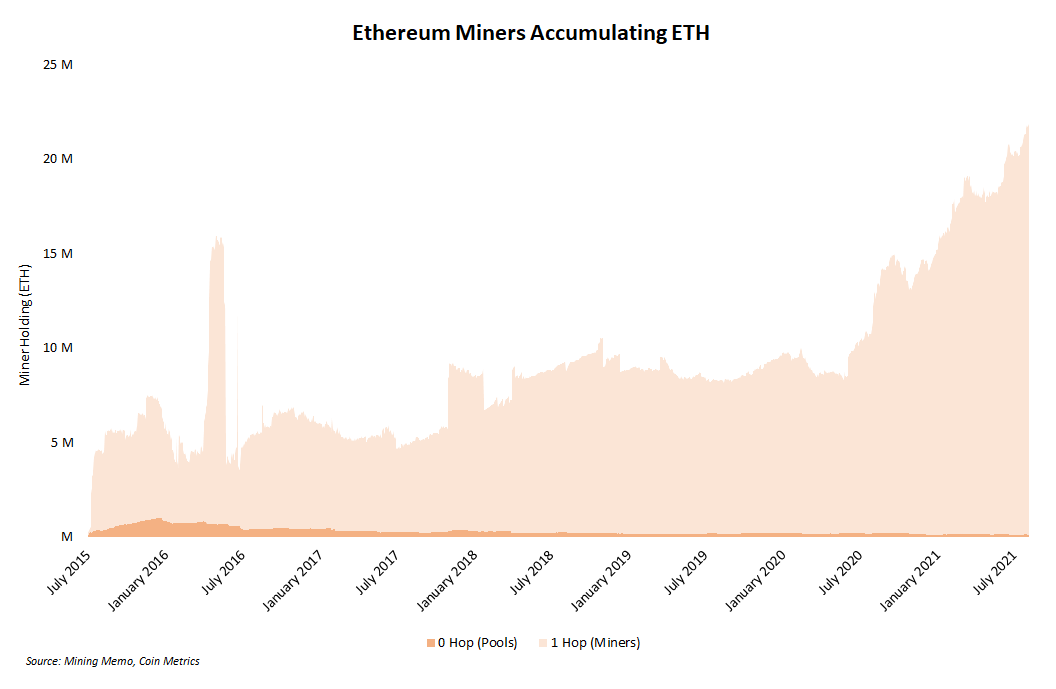

Ethereum miners aren't fighting back against protocol changes. Rather, they are hodling ether in preparation for an eventual move to Proof-of-Stake (PoS).

Ethereum miners now hold some 22 million ETH worth an estimated $80 billion, or about 17.5% of the network’s market capitalization. That’s compared to the 14.5 million ETH miners held on January 1. The general trend was first noted in March 2021.

There are both short run and long run reasons for holding ether, as demonstrated by the data.

Want more mining insights like this?

- Miners began noticeably stockpiling ether first in July 2020, during the throws of “DeFi Summer.” The emergence of native finance applications on Ethereum meant miners could partake in yield farming with mined assets.

- The launch of staking and validating on the Ethereum 2.0 Beacon Chain in December 2020 provided another avenue for earning yield on ether deposits. Further analysis is needed to see how many mining accounts have begun validating the new chain.

Lastly, ether’s price domination over the first half of 2021 cannot be overlooked. The second largest cryptocurrency not only completed a huge technical overhaul with EIP-1559, but has nearly fully recovered from May’s 50% price correction.

For miners, hodling ether is a bet on further price gains.