Bitcoin price increases have vastly outpaced hash rate growth since late July. Significant price jumps have failed to be followed by subsequent increases in hashrate. Under normal circumstances, more hashrate is deployed as prices move higher but we are certainly not in normal circumstances.

A mix of developments have been acting as headwinds for hashrate growth. Severe Chinese flooding and delays for Bitmain rigs are chief among these. Furthermore, a shady project linked to hosting company Minebest also may have made a claim to a significant amount of hashrate.

In this Difficulty Adjustment, we cover these three factors and detail their impact on preventing hashrate growth. We wrap up by covering what the hashrate futures markets suggest about future network hashpower. We also detail the latest rig releases, the launch of a mining facility in Kazakhstan, and the launch of a project for monitoring mining pools.

In the latest Proof of News, Whit and Ethan also discuss the flooding developments in China. Other topics include the Lancium versus Layer1 lawsuit and the possibility of a new ASIC manufacturer.

After two months of low volatility and volume in Bitcoin trading, price movements shifted gears in late July as price moved from below $9.5k to a recent high of $12,500. Higher prices generally means higher hashrate but hashrate growth failed to keep pace with the price jumps.

In fact, it seemed like network hashpower had hit a ceiling. While network difficulty was at 16.85 trillion, price increased by almost 20% but the subsequent difficulty adjustment was an increase of just 0.59%. Under usual circumstances, hashpower follows price as the margins for mining increase after price rises. However, the hashpower failed to keep up as a number of significant developments acted against hashrate growth.

Chinese Flooding

The severity of the flooding situation in China and its impact on Bitcoin mining cannot be understated. China has had months of havoc-wreaking flooding with infrastructure undergoing catastrophic damage. With roughly 65-70% of hashrate estimated to be based in China during the rainy season, mining farms are also in the firing line.

The flooding has spread from the central provinces of the Yangtze river to regions further upstream. These upstream regions – such as Sichuan – house the dominant share of Bitcoin’s hash rate during the rainy season. Delphi Digital research analyst Medio Demarco noted in a report last week that the Summer hash rate drops may be due to the higher difficulty levels.

“Despite a hazardous past few months in China, the dips in hash rate are more likely explained by the increasing difficulty”

Medio Demarco

However, reports from miners in China have made it clear that the damage is also extending to mining farms. Thomas Heller tweeted on August 18th that 10-15 EH/s dropped from Chinese mining pools as power stations were forced to shut down. Some rigs in the region have recently come back online but the Chinese flooding has undoubtedly been having a major impact on Bitcoin hashrate.

Bitmain Bottleneck

A bottleneck in the amount of new hashpower which can be delivered to miners has also prevented hashpower from keeping pace with price. The biggest ASIC manufacturer Bitmain has descended into chaos.

Jihan Wu ousting fellow co-founder and largest shareholder Micree Zhan last October evolved into a dramatic series of events. Zhan reclaimed the business licence to Bitmain and stopped operations at a key Shenzhen subsidiary responsible for delivering rigs. Bitmain recently announced that rig delays for orders placed in June/July will only be shipping in September/October.

Read More: A Timeline of the Bitmain Co-Founder Battle for Control

Bitmain will eventually split with Zhan and Jihan using separate supply chains and logistics for distinct entities. As the drama unfolded, a natural byproduct has been an uphill battle for miners seeking to secure latest-gen mining rigs.

Furthermore, firms that have secured mining rigs may not be deploying the hashpower on the Bitcoin network. Core Scientific secured roughly 17.5k Antminer S19 rigs from Bitmain but it is questionable how much of that hashpower will be deployed on Bitcoin. The Core Scientific website notes that the firm actively mines Bitcoin, Bitcoin Cash, and Bitcoin SV.

Bitcoin Vault Hashpower?

Moreover, a Bitcoin fork may be finding a home for a significant portion of SHA256 hashpower. Bitcoin Vault, a shady project started by Minebest, claims to have recently secured over 13 EH/s of SHA256 hashpower.

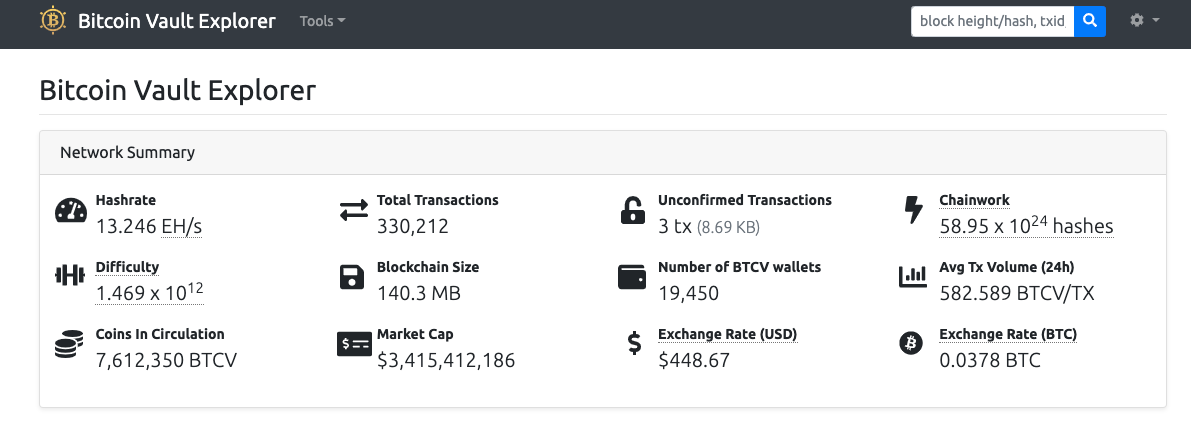

On the 20th of August, the Bitcoin Vault block explorer touted a hashrate of 13.246 EH/s. The reported hashpower has since dropped to ~5 EH/s. This data is non verifiable. But if it is true, it would explain why Bitcoin hashpower failed to rise during a period of significant price jumps.

However, it is unclear how the Bitcoin Vault network functions. Furthermore, the project is connected to Mining City, another shady initiative linked to Minebest. A previous analysis of Mining City made a strong case for it being a multi-level marketing ponzi scheme. It mainly targets the Asian market with Vietnam being their primary focus. We took a look at the plans available in the Mining City dashboard.

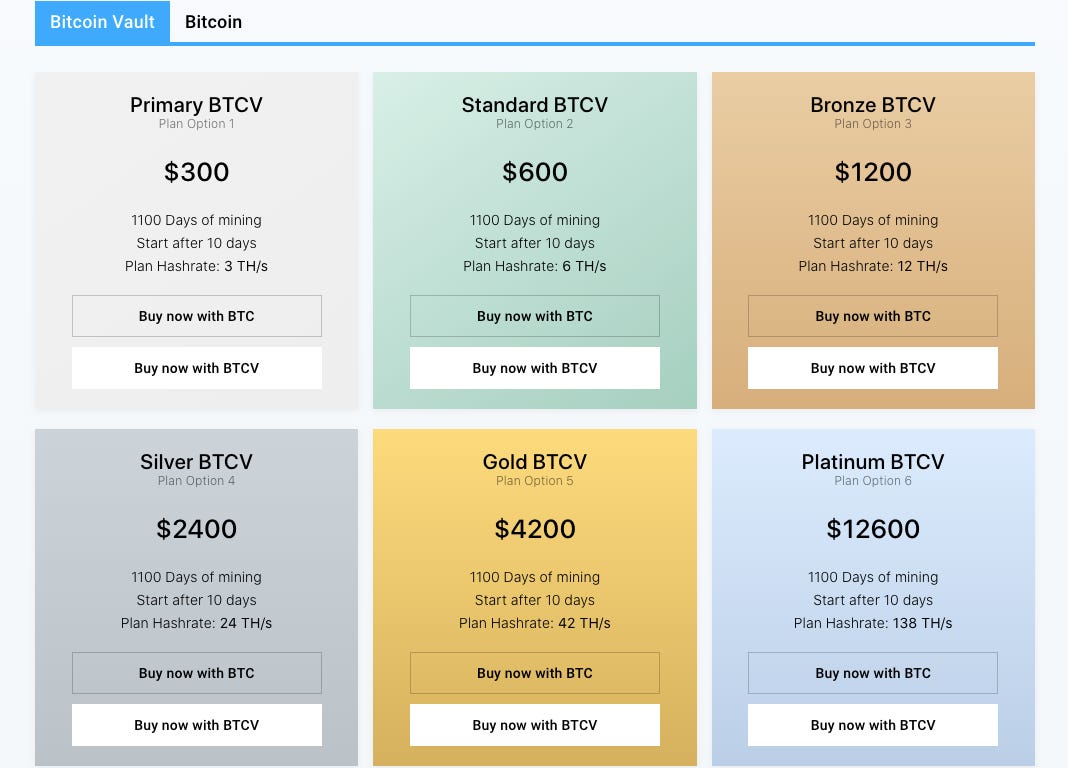

By purchasing one of these plans, buyers enter into an agreement with Cyprus-based entity “Prophetek INC Limited”. Each plan is marketed as a cloud mining contract with the proposal that the purchaser can ROI within 1100 days. $100 is reported to purchase 1 TH/s of hashing capacity in five of the six plans. Significant fees and deductibles are noted in the contract. For comparison, an Antminer S9 which miners were recently picking up for as little as $20 has roughly 14 TH/s of hashing capacity. Regardless, it is questionable whether the above contracts deploy any hashpower.

A lot of question marks hangover the Bitcoin Vault project. Whether it is responsible for taking a significant portion of the Bitcoin hash rate remains unknown. Whether it is even possible to direct hash rate to the network also remains unknown.

What Hash Rate Markets are Anticipating?

One month into Q3, market participants trading FTX hash rate futures were anticipating high hash rate levels over the quarter. Near the end of July, the Q3 contract was pricing in an average difficulty of 19.5 trillion for the blocks mined in Q3.

As the quarter progressed, it became evident that an average difficulty of 19.5 trillion was overly ambitious. As hashrate failed to rise in response to the significant price jumps, it became clear that the average difficulty would be far lower.

The market is currently pricing in an average difficulty of 17.23 trillion for Q3. The Q4 2020 and Q1 2021 contracts are estimating 20.7 trillion and 23.15 trillion respectively.

It is uncertain how long the Chinese flooding and Bitmain troubles will persist. Chinese rainy season typically takes place from April to October each year so it may very well also take a toll on Q4 hashrate.

Corporate restructuring is a lengthy process so the Bitmain roubles may have an impact far beyond Q4. As far as Bitcoin Vault is concerned, recent delays in commission payments to those that have purchased contracts may suggest that the scheme has already begun its descent.

- John

Industry Developments

Rig releases – StrongU announces two Bitcoin ASIC models – the H8 and H8 Pro. The specifications advertise a hashrate capacity of 74-84 TH/s with an energy efficiency of 40-45 W/TH. StrongU is a Shenzhen company that has previously designed ASICs for the X11 and Blake256R14 algorithms. The rigs will be priced at roughly $18.50 per TH. An announcement earlier in the year claimed that SHA256 rigs released by the company will use 5nm chips. Bitmain is the only Bitcoin ASIC company that has confirmed access to 5nm chips. Furthermore, Innosilicon have announced a new batch of Ethereum A10 Pro ASICs.

Enegix ready to open 180 MW mining facility in Kazakhstan – Mining facility operator Enegix is prepared to launch a mining facility near the Russian border at the start of September. The facility will have the capacity to house 50 thousand mining rigs. Filling the capacity with the latest generation rigs would produce 5-6 EH/s of hashpower which would be roughly 4% of the Bitcoin network. The energy is sourced from the Kazakhstani grid and will be coal-powered. Enegix seeks to do business with mining pools.

MIT Digital Currency Initiative launches project to analyze mining pool behaviour – MIT DCI launches Pool Detective which will monitor the behaviour of mining pools. The project uses mining rigs to connect to various mining pools and stores the activity between the rigs and pools within a database. The project aims to give a greater level of transparency to how mining pools behave and uncover incidents where pools act unfairly.

About HASHR8

Mining is the misunderstood heartbeat of blockchain technology. It fuels multi-million dollar IPO’s and drives institutional investors to big datacenters; it’s infrastructure is the subject of speculation and skepticism. Our global reach helps us demystify and broadcast the thoughts of industry leaders, and keep research firms, investors, and consumers up-to-date on trends and insights.