Making a half-court shot on the first try? That’s how one Ethereum project is feeling right now thanks to Maximal Extracted Value (MEV).

After last week’s addition of SparkPool, over 78% of Ethereum hash power is now using some version of Mev-geth – a software from research group Flashbots that allows miners to package sequence transactions in bundles on behalf of traders or themselves. Remarkably, the alpha version was only released in January.

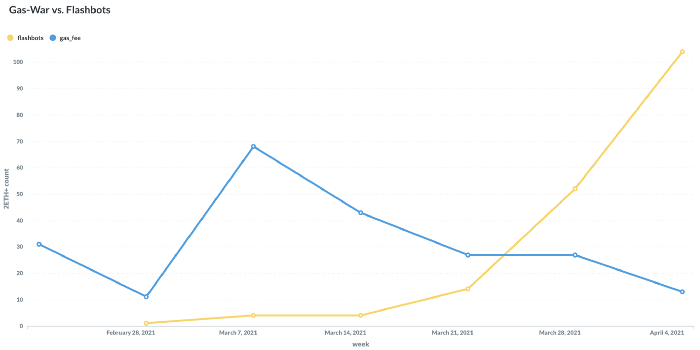

And, perhaps unintuitively, that software may be proving to be one reason Ethereum’s average gas fees are at a one month low. Some 30% of Ethereum blocks now include Mev-geth bundles, which are beginning to show an inverse correlation with gas fees – more bundles, lower gas prices.

Of course, declining fees can also be attributed to some traders moving to other blockchains (.e.g., Binance Smart Chain) and a decreasing interest in trading on Ethereum. But Mev-geth bundles should not be overlooked as they solve one issue every public blockchain has: Overuse by the wealthy at the expense of others.

- Bribes are included in the coinbase reward itself, sort of like an on-chain out-of-band payment. This bribe replaces a lot of on-chain transaction fees you’d typically see.

- Bundles don’t have to pay if the miner rejects the bundle on the relay network. Normally, a failed Ethereum transaction still has to pay a bit of gas which can get pricey.

More technically speaking, MEV solves what is known as Priority Gas Auction (PGA) tactics. PGA refers to bots fighting it out for inclusion in a certain block by spending a lot of gas repeatedly on the same transaction. They inadvertently increase the cost of using the network itself which everyone else has to also bear.

Want more mining insights like this?

Indeed, PGA bots are a big reason Ethereum became so expensive to use once decentralized finance (DeFi) applications took off last summer – bots were simply bidding up fees.

Anecdotally, Flashbots claims defanged PGA bots are already shutting down. By offering a priority highway lane to traders, Mev-geth may just solve Ethereum’s fee crisis.