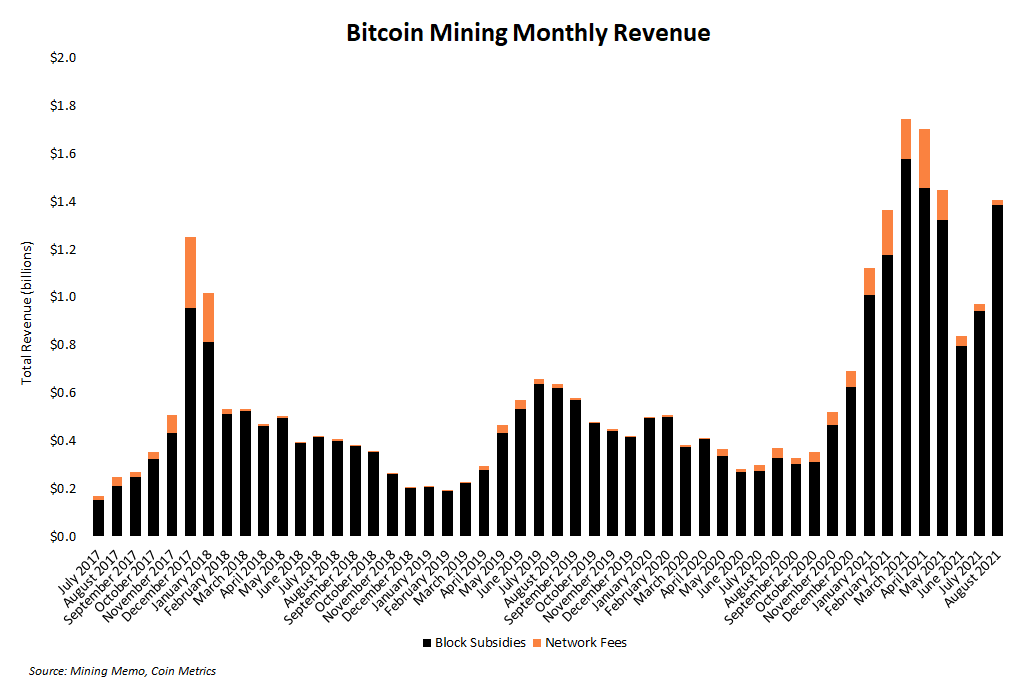

Bitcoin miners raked in a total of $1.4 billion in August, but barely 1% of that revenue came from transaction fees paid by Bitcoin users.

- Revenue jumped 45% from July when miners brought in a total of over $970 million.

- Network fees represented 1.3% of revenue, totaling $18.7 million.

Want more mining insights like this?

Throughout most of August, bitcoin rallied from around $37,000 to nearly $53,000. This price increase boosted the dollar value of miner revenues. Total miner revenue in August marked the fourth highest ever for Bitcoin miners.

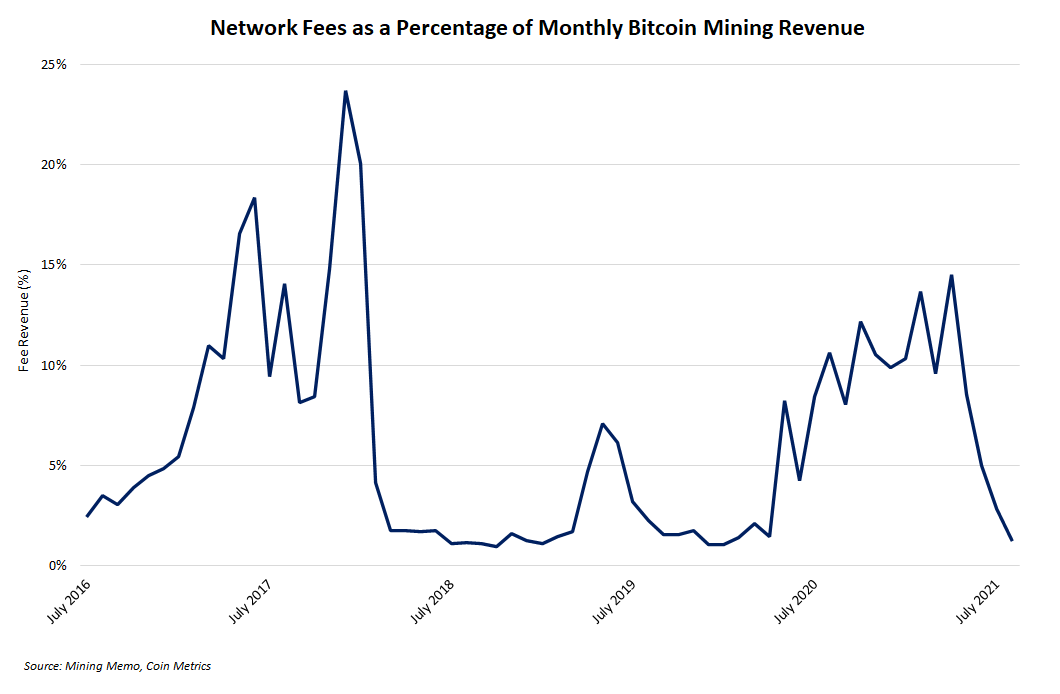

Despite a monster month for total revenue, nearly all revenue coming from miner subsidies isn’t an ideal scenario long term. Since May 2021, the percentage of revenue attributed to transaction fees has been steadily dropping.

Fee revenue is dropping simply because fewer people are using the Bitcoin blockchain right now. The possible reasons for this are various, including growth of Layer 2 payment protocols (e.g., Lightning Network) on Bitcoin, money flowing to other networks (e.g., Solana, Ethereum) to participate in ongoing decentralized finance and NFT crazes.

Regardless of the reason why, only 1.3% of August revenue came from fees. This marks the lowest monthly fee revenue as a percentage of total revenue since January 2020.

In the short term, a significant decrease in fee revenue is no cause for alarm. In the long term, fee revenue must play a significant role in financing miner activity. The consistent downward trend in fee revenue since April is far from ideal

A resurgence in on-chain activity is needed for a revival in fee-based income. Until then, even if the price continues to appreciate and total revenue goes up, fee revenue will continue to decline.