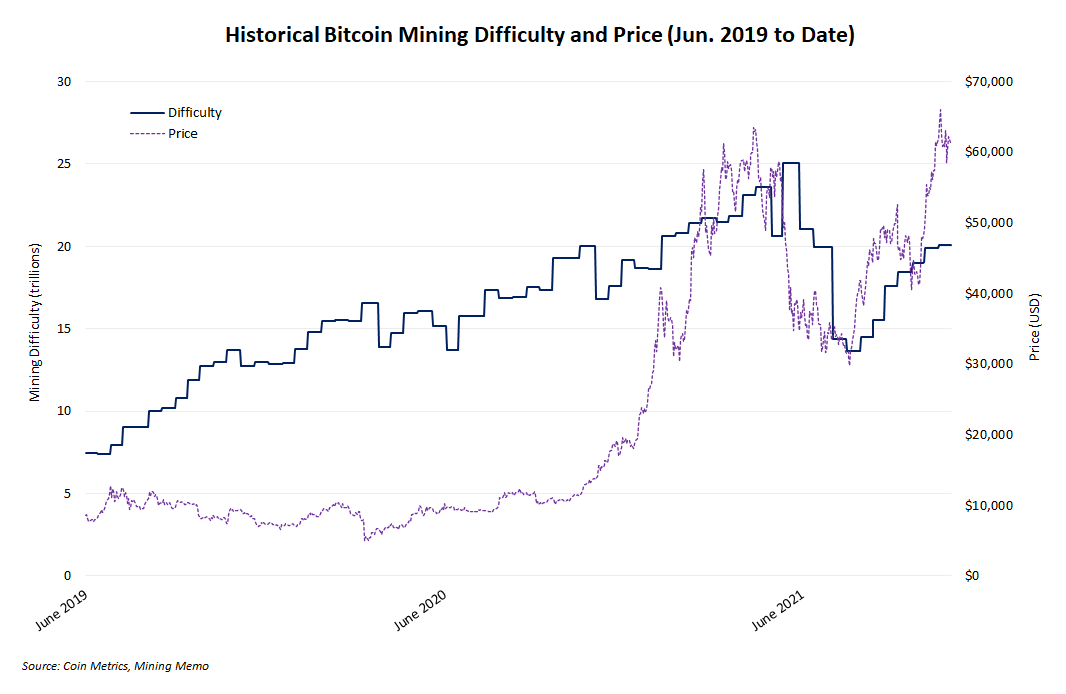

China’s crackdown on mining caused the single largest quarterly drop in hashrate for Bitcoin in Q2. But ever since, Bitcoin’s hashrate has roared back to life, with Sunday’s difficulty adjustment marking the eighth consecutive increase for the leading cryptocurrency network.

- Difficulty passed 20 trillion after Sunday’s adjustment.

- Bitcoin traded near $35,000 the last time difficulty was at 20T (June 2021).

Want more mining insights like this?

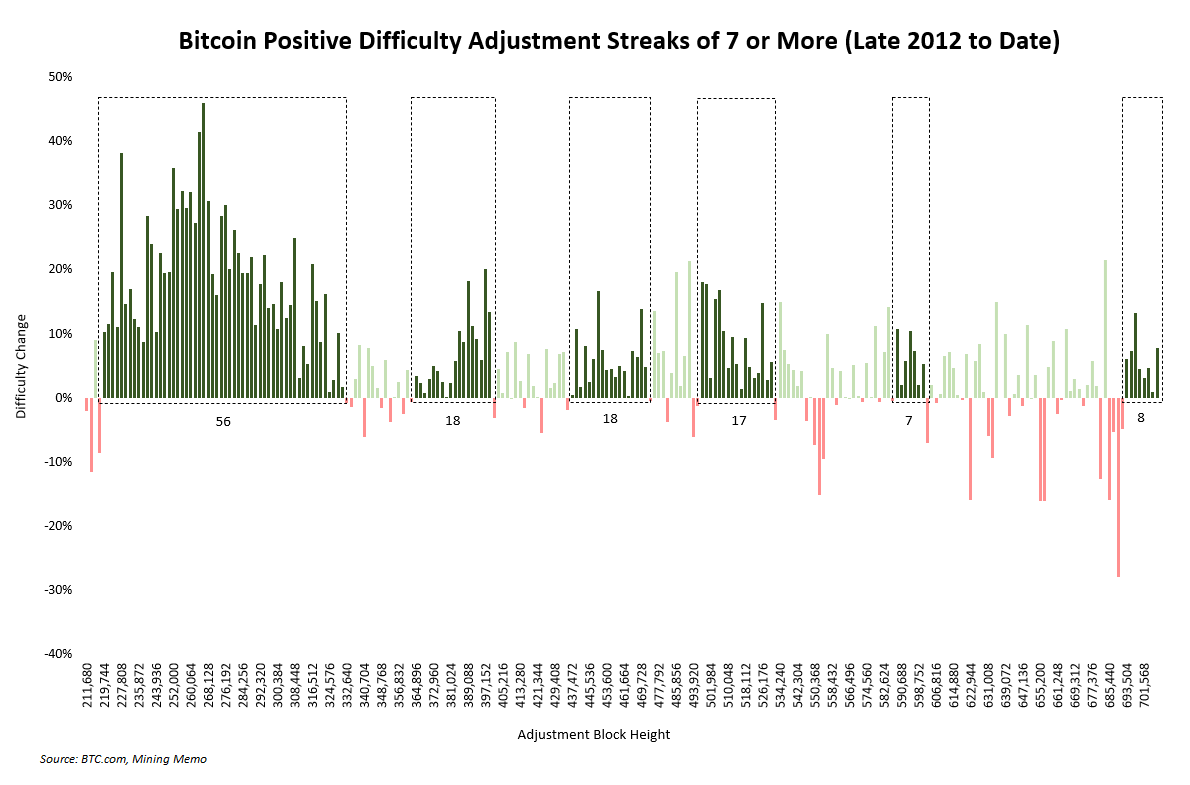

Difficulty increases have been far more common throughout Bitcoin’s history than downward adjustments. But streaks of several positive adjustments are noteworthy for easily identifying periods of extreme network growth.

Following China’s mining ban and the market’s subsequent drop, bitcoin miners relocating ASICs from China and bringing new machines online have caused the network to increase difficulty for the past 8 consecutive adjustments.

Suffice it to say Bitcoin’s network security is strong and growing stronger every week.

What’s more, mining is significantly more profitable at current difficulty levels than at the same levels earlier this year before China’s ban. Bitcoin’s price has appreciated so much over the period of time following the Chinese ban that profitability measured by dollar-denominated revenue per terahash per second per day is nearly double its levels during the summer before and shortly after China’s ban.

The norm for Bitcoin’s hashrate trajectory is sharply up and to the right. China’s mining ban caused hashrate growth to temporarily deviate from this pattern. But bullish miners chasing current profitability and rapidly expanding their current operations are quickly pushing hashrate growth back to its normal trend. And they’re making lots of money doing it.