Ethereum miners had a banner year – a silver lining to a cloudy future for the industry.

Ethereum mining revenue outpaces Bitcoin mining

Ethereum miners raked in some $1.8 billion in December revenue, compared to Bitcoin’s $1.3 billion. The GPU-dominated industry has now outpaced the ASIC-dominated sister industry for eight consecutive months.

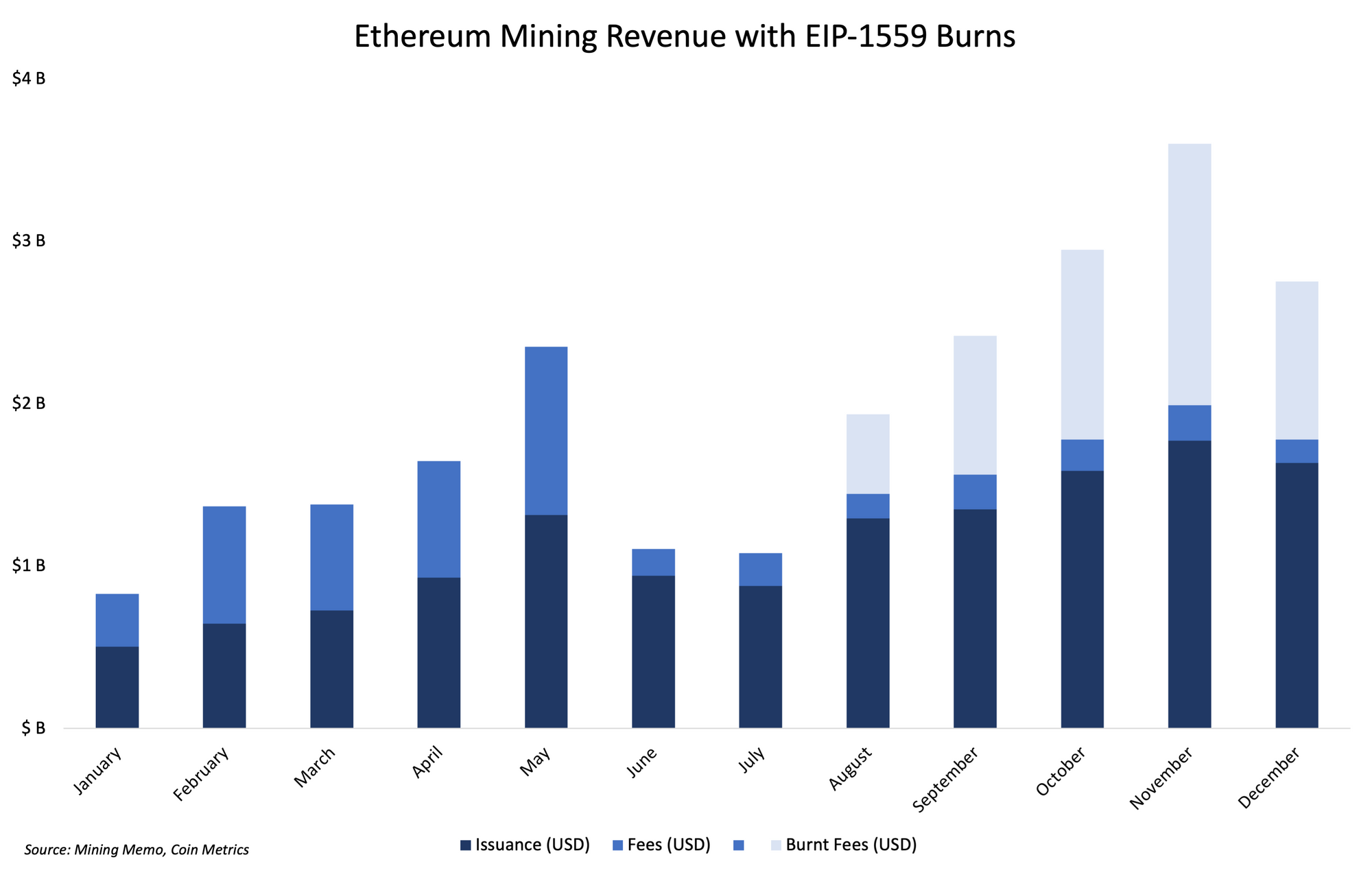

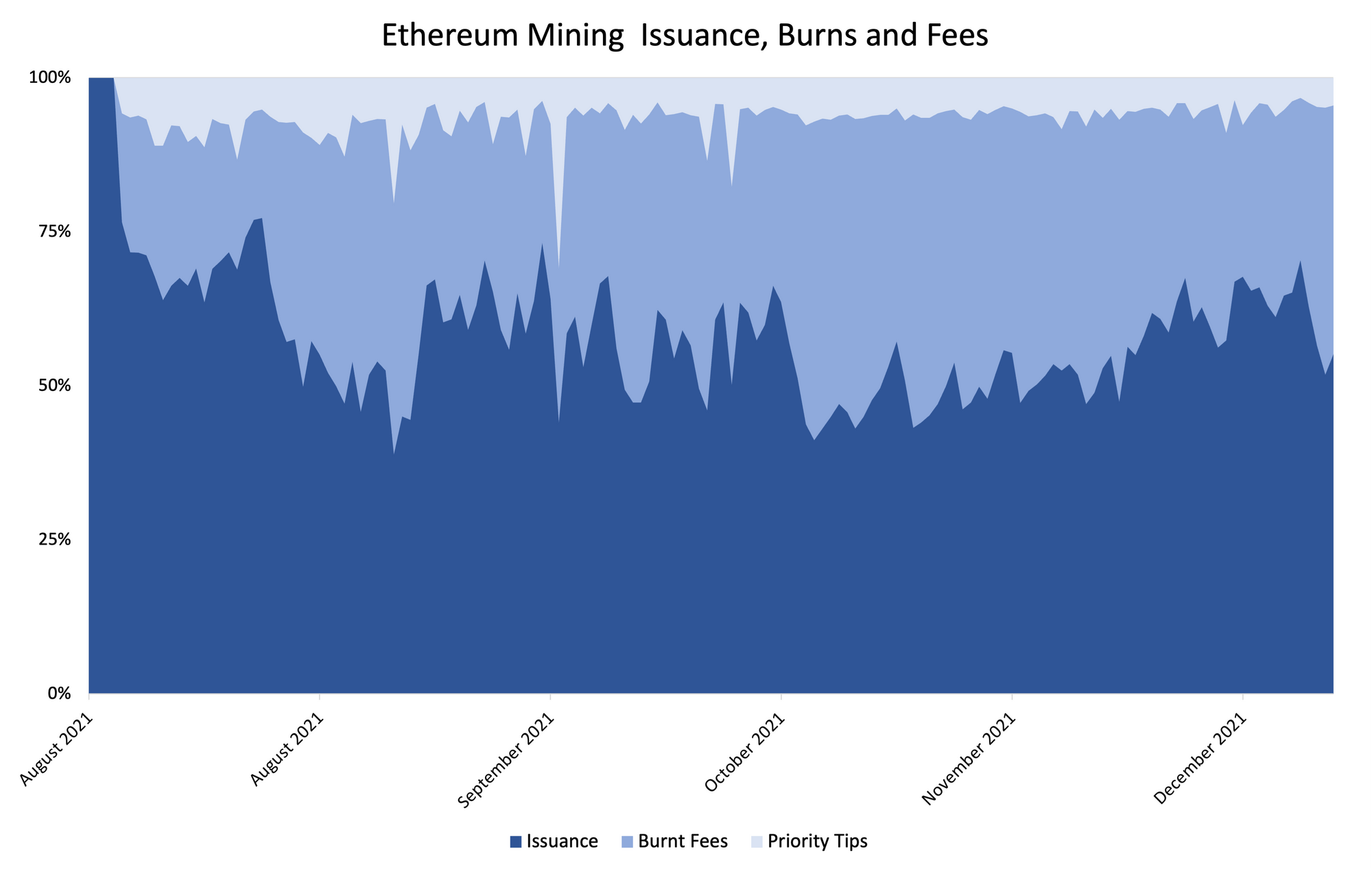

Ethereum burns $4.9 billion of ETH

Since EIP-1559 went live in August, Ethereum has programmatically burnt 1.3 million ETH, worth an estimated $4.9 billion. Between 20-50% of prior Ethereum mining revenue derived from transaction fees are now burnt. Priority fees paid to miners account for between 5-10% of miner revenue, depending on network conditions.

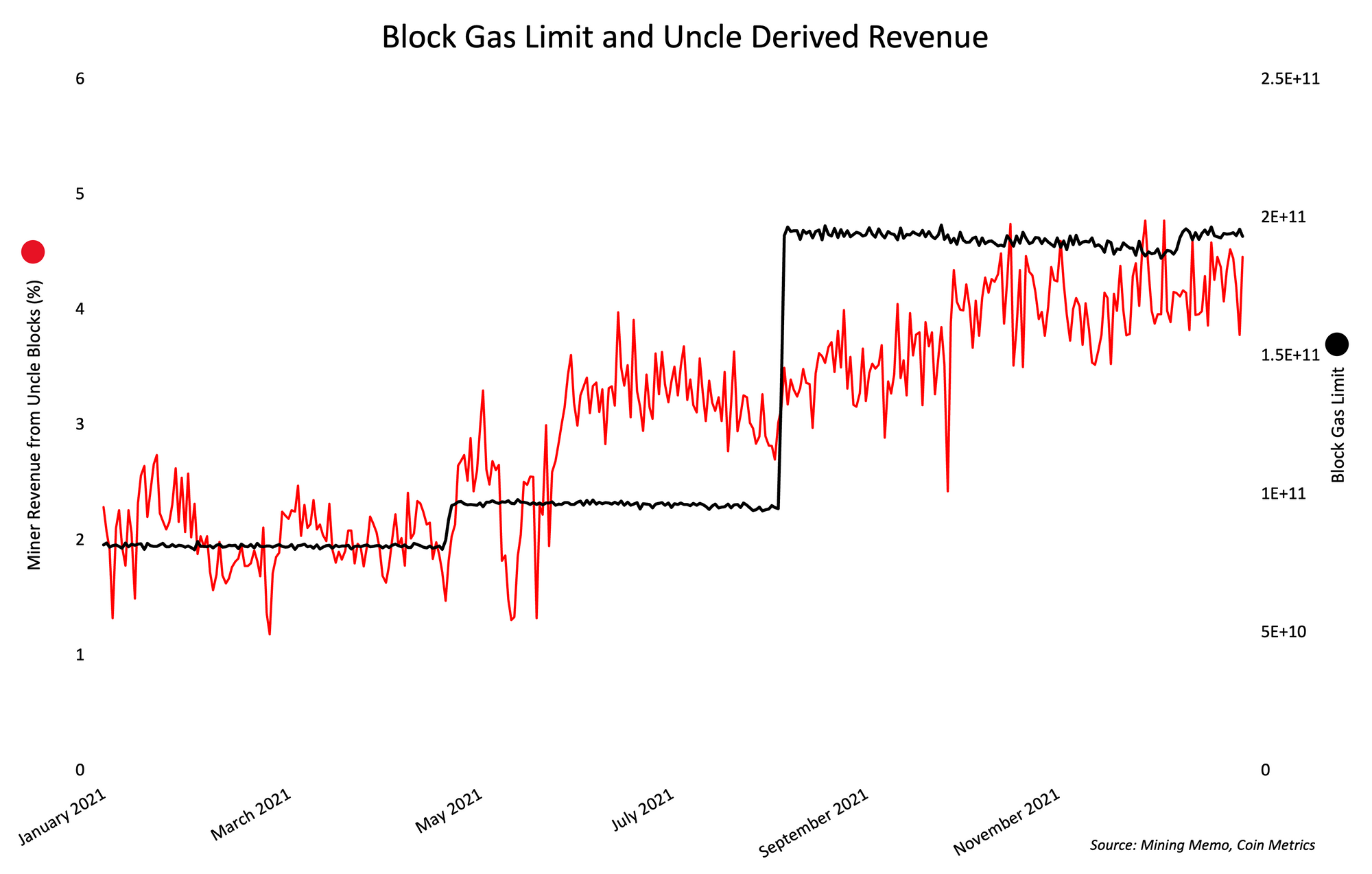

Revenue derived from Uncle blocks increases post-EIP-1559

The block gas limit was raised twice in April and August respectively, to a current target block gas limit of 15 million.

Uncles rewards – a reward paid to miners who perform adequate work, but whose block is not included in the final chain – rose to just under 4% in turn. Historically, an increase in block size is correlated with increased stales.

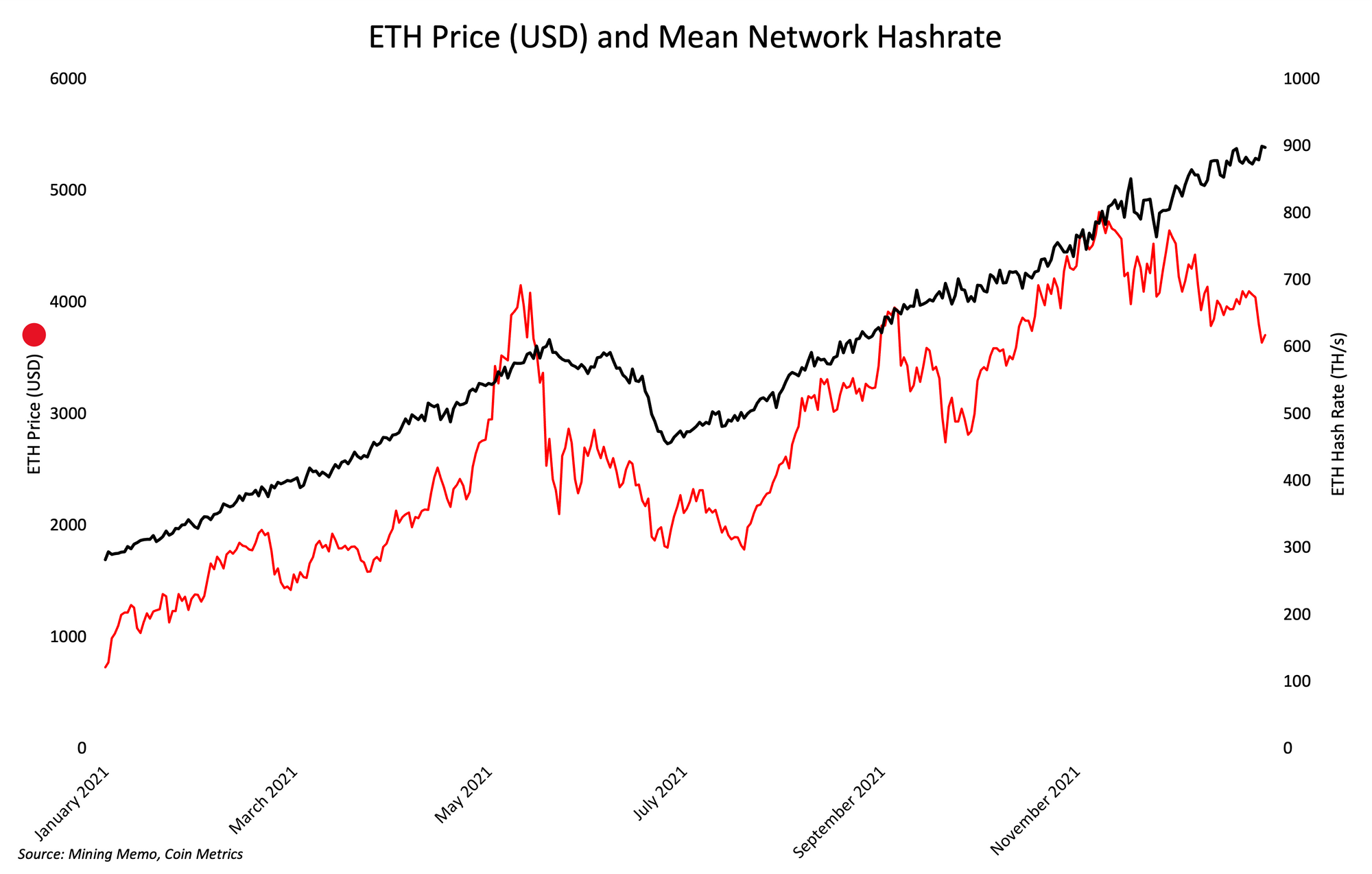

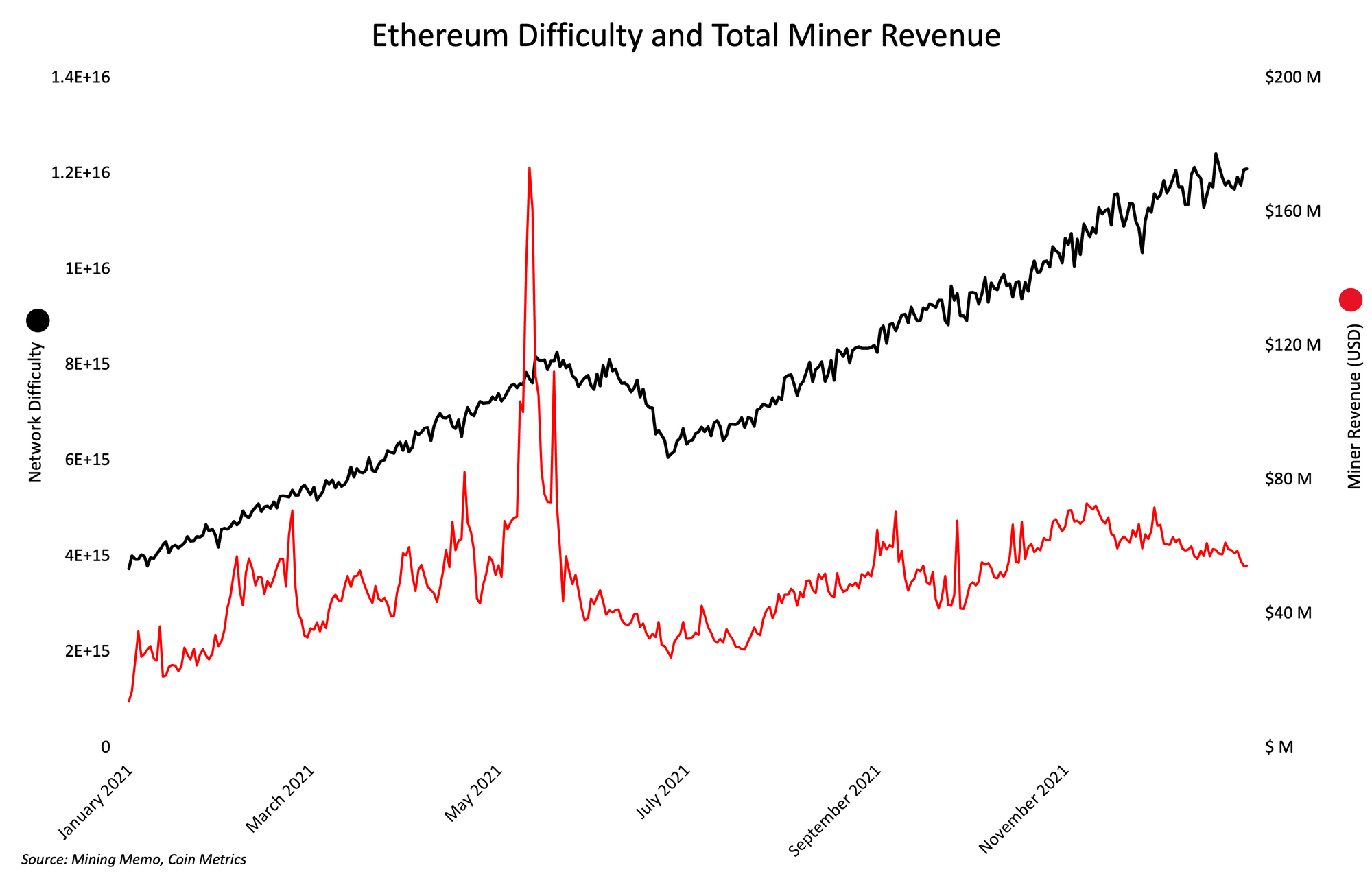

Ethereum hashrate breaks all time highs, repeatedly.

Minus a slight drop following the China mining ban, Ethereum’s hashrate broke all time records day-after-day. As of December 31, it stands at 950 TH/s.

Mining revenue remains stagnant, albeit high at an aggregate average $50 million in revenue per day.

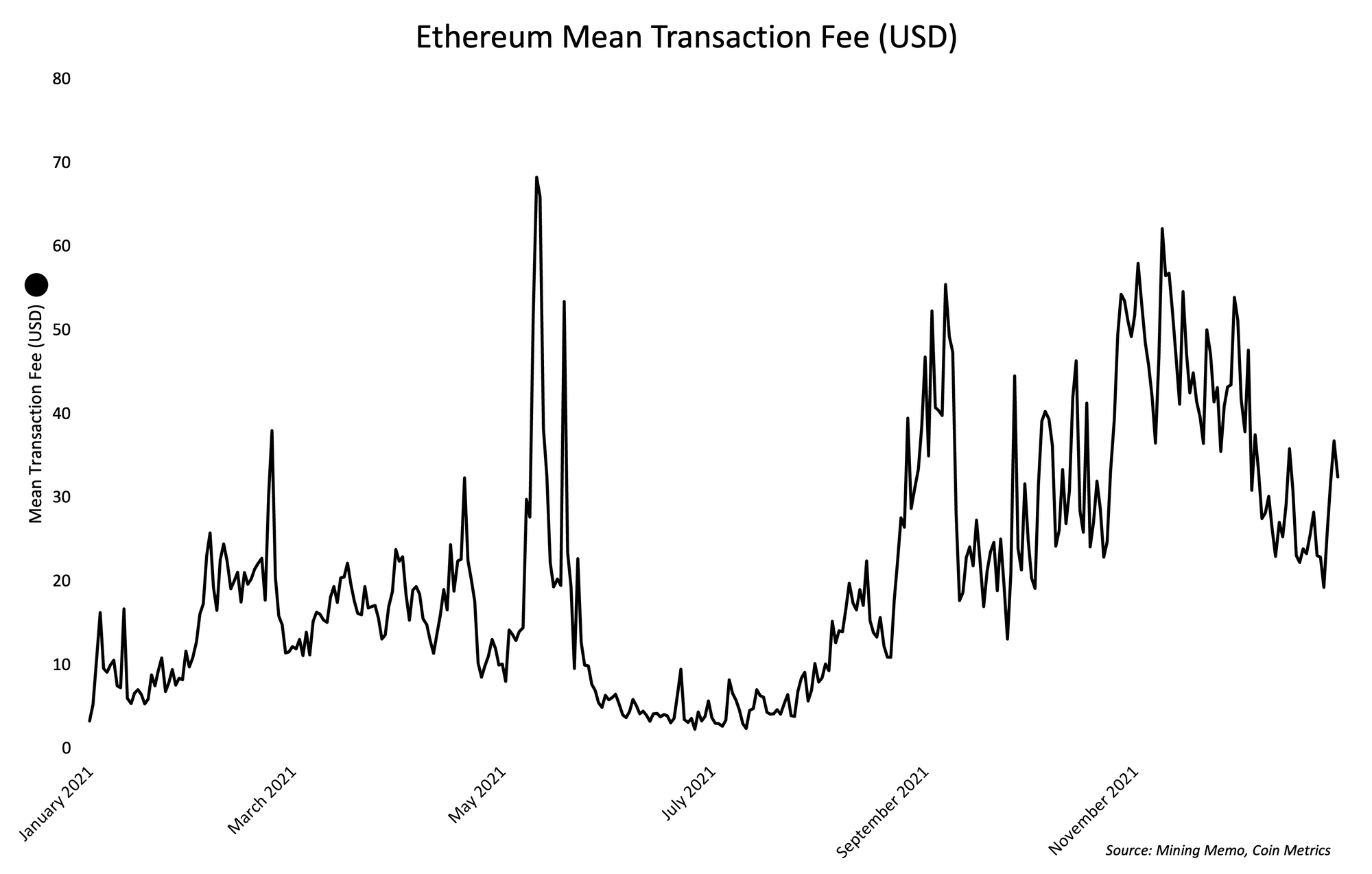

Transaction fees sideline investors

The rise of DeFi, NFTs and GameFi bear out in the average Ethereum transaction fee in dollar terms, clocking in at a yearly average of $21.09. Retail participants often fled to Ethereum alternatives such as Binance Smart Chain, Avalanche, Solana or Luna to escape high fees.

As mentioned, 2021 could very well be the final year for Ethereum mining. With the possibility of The Merge to Proof-of-Stake (PoS) in 2022, the landscape for Ethereum mining is sure to take a major departure from its current look.