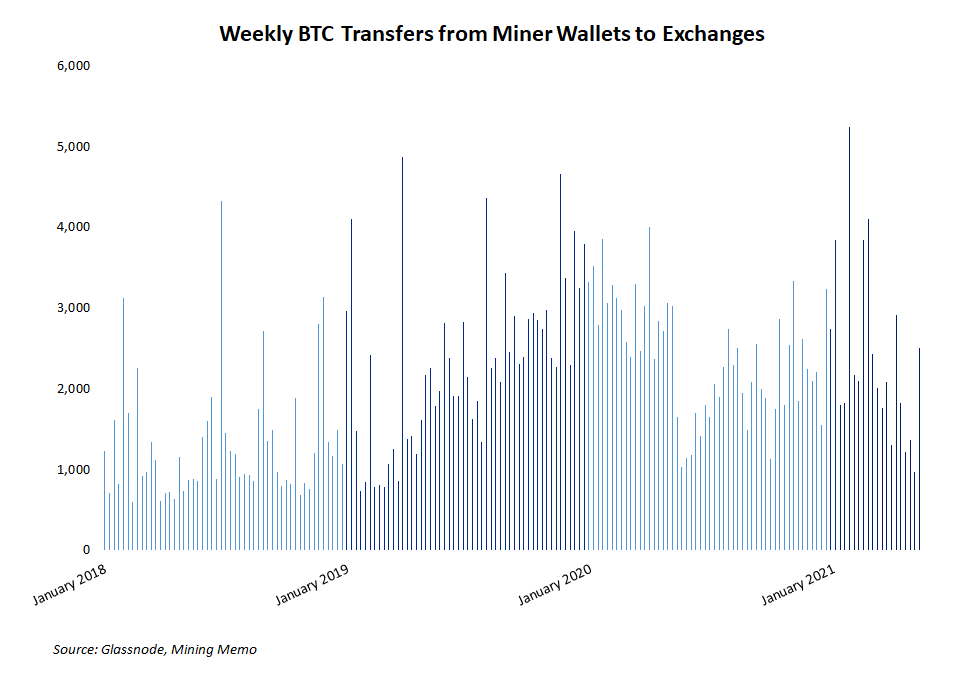

Bitcoin’s price has dropped nearly 35% off its all-time high near $65,000 over the past month. Trending down with the price is the volume of bitcoins flowing from miner wallets to exchanges.

- Weekly transfers to exchanges have trended downward since late January 2021.

- Weekly transfers dropped to a more-than-two-year low in early May.

Concurrent with the decrease in transfers to exchanges, the balance of miner wallets is starting to rebound, according to data from Glassnode. After a sharp drop in December 2020 when bitcoin was trading around $25,000, the total supply of bitcoins held by miners is slowly increasing again, reviving a trend that started in August 2019.

Blockchain-level transaction data should always be handled carefully and with an understanding that identifying entities behind on-chain activity is imperfect. Also, the data comes laden with assumptions, like inferring all flows to exchanges implies selling activity. After recognizing the assumptions and accepting the data’s inherent margin of error, on-chain data like those in this article can be very helpful for monitoring high-level trends.

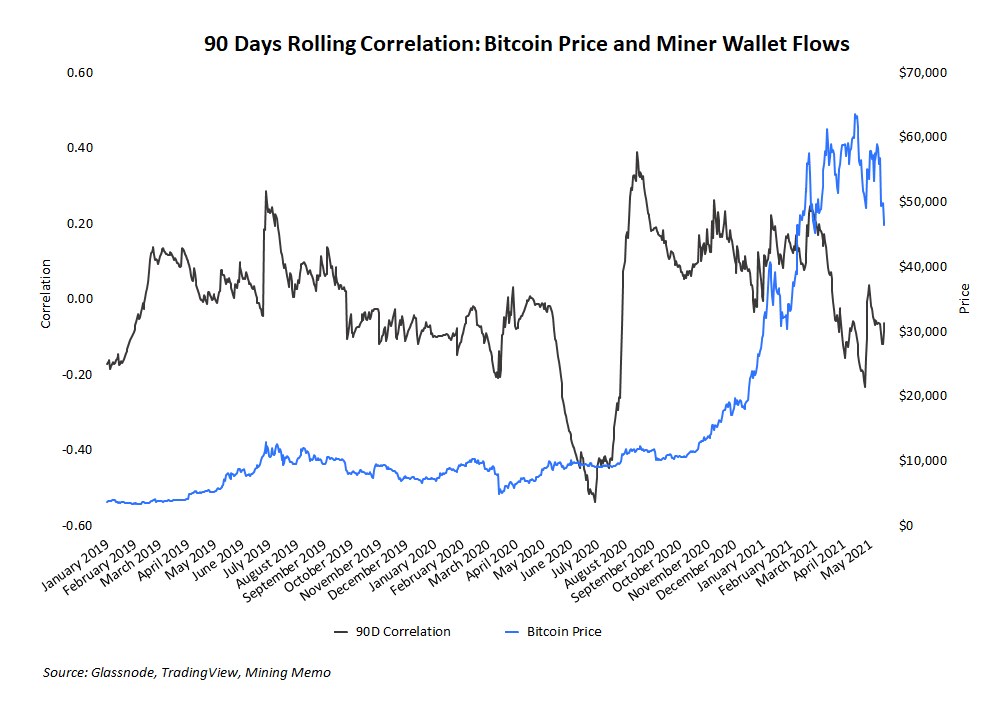

Miners often get blamed for sharp downward price movements even though the “miners are selling” myth has been refuted repeatedly, most recently here and here. That narrative has been refreshingly absent from bitcoin’s latest price drop, however.

Want more mining insights like this?

Correlating bitcoin’s price and miner wallet flows offers another perspective into this often-misrepresented piece of the market. As the below chart illustrates, the correlation is erratic and weak at best. The correlation has, moreover, steadily dropped since August 2020 as bitcoin’s price started its latest parabolic rally.

It’s not a shock to see fewer coins sold by miners as the price increases since bitcoin’s appreciating dollar value means their costs—priced in bitcoin’s they have to sell—decrease.

By default, bitcoin miners are extremely bullish. The investment in efficient hardware, hosting facilities, reliable electricity, etc. In fact, total coins held by miners are gradually increasing, and most miners tend to sell only what’s necessary for basic risk management and to cover their operational costs.

The bottom line is miners are bullish by nature, and they’re consistently transferring fewer bitcoins to exchanges. Even though bitcoin’s price has dipped a bit, miners are still hashing and hodling.