Ethereum mining revenues remain strong despite recent price headwinds.

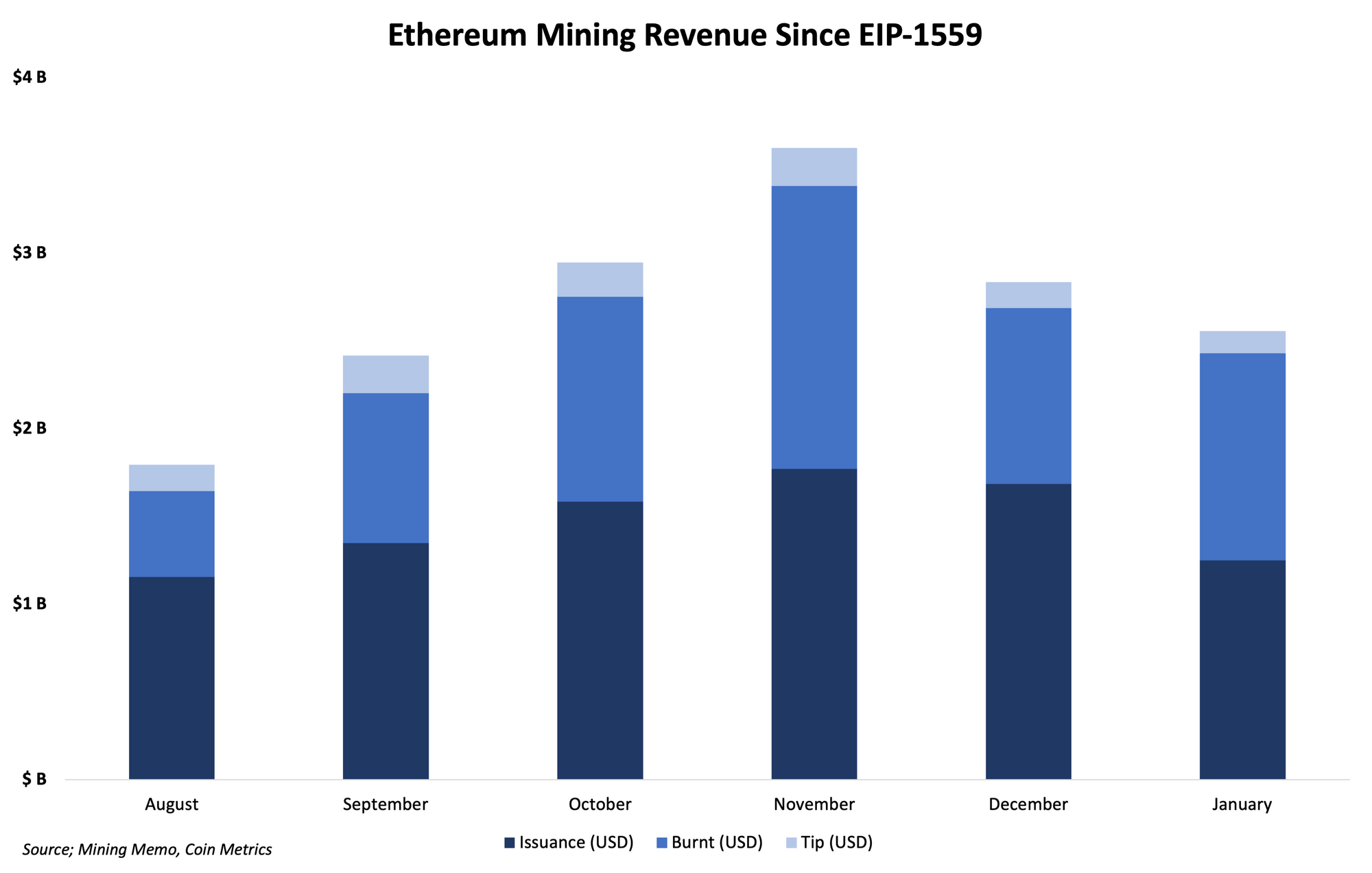

The GPU-dominated subsector earned $1.43 billion in revenue in January, beating Bitcoin mining revenue for the ninth consecutive month.

There may not be any cause for celebration going forward, however, as dropping transaction fee revenues, lower on-chain transfer volumes and bearish market sentiment dampen future prospects. Indeed, January’s average daily mining revenue was 33% lower than November, according to Coin Metrics.

Mining revenues

Mining revenues are derived from a few factors, all of which are trending against Ethereum miners: hashrate growth, on-chain transfer volumes and spot ETH price.

- Hashrate continues to hit record highs day-over-day, making mining more competitive and less profitable.

- On-chain volume remains stagnant compared to earlier stages of the bull market.

- Spot ETH price is down 27% year-to-date (YTD).

Only adding to this gloomy outlook is a determined developer community switching to Proof-of-Stake (PoS), a blockchain design that does not incorporate mining.

With this backdrop in mind, it's likely best for many Ethereum miners to aim for as quick of a return on investment (ROI) as possible, as Ethereum developer Tim Beiko suggested in a recent Compass Podcast.