Bitcoin’s hashrate has dropped 41% since the beginning of June. Mining difficulty is set for a record-breaking downward adjustment later this week. And the price is sitting in the low $30,000s, down over 50% from its all-time high in April.

What’s going on?

Hashrate is deviating from its upward trend.

Zooming out, Bitcoin’s hashrate growth trajectory has pretty much been “up and to the right” for its entire lifespan. Dips happen once in a while (e.g., Q4 2018), but they’re rare.

2021 is a bit exceptional though. Compared to the past few years, the ongoing hashrate drop has solidly deviated from the prior growth trend. Estimates from MiningPoolStats (MPS) show Bitcoin’s total hashrate is between 80-90 EH/s, down from over 150 EH/s on Jan. 1.

Want more mining insights like this?

Hashrate is following the price.

Since the market’s peak in April, Bitcoin’s price has dropped rather sharply. Bitcoin’s hashrate has followed, but its downward trend has been slightly less steep.

Hashrate almost always follows the price, not the reverse. But the current environment is somewhat of an exception. Bitcoin’s price and hashrate both reacted to a powerful exogenous catalyst—China’s crackdown on mining. More downward price action will continue eating away at mining profit margins, and cheaper bitcoin could cause some hashrate to go offline irrespective of the changes in China.

When price and hashrate will start to rebound is a very open question. Concerning hashrate, most but not all China-based hashrate has been powered off, leaving potentially some more downside for Bitcoin’s hashrate. Concerning price, the initial selloff was certainly catalyzed in large part by the chilling regulator news from China, but whether the price continues heading lower throughout the summer isn’t certain.

The bottom line is to understand market dynamics in bearish environments, remember: FUD affects the price and the price affects hashrate.

Mining pools are losing lots of hashrate.

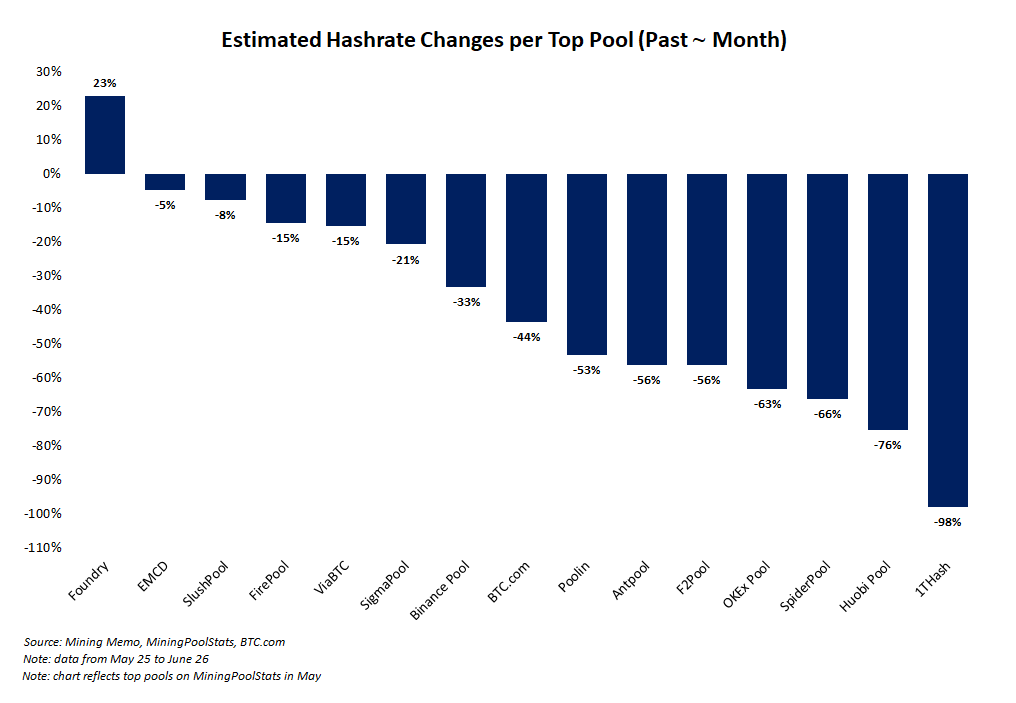

As a result of China’s crackdown, a significant amount of hashrate subscribed to top mining pools is going offline. That’s not surprising, but what might be is the scale of hashrate loss per pool.

Here’s a look at the estimated percentage change in hashrate from pools that were top ranked in May, per MPS. Notably, Foundry—a US-based mining pool—has seen significant growth over this period.

Miners are making more money.

At current prices and difficulty levels, mining is easier than earlier this year at similar price levels. This means miners profit per bitcoin mined is larger. With the record-setting downward difficulty adjustment expected at the start of July, those profits will grow even larger, assuming a similar price for bitcoin.

The monstrous hashrate and difficulty drops combined with the forced global hash power shuffle (thanks, China), bitcoin is entering a golden era of mining that offers more profitable hashing (short-to-mid term) and a stronger, more decentralized network (long term).

Learn more about mining’s golden age by listening to this interview with Compass Mining’s Hardware Procurement Lead Vincent Vuong.