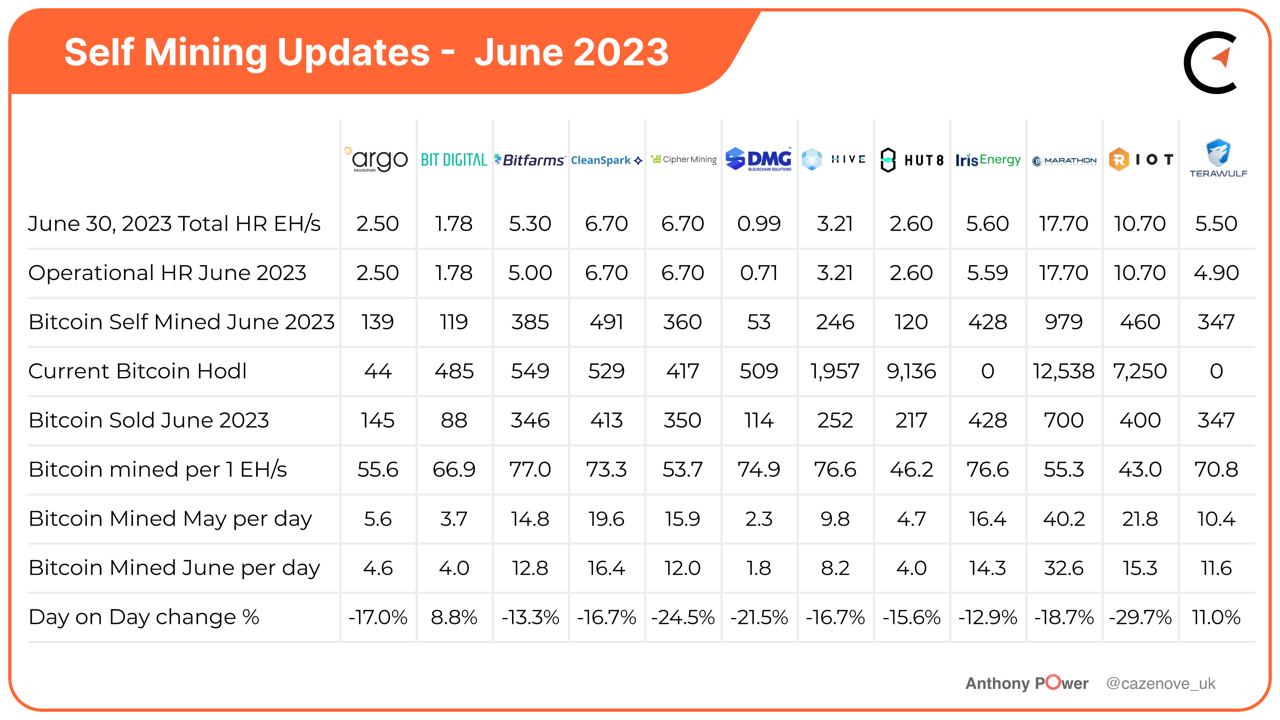

The level of rewards earned from Bitcoin mining in June reverted closer to normality after the surge of Ordinals related rewards in May. With this level of rewards, and taking into account the increased difficulty, North American-based miners saw an average drop of 14% in the daily amount of Bitcoin earned over the first summer month.

Mining difficulty continued to increase by an average of 3% during the month, as mirrored by the growth in global hashrate with a new all time high of 514 EH/s on July 8th 2023. The network difficulty has increased by 43% year to date, where the price of Bitcoin has achieved an increase in value of 84% over the same period.

The price of Bitcoin increased by 24% over the last 30 days as we have witnessed the price cross over the $31,000 level a number of times. Bitcoin mining shares, as previously highlighted, are more price volatile than Bitcoin as can be seen in the graph below, which has seen miners share prices increase by an average of 82% over the same period. TeraWulf’s stock (WULF), for example, increased 128%, compared with an increase in the Bitcoin price of 24% over the same period.

A number of the North American miners were able to take advantage of the hot weather in June and sell power and receive credits for participating in various schemes, such as the ERCOT 4CP program where miners receive benefits for regularly curtailing their power during the months of June to September. For a more detailed understanding of the scheme and how Riot Platforms has navigated the energy markets in Texas, check out the recent article below.

Read: How Riot Platforms manages Texas' energy market

Argo Blockchain (ARBK)

In the month of June, Argo Blockchain produced 139 Bitcoin at a rate of 4.6 BTC per day, a decrease of 17% from the rate achieved the previous month, which was attributed to the increased mining difficulty and the increased curtailment at the Helios site, due to the warm weather in Texas.

However, although the curtailment of energy impacts the number of Bitcoin mined the company were able to receive additional cash proceeds from certain power trading activities, managed by Galaxy Digital (GLXY), the operator of Helios.

The Company held 44 Bitcoin as at the end of June and we have seen this figure slowly decline each month of 2023, where the hodl at the start of the year represented 141 Bitcoin.

On a more positive note the company has started to receive the new Blockminer machines at its Quebec facilities and once deployed, will take their currently operational hash rate of 2.5 EH/s to a target of approximately 2.8 EH/s.

Bit Digital (BTBT)

Bit Digital produced 119.1 Bitcoin achieving an average of 4.0 Bitcoin per day, an 8.8% increase compared to the prior month. The increase in production, allowing for the increased mining difficulty and reduction in transaction fees in June, was primarily due to the higher average active operational hashrate achieved of 1.78 EH/s as of June 30, 2023.

The company continues to maintain a good crypto hodl with a majority held consisting of 485 Bitcoin and 11,739 Ethereum providing a total crypto value of $44.0 million. The company also held cash and cash equivalents of $18.5 million as at 30 June, 2023.

Bit Digital continues to actively stake its Ethereum holdings and had approximately 9,312 natively staked and 2,404 deployed in liquid staking protocols as of June 30, 2023. The company has an additional 960 Ethereum equating to 30 nodes deposited in a queue and due to be activated by the end of this month, earning 27 ETH by the end of June.

Bitfarms (BITF)

Bitfarms once again ranked number one Bitcoin miner in terms of Bitcoin production by EH/s, mining 385 Bitcoin with an operational hash rate of 4.9 EH/s. This equated to 12.8 Bitcoin per day, a reduction of 13.3% when compared the average daily production in May.

The company achieved a total operational hash rate of 5.3 EH/s as at the end of June, and reported an average operational hash rate of 5.0 EH/s for the month of June. They sold 346 Bitcoin during the month to pay for capital and operational expenditure and added 39 Bitcoin to their treasury taking the total Bitcoin hodl in custody to 549 equivalent to $16.7 million on June 30, 2023. The company also held $30 million in cash and cash equivalents and $19 million in remaining credits for pre-paid deposits to be applied against future miner purchase agreements, as at June 30, 2023.

Bitfarms continues to grow its hashrate and purchased 6,310 mining machines made up of a combination of Bitmain S19 Pro+, S19 j Pro and MicroBT M50S+ miners. This order will provide a blended energy efficiency of 28.5 W/TH providing a total hashrate of 749 PH/s for a cost of $13.68/TH.

The company installed 2,900 MicroBT machines at its Rio Cuarto site in Argentina in June, with a further 4,950 new miners due to be delivered in July and August. This will help the company achieve its target hash rate of 6.0 EH/s overall in Q3 2023.

The company also continues to complete the acquisition of the Baie-Comeau site, adding 22 MW of hydro power, and is expected to close during July 2023. The first 11 MW of this expansion is expected to come online this year.

CleanSpark (CLSK)

CleanSpark produced 491 Bitcoin during the month of June at an average daily rate of 16.4 per day, a drop of 16.7% on the previous month for the reasons highlighted above.

The Company sold 413 bitcoins in June 2023 at an average of approximately $27,200 per Bitcoin, achieving $11.2 million in revenue, to help pay for operational costs and fund growth. They were able to add 78 Bitcoin to their treasury taking their total to 529 Bitcoin with a value of $16.1 million.

On July 13th, CleanSpark announced that phase two of its mining campus in Washington, Georgia, is now live with a power capacity of 50 MW or 15,000 machines. Of those, 10,500 machines have been energized and are in operation taking the current hashrate to 8.0 EH/s, or halfway to the end of year goal of 16 EH/s. The cost of this site, including the acquisition costs of $25.1 million, construction, infrastructure and machines in the campus totalling $100 million has been fully funded.

Cipher Mining (CIFR)

The month of June proved to be a challenging one for Cipher Mining with hot weather and weak wind production forcing them to curtail their energy with more regularity. They produced 360 Bitcoin at an average of 12 Bitcoin per day, a drop of 24.5% on the average daily amount mined in May 2023.

The company increased their operational hash rate to 6.7 EH/s having received the delivery of all the recently purchased 11,000 Canaan machines, which were installed an energized during the month of June The company sold 350 Bitcoin during the month, adding 10 Bitcoin to their new Bitcoin hodl of 417, with a current value of $12.7 million.

The hot weather in Texas and the participation in the ERCOT 4CP program enabled Cipher Mining to sell energy back to the grid achieving power sales to the equivalent of 41 Bitcoin. The company will continue to focus on the most efficient optimization, whether that is through the mix of underclocking their machines, or selling power back to the grid at the most valuable times.

DMG Blockchain (DMGI)

DMG Blockchain had another challenging month in terms of operational hashrate, where the company managed only 710 PH/s, nearly 30% lower than the actual hashrate installed, caused by heat issues and a lightning strike on the transmission line.

The company produced 53.2 Bitcoin in June at an average daily rate of 1.8 Bitcoin per day, a drop of 21.5% based on the rate achieved in May. No additional new miners were added during the month, but the company has confirmed orders with Bitmain and shipping is occurring. They have 40 MW of containers now completed and the shipping of them to Christina Lake facility is moving forward too.

DMG Blockchain sold 114 Bitcoin during the month and now has a current hodl of 509 Bitcoin, valued at $15.5 million. The vast majority of the digital assets are currently held in self custody, but a small portion are held with Prime Trust, who has recently been issued with a cease-and-desist order from the state of Nevada, and then petitioned to be placed into receivership. The company holds approximately 49 Bitcoin and 45 Ethereum, with no access whilst the Financial Institutions Division carries out its investigation. In another similar occurrence with Silicon Valley Bank, account holders were made whole and it is hoped that the regulators do the same with Prime Trust holders.

Hive Digital Technologies (HIVE)

Hive Blockchain changed their name to Hive Digital Technologies with effect July 12 to reflect their recent diversification and mission to drive advancements in Artificial Intelligence supporting the Web3 ecosystem and providing small and medium-sized businesses with a more efficient alternative to major cloud service providers, utilizing the 38,000 high performing Nvidia GPU chips, held by the company. These chips were originally earning significant amounts of revenue, mining Ethereum at margins in excess of 90% before the coin moved to proof-of-stake in September 2022.

The company produced 246 Bitcoin, using their 3.2 EH/s of Bitcoin ASIC miners in the month of June, at an average rate of 8.2 Bitcoin per day, a reduction of 15.7% on the previous month. The company also added a further 13 Bitcoin through use of its GPU mining.

Since the end of June the company have increased their ASIC hashrate to 3.4 EH/s in the first week of July, and this is expected to continue to grow during July, as the majority of their recent previously announced order 1.26 EH/s of ASICs have been shipped, and continue to be installed at their facilities. Hive Digital appears to be on track with their interim goal of 4 EH/s, and are continually evaluating opportunities to reach their year end goal of 6 EH/s.

Hive Digital sold 252 Bitcoin during the month to meet operational and capital costs and have a current hodl of 1,957 Bitcoin with a current valuation of $59.7 million.

Hut 8 (HUT)

Hut 8 mined 120 Bitcoin in the month of June at an average daily rate of 4 Bitcoin per day, a reduction of 15.6% on the average daily rate achieved in the month of May. The current, well documented, challenges faced with their electrical issues at the Drumheller site, received some positive news with the team at the Alberta Site repairing more than 3,700 hashboards in June alone. The company is now focused on getting these repaired miners installed and energized and completing repairs on the remaining miners.

The company sold 217 Bitcoin during the month and has one of the largest amount of Bitcoin reserves of all the North American listed miners with 9,136 Bitcoin with a valuation of $278.2 million as at June 30.

On June 14, 2023 Hut 8 continued to drive their high powered computing strategy by announcing the signing of a 5 year agreement with Interior Health, the health authority for southern British Columbia for co-location services at the company’s flagship Kelowna data centre.

The company disclosed in an amendment to its S-4 Registration Statement concerning its planned merger with US Bitcoin Corp (USBTC) stating that once completed, the self-mined total hash of the new company will be 7.5 EH/s.

Hut 8 announced on June 26th, that it had entered into a$50 million credit facility with Coinbase Credit, Inc. to be used for general corporate purposes.

Iris Energy (IREN)

Iris Energy produced 428 Bitcoin during June at an average rate of 14.3 per day, 12.9% lower than the daily rate achieved during the month of May and received $600k in estimated power sales, equivalent to 22 Bitcoin at their Childress site, using an automated algorithm.

The company continued to increase their operational hash rate to 5.6 EH/s in June, taking their year-to-date current hash rate increases to an impressive 4.2 EH/s or 273%. The company expect to grow their hash rate to 9.1 EH/s by early 2024 as they increase

Their electricity cost per Bitcoin during the month amounted to $13,011 representing a mining margin of 57% The company continues to sell their mined Bitcoin on a daily basis to meet their operational and capital growth obligations.

Marathon Digital (MARA)

Marathon Digital produced 979 Bitcoin dring the month at an average rate of 32.6 per day, a reduction of 18.7% on the average daily amount achieved in May. The company was able to add a further 2.5 EH/s taking their total operational hash rate for the month to 17.7 EH/s an increase of 16% with a further 4.1 EH/s installed awaiting energization.

The company is finally close to achieving its hash rate growth target of 23 EH/s with the last building in Ellendale, North Dakota, due to come online in July and final elements at Garden City, Texas, also expected to be completed within that same period. The company also announced that the joint venture with UAE partners, Zero Two, operating at the Mina Zayad facility in Abu Dhabi powered up this week and started hashing. It should be noted that this hashrate is not included in the current or growth hash rate reported above.

Marathon Digital sold 700 Bitcoin to cover operational and capital costs, adding 279 Bitcoin to their hodl, now totalling 12,538 Bitcoin with a valuation as at 30th June of $381.7 million. The Company also ended the month with $113.7 million in unrestricted cash and cash equivalents providing a strong financial position as the halving approaches in April 2024.

Riot Platforms (RIOT)

During the month of June, Riot Platforms mined 460 Bitcoin while significantly leveraging their power strategy. As the temperatures in Texas reached near record levels during the month, causing power demand to be high, the company made dynamic decisions on their power usage based on market signals.

Through participation in various programs within ERCOT, highlighted above, the company generated $8.4 million in power sales and $1.6 million in demand response revenue. This total of $10 million represents the equivalent of an additional 361 Bitcoin when based on the average price of Bitcoin during the month of June, and would have placed the company top in both the production by EH/s and Utilization metrics below. The company’s operational hash rate remained at 10.5 EH/s as parts to repair Building G are still on order.

Riot Platforms sold 400 Bitcoin during the month adding 60 to its treasury and taking the total hodl to 7,250 equivalent to $220.7 million as at June 30, 2023.

On June 26, 2023 the company announced the purchase of 33,280 MicroBT machines for a total price $162.9 million, equating to approximately $21.50 per TH/s. This will take their immediate growth hash rate to 20.1 EH/s, as they build out the new facility at Corsicana in Navarro County, Texas, over the next 12 months. The company has an option, in whole or in part, to purchase an additional 66,560 additional miners adding 15.3 EH/s, and taking their self-mining capacity to a potential total of 35.4 EH/s, through December 31, 2024.

TeraWulf (WULF)

Terawulf increased its hash rate capacity to 5.5 EH/s and produced 347 Bitcoin during the month at an average rate of 11.6 Bitcoin per day, an average daily increase of 11% on the previous month. Unlike many of the company’s peer miners during the hot months of the year, power curtailment is not an issue as the company recorded an availability of 98% in June.

The company continued to sell their bitcoin during the month, achieving $9.6 million to meet their operational and capital expenditure. They have one of the cheapest energy deals, which averaged 3.5 kWh in June, enabling them to achieve an impressive mining margin of 69%.

Building 2 at Lake Mariner facility in New York has now been fully commissioned with the whole comprising 34,000 miners, of which 5,000 are hosted, with a further 16,000 self-miners at the nuclear-powered Nautilus facility in Pennsylvania.

Mining Performance

One useful metric to compare Bitcoin miners against one another is Bitcoin mined per EH/s. Once again, Bitfarms finished in first position with an impressive 77.0 Bitcoin per EH/s. Both Hive Digital and Iris Energy finished with 0.5% of this total with DMG Blockchain completing the top 4.

Of course, the metric is limited by offline time, including curtailment events. For example although Riot Platforms were bottom in terms of production by EH/s, once you take the $10 million earned in power sales and demand response revenues and convert that to equivalent Bitcoin, they would effectively finish top of the performance tables.

Another useful metric to consider is a miner utilization rate. What this metric considers is the amount of Bitcoin a miner produced compared to an amount of Bitcoin they could have produced with the energized hashrate. Hive Digital and Iris Energy again lead the rankings with CleanSpark and Bitfarms filling the top 4, respectively.

Bitcoin Miners sell a proportion of their production.

In 2021 we witnessed the Bitcoin miners hodl the majority of their productions as the price of Bitcoin grew rapidly. In 2022 as the price of Bitcoin started to fall, many miners, especially those now saddled with significant debt were forced to sell. Marathon Digital and Hut 8 were each determined to hold onto their Bitcoin as long as practical. In this current year we have seen all the miners sell some or even all their production as the Bitcoin price has started to rise.

The chart below highlights that 58%of the miners are adopting a strategy of selling part of their production and adding to the crypto treasury in readiness for the halving, next year.