Takeaways

- Network hashrate jumped 29% in one week, from Jan. 9-15.

- Bitcoin's difficulty mechanism responded with a 9% increase.

Bitcoin network difficulty hit a new all-time-high Thursday of 26 trillion, up 9.3% from the previous two week period, according to data page Clark Moody. The jump comes some eight months since the previous record high preceding the China Bitcoin mining ban of mid-2021.

Difficulty adjustment is a process wherein Bitcoin changes how hard it is to mine bitcoin. Every 2016 blocks – two weeks on average – the Bitcoin network measures the current hashrate of all miners and adjusts mining difficulty based on the number of miners online. In this way, Bitcoin preserves its supply issuance rate, among other technical nuances.

Read: What is mining difficulty?

For miners, increased difficulty means less profitable mining. Hashprice – a metric measuring the revenue per terrahash (TH) of a machine – dropped some 14%, from $0.21 TH per day to $0.18 TH per day, according to Hash Rate Index.

For the network, increased difficulty indicates more hashrate joining the network, bolstering Bitcoin’s security. A fair tradeoff, perhaps.

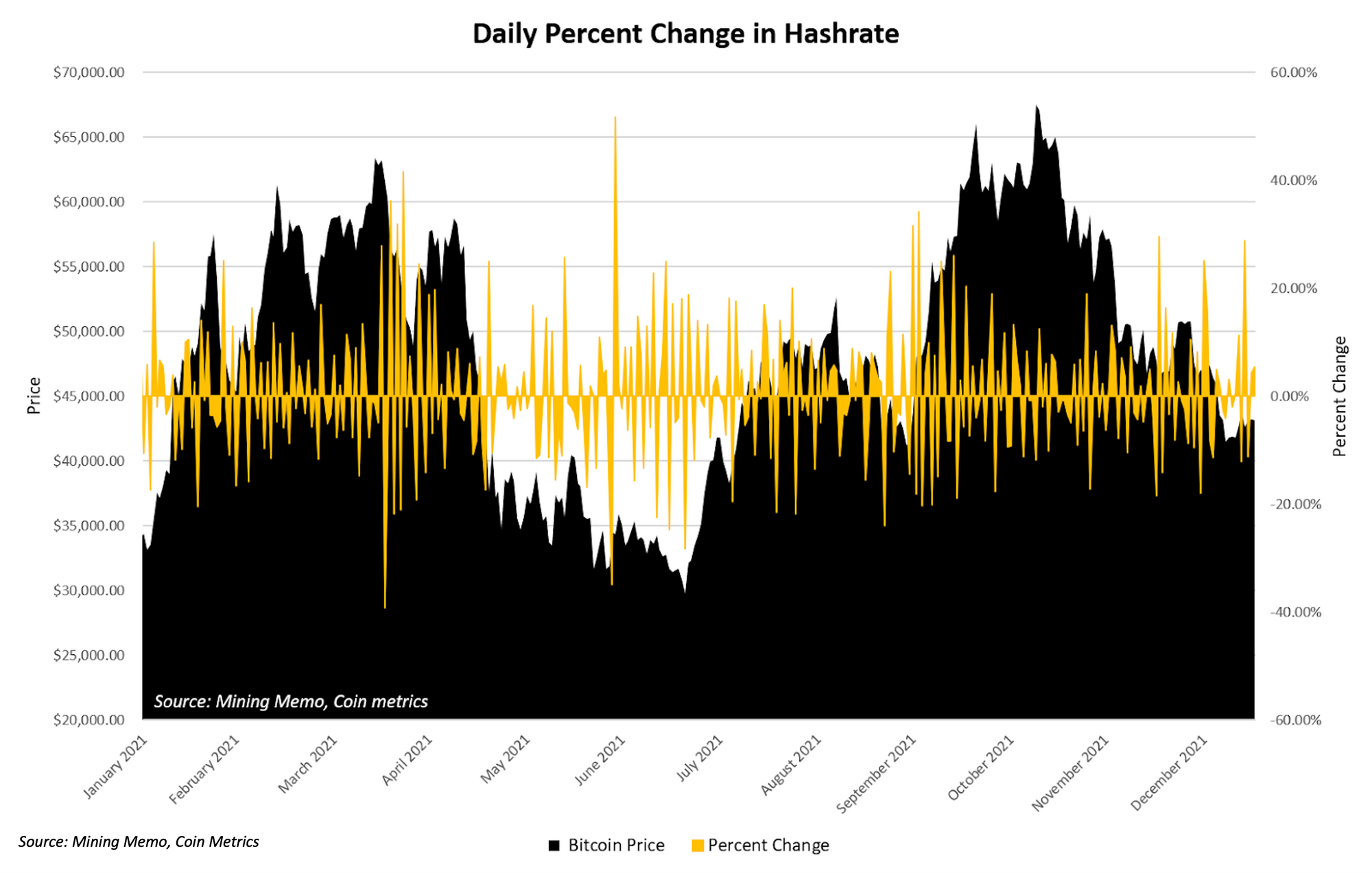

The change in difficulty was preceded by the eighth-largest weekly change in hashrate by percentage in the last 12 months. The jump indicates miners will continue to deploy machines despite worsening bitcoin price conditions. A recent survey from Galaxy Digital on public Bitcoin mining firm deployments came to a similar conclusion.

Indeed, Bitcoin miners continue to rack machines at a furious pace after China surrendered its hashrate to jurisdictions around the globe. Since then, difficulty has trended upward as hashrate continues to join the network in jurisdictions that have a friendly environment for long-term data centers, such as the United States.

For miners, the difficulty change is yet another reminder to keep operations as efficient as possible. Minting Bitcoin won’t always be as cheap as it is today.