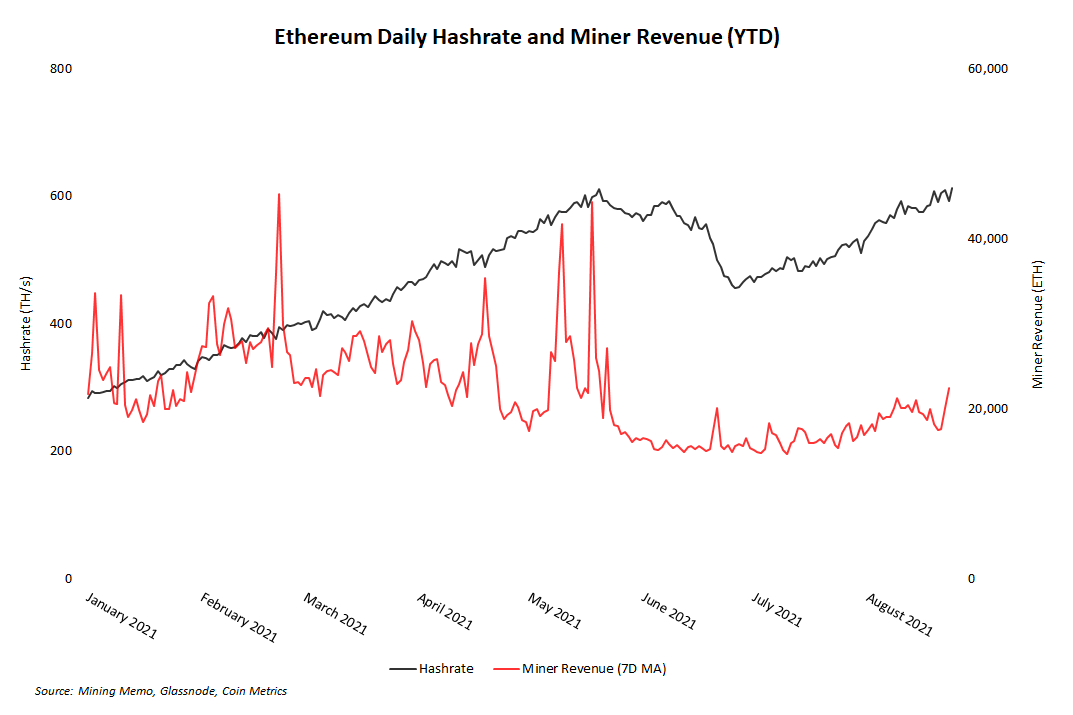

As of Thursday, Ethereum’s hashrate has recovered to a new all time high of 612 TH/s. Ethereum’s last record occured on May 20 at 610 TH/s. A blow off top in Ethereum’s price followed by China’s Bitcoin mining ban over the next three weeks sent the network’s hashrate down 25%, bottoming near 455 TH/s.

Ethereum operates on a different hashing algorithm, Ethash, than Bitcoin’s SHA-256, leading to a different measurement unit than Bitcoin’s EH/s. Ethereum also adjusts difficulty per block, as opposed to Bitcoin’s two week epoch adjustment period.

Want more mining insights like this?

Profit takes priority

Given the high profitability of Ethereum ASICs, its likely Chinese miners prioritized getting these machines back online first, and therefore aiding a hashrate rebound. Indeed, an Ethereum ASIC such as an Innosilicon A10 can generate $10-$20 more in daily revenue than an Antminer S19.

Nonce analysis from Kristy-Leigh Minehan and Tim Ireland in July showed that Antminer E3’s did leave the network during the time period in question (mid-June). Follow up analysis will all but confirm that the Ethereum ASICs in question are back online.

Why come back online?

Some may question why Ethereum miners would join the network again after three consecutive blows: price drop, China ban and EIP-1559. But while the makeup of mining revenue has changed shape a great deal since the last hashrate peak, price prospects for ETH remain strong on both the supply and demand side.

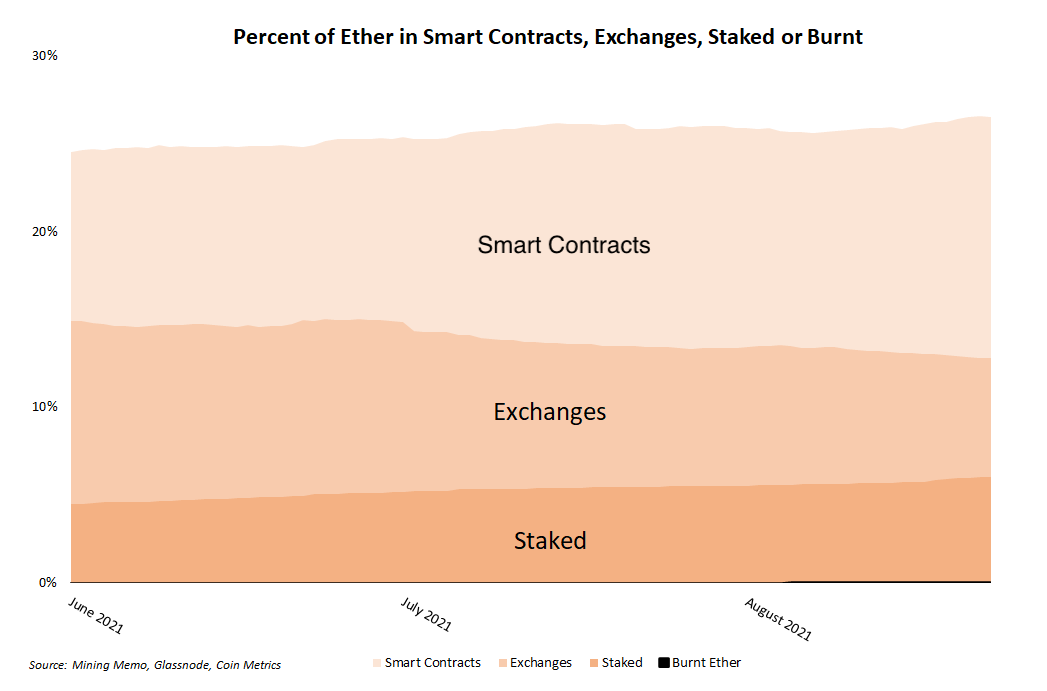

- The Eth 2.0 staking contract is now the network’s largest with nearly 7 million ETH.

- Over 100,000 ETH have been burnt since EIP-1559 launched August 5.

- Strong waves of user adoption from DeFi and NFT waves increase demand for ETH.

Chasing inflation rewards remains too lucrative to sit out, regardless of transaction fee losses.