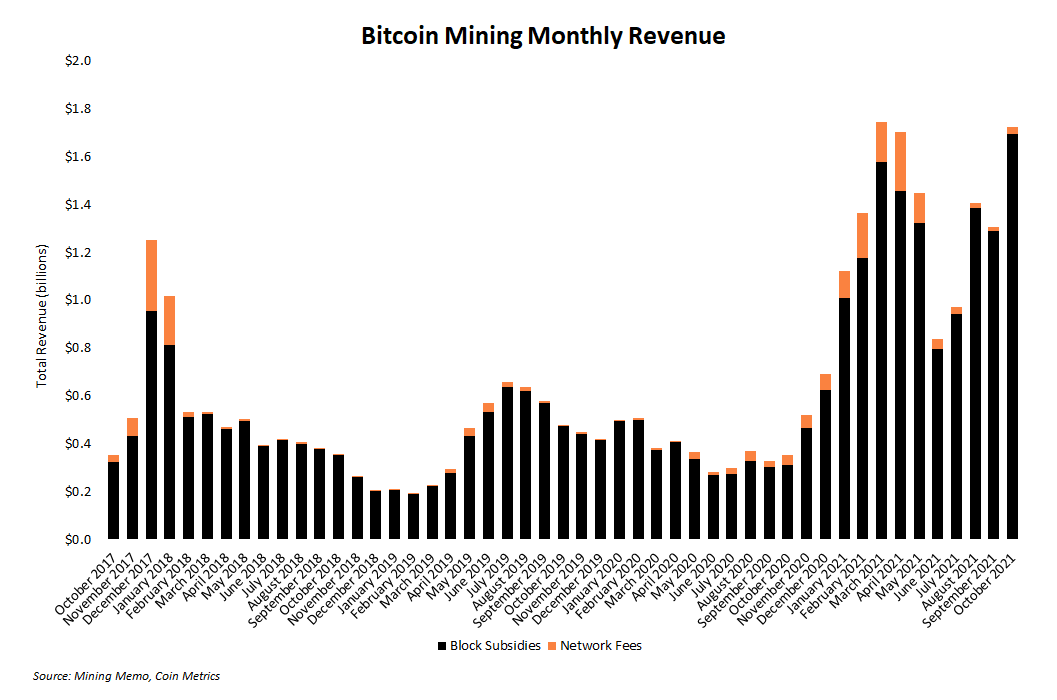

Bitcoin miners enjoyed a nice payday last month, ending October with over $1.72 billion in total payouts, a marked increase from September income. Nearly all of the increase in dollar-denominated mining revenue from October is due to bitcoin’s price appreciation, not an increase in Bitcoin’s use. Most of the cryptocurrency market’s attention is still on alternative cryptocurrencies and NFTs

- Bitcoin’s price jumped 33% through October.

- Network fees remained low, representing only 1.6% of revenue last month.

- Total revenue increased 32% from September, thanks to bitcoin’s price appreciation.

Want more mining insights like this?

Through most of October, bitcoin’s price went up. This was the catalyst for a marked increase in monthly mining revenue. Starting the month trading around $43,000, the leading cryptocurrency set new record highs above $66,000 late in the month.

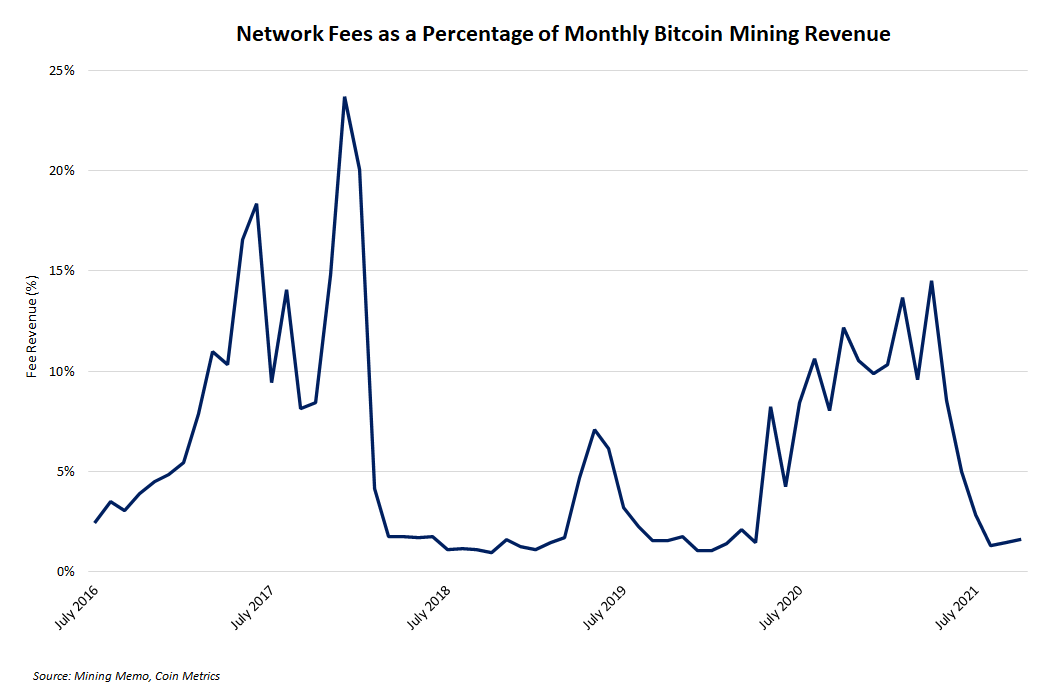

Despite nearly setting a new record for monthly revenue, nearly all revenue coming from miner subsidies again, which isn’t an ideal scenario long term. On-chain data from Coin Metrics shows that transaction fees have flatlined since July.

Fee revenue is dropping simply because fewer people are using the Bitcoin blockchain right now. The possible reasons for this are various, including growth of Layer 2 payment protocols (e.g., Lightning Network) on Bitcoin, money flowing to other networks (e.g., Solana, Ethereum) to participate in ongoing investor interest in alternative cryptocurrencies, including decentralized finance tokens and NFT projects.

Regardless of the reason why, barely 1.6% of October September revenue came from fees. This marks one of the lowest monthly fee revenue as a percentage of total revenue since January 2020, although a slight increase from August (1.33%) and September (1.47%).

In the short term, a significant decrease in fee revenue is no cause for alarm. In the long term, fee revenue must play a significant role in financing miner activity. The consistent downward trend in fee revenue since May is far from ideal, although many market factors make it trivial to explain away.

A resurgence in on-chain activity, not just price action, is needed for a revival in fee-based income. Until then, even if the price continues to appreciate and total revenue goes up, fee revenue will continue to decline.