Bitcoin miners must join a mining pool to get paid regularly. But not all pools serve their miners the same.

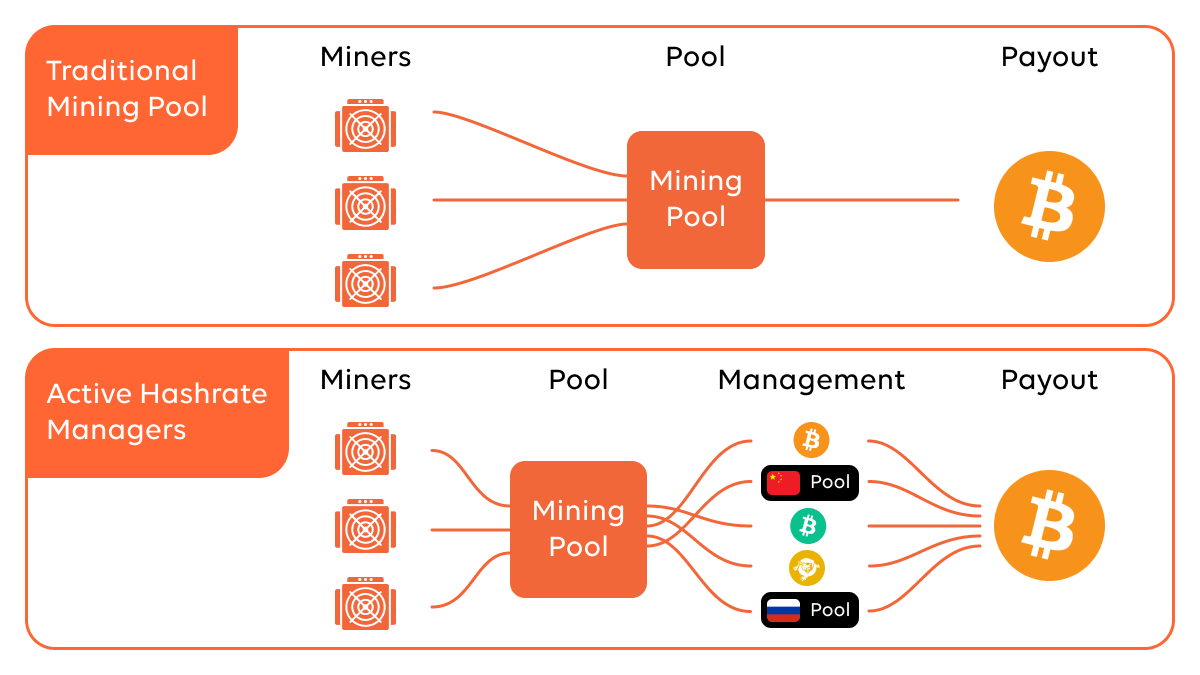

Nearly all of the world’s largest mining pools operate with the traditional structure of allocating a miner’s hashrate to mine the coin they choose and paying them in that same coin. A bitcoin mining pool, for example, will pay a miner in bitcoin based on the hashrate that they contribute to the bitcoin pool.

Other mining pools are structured as hashrate managers, or profit switching pool services. Most miners don’t understand the difference between this service and a traditional pool. In short, hashrate managers employ profit-switching strategies that rotate between different cryptocurrencies and mining pools with a goal of maximizing profits instead of mining one particular coin, like bitcoin.

Want more mining insights like this?

The piece explains hash rate managers and examines the reliability and feasibility of their operations.

Hashrate management basics

With traditional mining pools like F2pool and Slush Pool, a bitcoin miner connects directly to the bitcoin pool, contributes their hashrate to mining bitcoin, and gets paid in bitcoin. But a bitcoin miner who uses a hashrate manager gives their hashing power to a pool that directs the hashrate to different blockchains and even other mining pools resulting in the miner having no idea who or what is mining with their hashrate.

This process results in a couple different likely scenarios for miners using hashrate managers.

- A bitcoin miner using this service could receive payouts in bitcoin, but in practice their hashrate could have been used to mine any other SHA-256 coins, like Bitcoin Cash or Bitcoin SV. (The same could happen with a Zcash miner's hashrate, for example, rotating between other equihash coins.)

- A miner could exclusively join a North American hashrate management pool, but their hashrate could be bounced and transferred all around the world to Chinese, Russian, or South American pools.

Hashrate management services for a variety of coins are offered by Luxor and Greatpool. Other hashrate managers that use white label pools include Blockware and Sigmapool.

A white label pool is a mining pool that has been rebranded using another existing mining pool in the background. A “North American” pool could be white labelling a Chinese pool in the background, for example, and a miner using the pool would not know where their hashrate is sent.

Profit switching explained

A hashrate manager that deploys profit switching strategies does not commit to mining a single cryptocurrency or mining through a single pool. Instead they switch between coins based on profitability over a set period of time with the goal of maximizing profits.

The game of profit switching is primarily based on deploying proprietary algorithms or predictive analytics to try to beat traditional pool earnings, but this is not always a successful strategy. These algorithms can be implemented directly by the pool or by third parties. After attempting to determine which coin is currently the most profitable to mine, the managers then allocate their miners’ hashrate to that coin’s network.

Profit switching can also occur between different mining pools within a specific cryptocurrency. Because some pools charge different fee rates for certain groups of miners or different fees for mining block rewards or transaction fees, hashrate managers attempt to beat traditional pool earnings by occasionally switching hashrate between pools depending on fees and expected payouts.

Downsides of hashrate managers

Switching between multiple pools and blockchains can potentially cause connectivity problems, leading to degraded pool performance and stability. In fact, there have been reports of users experiencing issues when trying to connect to hashrate manager pools.

Depending on the design of their algorithm, a hashrate manager’s strategies can decrease their pool’s stability. For example, if the algorithm switches between pools, it would reduce the ASICs time online due to having to constantly reconnect to different pools; reconnecting can take several minutes. Overtime, these minutes add up significantly and reduce miner uptime by a couple percentage points resulting in around 98% uptime versus the 100% uptime of traditional mining pools. If a bitcoin miner plans to run their ASICs long term, this uptime reduction will reduce their long term profitability despite potentially achieving higher short term profits.

Lastly, some hashrate managers mine coins with low liquidity and a smaller market cap. Low cap coins are necessarily harder to sell. Compounding this issue is a given algorithm's difficulty in choosing between profitable coins. For example, at what threshold should an algorithm swap to one coin over another? And what if that value changes? Baked in thresholds can be slow to switch between blockchains, potentially causing a reduction in efficiency of the hashrate manager’s pool.

Why does this matter?

Many miners have incentives that go beyond profit. Bitcoin miners often plug in ASICs to support the network’s resiliency and contribute to further decentralizing the network’s hashrate. Miners who opt to join a hashrate manager’s pool do not achieve these objectives because their hashrate is frequently allocated to mine for other blockchains, like BSV and BCH. The miner cannot verify which networks their hashrate is supporting.

In summary, profit maximization is an unrealistic goal. Even if a miner’s primary objective is to maximize profits, hashrate management often doesn’t achieve this in the long run due the reliability and stability problems that often come with deploying profit switching algorithms. Failure to predict changes in mining profitability or to exploit a profitable disparity between pool payouts can leave the hashrate management strategy at best no more profitable than mining with a normal pool.