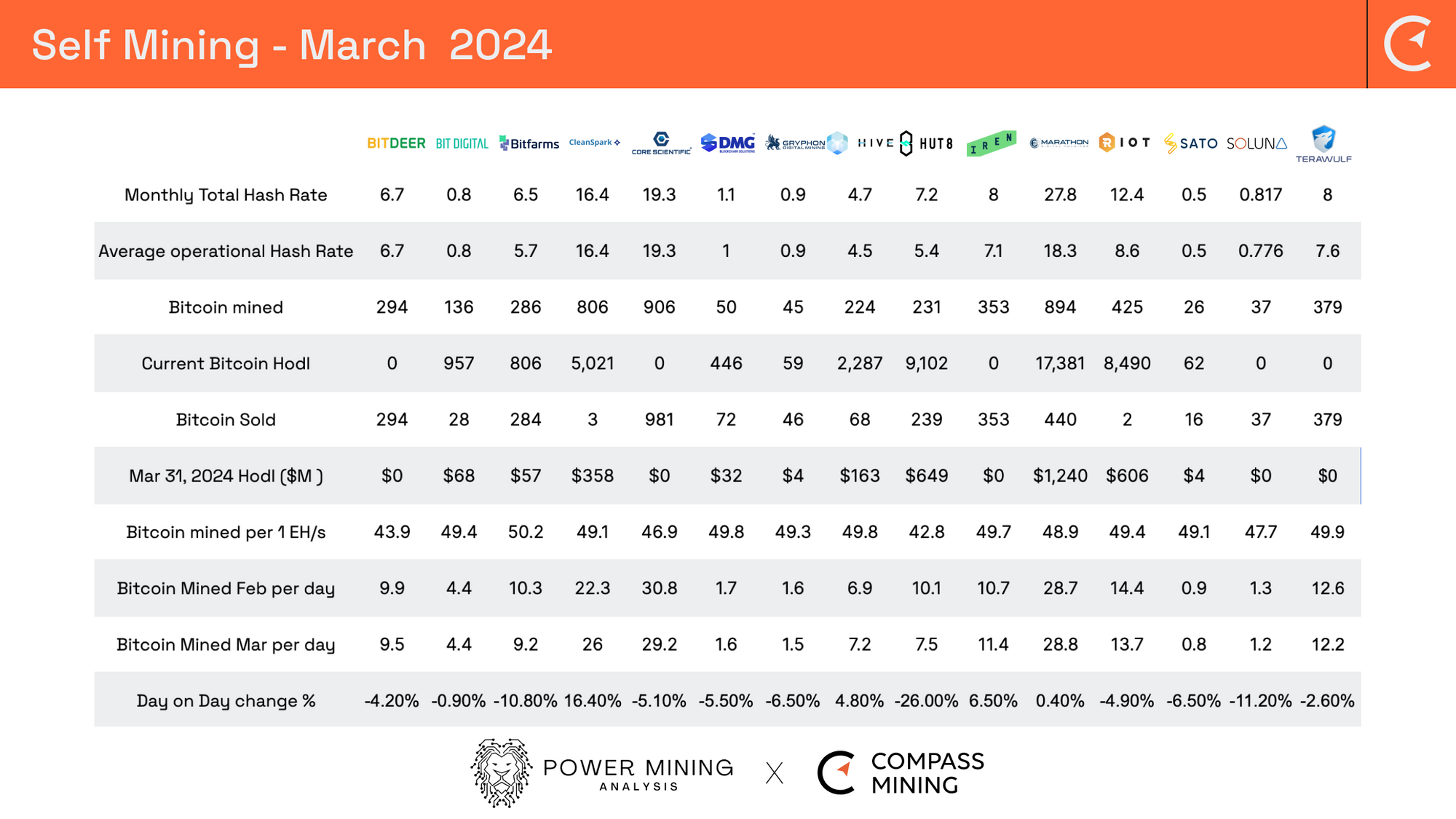

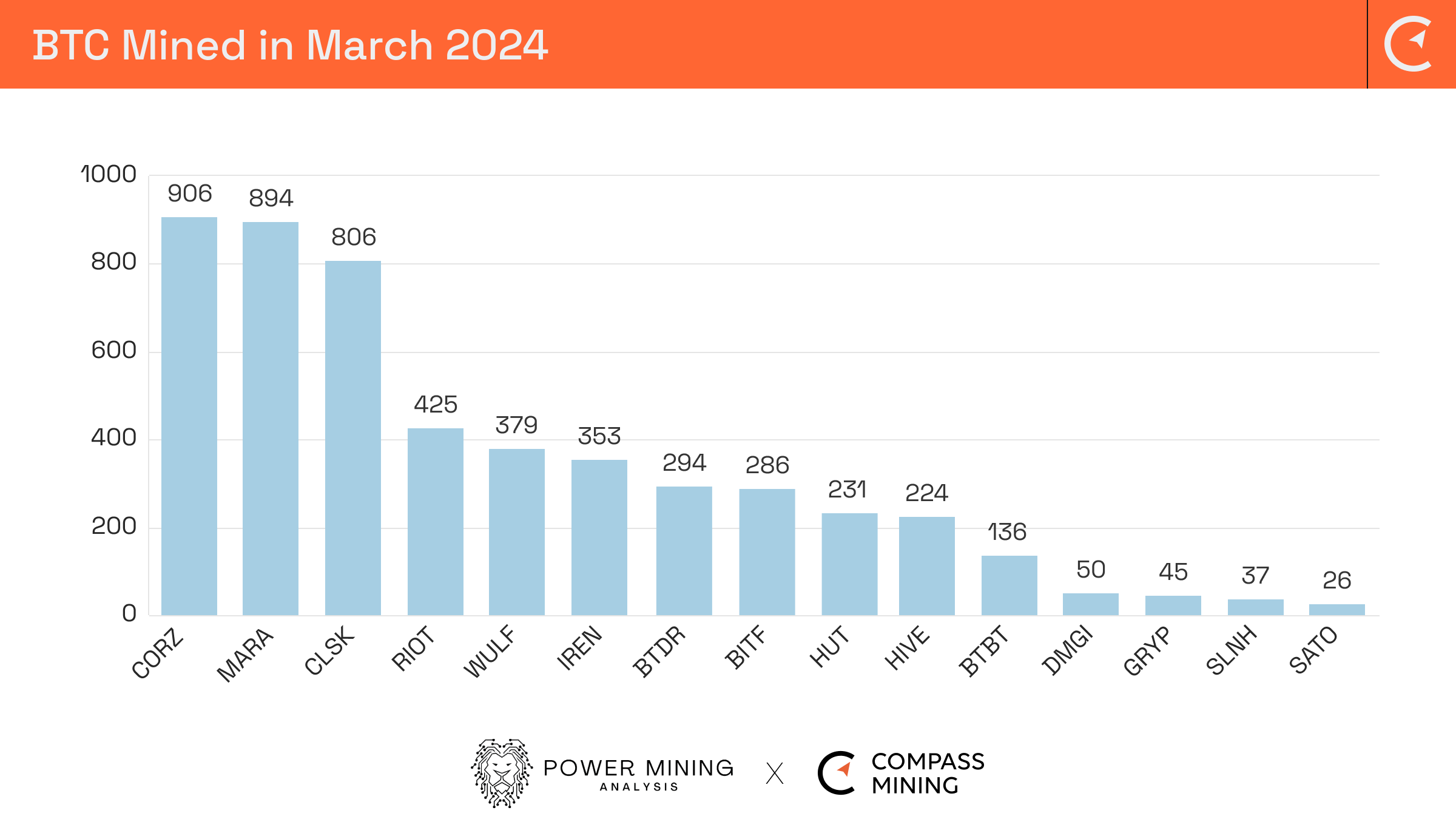

The month of March witnessed the global hash rate continue its upwards trajectory towards 800 EH/s as more mining machines were added to the network. This impacted the Bitcoin mining difficulty, which increased by 4.8%, meaning lower production for many of the North American miners who were not able to increase their operational hash rate during the month.

The price of Bitcoin, however, increased by 17% during the same period which more than offset the difficulty increase and actually brought much needed additional revenues for miners as they approach the Halving, which is due to occur in less than ten days time.

Continued production woes for Marathon Digital (MARA)

Having broken every mining metric record in December 2023, Marathon Digital performance has failed to operate with the same success. The company’s production has declined with continued setbacks in Q1 2024, due to equipment failures, maintenance, and weather-related issues across sites. The Ellendale facility transformer challenges also persist, impacting capacity. MARA has indicated that recovery efforts are underway, aiming for gradual capacity increase over the next few months.

The company produced just 894 Bitcoin in March at a daily rate of 28.8 Bitcoin per day, a 0.4% increase in the daily rate achieved in February. These Bitcoin were achieved with an average operational hash rate of only 18.3 EH/s, approximately 10 EH/s (-34%) lower than the currently installed hash rate.

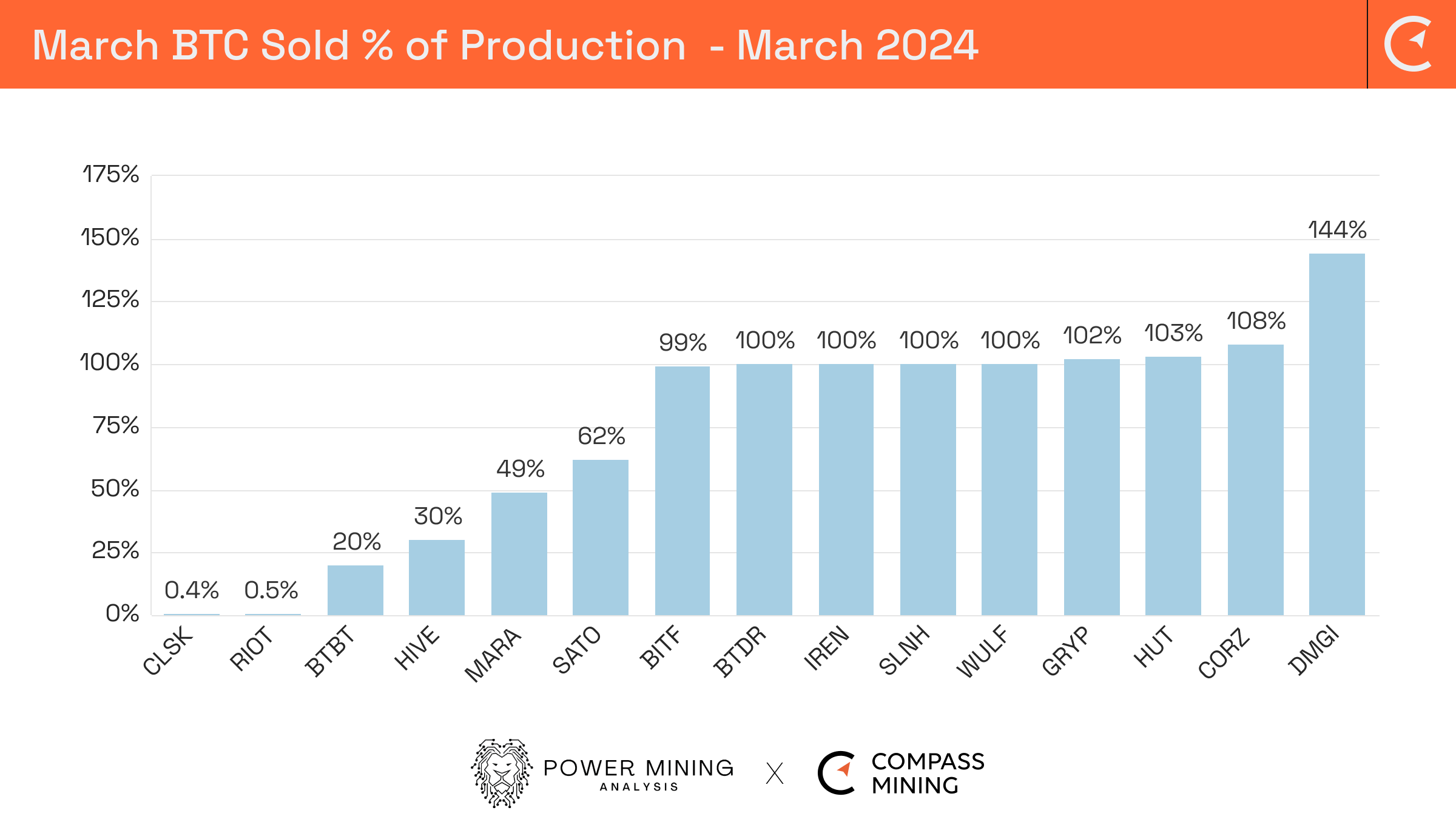

On a positive note, the company increased its hodl to 17,381 Bitcoin with a value, as of March 31, 2024, of $1.24 Billion. They also added to their unrestricted cash and cash equivalents to round out a treasury balance of $1,563.4 million as of March 31, 2024.

Bitdeer Technology (BTDR)

On March 26, 2024, Bitdeer disclosed plans to amplify its hash rate expansion throughout the remainder of the current year, targeting a 3.4 EH/s increase. This enhancement will be achieved through the deployment of SEALMINER A1 miners in its Rockdale, Texas, and Norway data centers by Q3 and Q4 2024. The company aims to augment its hash rate by approximately 4.8 EH/s while retiring 1.4 EH/s of older mining rigs, projecting an increase in proprietary hash rate from 8.4 EH/s to around 11.8 EH/s by year-end.

Looking ahead to 2025, Bitdeer anticipates further expansions potentially adding 30-40 EH/s, with newer models replacing older rigs. This could lead to the total hash rate under management exceeding 46 EH/s by the end of 2025. Linghui Kong, Bitdeer's Chief Business Officer, expressed confidence in the SEALMINER A1's efficacy, highlighting its rigorous in-house testing to enhance fleet efficiency. The chip's power efficiency underscores Bitdeer's commitment to optimizing mining operations.

Despite a reduction in daily mining rate compared to the previous month, Bitdeer mined 294 Bitcoin in March at an average daily rate of 9.5 Bitcoin per EH/s, marking a 4.2% decrease.

Additionally, on April 4th, the company announced securing orders from Taiwan Semiconductor Manufacturing Company for wafers, expected to yield mining machines worth around US$60 million in Q3, subject to manufacturing expenses. Bitdeer has also successfully deployed its NVIDIA DGX SuperPOD H100 system in Singapore, pioneering this service in Asia.

Bit Digital (BTBT)

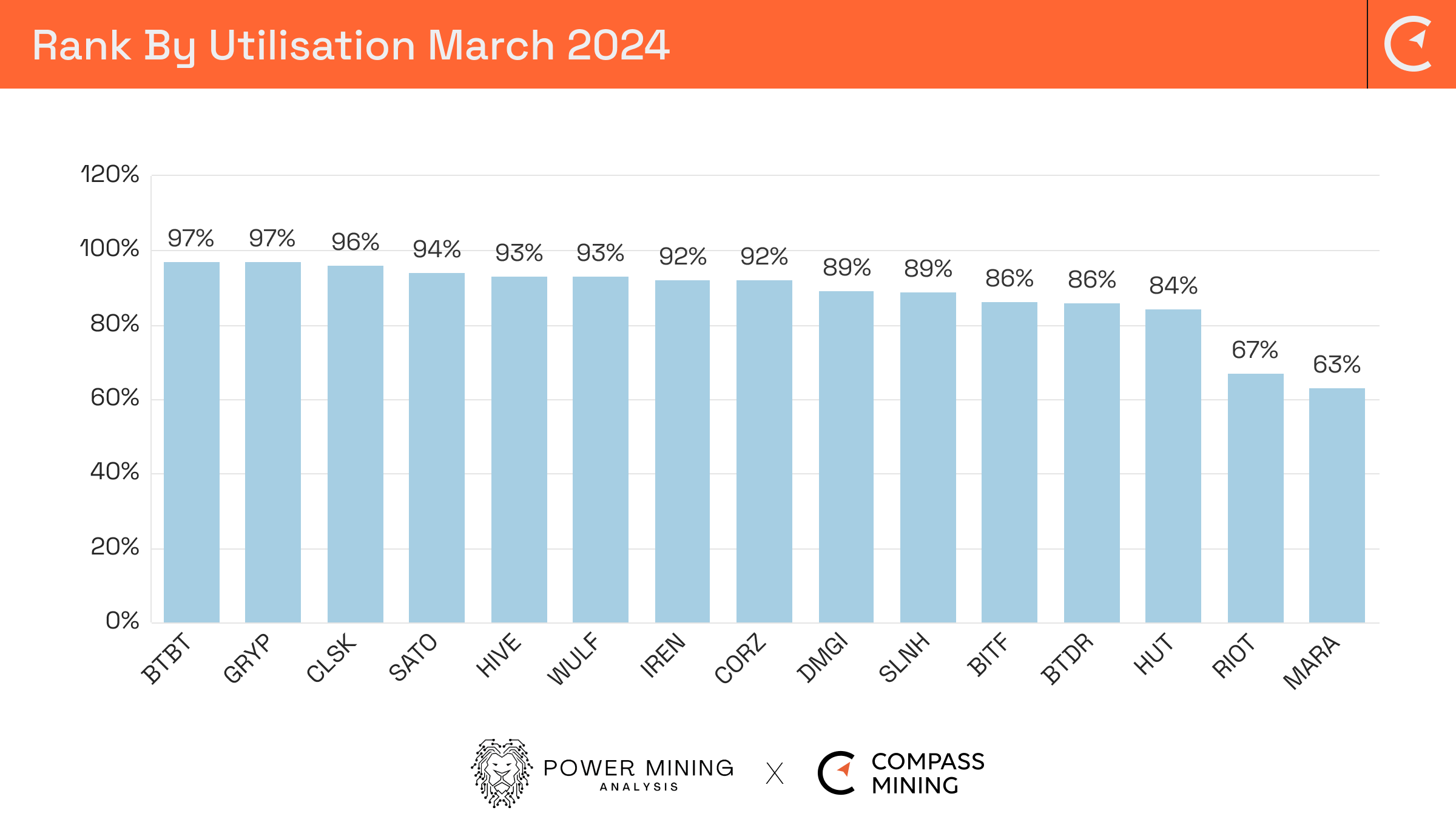

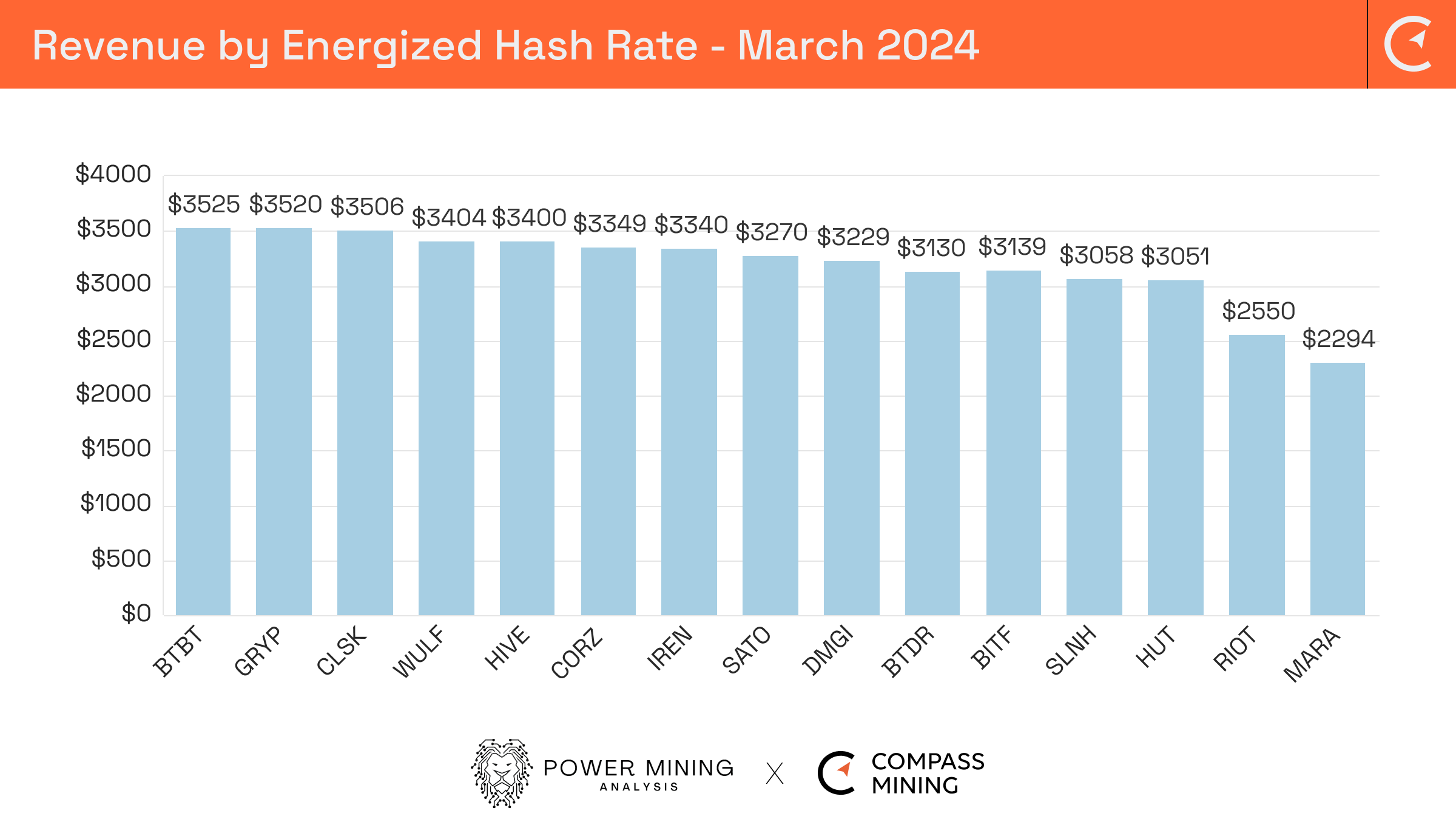

Bit Digital had a really good month, producing 136.4 Bitcoin during March, at an average daily rate of 4.4 Bitcoin per day, equal to that mined during the previous month, although revenues achieved, thanks to the rise in Bitcoin, were up by $1.8 million (+24%). In terms of mining utilization, the company achieved top spot in comparison to peer miners with over 97%.

The company sold just 28 Bitcoin from their production to increase their hodl to 956.6. They also maintain a significant Ethereum hodl of 16,032 and when combined with their cash and cash equivalents of $34.9 million, it takes the total treasury position to just over $162 million available, as of March 31, 2024.

Bit Digital's saw their 3,008 ETH staked, achieving a 2.8% blended APY and earning 29.0 Ethereum rewards. Additionally, Bit Digital AI, their high performance computing business segment involved 251 active revenue-generating servers, yielding an estimated $4.3 million during the month. On March 26 Bit Digital announced a proposal from a current client to expand Bit Digital AI. The proposal includes adding 2,048 GPUs, totaling 4,096 GPUs. Subject to terms being acceptable, this addition will help the company achieve its target of $100 million annualized revenue.

Bitfarms (BITF)

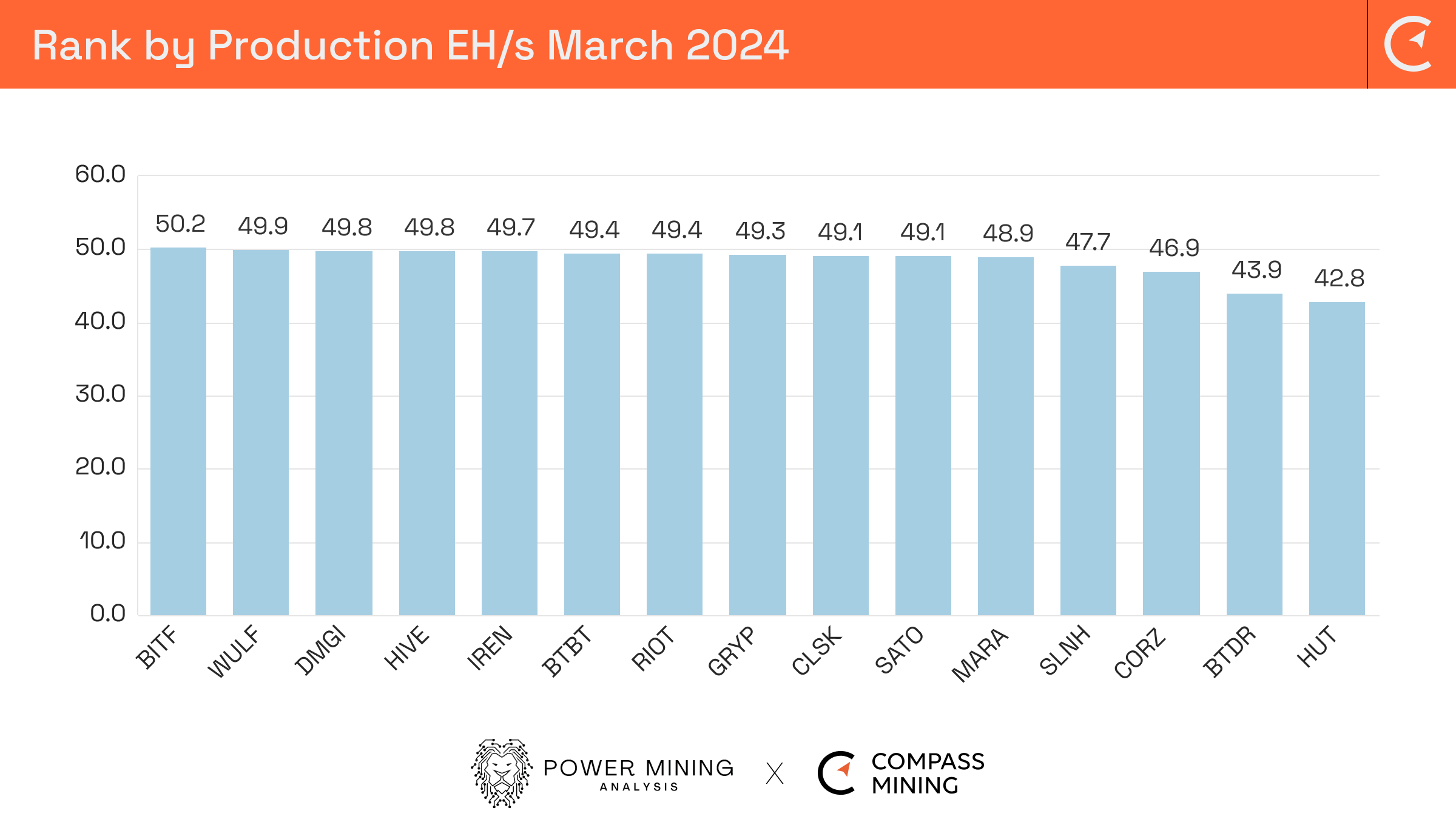

Bitfarms produced 286 Bitcoin during the month of March at an average daily rate of 9.2 Bitcoin, a reduction of 10.8% on the average daily rate achieved in February. This was caused by grid-stabilizing curtailment initiatives, power plant maintenance in Argentina, temporary decreases in average operating EH/s due to facility upgrades, and a 4.8% rise in network difficulty. In terms of production by EH/s, consistent performer Bitfarms returned to the top of the table, with 50.2 Bitcoin per EH/s

Geoff Morphy, the current President and CEO, who will be stepping down shortly, announced the purchase option for 51,908 Bitmain miners, including T21 and S21 models, citing the confirmed performance of T21s and soaring Bitcoin prices. These acquisitions, alongside previous orders, are expected to propel the company's mining capacity to 21 EH/s by year-end, enhancing operational efficiency and positioning them for improved profitability amidst rising Bitcoin values.

The company sold 284 Bitcoin, representing 99% of their monthly production, adding 2 Bitcoin to their new hodl total of 806, which when added to the cash balance of $66 million, takes their total liquidity to $123 million, as of March 31, 2024.

Core Scientific (CORZ)

Core Scientific had an impressive March, with the highest monthly production for a second consecutive month, totalling 906 Bitcoin, at an average rate of 29.2 Bitcoin per day, a reduction of 5.1% on the daily amount achieved in February. This was predominantly caused by the rise in mining difficulty and the decreased power consumption at its data centers on multiple occasions, contributing 6,063 megawatt hours to local grid partners.

At the close of March, the company received and deployed around 2,500 new Bitmain S21 miners, marking the initial delivery of the previously announced 2.5 EH/s order. Anticipated completion for the remainder of the S21s is set for April 2024. Core Scientific elevated its active self-mining hash rate to 19.3 EH/s, part of its goal to reach 21.8 EH/s by 2024 year-end.

Core Scientific replaced prior-generation miners and relocated them to Calvert City, KY, and Pecos, TX data centers, where 21MW of new infrastructure was activated, bringing the company's total operational infrastructure to 745 MW.

CEO Adam Sullivan highlighted the exceptional achievements of Core Scientific's Austin team, surpassing expectations by completing the initial 16MW phase of infrastructure ahead of schedule, and enabling their High Performance Computing (HPC) client to promptly deploy GPUs, with potential revenue streams in excess of $100 million.

The company sold 981 Bitcoin during the month, representing 108% of the March production for total revenues of $66.3 million.

DMG Blockchain (DGMI)

DMG Blockchain mined 49.8 bitcoin during the month of March, at an average daily rate of 1.6 Bitcoin, a reduction of 5.5% on the rate achieved in February.

On March 21, 2024 the company announced an operational update, detailing progress on its mining capacity and deployment plan at their Christina Lake facility where a further 54 mining containers are due to be energized, with four already operational. Full operational status is anticipated by the end of June 2024 to support the deployment of the new T21 fleet.

DMG Blockchain will use the standard energy mode for the deployment of its ordered 4,550 Bitmain T21 miners, currently being shipped, projecting 0.86 EH/s output at 19 J/TH efficiency. This should take the company's total energized hash rate closer to 2.0 EH/s. The company is also establishing a new data center in British Columbia, with access to low-cost renewable energy.

The company sold 71.8 Bitcoin during the month, representing 144% of the March production, providing a current hodl of 446 Bitcoin, with a value of $32 million as of March 31, 2024.

Gryphon Digital Mining (GRYP)

Recently publicly listed Gryphon Digital Mining produced 45 Bitcoin, with a value of $3.1 million based on the average March bitcoin price of $67,509, at an average daily rate of 1.5 Bitcoin, a reduction of 6.5% on the average daily rate achieved in February. In terms of utilization, the company was only narrowly beaten to 1st place by Bit Digital.

The company’s self mining business operated at a record average hash rate of 912 PH/s during March, achieving 49.3 Bitcoin per EH/s, another record for the company. To enable these levels of production the company has initiated its machine upgrade program by purchasing Bitmain S21 200 TH/s machines, aiming to enhance its hashing power and reduce fleet efficiency.

In terms of environmental sustainability, the company electrified 100% of its Scope 1 and Scope 2 operations using zero-carbon emitting hydro power. Additionally, Gryphon Digital Mining became the first bitcoin miner to publicly publish granular carbon emissions data in partnership with CarbonChain, continuing its proactive approach to transparency and sustainability, setting a precedent in the bitcoin mining industry and reflecting the company’s responsible corporate decision-making and environmental stewardship.

As of March 31, 2024, Gryphon Digital Mining held 59 bitcoin in its treasury, with a current value of $4 million..

Hive Digital (HIVE)

Hive Digital mined 224 Bitcoin during the month of March, at an average daily rate of 7.2 Bitcoin, an increase of 4.8% on the average daily rate achieved in February. The increase was due to the receipt and installation of S21 mining machines which concluded March with a 4.7 EH/s mining capacity, a 13% increase in month-end hash rate.

Executive Chairman Frank Holmes highlighted the company's focus on maintaining a robust balance sheet ahead of the upcoming Halving event. President and CEO Aydin Kilic underscored the company's technological stability through the integration of Bitmain S21 Antminers, anticipating a total target hash rate of 5.5 EH/s by the end of June 2024 with a global average fleet efficiency of 25 J/TH.

Having sold 68 Bitcoin, representing 30% of their monthly production during March, the company added to its growing hodl, which as of April 4, 2024, is 2,315 Bitcoin, up from 2,131 BTC in February 2024 with current value of $160 million. This choice to hodl Bitcoin is aligning with its strategic emphasis on increasing this position amid increased Bitcoin demand.

Hut 8 Corp (HUT)

Hut 8 produced 231 Bitcoin during March, at an average daily rate of 7.5 EH/s, a reduction of 26% on the average daily amount achieved in February, mainly due to the closure of the Drumheller site, with efficient miners now being relocated to Medicine Hat and inefficient ones retired. The company anticipates improved operational efficiency as a result of these adjustments.

Furthermore, notable advancements were made at the Salt Creek site, with full energization expected by April and ahead of schedule. Hut 8 also relocated miners from Kearney and Granbury to owned sites like Salt Creek and Alpha, prioritizing fleet control and energy cost reduction leading up to the Halving. Hut 8 will maintain revenue generation until the agreement's termination in April, entitling the company to an early termination fee of $13.5 million.

The company sold 239 Bitcoin during March representing 102% of the production, but maintained an impressive hodl totalling 9,102 Bitcoin, in their treasury, at a value of $649 million, as of March 31, 2024.

IREN (IREN)

IREN produced 353 Bitcoin during the month, at an average daily rate of 11.4 Bitcoin, an increase of 6.5% on the average daily rate achieved in February. This increase was due to the company reaching another milestone of energized hash rate with 8 EH/s. The company is well on their way to achieving their fully funded hash rate targets of 10 EH/s by mid 2024 and 20 EH/s by the end of 2024.

With 180 personnel currently on site to support the Phase 1 Childress expansion, of which 60 MW is currently operating, with the remaining 40 MW under construction is due to be completed by June 30, 2024. Phase 2 and 3 which will bring a further 200 MW of power, will support the company achieving its year end hash rate target.

IREN is progressing well with its cloud services operations at their Prince George data center, with 248 NVIDIA H100 GPUs operating and a further 568 currently undergoing commissioning, which when fully operational could bring $14-$17 million of annualized hardware profit. Their current customer, Poolside AI, has recently extended the current contract by an additional 4 month term commencing mid-April 2024, with a further option to add an additional 2 months at the customer’s election. Daniel Roberts, Co-Founder and Co-CEO of Iris Energy, remarked on the significance of their extended collaboration with poolside, "the broadening of our partnership with poolside underscores the excellence of our AI Cloud Services division, encompassing our technology stack prioritizing performance for AI and cutting-edge data centers fueled by renewable energy."

Riot Platforms (RIOT)

Riot Platforms mined 425 during March at an average daily rate of 13.7 Bitcoin, a reduction of 4.9% on the average rate achieved in February and mainly due to the mining difficulty increase.

It’s been no secret that there have been a number of operational issues at the Rockdale facility over the past 18 months and production is noticeably not at the levels of its peer miners. To avoid any further speculation, the company has now included their operational facility hash rate in their monthly update, currently at 8.6 EH/s.

Jason Les, CEO Riot Platforms highlighted in a recent podcast that a significant number of mining rigs were not performing optimally and that, in February 2024, the company announced a further order with MicroBT, procuring 31,500 air-cooled miners for the Rockdale Facility. Approximately 17,000 miners from this order are anticipated to replace the underperforming machines currently in operation at the facility. Meanwhile, the deployment of the remaining 14,500 miners will bolster the hash rate capacity of Riot's self-mining operations at the Rockdale Facility to 15.1 EH/s by the end of July 2024.

Riot Platforms 1GW facility at Corsicana is due to start energizing in April 2024.

The company is in the process of developing Phase 1 of its Corsicana Facility, projected to reach 400 megawatts (MW) of mining capacity upon its initial completion. Ultimately, the Corsicana Facility aims to achieve a total developed mining capacity of 1 gigawatt (1,000 MW).

In March, significant progress was made at the facility as the immersion systems were installed in the first building, Building A1, with miner installation underway. The 400 MW substation is slated to be energized in early April 2024, followed by the commencement of operations in Building A1 shortly thereafter.

Riot Platforms sold just 2 Bitcoin during the month and added 423 to its hodl, now totalling an impressive 8,490 Bitcoin with a value of $606 million as of March 31, 2024. This hodl added to their cash held totals $685 million, which then boasts an impressive total Treasury position of $1.3 billion.

SATO Technology (SATO)

SATO Technology mined 26 Bitcoin during the month of March at an average daily rate of 0.8 Bitcoin, a reduction of 6.5% lower than the previous month due predominantly to the increased mining difficulty.

The company sold 16 Bitcoin, representing 62% of its monthly production to cover operational costs, adding 10 Bitcoin to its current hodl, totalling 62 Bitcoin with a current value of £4.42 million.hen added to the current cash balance of $0.97 million, their total treasury is $5.4 million.

SATO Technology also announced that Andrew Bond, Managing Director Rosenblatt Securities, is joining the Board of Directors, where they believe his expertise and vision will be invaluable to their growth. The company bid farewell to Fred Pye, whose contributions have been instrumental since their public listing.

Soluna Holdings (SLNH)

Soluna Holdings produced 37 Bitcoin during the month of March, at an average rate of 1.2 Bitcoin, a reduction of 11.2% on the previous month, although revenues achieved were significantly higher due to the increased price of Bitcoin.

The company also announced a number of project updates:

- With regards to Project Dorothy 1A and 1B, the company has executed a supplemental agreement with a strategic hosting partner to expand the deployed fleet at the site, capitalizing on identified power design efficiencies. The favorable weather conditions in March ensured minimal data center curtailment.

- Progress is now nearing completion on the approval process for Project Dorothy 2, with the power partner, whilst the construction bid process is also reaching its final stages. Selection of potential construction partners is imminent.

- The successful installation of the first AI customer, at Project Sophie marks a milestone, transitioning seamlessly to steady-state operations. Infrastructure upgrades are underway to enhance the hosting customer experience.

- The company is in the final stages of negotiations for the commercial agreement on the Power Purchase Agreement (PPA) for Project Kati. Progress continues in ERCOT planning, with final comments received on the reactive power study. Negotiations with landowners for site lease and discussions with critical equipment providers are ongoing.

TeraWulf (WULF)

TeraWulf had a good month producing 379 Bitcoin, in March, at an average daily rate of 12.2, a slight reduction of 2.6% on the average daily rate achieved in February. The increase in mining difficulty was offset due to the replacement of approximately 1,000 older generation miners with S19k Pro miners. The company had a monthly operating hash rate of 7.6 EH/s and achieved a total of 8.0 EH/s by the end of March.

In early April, TeraWulf anticipates the further delivery and energization of an additional 3,000 S19k Pro miners at the Lake Mariner facility. These new miners will replace older generation models and contribute to the expansion of the miner fleet. Sean Farrell, SVP of Operations at TeraWulf, highlighted the recent initiatives at Lake Mariner during March. A substantial portion of the mining fleet underwent implementation of third-party firmware, with preliminary findings suggesting a potential efficiency enhancement of up to 10%.

Construction of Building 4, slated to provide 35 MW of power at the Lake Mariner facility, remains on schedule for completion by mid-2024 and is projected to elevate TeraWulf's overall operational capacity to approximately 10 EH/s.

Additionally, in line with previous announcements, the company is actively exploring a significant high-performance computing (HPC) endeavor at the Lake Mariner location. TeraWulf has allocated an initial 2 MW block of power for this initiative, enabling the deployment of thousands of state-of-the-art graphics processing units (GPUs).

On April 3, 2024 TeraWulf released its first Corporate Social Responsibility (CSR) report for fiscal year 2023. The report underscores the company's ESG commitments and achievements, including sustainable mining practices and workforce well-being. Prepared with an independent consultant, the report emphasizes transparency and ongoing improvement.

On April 8, 2024 the company announced it had made an additional repayment of $30.1 million towards its Term Loan, reducing the debt balance to $75.9 million. Patrick Fleury, CFO, noted

that this follows a $40 million repayment over six months. He added that given the current approximate Bitcoin price of $70,000, they anticipate a fully loaded cost of mining a Bitcoin of only $37,000, post Halving. This efficiency will enable them to continue to rapidly reduce the debt and then allocate profits towards growth, dividends, or share buybacks post-debt settlement.

Summary

In the midst of heightened mining difficulty, Bitcoin miners faced reduced production levels in the past month. Yet, the surge in Bitcoin's value has actually translated into considerable revenues, effectively offsetting the productivity dip.

With the impending Halving, slated within the next 10 days, miners are now bracing for a 50% reduction in mining rewards. April's forthcoming updates are eagerly awaited, offering insights into the North American miners' readiness for this imminent event.