Block 682,170 was the first “clean” block mined by public mining company Marathon’s new pool. The block’s coinbase even contained the message: “MARA Pool - OFAC Compliant Block.”

This block marks a continued push to popularize the controversial practice of trying to mine “compliant” Bitcoin blocks that exclude transactions from sanctioned entities and generate “clean” bitcoins.

To be clear, mining “clean” blocks is a euphemism for regulator bootlicking and is a direct attack on Bitcoin’s fungibility. The self-imposed practice also carries non-trivial financial disadvantages and a variety of obstacles that, in practice, make “clean” blocks very, very difficult to mine.

Practical problems for “clean” blocks

To generate a “clean” block, all the coins received by a miner must not be “tainted,” which means not used by a sanctioned entity or in criminal activity. Even though many Bitcoin addresses have been successfully matched with real-world identities, all or even most certainly have not. Thus, selecting transactions based on who the senders might be becomes little more than a guessing game.

Read: What is a “clean” block?

The only way to guarantee that all transaction fees in a block are “clean” is to mine zero transactions unless the miners opts to only process transactions from a whitelist of Bitcoin addresses. Any transaction that may later be discovered to have connections to a criminal or sanctioned entity ruins the entire “clean” block effort.

Want more mining insights like this?

In other words, simply avoiding addresses on a blacklist is insufficient. Without an address whitelist, only empty blocks can be clean blocks.

Read a thread on the myth of “clean” coins from Galaxy Digital’s Amanda Fabiano.

Even after including zero transactions, a “clean” block still isn’t safe. The address that receives the coinbase transaction with the block’s mining subsidy is, of course, public and can receive transactions.

Any other bitcoin wallet that sends the tiniest amount of bitcoin to the coinbase address taints the bitcoins and sabotages the entire endeavor. Unlike the transaction problem, where a miner can simply opt to exclude all transactions, preventing “tainted” bitcoins from being sent to the coinbase address is impossible.

Marathon’s “clean” block suffered from “tainted” transactions and coinbase address contamination, making their block not so clean after all.

- Their block included a transaction from an address associated with the Hydra market, a large Russian dark web drug marketplace.

- Their subsidy-receiving address was also dusted with 0.000025 BTC shortly after the block was mined and discussed on Twitter.

Maybe Marathon’s next block will be cleaner, but with less than 0.5% of the Bitcoin’s hashrate at the end of Q1 2021, that might take a while.

Financial problems for “clean-blockers"

Whether a “clean” miner elects to exclude all transactions from their blocks or only select from an address whitelist, the passed up fee revenue is a non-trivial cost that will only become more significant with each subsidy halving.

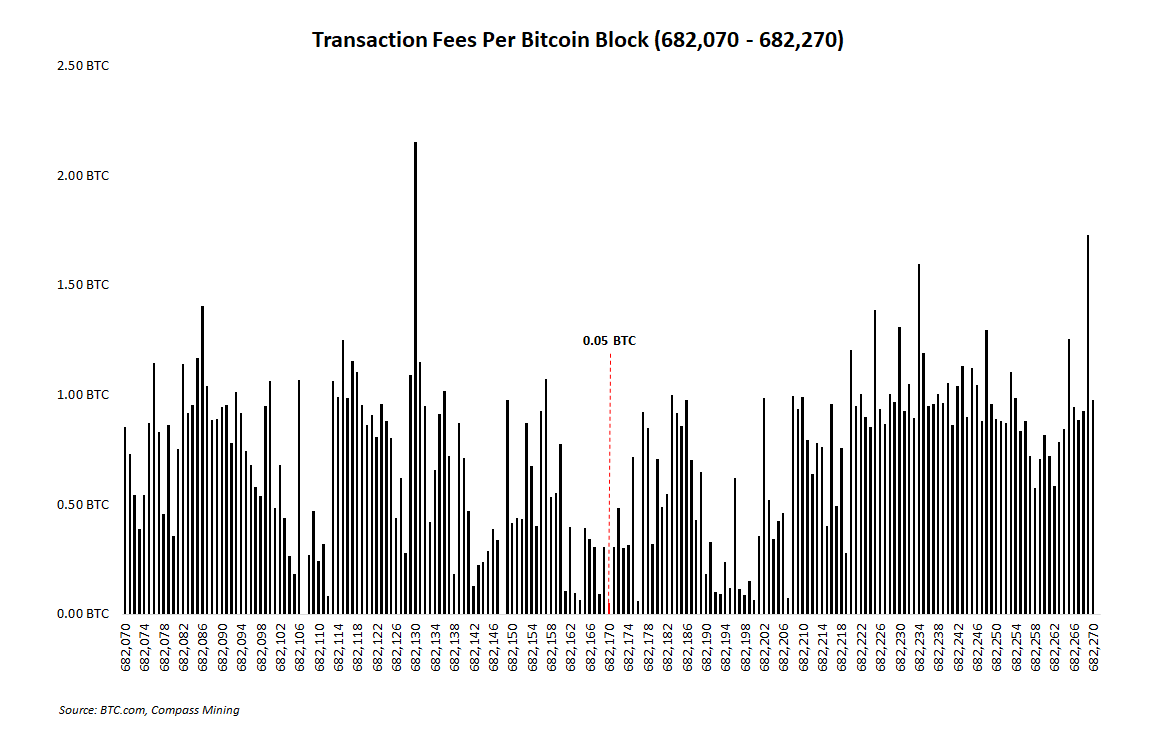

Even though Marathon didn’t actively filter transactions for block 682,170, the fees collected from mimic what a miner can expect to be paid from operating off an address whitelist. Although not entirely uncommon, the block contained an extraordinarily low 0.05 BTC in fees (roughly $3,000 at the time). Here’s a comparison of that block’s fees with fees from 100 blocks before and after it.

So what?

For Marathon, the question is whether the financial benefits for its market value and stock price outweigh the loss in forgone transaction fees. If Reddit discussion is any indication, users claiming to be Marathon shareholders aren’t happy.

Forgone transaction fees also implies some amount of forgone hashrate from solo miners looking for a pool. Joining a pool that can only pay shares of the mining subsidy and no transaction fees seems unattractive.

It’s reasonable to expect Marathon won’t be the first mining company to lean on “compliant mining” as an edge to gain market share as politics pays increasing attention to the bitcoin industry. But an overwhelming majority of hashrate will continue to be controlled by miners who respect Bitcoin’s fungibility, process all valid transactions, and enjoy the profits from doing so.