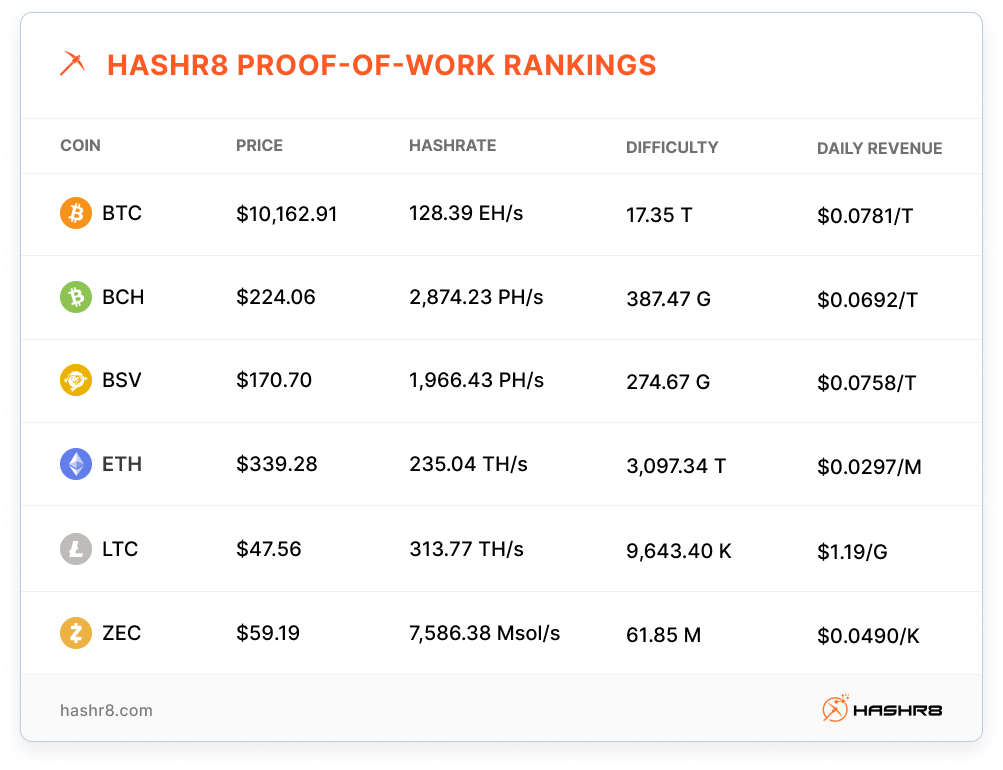

The Bitcoin price significantly dropped from $11,800 on 1 September 2020 to $10,100 on 6 September 2020. The price drop was coupled with a significant amount of SHA256 hashrate moving from other chains to mine Bitcoin, causing daily mining revenue to drop from around $0.089/TH to $0.0781/TH. Network difficulty decreased by 1.21% on 7 September but is currently trending up for the next adjustment.

? New Hardware

Nano (豪微科技) has launched a new GRIN miner – the iPollo G1. It has a computing speed of 400 Gps and consumes 2800 watts. The shipping date is currently unknown. Cybtc has completed an iPollo G1 Review.

ETC 51% Attacks

During early August 2020, ETC once again suffered 51% attacks from hashrate rented through Nicehash. ETC Labs announced they are looking to pursue legal action against those who conduct or facilitate malicious attacks. In their response, Nicehash highlighted that Nicehash does not support or enable 51% attacks, but its hashrate might be abused by the attacker.

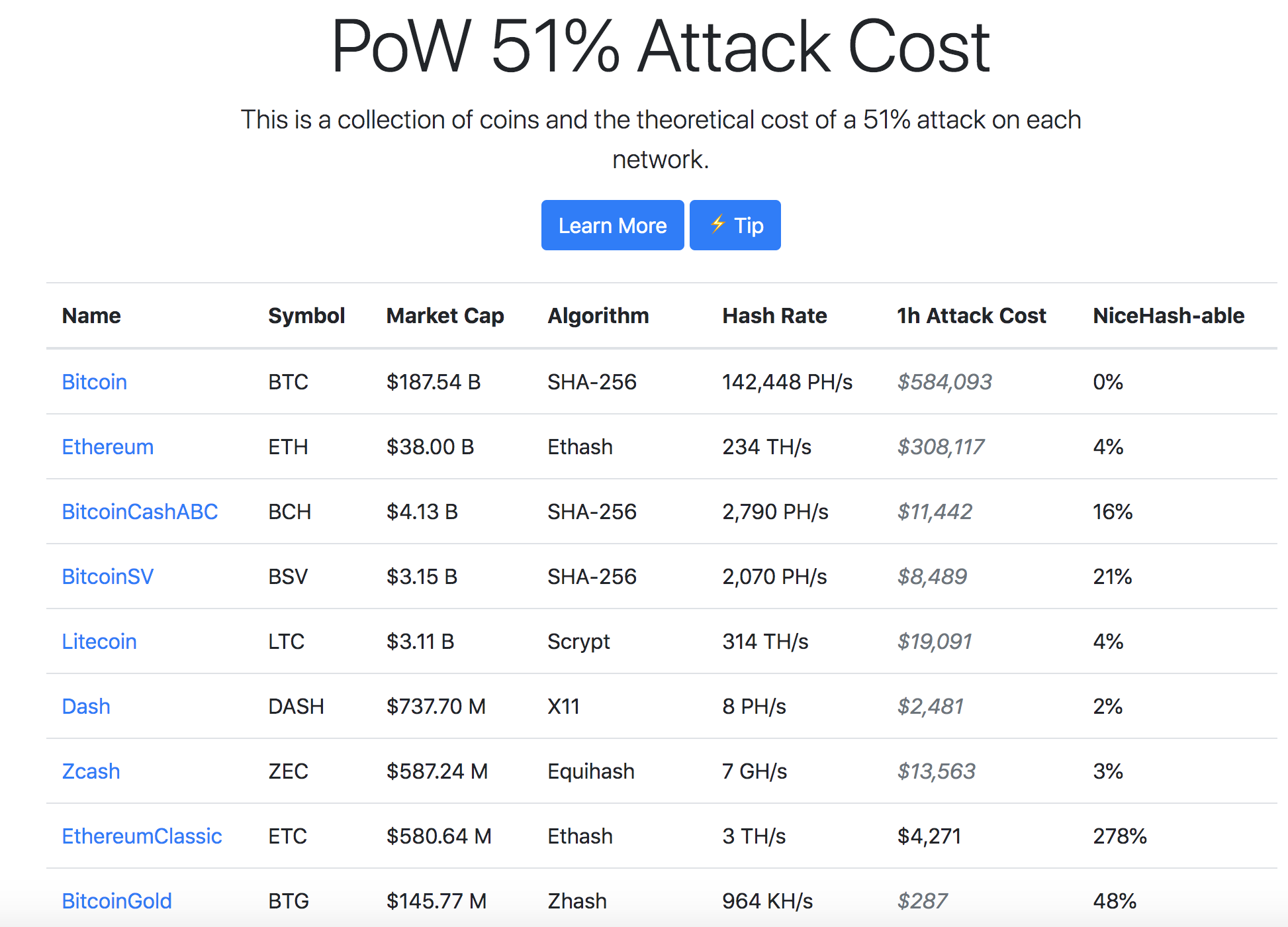

It's impossible to prevent a 51% attack from the hashrate-renting platforms themselves in a truly decentralized proof-of-work network. All one can do is make the attack's cost more expensive than the potential reward of the attack itself.

Proof-of-work projects have, and can, engage in Defensive Mining. Defensive Mining is the act of mining with physical machines or rented hashrate, focusing on increasing network security, rather than purely for profits.

A useful website is Crypto51, which highlights the theoretical cost of a 51% attack on various proof-of-work networks.

Pool Competition

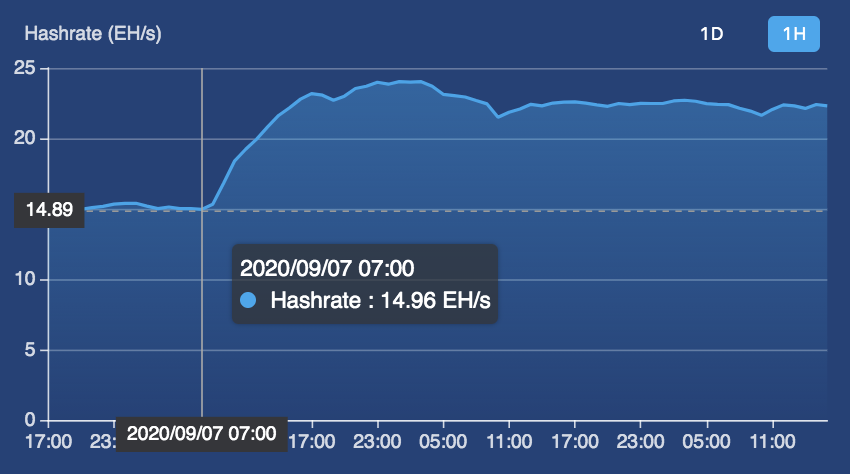

BTC.com once again experienced a massive 7 EH/s jump during the week, with Mining City showing up also on various block explorers with 7 - 8 EH/s.

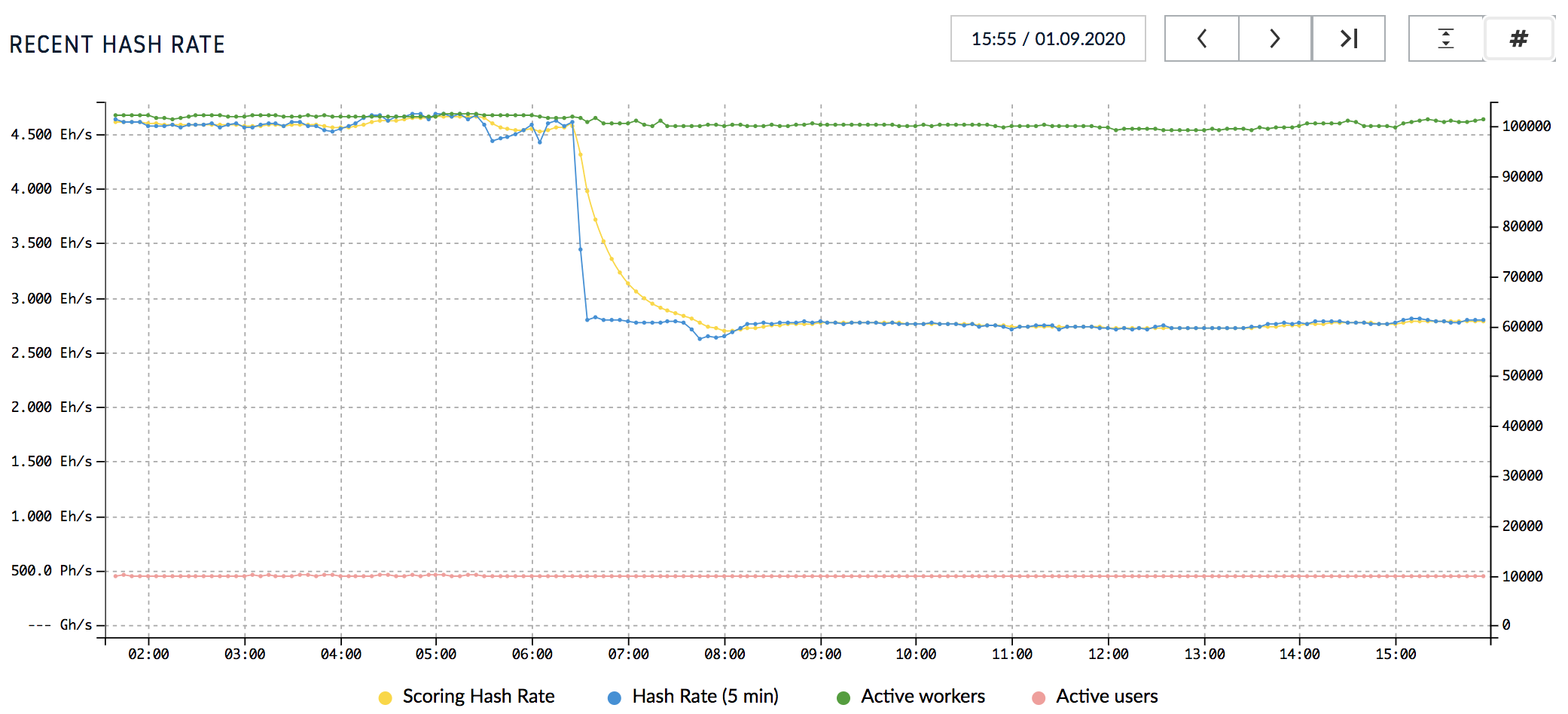

The other notable hashrate movement was around 2 EH/s of BTC hashrate that seemingly moved from Slush Pool to F2Pool on 1 September 2020.

? Mining around the Globe

?? China

New ASIC chips. There are reports that Micree Zhan is selling 5nm chips to Chinese customers for January shipment. The Antminer WeChat account (controlled by Jihan Wu) issued an official announcement warning of the risks of purchasing machines with these chips. The announcement also stated the test chip has not yet been obtained, and the tapeout has not been completed.

It would not be wise to take a bet on unproven 5nm chips as a miner, especially since Bitmain is experiencing leadership turmoil. Bitcoin mining is now ultra-competitive, and strategic players have longer time horizons than ever before. It would be risky to take a huge gamble when other new or second-hand options are still available from ASIC manufacturers or secondary markets.

Bitmain legal. Bitmain continues to be in the news with their legal challenges. A court in China has denied an appeal by bitcoin mining giant Bitmain seeking $30 million in damages from the three co-founders of Poolin.

The three co-founders initially worked for BTC.com (one of Bitmain's pools) before launching Poolin. The court ruled that Pan Zhibiao, Li Tianzhao, and Zhu Fa must pay about $200,000, $178,000, and $154,000, rather than $30 million in damages.

?? USA

Canaan released its unaudited financial results for Q2 2020. The total amount of hashrate sold from its ASICs was 2.6 EH/s, an increase of 188% from Q1 (0.9 EH/s). 2.6 EH/s is approximately 50,000 new-gen machines if using the A1066 (50 TH/s or A1066 Pro (55 TH/s) baseline.

Gross profit has increased both year-on-year and quarter-on-quarter; however, the company has posted a net loss.

Canaan also announced a US$10 million share repurchase program. The company said it would repurchase its American depositary shares (each ADS represents 15 Class A shares) and/or Class A shares directly over 12 months starting 22 September. Canaan plans to fund the repurchases from its existing cash balance.

Bitfarms released its financial results for Q2 2020, reporting a net loss of $3.7 million. Bitfarms mined 815 Bitcoins with an average break-even Bitcoin price of $5,075. The company completed its 5MW expansion and now has 56 MWs under management. The company acquired 1,865 WhatsMiner M20S (approx. 135 PH/s during the quarter, and their current hashrate is 813 PH/s.

?? Russia

As reported by Coindesk, there is some potential uncertainty for Bitcoin mining in Russia. According to the first report, Russia's mining farms would have to register to the government under a proposed new bill. If passed, a data center operator must provide information about the facility's computing capacity, how the data is stored, which services the center offers, and its cost.

According to the second report, the Russian Ministry of Finance has drawn up a new draft bill to outlaw cryptocurrency use. Since mining farms receive payment in the form of cryptocurrency, the new bill may render this illegal.

It's hard to know how this will play out, but worth keeping a close eye on.

?? Kazakhstan

Reuters and BTC Times reported that the Digital Development Minister of Kazakhstan, Bagdat Mussin, said that Kazakhstan is in talks to attract investments worth $714 million into the cryptocurrency sector. He stated that more than $190 million had been invested in the industry already.

Kazakhstan has been one of the fastest-growing countries for Bitcoin mining over the past few years.

Firstly, there is an abundance of cheap coal power available for mining - hundreds of megawatts. Secondly, the conditions in Kazakhstan are very suitable for mining. It's close to China, and the climate is cold. It's becoming a popular location for Chinese miners to move old-gen machines from China to Kazakhstan to take advantage of cheaper electricity prices outside of the Sichuan Hydro Season.

Lastly, Bitcoin mining has mostly received a positive response from the local Kazakh government, and Bitcoin miners can operate their business legally and pay relevant taxes.

Although mining in Kazakhstan is growing, it's unlikely it would become larger than the big three players of mining soon: China, USA, and Russia, due to the established nature of Bitcoin mining and the continued expansion of new mining farms in those countries.

An interesting fact of mining in Kazakhstan is that investment into these large farms and primarily led by foreign companies. In contrast, mining investments in China, the USA, and Russia are usually locally driven, which means political stability and the business landscape for international business in Kazakhstan are significant for its continued growth.

?? Malaysia

Officials in Johor, Malaysia, have raided and shut down two mining farms for electricity theft of approximately $600,000. Illegal wiring was installed so that electricity was supplied directly and not through the meter.

Electricity theft for crypto mining is not a one-off occurrence, as many small mining farms are operating illegally in Malaysia. A representative of the electricity company TNB said 288 mining farms had been raided in Johor since 2018, including about 90 in 2020.

Malaysia is one of the leaders in South-East Asia for Bitcoin mining. There is a Bitmain factory in Malaysia, often used for international shipments to avoid import tariffs. The proximity of the factory makes it easier for Malaysian miners also to source second-hands mining rigs.

About HASHR8

We are a modern media and bitcoin mining company focused on driving the mass adoption of cryptocurrency. Our research analysts and content creators strive to provide actionable and engaging content on the most relevant industry topics.

For more information, submit a story for review, or share a newsworthy tip, please email us at [email protected].