Iris Energy, an Australian Bitcoin Mining company listed on the NASDAQ, has released its full year accounts for the period ended June 30, 2023; providing a loss, after tax, of $171.9 million, equating to $3.14 loss per share. This loss was an actual reduction from the $419.8 million of losses achieved in the previous financial year.

The company reported an Adjusted EBITDA of $1.4 million, a metric which allows companies to monitor profitability on a current basis. It should be noted the metric has limitations which can vary significantly in comparison to other companies, and for this measure, Iris Energy, adjusts the net loss by removing the following expenses which do not impact their ongoing profitability:

- Share-based payments expenses

- Foreign exchange gains/losses

- Impairment of assets

- Other income

- Loss on disposal of property, plant and equipment

- Gain on disposal of subsidiaries

The company mined 3,259 Bitcoin during the year, an increase in annual production of 132.9% on the amount achieved during FY 2022. This was due to the significant growth in hash rate to 5.6 EH/s, an increase of 4.4 EH/s representing 381%.

The company has announced further hash rate growth to 9.1 EH/s by expanding the operating facilities at the Childress site, in Texas, from 20 MW to 100 MW, to be achieved in early 2024, with a further 500 MW of power available, for further expansion.

On November 4, 2022, Iris Energy received a default notification on its ASIC collateralized loan with NYDIG, limited on the recourse of the default because of its financial planning and use of a special purpose vehicle (SPV) to shield the liability, leaving New York Digital Investment Group (NYDIG) with a debt exceeding $107.8 million, collateralized by miners totalling 3.6 EH/s which were effectively worth in the region $65-70 million. The company, subsequently, handed back the miner machines to the lender and were able to remove the total debt held on the balance sheet.

As can be seen from the graph above, the company had reached a hash rate close to 4.0 EH/s by October 22, but after default and the return of the miners to NYDIG, the hash rate dropped to 1.1 EH/s.

Iris Energy had $39.4 million in cash and cash equivalents on the balance sheet along with $59 million in miner prepayments with Bitmain as at December 31, 2022 and utilized these resources to deliver a current hash rate of 5.6 EH/s, by June 2023, debt free.

Next Gen Compute and Generative Artificial Intelligence (AI)

Generative AI is the most talked-about form of artificial intelligence at present, and Iris Energy like other North American Bitcoin miners, HUT 8 (HUT) and Hive Digital (HIVE), are about to enter this sector, having recently purchased 248 NVIDIA H100 GPUs for approximately US$10 million, due to arrive in the coming months. Iris Energy, like other North American Bitcoin Miners, HUT 8 (HUT) AND Hive Digital (HIVE), are about to enter the Generative AI sector - the most talked about form of artificial intelligence to date.

Iris Energy recently purchased 248 NVIDIA H100 GPUs for approximately $US10 million which are due to arrive in the coming months. The company is already in discussions with a number of potential clients and believe that the market is currently at the ‘early adoption’ phase of this technological cycle.

How does Iris Energy compare to its ‘peer’ North American Bitcoin miners?

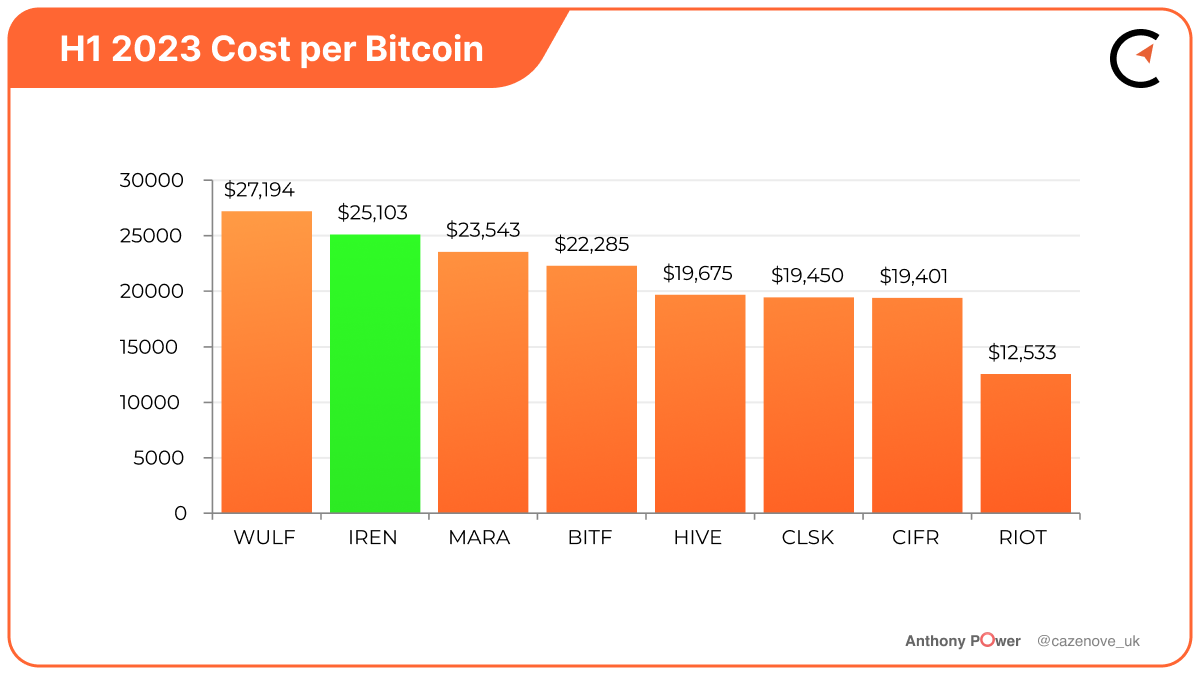

One of the simplest ways to compare the North American listed Bitcoin miners, is to calculate the cost to mine 1 Bitcoin, taking into account all the ‘cash costs’ incurred. For this exercise depreciation, asset impairments and stock compensation, although real accounting costs of the business, have been excluded.

As Iris Energy is only obligated to release half yearly financial updates, the comparative numbers in the table below, reflect the first half of 2023 for each miner.

Mining Margin = Total self-mining revenues - Total self-mining direct costs

The total direct costs are predominantly energy costs. Iris Energy achieved a gross mining margin of 52% in H1 2023 which matched the margin achieved in the previous 6 month reporting period. Significant operating costs, including General and Administrative (G&A) and ‘other operating’ expenses brought the total cost to mine 1 Bitcoin at $25,103, a net operating margin of 3%. With the company now operating at a much higher hash rate than the average achieved during H1 2023, it is expected that the operating costs should significantly reduce, per Bitcoin, as production for H2 2023 increases.

The development and growth of the Childress site in Texas, will provide more opportunities for the company to improve margins by agreeing to regularly curtail energy, when the domestic demand is high, for the receipt of demand response credits.

In August 2023, Iris Energy chose to curtail energy when prices spiked, resulting in the company being effectively paid $28,000 to mine each Bitcoin. They then sold each Bitcoin for a further $28,000, achieving a total mining profit of $56,000 per Bitcoin. This energy dynamic appears to have altered the Bitcoin mining strategy for many of the Texas based miners, especially at a time when Bitcoin rewards are low, and due to get even lower as the halving approaches.

The company is now focusing their attention on scaling up Childress and starting to work towards reaching a target of 30 EH/s. They have produced a financial plan which totals $626 million including the recently disclosed SEC filing highlighting the intention to offer any combination of the following securities: ordinary shares, debt securities, warrants, subscription rights, purchase contracts and units up to a total of $500 million. The company has confirmed it will continue to sell Bitcoin daily and re-invest the proceeds in the business.

TeraWulf (WULF)

TeraWulf benefits from having part of its production located at the Nautilus site, supplied by 50 MW of nuclear energy at a fixed cost of $0.02 kWh, helping them to achieve a gross mining margin of 74%. If not for the fact the company currently has approximately $120 million of debt on the balance sheet, having paid interest costs of $8.5 million in H1 2023, their operating margin would be more competitive with CleanSpark (CLSK) and Cipher Mining (CIFR). In 2024, the company expects the cost to mine 1 Bitcoin to reduce considerably, from $27,194 to $18,637 per coin through increased Bitcoin production and reduction in the current debt position.

Riot Platforms (RIOT)

Riot Platforms has the largest mining facility in North America, and has significantly benefited from utilizing its energy strategy throughout the reporting period. This has helped the company achieve a gross mining margin of 70% and with low operating costs, the company was able to produce 1 Bitcoin at a cost of $12,153, achieving a net margin of 50%, the highest achieved when compared to all listed North American Bitcoin miners.

The company has a fixed energy price agreement, enabling it to continuously mine Bitcoin. However, when the cost of power spikes, the company can curtail and sell blocks of power back to the grid, when the decision is economically advantageous to do so. Riot Platforms are also part of the Electric Reliability Council of Texas, Inc. (“ERCOT”) 4CP ancillary services program, helping deliver power to 25 million customers, ensuring system reliability and open access to power transmission.

In August 2023, the company achieved a monthly record of $31.7 million in power credits, effectively providing 50% more benefit had they kept the machines mining 24/7 throughout the month.

Hive Digital (HIVE)

In the previous two calendar years Hive Digital achieved the best mining margins of all the North American miners, helped by significant revenues through mining Ethereum, with margins in excess of 90%. The Ethereum merge occurred in September 2023, resulting in a technological overhaul of the Ethereum blockchain that shifted the protocol from proof-of-work to proof-of-stake, ending all Ethereum mining.

The company had to focus its large GPU hash rate to deliver revenues mining alternative coins, and although they were still able to achieve a 20% net cash margin, in H1 2023, this has not replaced the levels of margins, achieved through Ethereum mining.

Hive Digital have turned their attention to utilizing their significant GPU power to Alternative Intelligence (AI) and High Performance Computing (HPC), supporting the new Web3 ecosystem. The company expects the revenues for this new business model to reach a run rate of $15 million, per annum, in the next 12-18 months.

Balance Sheet Strength

Balance sheet strength is important for businesses, investors, and other stakeholders as it reflects a company's financial health and stability. A strong balance sheet indicates that a company has sufficient assets to cover its liabilities and is in a good position to weather financial challenges, making it important in the Bitcoin mining industry.

One of the simplest liquidity ratios to use is the current ratio. A current ratio above 1.0 indicates that a company can cover its short-term liabilities with its short-term assets.

With the exception of TeraWulf, who have a significant amount of short term debt on the balance sheet, all the remaining miners in the table above have a ratio above 1, indicating that they should be able to comfortably meet their financial obligations during the next 12 months.

Iris Energy managed to improve their balance sheet strength significantly over the last 8 months, since the default, as highlighted above, seeing their current ratio improve from 0.53 to 3.72, providing plenty of cover to meet current liabilities due in the next 12 months.

Bitfarms (BITF) worked hard to reduce their debt, having reached a staggering $160 million just over 12 months ago. They focused on cost cutting, planned their hash rate growth with more precision and have reduced their debt to a current balance of $11.8 million as at August 31, 2023. They fully expect to reduce this total to zero, in readiness for the next halving in April 2024.

Marathon Digital (MARA) has a significant amount of current assets, totalling $422.4 million, including cash and equivalents of $113.7 million as at June 30, 2023. With a total of $28.3 million in current liabilities, this provides a ratio of $14.91 for each net asset to cover each $1 of liability.

Riot Platforms (RIOT) with an even higher amount of $482.8 million in current assets have equally built a large cash war chest along with a substantial Bitcoin hodl in their treasury.

Enterprise Value (EV) = Market Capitalization + Debt - Cash and cash equivalents

Another measure to highlight value is to consider the net asset value (NAV) of a company as a ratio to the EV, thereby providing a more complete picture of a company's financial health and obligations.

If you take the metric EV divided by (NAV) it will inform whether the company is valued at a premium or discount. A ratio of 1 means that the market values the company roughly in line with its net asset value. A ratio greater than 1, it indicates that the company is trading at a premium to its net asset value, maybe suggesting that investors have confidence in the company's ability to generate future profits, whereas a value less than 1 suggests the company is trading at a discount.

From the table above Iris Energy is the only company to have a ratio less than 1, suggesting the current share price is undervalued. Bitfarms and CleanSpark both have an EV/NAV ratio of 1.01 and 1.09, which suggests to be in line with market value. Marathon Digital has a ratio of 3.18 indicating that there is a premium built into the share price.

I have also taken the EV and divided it by the hash rate, making allowances for the ‘other revenue streams’ of each company, such as hosting. Once again, Iris Energy has the lowest valuation of $39.59 million per EH/s.

Year to date mining production performance

The mining performance of Iris Energy since it became a public miner on November 21, 2021 has been one of consistency, finishing in the top 3 miners, in terms of production by EH/s, every month. In fact, the top 4 miners in the table below have proven to be extremely consistent in terms of production and utilization of their hash rate.

Although Riot Platforms and Cipher Mining (CIFR) are producing less Bitcoin per month than peer miners, both are benefiting from their energy strategies as other metrics (Gross Mining Margin) and monthly mining updates have highlighted.

There will need to be more suitable metrics which are able to highlight the equivalency earnings from self mining as miners continue to adopt these strategies.

Summary

Iris Energy has managed to turnaround its troubles towards the end of 2022, which saw the hash rate fall to a little over 1.0 EH/s. hen within a period of fewer than 6 months, it has grown to a current hash rate of 5.6 EH/s with further planned growth to 9.1 EH/s.

As the halving approaches, the Bitcoin production and margins should both increase, especially if they are to continue utilizing their energy strategies in Texas.

The diversification into AI and HPC will provide additional revenues for the company that are not linked to the price of Bitcoin. The potential growth in these industries is huge and the company believes they are ‘still early,’ in this new technology.

From a valuation perspective, when compared to ‘peer miners’ Iris Energy’s current share price is undervalued. They have managed to strengthen a balance sheet that had over $100 million of debt at the last reporting to literally zero.

The company has significant cash funds available when the right investment presents itself, and has ensured that further funding via the recent $500 million at-the-market offering is available for growing the Childress site and taking advantage of the 600 MW of power available.