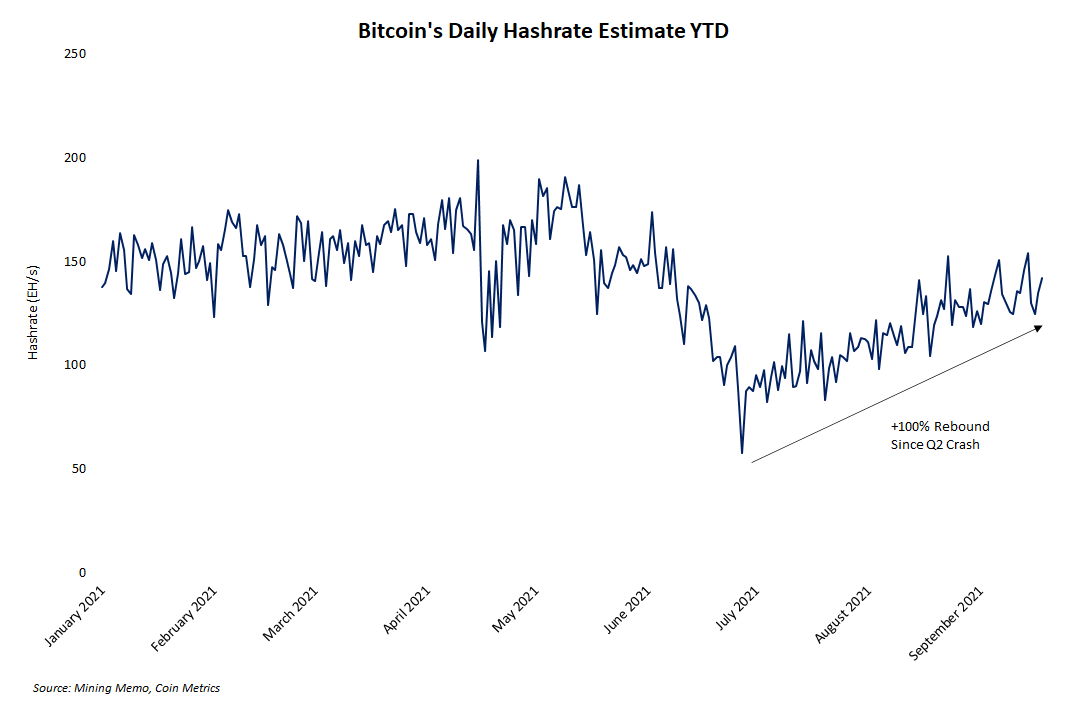

One of the biggest stories this year in cryptocurrency markets was the hashrate (and price) crash that followed China’s crackdown on mining. But over the past several months, Bitcoin’s hashrate has made a remarkable recovery and continues to pare its losses.

The following charts in this article illustrate different aspects of Bitcoin’s hashrate recovery after China’s ban. As the mining market rebounds and continues growing, hashrate has become more diversified in its power use and more decentralized in its geographic distribution.

Want more mining insights like this?

Since its lows in the second quarter, Bitcoin’s hashrate has seen a rebound of more than 100%. Of course daily hashrate fluctuations vary widely and are estimates based on block times and other network data. But this recovery is still significant.

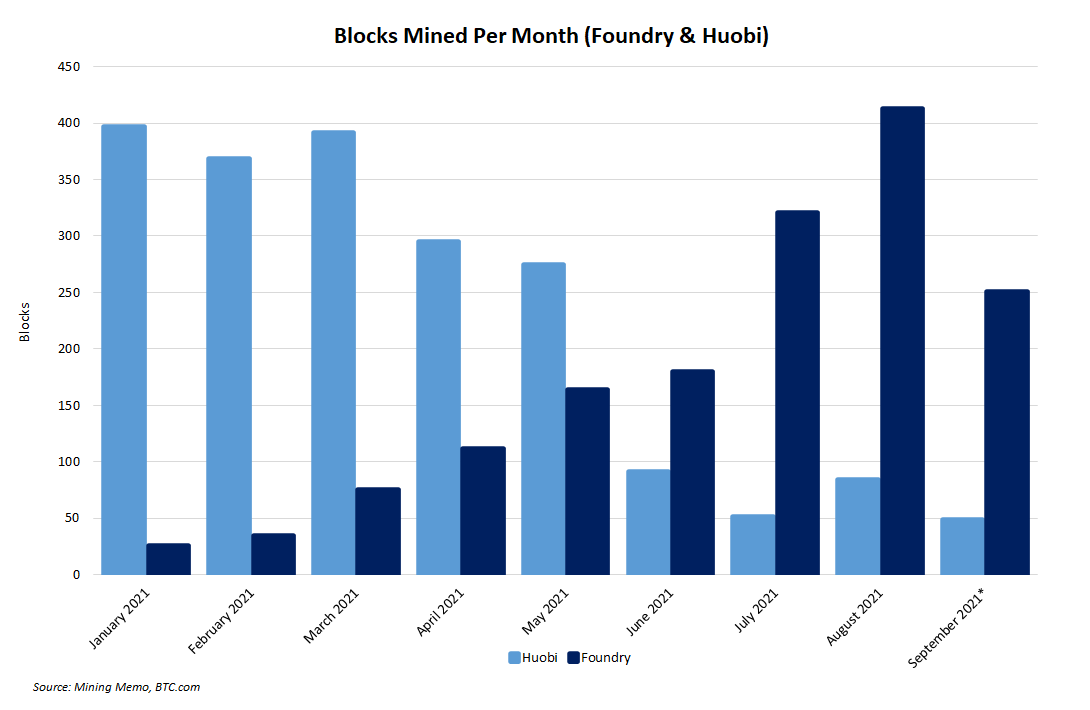

Most analysts assume that the hashrate recovery is due to machines from Chinese miners relocating and coming back online, but this isn’t the case. Some Chinese miners have opted to put their ASICs in storage and many are still looking for available hosting space to power on their hardware. In fact much of the hashrate recovery is credited to new hashing power coming online from miners in North America, Latin America, and other regions. The majority of this new hashing power is from the delivery and deployment of ASICs purchased last year.

This shift in hashrate is starkly illustrated by the contrast in monthly blocks mined by Foundry and Huobi. After China’s ban, Huboi’s hashing power took a tremendous hit. Conversely, Foundry’s mining capacity continued growing and regularly set new highs in total blocks mined.

Other pools like AntPool and Poolin also suffered drops in hashrate from the China crackdown. But those pools have largely recovered their hashrate after relocating machines to the U.S. and other regions.

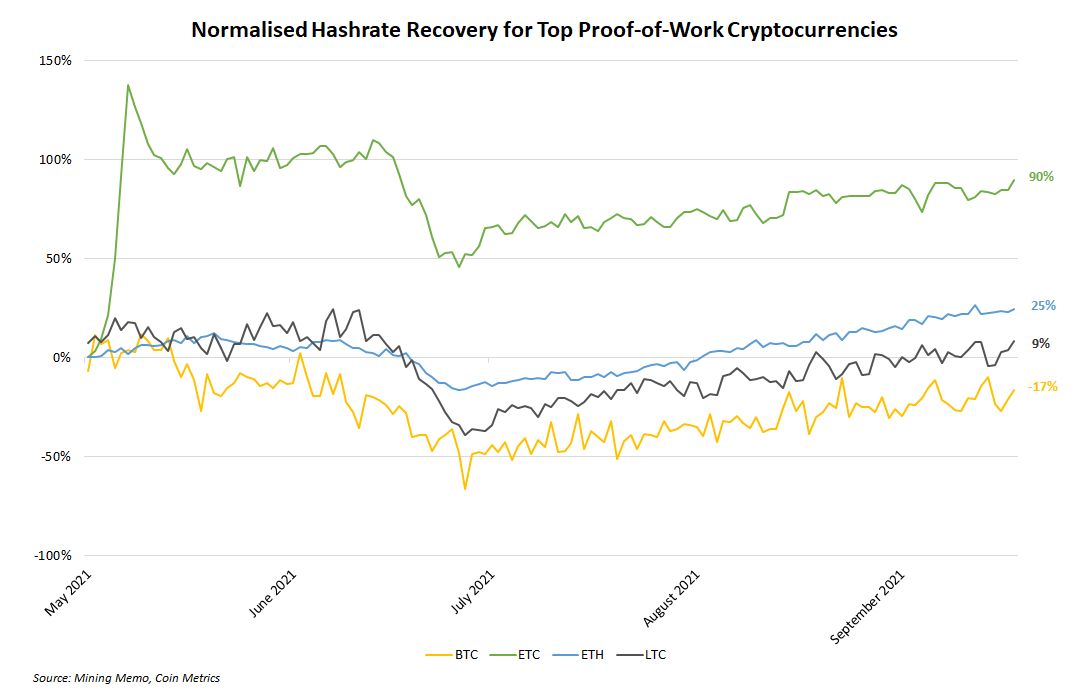

Bitcoin isn’t the only Proof-of-Work coin that has seen strong hashrate recovery. Other top cryptocurrencies like Litecoin, Ethereum, and Ethereum Classic have also rebounded strongly, and all three have seen positive growth relative to their hashrates in May. Meanwhile, Bitcoin is still several percentage points below its May levels.

Throughout Bitcoin’s entire history, the hashrate chart has always shown an up-and-to-the-right trajectory. Despite periodic drops along the way, Bitcoin’s hashrate should soon return to its normal path of growth. Even this summer’s chilling news from China cannot stop that. China’s crackdown contributed to the democratization of Bitcoin’s hashrate, and thus increased the network’s resilience.