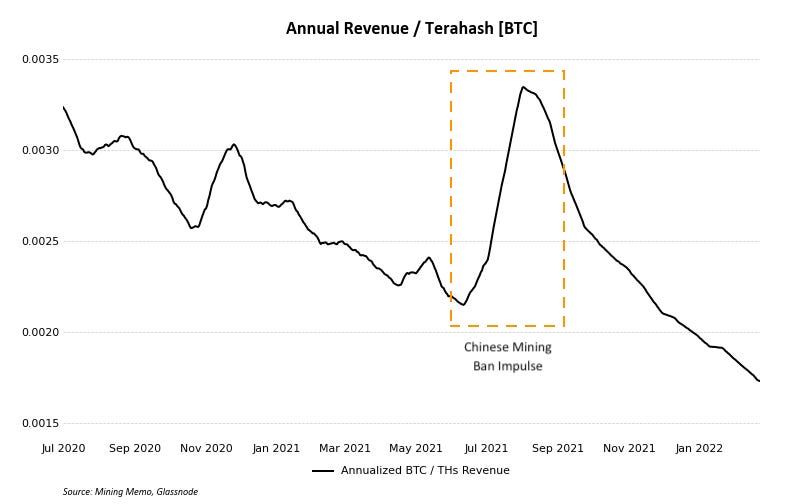

Nearly ten months ago, half the global bitcoin hash rate rapidly went offline. It’s no secret that the Chinese mining ban created an extremely profitable vacuum for U.S. and international miners alike. The large jump in bitcoin-denominated revenue per hash led to generous valuations of public bitcoin mining companies and profits far higher than predicted for private miners.

Thanks to the Data Always newsletter for this guest post.

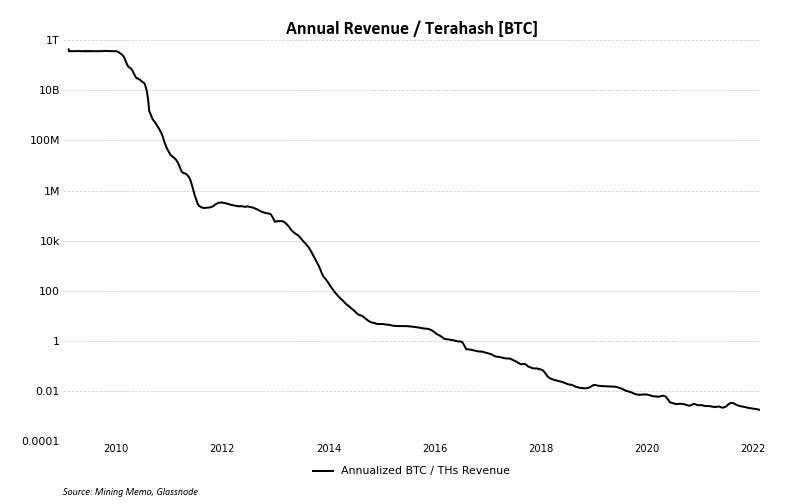

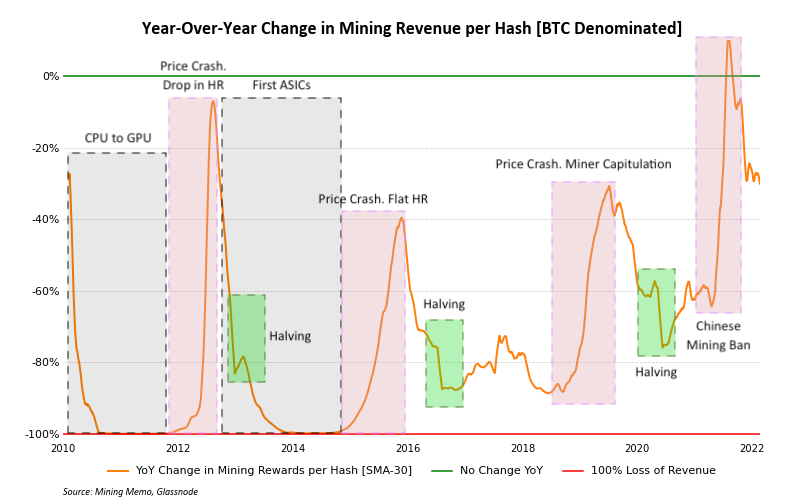

Hash rate-normalized revenue has been in an exponential downtrend since 2010 as bitcoin exploded in popularity and miners began experimenting with GPUs. It seems fated that the decline will continue indefinitely due to the pre-programmed subsidy cuts, the ever-increasing adoption of cryptocurrencies and the permanent arms race for new and more efficient mining rigs.

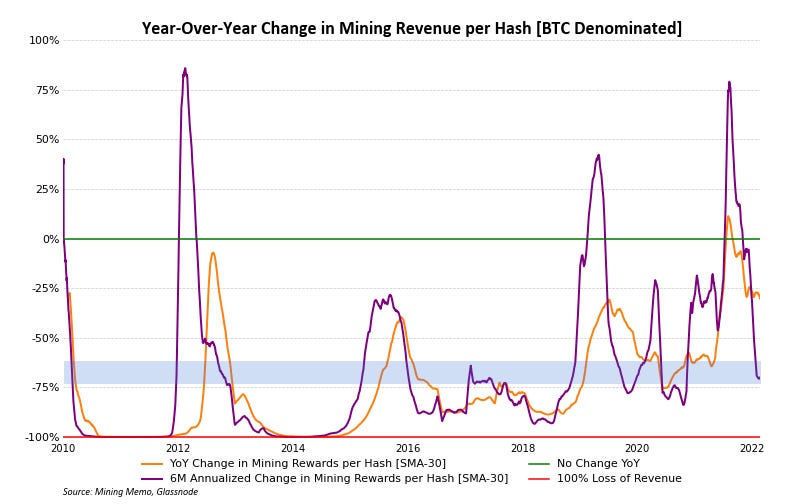

2021 was a unique and extremely strong year for non-Chinese bitcoin miners. For the first time ever, the network saw an increase in year-over-year revenue per hash as the vast majority of Chinese hash rate was forced offline. Even today, ten months after the onset of the mining ban, the year-over-year metrics continue to look promising. But ten months is less than a year, and as the base effects die off in the coming months, the comparison is set to change dramatically.

Switching from year-over-year revenue change to a six-month annualized change metric, we see that revenue per hash is once again falling in line with traditional rates. The past six months has seen an annualized decrease in revenue per hash of 70%.

Other than the transition from CPU to GPU mining and the rise of industrial bitcoin mining alongside the initial development of ASICs, the current rate of depreciation of hash rate is well in line with historical values. To play devil’s advocate, the current rate of decline may be exaggerated due to international relocation of formerly Chinese mining machines, but with Intel and Block (formerly Square) looking to enter the miner manufacturing industry, there is the potential for a strong surge in supply in the coming years.

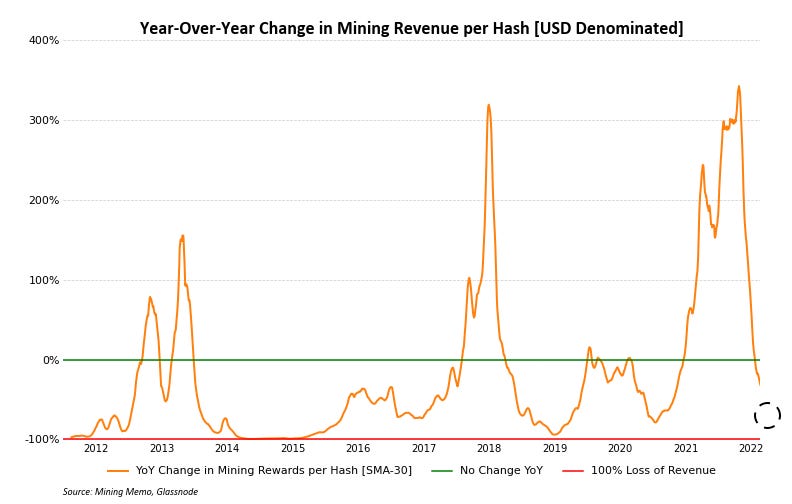

Examining bitcoin miners as businesses rather than hedge funds, the most important metric is U.S. dollar-denominated revenue per hash. 2021 saw the largest year-over-year spike in history as the bitcoin bull market and Chinese ban combined to drive extreme value to miners.

Unfortunately, the large price decline beginning in early November and the upcoming elimination of base effects are combining to bring depreciation back in line with historical values. The six-month annualized U.S. dollar revenue per hash is currently down 74% while showing no signs of slowing down. Without a resurgence in price, competition is destined to continue to eat away at profits.