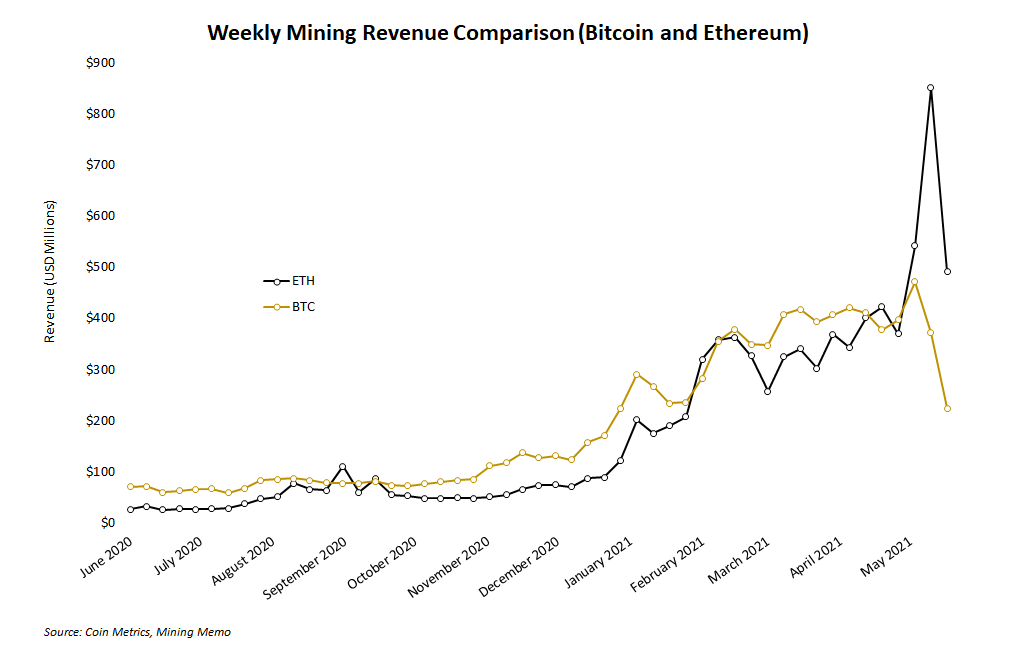

Ethereum monthly mining revenue is set to outpace Bitcoin for the first time during the current bull cycle, highlighting both ether’s exceptional price gains and on-chain markets’ strong demand for block space even during a drawdown in token prices.

Ethereum miners raked in $2.19 billion in total revenue during the first three weeks of May, with 48% coming from transactions fees alone, according to Coin Metrics data. Bitcoin miners took in $1.43 billion over the same period.

Ether’s price appreciation has helped induce eye-watering revenue. Ethereum mining revenue first topped $1 billion in February when ether was trading around $1,700. Three months later, ether set its current record high of $4,400 on May 12, and mining revenue growth has kept pace with ether’s price.

- Fees alone brought in $78 million for Ethereum miners on May 19, topping the average monthly revenue from December 2018 to April 2019.

- Ethereum mining revenue has surpassed Bitcoin mining revenue a few times before (e.g., during the 2017 bull cycle). But the flippening is always short lived.

The variety of assets transferred on Ethereum and the subsequent value settled is a primary reason for why mining revenue is soaring. Gas fees, which are paid to miners, measure demand for blockspace. Ethereum’s average gas fees hit a record high of $70 per transaction on May 19 while decentralized exchange (DEX) traders sought to close positions as asset prices tumbled.

Want more mining insights like this?

Higher revenue directly correlates to an increase in miner difficulty as more graphics processing units (GPUs) join the network to mine. Ethereum’s mining difficulty, which adjusts after every block, has doubled since January 3, according to Etherscan. Despite this monstrous increase, transaction fees are keeping Ethereum mining highly profitable.