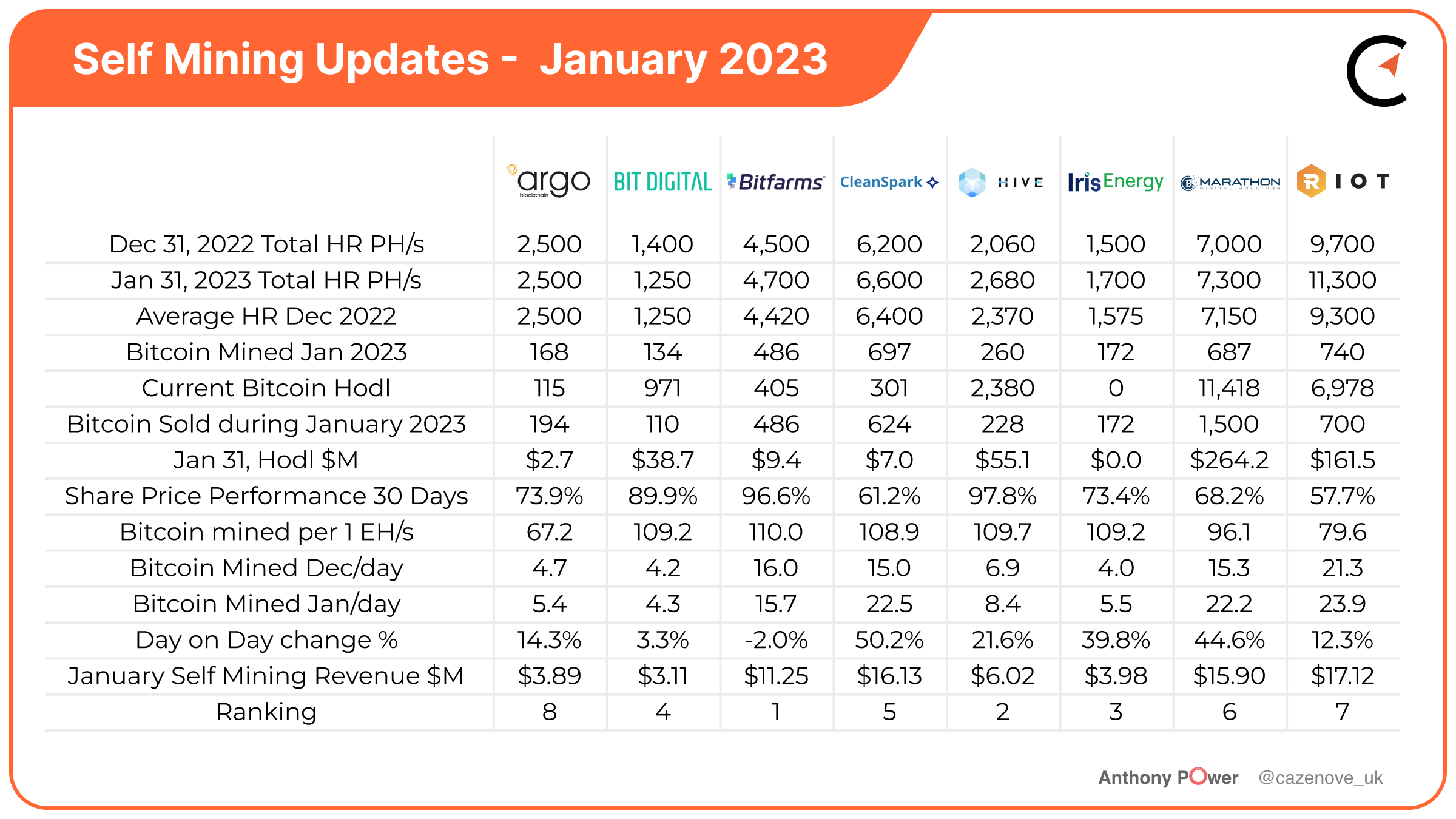

A bit of position jostling for first place followed the cheery price action. Record monthly production totals for CleanSpark and Riot Platforms were reported, although not sufficient to knock Bitfarms off the top spot for January 2023. Hive Blockchain and Iris Energy follwed Bitfarms to round out the top three, with notable performances from Bit Digital and CleanSpark.

Luckily, surging mining difficulty did not have a significant effect on North American-listed miners, with most managing to make excellent use of the increase in Bitcoin price and add to their operational hashrates during the month.

Argo Blockchain (ARBK)

Argo Blockchain produced its first monthly mining update since the handover of its flagship Helios site in Texas to Galaxy Digital (GLXY), producing 168 Bitcoin at a daily rate of 5.4 EH/s and although an increase of 14.4% on the daily rate for December, it provided an equivalent of 67.2 Bitcoin per month.

The update comes as Peter Wall, the CEO and interim chairman of Argo Blockchain, announced his resignation on Feb. 9, following three years as head and five years of service at the company. The board has appointed Chief Operating Officer Seif El-Bakly, CFA, as the interim CEO, while a recruitment firm is being engaged to source a replacement. Martin Shaw, a current non-executive director of the company, has been appointed chairman.

Argo’s mining revenues for the month totaled $3.42 million, an increase of 37.3% on the revenues achieved in December. The company sold 194 Bitcoin during the month to meet its operational commitments.

Bit Digital (BTBT)

Bit Digital mined 134 Bitcoin in January at a rate of 4.3 a day, an increase of 3.3% on the daily rate achieved in December. The company announced it has 13,065 miners deployed, representing 34% of the total fleet and providing an operational hashrate of 1.25 EH/s.

The New York City-based firm has a total hodl of 971 Bitcoin and 10,222.3 Ethereum valued at some $38.7 million, and cash and cash equivalents of $28.0 million as of Jan. 31.

Bit Digital was also able to gain compliance with the Nasdaq, as share prices recovered over the last 30 days with an increase of 89.9% and have held above the $1 threshold continuously since Jan. 12.

Bitfarms (BITF)

Bitfarms–always first to announce monthly mining updates–had yet another solid performance, producing 486 Bitcoin at a daily rate of 15.7 Bitcoin. The Canadian miner earned $11.2 million in revenue, an increase of $3 million on the revenue achieved in December 2022.

The mining difficulty increase and energy curtailment were factors that once again impacted production as a normal part of the company’s operations during the winter. As a result, Bitfarms temporarily curtailed operations in Quebec, supporting the community by restoring power back to the local grids.

The company’s average operational hashrate increased to 4.42 EH/s, with 4.7 EH/s hit by month’s end, due to the installation of 2,888 new MicroBT M30s in Paraguay. The firm now operates 288 PH/s in the region.

The company sold 405 Bitcoin for a total of $9.4 million and used some to repay $2.5 million of debt, which included repayment of its highest interest rate equipment loans totaling $830,000.

Notably, Bitfarms announced it had agreed to settle its remaining $21 million of debt with lender Block-Fi for a single cash payment of $7.75 million, removing any charge against the assets. This will also lower the company’s current debt down from a high in June 2022 of $165 million to a more manageable $25 million. The company’s plan is to become debt-free before the next halving in May 2024.

CleanSpark (CLSK)

CleanSpark continues to set the pace for Bitcoin miners, increasing production by 50% month-over-month. At an average of 22.5 Bitcoin per day, the Las Vegas-based firm mined 697 Bitcoin.

The company has a deployed fleet of about 66,000 latest-generation Bitcoin miners with a total operational hashrate of 6.6 EH/s, up 7% from December 2022 and up 214% from January 2022. CleanSpark was able to operate its miners at 98% capacity during the month, another all-time record providing the company with 108.9 Bitcoin per EH/s for the month.

CleanSpark sold 624 Bitcoin during the month for a total of $11.9 million, tto cover its operational and capital growth requirements, and has a remaining hodl of 301 Bitcoin with a value of $7 million.

Hive Blockchain (HIVE)

The company produced 260 Bitcoin in January at a daily rate of 8.4 Bitcoin per day, an increase of 21.6% on the previous month and equivalent to 109.7 Bitcoin per EH/s. The company was also able to earn $180,000 in income from balancing the grid during the month.

Hive Blockchain also announced on Jan. 17 the appointment of Aydin Kilic as president and chief executive officer. His primary role will be overseeing the tactical execution of the company’s global strategies, business development initiatives and engagement with the capital markets. He will continue to report to Executive Chairman Frank Holmes.

The company increased its average operational hashrate from 1.89 EH/s to 2.37 EH/s during the month, at a rate of 109.7 Bitcoin per EH/s. This increase in hashrate was due to the deployment of over 6,700 ASIC miners into its data centers, including 3,200 HIVE Buzz Miners powered by the Intel Blockscale ASIC and all of the 3,570 S19j Pros the company acquired in December 2022.

Hive Blockchain continued to sell more Bitcoin than it mined during the month of January to cover operational and capital growth costs, and the company has a current Bitcoin hodl as of Feb. 7 of 2,430 BTC with a value of $55.1 million.

Iris Energy (IREN)

Iris Energy produced 172 Bitcoin at a rate of 5.5 per day, a 40% increase on the daily average rate achieved in September. It achieved this total with an average operational hashrate of 1.58 EH/s, up from 1.09 EH/s in September. This increase was helped by the additional 0.2 EH/s of miners installed at the company’s Mackenzie site, which takes its current capacity to 1.7 EH/s. A further 0.3 EH/s is installed, in-transit or pending deployment.

Iris Energy sold all its Bitcoin mined during the month for $3.5 million, an increase of 66% in what was achieved in December, helped by the increased hashrate and the increase in Bitcoin price during January.

The construction at the Childress site continues to progress well, with the first 20 megawatt (MW) data center structure and miner racking completed. The internal data center electrical fit out has now commenced. The 600 MW transformer and two 100 MW transformers have also been installed and assembled on site.

Marathon Digital (MARA)

Marathon Digital had a much-improved January, producing 687 Bitcoin or an average of 22.2 Bitcoin per day–a 45% increase on the previous month’s production–due to the improvement of working with the new hosting provider in McCamey, Texas, and addressing the maintenance and technical issues at the King Mountain data center.

In January, the Las Vegas-based company installed and energized 2,100 S19 XPs, providing 0.3 EH/s at the Jamestown facility. The firm now has over 71,000 mining rigs for 7.3 EH/s.

Marathon also announced that 26,700 S19 XP miner rigs, providing 3.7 EH/s, are already installed and awaiting to be energized at Applied Digital’s facilities in Garden City, Texas, and should be energized during the first quarter of 2023.

Due to the good production numbers, Marathon Digital actually sold 1,500 BTC during the month. The company maintains a considerable hodl of 11,418 BTC, of which 8,090 BTC remains unrestricted, with a current value of $187.2 million, as of Jan. 31. The company will continue to sell Bitcoin monthly when appropriate for operational requirements, treasury management or general corporate purposes.

The company also has unrestricted cash on hand of $133.8 million, providing a total current liquidity of $321 million, placing it in a strong position to navigate through the current bear cycle.

Marathon Digital also announced in January that it had entered into a shareholders’ agreement with FS Innovation, LLC, to establish and operate mining facilities under a newly formed company, Abu Dhabi Global Markets (ADGM), providing the company with a 20% stake at a cost of $81.2 million. The initial project will consist of two digital asset mining sites comprising 250 MW in Abu Dhabi.

Riot Blockchain (RIOT)

Riot Platforms, Inc. produced another new all-time high of 740 Bitcoin in January 2023 at an average daily rate of 23.9 Bitcoin per day–an increase of 12.3% on the previous month.

The Texas miner has a deployed fleet of 82,656 miners, with a hashrate capacity of 9.3 EH/s as of Jan. 31.

Those figures do not include the 17,040 miners or approximately 2.5 EH/s currently offline due to damages caused by severe weather at the company's flagship Rockdale site in December. Work is now completed on Building F, which will provide 0.6 EH/s of capacity, while the company considers several options to bring the remaining 1.9 EH/s on line in Building G.

The impact of this has caused Riot Platforms to announce its target of 12.5 EH/s of self-mining operational hashrate to be delayed past Q1 2023.

On a positive note, the company received 5,130 new S19-series miners, deployed 6,912 S19-series miners and ended the month with approximately 1,152 miners staged for deployment. This will take its operational hashrate capacity, excluding Building G, to approximately 9.4 EH/s.

Riot Platforms sold 700 Bitcoin during January to cover operational costs, generating $13.7 million. It currently has a Bitcoin hodl of 6,978 Bitcoin with a value of $161.5 million.