Marathon Digital breaks mining record

In their December 2023 Bitcoin Miner Monthly Update, Marathon Digital achieved a remarkable milestone by breaking its monthly mining production record, mining 1,853 Bitcoin. This elevated the company to a unique position, surpassing its closest North American competitor by 676 Bitcoin.

The network's bi-weekly difficulty adjustments responded to increased miner participation, leading to a 6% difficulty increase in December. Contrary to expectations, miners thrived during December. Miners benefited from a surge in transaction fees, providing an average of over 20% premium per block, and a 12% increase in Bitcoin price from $37,712 on November 30, 2023, to $42,265 on December 31, 2023.

Bitdeer (BTDR)

In December, Bitdeer produced 434 Bitcoin, at a daily rate of 14 Bitcoin, an increase of 4.2% on the daily rate achieved in November 2023, and an increase of 149.4% from the total mined during December 2022. This occurred despite the company retiring 6,000 legacy mining machines, taking their operational hash rate to 6.7 EH/s (-7%).

The Gedu Data center maintained full functionality, contributing a 3.3 EH/s hash rate and mining 230 Bitcoin, constituting approximately 53.0% of the monthly total. Additionally, the inclusion of a new general hosting customer led to a growth in their hosting hash rate to 12.6 (+2%)

The construction of the 175MW immersion cooling data center at the Tydal mining facility in Norway is progressing as scheduled and is set to conclude by mid-2025. Concurrently, plans are underway for a 221MW datacenter in Ohio, United States, aligning with their strategy to expand electrical capacity, with completion also anticipated in 2025.

In the realm of AI cloud services, the company received their initial NVIDIA DGX H100 systems in December, initiating installation and testing. Based on current progress, the launch of their cloud service platform is expected in the first quarter of 2024. We have witnessed in recent months, this strategy being replicated by a number of the Bitcoin miners, diversifying into the High Performance Computing (HPC) data center management.

They have certainly started the year impressively focused on continuing to deliver value through all their separate business units. After a good first year as a public miner, it will be interesting to see what 2024 has in store,

Bit Digital (BTBT)

In December 2023, Bit Digital demonstrated continued robust performance, producing 169.5 BTC, at a daily rate of 5.5 Bitcoin per day, an increase of 14.9% on the daily rate earned in November. This was partly achieved as the company’s operational hash rate reached approximately 2.52 EH/s by December 31, 2023, an increase of 12% and the additional miner rewards per block. With the increased Bitcoin price, the company achieved $7.2 million, an increase of $1.8 million (+33%) on the total revenues self mining earned in November. Bit Digital has also declared its objective to double the operational fleet in Bitcoin mining, aiming to reach ~ 6.0 EH/s by the end of 2024.

The company increased their Bitcoin ‘hodl’ to 643 Bitcoin, valued at $27.2 million by selling just 22% of their monthly production. The company also have a significant Ethereum ‘hodl’ of nearly 17,400 coins valued at $39.7 million, cash and cash equivalents of $16.9 million, taking the total value of their treasury holdings to an impressive $85.1million, as of December 31, 2023, essential for when the next Bitcoin halving occurs in April 2024.

In the realm of Proof-of-Stake, Bit Digital actively staked ~ 12,752 ETH across native and liquid staking protocols by December 31, 2023, achieving a blended APY of approximately 3.67% on its staked ETH position for December, earning staking rewards of about 38.5 ETH.

The Company announced the receipt of 192 AI servers, featuring a total of 1,536 Nvidia HGX H100 GPUs, from Super Micro Computer, Inc. 64 AI servers are now successfully installed and undergoing testing at the Iceland datacenter, with the remaining servers expected to arrive in the first half of January 2024.

Bitfarms (BITF)

2023 has been an amazing turnaround year for Bitfarms, under the leadership of CEO Geoff Morphy, which witnessed them strategically execute their growth plan, securing $118 million in liquidity, low-cost power contracts up to 593 MW, and a miner purchase agreement for 63,888 Bitmain miners in 2024. Morphy emphasized that nearly 70% of the new miners would be deployed in existing US and Canadian farms, while the rest would support the accelerated Paso Pe, Paraguay expansion.

The company is on track to meet its Q2 2024 targets of 12 EH/s and 310 MW operating capacity, representing 85% and 29% increases from year-end 2023. The flexibility in the contract allows Bitfarms to potentially achieve 17 EH/s and 23 J/TH fleet efficiency by the close of 2024.

Bitfarms mined 446 Bicoin during the month of December at a daily rate of 14.4 Bitcoin, an increase of 10.1% on the previous month, increasing monthly mining revenues of $18.9 million by 28%. This increase in production was despite the company unable to maximize its full 6.5 EH/s of capacity, operating effectively at 6.2 EH/s.

Having mined a total of 4,928 Bitcoin during 2023, the company increased their ‘hodl’ to 804 Bitcoin with a value of $34 million as of December 31, 2023 after selling 44 Bitcoin to cover their operational and capital expenditure.

During the month, Bitfarms successfully diminished its total outstanding indebtedness by $2.0 million, leaving a remaining balance of $4.0 million, slated for complete settlement by February 2024. Additionally, the company also maintained a robust financial position with approximately $84 million in cash and cash equivalents, providing a good level of liquidity as the halving approaches in less than 15 weeks.

Cleanspark (CLSK)

CleanSpark achieved notable growth in 2023, mining 7,391 Bitcoin, a total only bettered by North American publicly traded miners Core Scientific and Marathon Digital during 2023, and a 60% increase from total production in 2022. The company adopted more of a ‘hodl’ strategy in 2023 with Bitcoin holdings surging over 1,200% to 3,002 Bitcoin, valued at approximately $126.9 million as of December 31, 2023.

In December, the company set another record by mining 720 Bitcoin, at an average daily rate of 23.2 Bitcoin and selling 293 Bitcoin at an average of $42,700 per coin, yielding proceeds of approximately $12.5 million. The company maintained its operational hash rate of 10.08 EH/s, with a monthly utilization of 99% achieved, second only to Marathon Digital.

The Sandersville expansion achieved key milestones with the completion of all ten building structures for the 150MW expansion. The company now possesses all Antminer XPs in Georgia, conducting firmware upgrades on Antminer S21s in preparation. All machines necessary for the 150MW expansion have been delivered and are set for installation in the coming weeks, aligning with the planned energization in February 2024.

On January 8, 2024, CleanSpark unveiled plans to augment its proprietary hashing power in the ongoing competitive landscape, placing a new order for 12 EH/s in Bitmain’s Antminer S21, amounting to $193 million. The Georgia-based company secured an option to acquire an additional 100,000 units of the Antminer S21 at a fixed rate of $16 per TH/s, exercisable within the year. The initial 60,000 units, expected in Q2, will add 12 EH/s to CleanSpark’s existing 10 EH/s of operational hashing power. If fully exercised, the option could contribute an additional 20 EH/s, positioning the company strategically for the next market surge.

Core Scientific (CORZQ)

In December, Core Scientific generated 1,177 self-mined Bitcoin, at a daily rate of 38 Bitcoin per day, an increase of 19.4% on the rate achieved in November and for the entirety of 2023, the company produced a total of 13,762 self-mined Bitcoin.

Total monthly self mining revenues of $49.7 million were recorded, an increase of $13.8 million (+38%) on the revenues achieved during the previous month. This was due to the increased mining rewards achieved, the increase in Bitcoin price and the increased operational hash rate to 16.9 EH/s (+11%).

The company successfully prepaid the outstanding balance on its debtor-in-possession (DIP) financing package from B. Riley Financial. This move ensures access to the full $35 million available, maintaining robust liquidity for the targeted emergence in mid to late-January 2024. CEO Adam Sullivan highlighted the company's exceptional performance, solidifying market leadership and strong cash flow, making the repayment a strategic achievement in anticipation of the planned emergence later this month.

DMG Blockchain (DMGI)

DMG Blockchain produced 72.1 Bitcoin at a daily rate of 2.3 Bitcoin, an increase of 7.8% on the daily rate in November, adding self mining revenues of $3.0 million, an increase of 25% on the revenues achieved, during the previous month.

The company sold 46 Bitcoin, representing 64% of their production. They have increased their current ‘hodl’ to 455 Bitcoin with a value of $19.2 million as of December 31, 2023.

Hive Digital (HIVE)

Hive Digital mined a total of 282.8 Bitcoin during the month of December at a rate of 9.1 Bitcoin per day, a reduction of 1.1% on the rate achieved during November. This reduction was due to the New Brunswick facility undergoing final maintenance on its substation, operating at 1.8 EH/s. Upon the facility's anticipated resumption of operations in January 2024, it is projected to reach its full potential of 2 EH/s. The company highlights that, before maintenance, the peak global hashrate was 4.3 EH/s.

Self-mining revenues, however, increased by 15% to $12 million in the month, due to the increased Bitcoin rewards and increase in the Bitcoin price. The company sold 203 Bitcoin representing 72% of its monthly production, adding 80 Bitcoin to its current ‘hodl’ total of 1,707 valued at $72.1 million as of December 31, 2023.

Hive Digital has acquired 7,000 Bitmain S21 Antminers, augmenting its ASIC purchases, with previous acquisitions, to 16,800 new-generation ASICs. With a current inventory of 6.6 EH/s, the delivery of 1.4 EH/s in S21 Antminers will elevate total ASIC capacity to 8 EH/s. The strategic move aligns with growth plans to expand production, uphold Bitcoin holdings, and extend the high-performance computing platform using Nvidia chips in 2024.

Hut 8 Corp (HUT)

Hut 8 continued to improve monthly performance, producing 453 Bitcoin at a rate of 14.6 Bitcoin per day, an increase of 12.4% on the previous month, and increasing monthly self mining revenues by 30% to $19.1 million. This was achieved despite temporary self-mining machine downtime for maintenance; December saw a Bitcoin production increase due to enhanced efficiency and transaction fees at key sites.

The company sold 387 Bitcoin representing 85% of their production, adding 66 coins and bringing their total ‘hodl’ to an impressive 9,195 Bitcoin, with a valuation of $388.6 million as of December 31 2023.

On December 31, Hut 8 finalized a $7.1 million deal for a 63 MW substation and 1.9 acres of land, with an additional lease for 20 acres in Culberson County, Texas. This strategic move allows for front-of-the-meter site development, demand response programs, and expansion of self-mining or hosting capacity.

The approval from the U.S. Bankruptcy Court enables Hut 8 to proceed with its comprehensive mining operations plan in partnership with Celsius Network LLC, overseeing 12 EH/s computing capacity and 300 MW of energy.

Iris Energy (IREN)

Another good month for Iris Energy as they produced 399 Bitcoin at a rate of 12.9 per day, an increase of 6.1% on the rate achieved in November. Self mining monthly revenues increased by 22% due to the increase in Bitcoin price and the additional rewards achieved per block. The company made use of the energy strategy, during the month, achieving $200,000 in power sales, equivalent to nearly 5 Bitcoin.

On December 15, 2023, the company announced the acquisition of 1.6 EH/s of new-generation Bitmain T21 miners for $22.3 million, payable in installments. Commencing in January 2024, a gradual rollout of an 80 MW expansion at Childress will facilitate the augmentation of the operating hash rate, escalating from 5.6 EH/s to 10 EH/s

The new miners, including Bitmain S21 and T21, will enhance fleet efficiency from 29.5 J/TH to 24.8 J/TH upon installation. Concurrently, early works and procurement for the next 100 MW of data centers at Childress are underway, with 500MW of additional power available on site.

Marathon Digital (MARA)

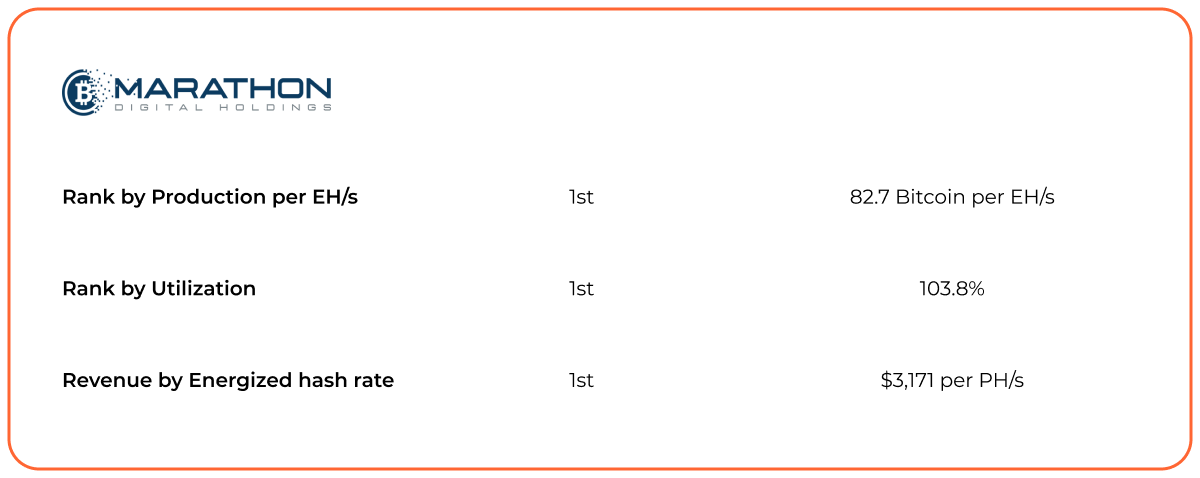

December proved to be a record breaking month for Marathon Digital, in terms of production and mining metrics. They actually finished top al all three mining metrics for the month of December:

The company’s total production reached 1,853 Bitcoin, an increase of 56% on the amount of Bitcoin achieved in November. The company banked self mining revenues of $78 million during December, an increase of $33.6 million (+75%) on the previous month.

This increase in production was due in part to the 8,900 of Marathon's Bitcoin miners, equivalent to approximately 0.7 EH/s, activated at Applied Digital's Garden City, Texas facility. This deployment contributed to a 7% expansion of Marathon's operating fleet, totaling about 199,200 Bitcoin miners, taking their hash rate to 24.7 EH/s.

This increase in revenues was also due to the increase in mining rewards and Bitcoin price. Another significant factor is that Marathon Digital has their own ‘mining pool’ enabling them to capture the full block fees, attributing 380 Bitcoin (22%) to their production, alone.

The company sold 704 Bitcoin, representing 38% of their monthly production, adding 1,149 to their ‘hodl’ now totalling 15,174 Bitcoin and valued at an impressive $641.3 million as of December 31, 2023. The company also has a balance of $356.8 million in cash and cash equivalents taking the total treasury position to $998.5 million.

Marathon, a key player in the Bitcoin ecosystem, has agreed to acquire two operational Bitcoin mining sites, totaling 390 megawatts, from Generate Capital for $178.6 million. This marks Marathon's transition to managing a diversified portfolio of fully-owned Bitcoin mining operations. The acquisition expands their capacity to approximately 910 megawatts, 45% of which will be owned directly, with potential for a doubled operational hash rate to 50 EH/s in the next 18-24 months. The transaction is set to close in Q1 2024.

Riot Platforms (RIOT)

Riot Platforms produced 619 Bitcoin during the month at a daily rate of 20 Bitcoin, an increase of 35% on the rate achieved during the month of November. Although a better performance in December and hash rate now at 12.4 EH/s, the company had an effective utilization rate of 69%.

This, however, does raise a number of questions as to why their mining performance at Whinstone is significantly lower, when compared to peer miners in the table above, where the total average achieved during December was close to 94%.

During the year they have utilized their energy strategy to curtail and receive power and demand response credits totalling $71.6 million, which has effectively kept their mining costs extremely low. In December, they received $500,000 in demand response credits only, equivalent to 12 Bitcoin, which implies they were not required to curtail their energy.

The company sold 599 (97%) of the production in December, providing $25.7 million in sales, whilst adding 20 coins to their ‘hodl,’ which now stands at $311.2 million

Riot Platforms is advancing Phase 1 of the Corsicana Facility, its second large-scale site, aiming to add 400 megawatts. The foundation for Building A1 was poured in December, with the structure under construction. Building A1 is anticipated to be operational by Q1 2024, and subsequent buildings in the 400 MW Phase 1 expansion are scheduled for energization in the following months. The fully developed Corsicana Facility is projected to reach 1 gigawatt in total capacity, and with significant mining orders with Micro BT placed, is strategically poised to elevate their self-mining hash rate to 28 EH/s, by the end of 2024.

SATO Technology (SATO)

SATO Technology had another impressive month, producing 38 Bitcoin during the month of December at an average rate of 1.2 Bitcoin per day, an increase of 5.6% on the rate achieved in the previous month. Monthly mining revenues also increased in the month by $0.3 million (23%) to $1.6 million. In terms of mining metrics, they were only surpassed, in December, by Marathon Digital, Iris Energy and Cleanspark.

The increase was due to the additional fees achieved with each block and the increase in the price of Bitcoin. The company sold 41 Bitcoin to pay for operational costs and have a current ‘hodl’ of 40 Bitcoin with a value of $1.7 million. The company also has cash and cash equivalents of $1.67 million, taking their total treasury to $3.37 million, as of December 31, 2023.

TeraWulf (WULF)

TeraWulf produced 334 Bitcoin in December, at an average rate of 10.8 Bitcoin per day, an increase of 6.4% on rate achieved during the previous month. Although monthly utilization dropped slightly to 92%, the company still managed to increase their self mining revenues to $14.1 million, an increase of $1.9 million (+16%).

On December 28, 2023, TeraWulf reported details of their expansion plans which provides for a fully funded 7.9 EH/s expansion, equating to a 58% increase in their currently self-mining capacity.

Operational Building 3 at Lake Mariner sets the stage for receiving and activating 18,500 BITMAIN Antminer S19j XP miners by February 1, 2024. Concurrently, Building 4's construction is underway, scheduled for mid-2024 completion, elevating TeraWulf’s operational capacity to ~10 EH/s.

Additionally, a 2024 expansion of their high-performance computing project at Lake Mariner will support generative AI and large language model applications, reinforcing TeraWulf’s position at the forefront of efficient and profitable mining fleets.

Anticipating the repayment of ~ $14 million of debt with Q4 2023 generated cash, an additional $11 million is expected to be repaid in January 2024, reducing future interest payments for the company.