Updated: September 2020

The Bitcoin mining industry is a complex ecosystem of interdependent players. In this Compass Mining educational, we give a simplified outline of the biggest actors in the Bitcoin mining industry while highlighting their relationships with other players.

In reality, Bitcoin mining companies will often crossover between the lines that we draw below. Mining pools will seek to provide other services to increase their value-add to miners while hardware companies may have significant proprietary mining operations.

Nonetheless, we draw classifications for the major players. We split the industry into four broad categories – miners, mining pools, hardware, and service providers.

Read more: What is hashrate? – Explaining the fuel behind Bitcoin mining

Bitcoin Miners

Miners are the essence of the Bitcoin mining industry. Almost all other actors in the industry exist to serve miners. The term ‘miner’ can either refer to the individual who is running mining equipment or the equipment itself.

The reality of the Bitcoin mining industry is that hobbyist miners are a dying breed. Any that do exist are likely extremely unprofitable or are operating with free electricity. Bitcoin mining has evolved into an industry and modern-day miners operate huge facilities with investments of billions of dollars of capital. It is estimated that over $18 billion has been invested in Bitcoin mining. The increased competitiveness of Bitcoin mining has resulted in the industry being dominantly concentrated in China. An ability to secure lower energy rates, low labour costs, and proximity to hardware manufacturers are some of the reasons why China dominates mining. Other regions with significant shares of hashrate include Kazakhstan, Russia, and the United States.

Block rewards are the source of a miners revenue. At the time of writing, the annualized market for block rewards is roughly $4.1 billion. This market size will depend on the price of Bitcoin, the block issuance rate, fees paid by users, and the difficulty level of mining Bitcoin. How much of the market an individual miner can expect to capture depends on their portion of the total network hashrate.

Bitcoin miners generate hashrate by purchasing mining equipment. This equipment can be purchased from Bitcoin ASIC manufacturers or resellers. In almost all cases, Bitcoin miners will effectively sell their hashrate to mining pools. Because each miner typically represents a small portion of the overall Bitcoin network hashrate, they reduce the variance in their payouts by connecting to a mining pool.

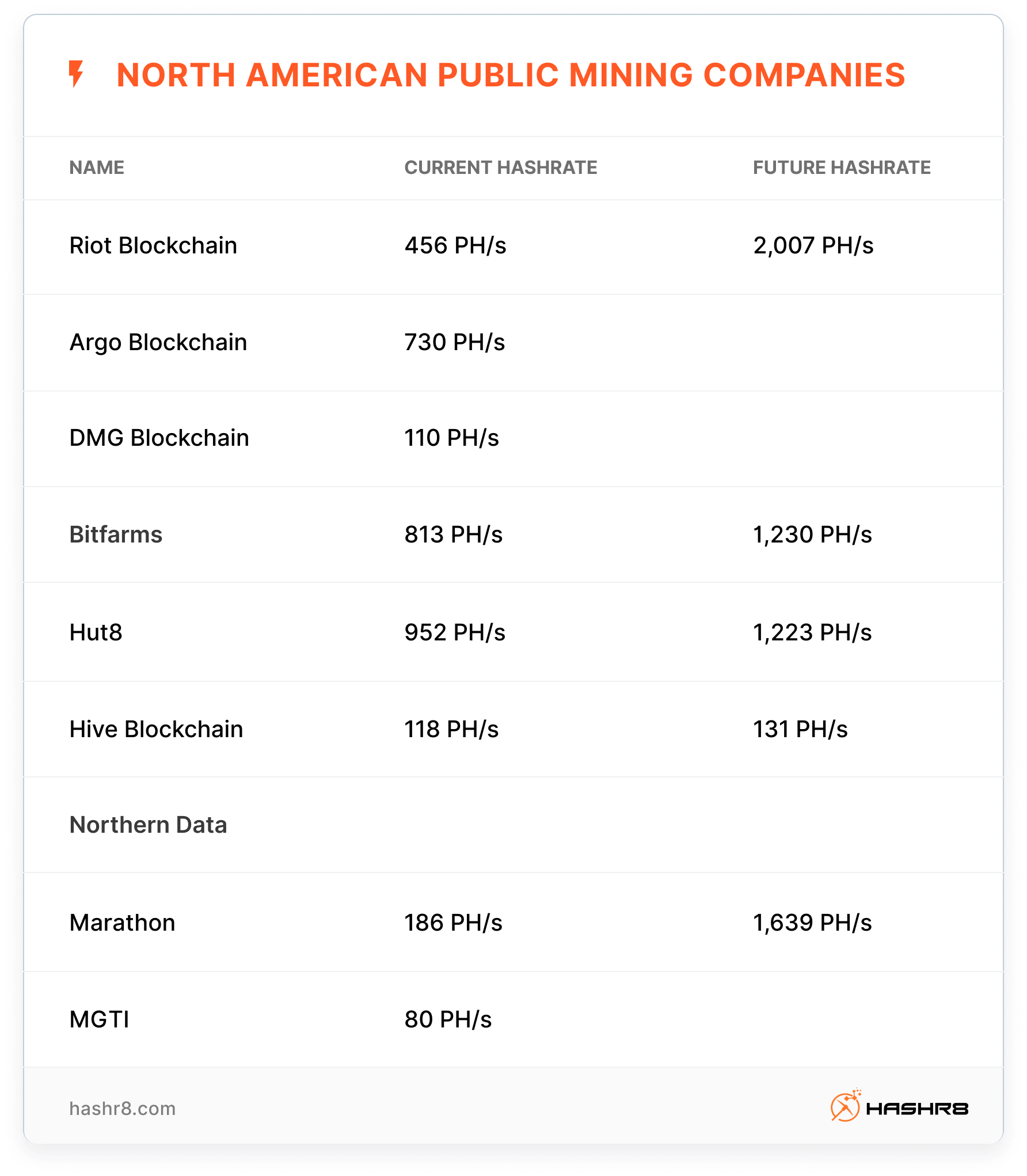

Miners are generally extremely secretive in their operations. However, here are some publicly listed miners who regularly report their mining activities.

Mining Pools

The idea for mining pools originated in 2010 when Marek “Slush” Palatinus started Slush Pool. The concept was designed in response to the emergence of GPU mining on the Bitcoin network. Slush detailed the concept of miners pooling their hashrate in a BitcoinTalk post.

Mining pools send miners block headers with prefilled transactions. Miners work on the block template until they find a solution that meets a predetermined output or until another miner solves the block. Miners submit shares to mining pools that represent the work they execute on the block templates. In the case that another miner solves the block, the mining pool will send them a new block template. Mining pools connect with miners over a mining protocol called Stratum. The company behind Slush Pool – Braiins – has been working on improving the design of Stratum to give greater decision-making control to the miners.

Miners that are connected to a pool receive a share of the rewards based on the portion of work they complete. Mining pools employ various payout schemes. The most popular payout schemes are pay per share (PPS) and pay per last N share (PPLNS). In PPS, miners receive a regular payout which is proportional to the amount of shares you submit to the mining pool. This removes the luck factor for the miner as the mining pool commits to paying miners based on the shares they submit. If the mining pool is unlucky and finds no blocks, it will still pay its miners.

On the other hand, PPLNS pays a miner once the winning block is found. This transfers the element of luck back to the miners as their payout is dependent on a block being found. Once a block is found, the miner will receive a payout based on the amount of shares submitted in the lead-up to finding the winning block.

The leading Bitcoin mining pools are the following:

- F2Pool

- Poolin

- BTC.com (owned by Bitmain)

- Antpool (owned by Bitmain)

- ViaBTC (partially owned by Bitmain)

- Slush Pool

Bitcoin ASIC Manufacturers

The equipment used to mine quickly evolved beyond CPUs and GPUs. In 2013, the first hardware which had been specially designed to mine Bitcoin started to emerge. Application specific integrated circuits (ASIC) hardware removes all flexibility from a computer's function to maximize performance for a specific task.

In the case of Bitcoin ASIC hardware, rigs were specifically designed to maximise their ability to solve the SHA256 algorithm. The emergence of Bitcoin ASIC hardware quickly made all other forms of mining hardware obsolete. The business of designing and delivering Bitcoin ASIC hardware has become one of the most competitive in the Bitcoin mining industry.

Bitcoin ASIC manufacturers secure chip allocations from foundries such as Taiwan Semiconductor (TSMC) and Samsung. Once ASIC design is ready, manufacturers send the designs to the foundries for the tape-out process. If the tape-out process is successful, the ASIC hardware can proceed to mass production.

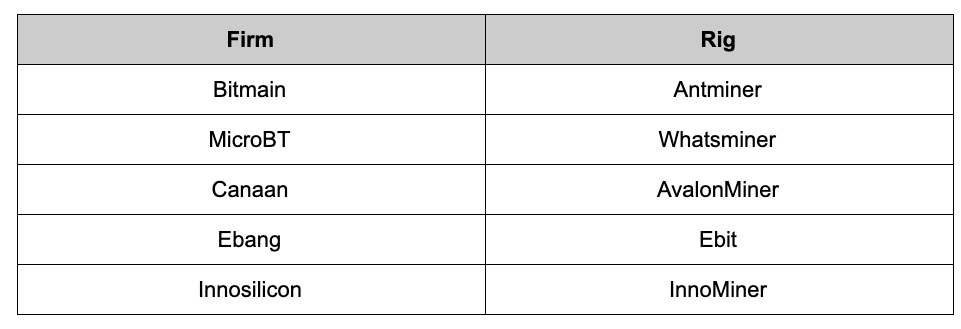

To date, Bitmain has been the dominant force in the Bitcoin ASIC market. In 2017, the firm claimed to have a market share of 77% in 2017. However, recent turmoil at the company strengthened the position of their primary competitor MicroBT. The other major Bitcoin ASIC manufacturers that mass produce include Canaan, Ebang, and Innosilicon. Some firms have also released small batches of rigs such as SBI Group releasing the SBI Carbon. Each firm has their own respective brand of ASIC. The latest-generation of Antminer and Whatsminer rigs are currently on the edge of innovation in the industry and their rigs are vastly more power efficient than competitors.

How the hardware market will shape up in the future is vastly uncertain. Bitmain have had a grip on the market to date. They have ventured into almost every aspect of the industry including proprietary mining, mining pools, and cloud mining. However, their dominance in the market has been dwindling amid a hostile battle between two of the firm’s founders. MicroBT has been well positioned to capture market share as the troubles at Bitmain intensify. MicroBT was founded by Doctor Zuoxing Yang, a former Bitmain engineer who led the efforts behind the Antminer 7 and Antminer 9 rigs.

Read More: A Timeline of the Bitmain Co-Founder Battle for Control

Service Providers

A broad and diversified services industry has emerged to cater to the needs of both miners and retail interested in mining. Here are some of the main business models that have emerged.

Hosting – Mining farms with spare capacity will often offer space to miners. Miners can send their rigs to the facility and an agreement is formed between the miner and the mining facility owner. Agreements can vary with service-fee agreements being the most popular. Recently, mining farms have had extra capacity and many hosting providers have turned to revenue sharing models to attract miners seeking to host.

Cloud Mining – Cloud mining is a business model which has existed since the early years of the mining industry. Cloud mining is based on the concept that parties interested in mining can purchase contracts for hashrate instead of investing in the equipment necessary. Cloud mining contracts have generally preyed on retail investors who are unfamiliar with the dynamics of mining. Contracts that have the possibility of being profitable are extremely rare and most contracts are filled with service fees that eradicate any possibility of purchasers seeing ROI.

Financial Services – Financial services for miners has been one of the fastest growing niches in the Bitcoin mining industry. Many firms have launched products that are specifically tailored to miners. Furthermore, many firms have begun specifically focusing on servicing miners. Financial products such as hashrate futures were designed to allow miners to hedge their risk. Lending options have also emerged like allowing a miner to use their hardware equipment as collateral for a loan. Financial services firms that cater to miners include MatrixPort, Babel Finance, Atomic Loans, and Amber Group.