Bitcoin price

The Bitcoin price closed the month of July at $64,619 increasing by 3.1% during the month, providing much needed relief for Bitcoin miners who have witnessed rewards drop by 50% at the recent halving.

However, Japan's recent currency appreciation led to the unwinding of carry trades and a sell-off in risk assets, including Bitcoin, taking the price below $50,000, last week. Speculators had previously borrowed yen at zero interest, converted it into stronger currencies like the dollar, and invested globally, which significantly devalued the yen.

Following Japan's 0.25% interest rate hike, the yen surged nearly 10% against the USD, causing Bitcoin's yen-denominated price on Tokyo’s bitFlyer exchange to drop nearly 15%, outpacing its 11% decline on Western exchanges. With the Bank of Japan raising rates, money flows are reversing, and the Bitcoin price has seen strength in the last few days regaining $60,000.

Hashprice

"Hashprice," a term introduced by Luxor, represents the expected daily value of 1 TH/s of hashing power. This metric measures a miner's potential earnings from a given amount of hashrate. While hashprice can be expressed in any currency or asset, it is typically displayed in USD or BTC (sats).

When the markets, led by Japan, crashed last week, the daily rate of hashprice per PH/s dropped to an all-time-low of $35 for each PH/s on line. This would make it challenging for even the most efficient miners with access to low cost energy the ability to mine with a margin sufficient to cover operating costs.

Global Hash Rate and Bitcoin Mining Difficulty

The global hash rate maintained a range between 500 EH/s and 700 EH/s in July, reaching an all-time-high on July 23, 2024, actually climbing significantly above 800 EH/s.

The mining difficulty, however, actually dropped by an average of 3.1%. This did not provide relief for miners in terms of their production, during one of the warmest months of the year, where more curtailment was utilized by the Bitcoin miners. The next mining difficulty adjustment is due to change in a little over 3 days time and is currently due to drop by 5.36%, making the opportunity to mine more bitcoin for those miners on the global network.

Ethereum ETF

The Securities and Exchange Commission approved the listing of multiple spot Ethereum exchange-traded funds (ETFs), on July 22, 2024, concluding an eight-month review process. These ETFs, based on Ethereum’s spot price, began trading on the same date and marks a significant milestone, legitimizing Ethereum and offering institutional investors a new entry point into cryptocurrency markets, beyond Bitcoin.

Bitdeer Technologies (BTDR)

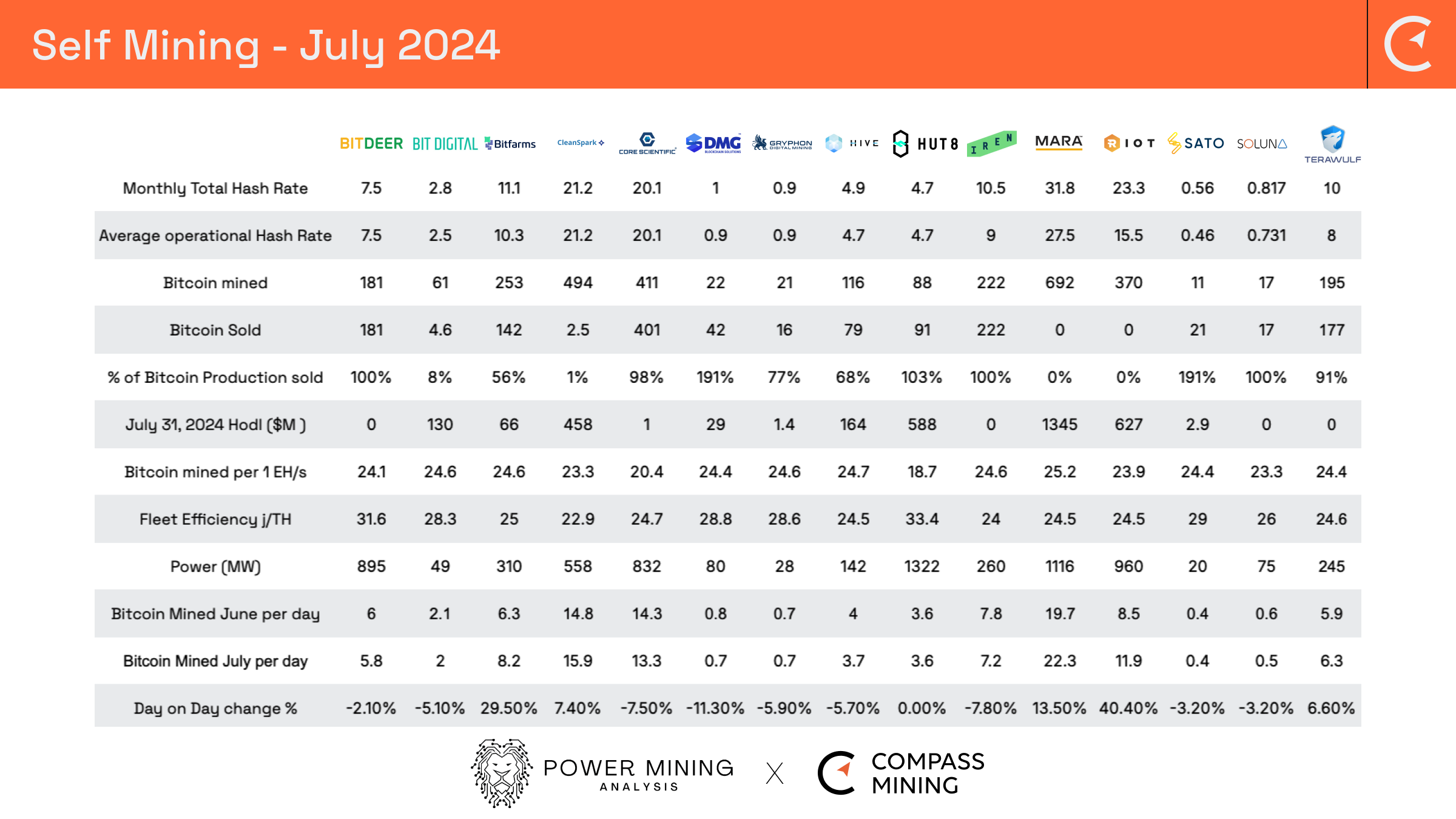

In July Bitdeer produced 181 Bitcoin at an average daily rate of 5.8 Bitcoin per day, a small reduction of 2.1% on the average rate achieved during June, despite fleet efficiency currently at 32.5 j/THs. It should be noted that Bitcoin self-mining actually forms a smaller part of the overall current business model for the company, with hosting accounting for just 35.4 % of the total hash rate.

The company is looking to increase the efficiency of its miner fleet and is progressing as planned with the mass production of SEAL01 chips and SEALMINER A1 series mining rigs, available in both air-cooled and hydro-cooled configurations.

The initial tape-out wafers for the SEAL02 chip, produced by Taiwan Semiconductor Manufacturing Company (TSMC), are expected to be delivered in late September 2024. If testing proceeds successfully, mass production will begin by the end of 2024. Additionally, research and development efforts for the SEAL03, our third-generation chip, are ongoing.

Bitdeer’s Artificial Intelligence (AI) cloud services, powered by NVIDIA DGX SuperPOD with the H100 system, achieved 100% utilization in July. The company plans to expand AI cloud operations to capitalize on emerging opportunities while mitigating the risk of overinvestment. To enhance this data center strategy, the company has engaged with TLM Group, a leading consultant in HPC/AI datacenter engineering and construction, to conduct comprehensive site assessments and provide guidance on co-location, joint ventures, and other monetization options.

Bitdeer is advancing key infrastructure projects across multiple sites. In Rockdale, Texas, a 100 MW hydro-cooling conversion is underway with demolition starting in August and phased energization set for Q4 2024. Tydal, Norway, is progressing on its 175 MW expansion, also targeting Q4 2024. Meanwhile, Massillon, Ohio (221 MW) and Jigmeling, Bhutan (500 MW) are on track for energization by late 2025 and early 2025, respectively.

The company has a total current pipeline capacity of 1.65 GW of power with a total global contracted capacity set to potentially reach 2.54 GW.

Bit Digital (BTBT)

Bit Digital mined 60.5 Bitcoin in the month of July at an average daily rate of 2.0, a reduction of 5.1% on the daily rate achieved in June, achieved with an operational hash rate of 2.46 EH/s.

In July, Bit Digital AI received $4.3 million in monthly payments for its HPC contract. The Company has ordered an additional 256 Dell servers with 2,048 Nvidia HGX H100 GPUs, scheduled for delivery in July 2024. These servers will be deployed at the Iceland datacenter in August 2024, where they are expected to generate revenue, taking their annualized HPC revenues from $50 million to $92 million.

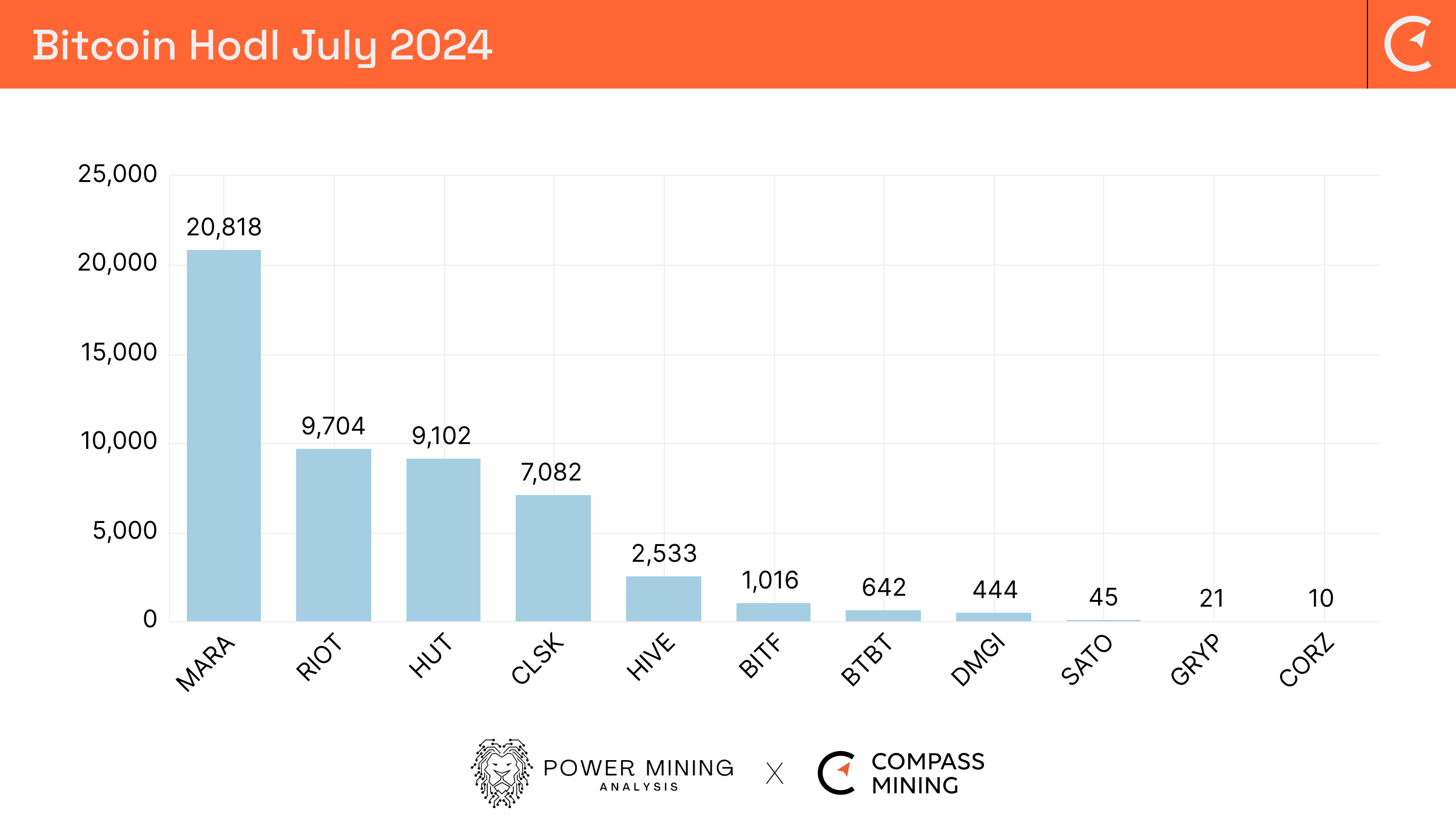

As of July 31, 2024, Bit Digital held 641.8 Bitcoin and 27,274.4 Ethereum, valued at approximately $41.5 million and $88.1 million, respectively. Total liquidity stood at $211.9 million, including $82.1 million in cash. The Company also had 17,184 ETH staked, earning a 3.3% annual percentage yield (APY) and 47.5 ETH in rewards during July 2024.

Bitfarms (BITF)

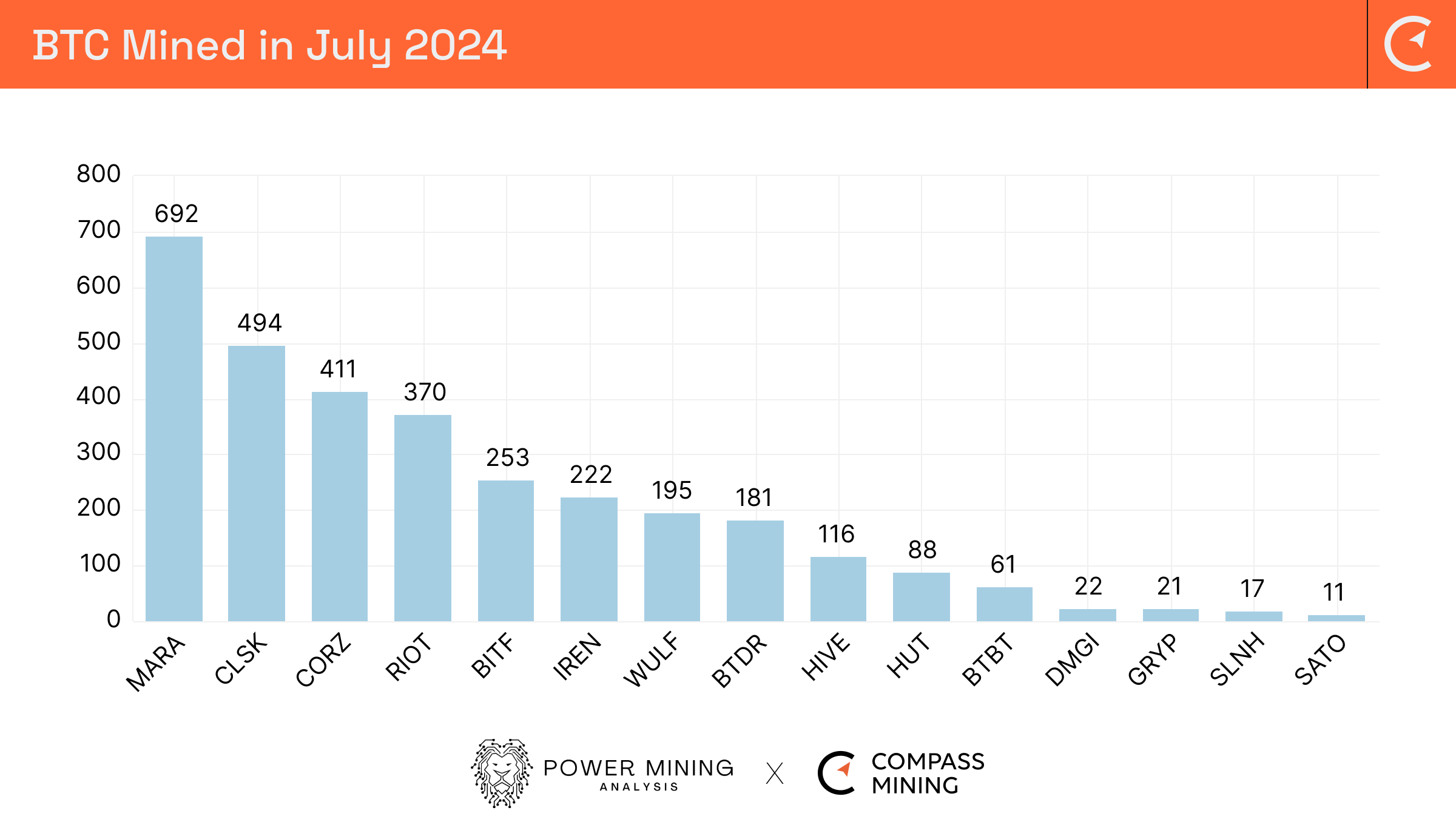

Bitfarms produced 253 Bitcoin in July at an average rate of 8.2 per day, an increase of 29.5% on the rate achieved during the previous month and due in the main to the additional 2.7 EH/s of hash rate coming on-line.

Bitfarms increased its monthly Bitcoin production by 62% since the April halving, demonstrating strong operational efficiency. The Paso Pe site in Paraguay is fully operational, while rapid construction continues at Yguazu. Despite some underperformance in a batch of T21 miners, hence the company has yet to meet their H1 hash rate target, replacements are expected soon. Bitfarms' 2024 growth and efficiency plans are fully funded, targeting 21 EH/s by year-end, with increasing Bitcoin reserves.

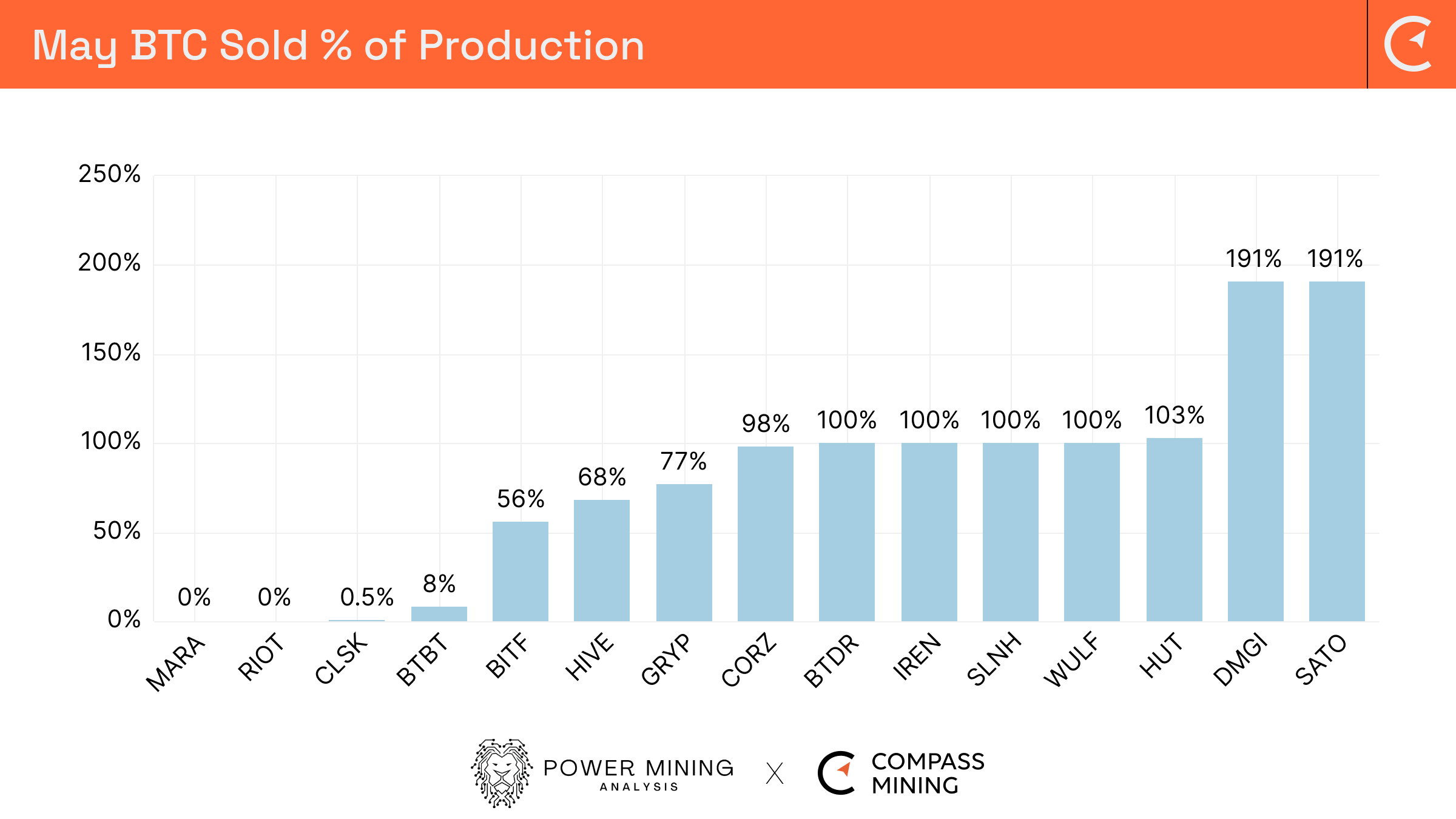

Bitfarms sold 142 of the 253 Bitcoin, generating $8.6 million as part of its treasury management strategy. The Company added 111 Bitcoin to its treasury, increasing its holdings to 1,016 Bitcoin, valued at $67.2 million as of July 31, 2024. Additionally, Bitfarms also held 233 long-dated Bitcoin call options.

Core Scientific (CORZ)

Core Scientific produced 411 Bitcoin in July at an average rate of 13.3 Bitcoin per day, a reduction of 7.5% on the daily rate achieved in June.

The company’s CEO, Adam Sullivan, expressed optimism about the future of the company's Bitcoin mining business as it transitions miners to dedicated sites and prepares to adapt a significant portion of its high-power infrastructure for HPC hosting. He highlighted plans to integrate Block’s new 3-nanometer ASIC chip next year, which will drive substantial miner upgrades and hash rate growth. Sullivan also noted that Core Scientific became the first miner to join Foundry Donate, supporting the core developers of the Bitcoin Network.

The biggest news story in the Bitcoin mining industry, so far, in 2024, just got bigger this week, with Core Scientific announcing a further increase in their High Performance Computing (HPC) hosting contract with CoreWeave by adding 112 MW to their contracted total of 270 MW.

The table below highlights the effective cash flows and assumptions in delivering 382 MW of power and achieving a planned $4.785 Billion in net profit over the life of the contract.

The Company still has a further 118 MW available from their total of 500 MW allocated to this business and who would now bet against CoreWeave increasing the capacity requirements further.

DMG Blockchain (DMGI)

DMG Blockchian mined 22 Bitcoin in July at an average rate of 0.7 Bitcoin per day, a reduction of 11.3 % on the average achieved during the previous month. Sheldon Bennett, DMG's CEO, noted that in July, the company faced challenges at its Christina Lake data center due to a sustained heatwave that affected hashrate production and delays in deploying new power infrastructure for its fleet of 4,550 Bitmain T21 mining servers, expected to generate 0.86 EH/s. Full energization of the T21 fleet is now anticipated in August.

The company sold 42 Bitcoin representing 191% of the monthly production and currently have 444 Bitcoin held in their treasury with a valuation of $29 million as at July 31, 2024. DMG Blockchain also granted 100,000 stock options to a contractor. The options, priced at $0.52 per share, are exercisable over three years and will vest in four equal installments over 12 months.

Gryphon Mining (GRYP)

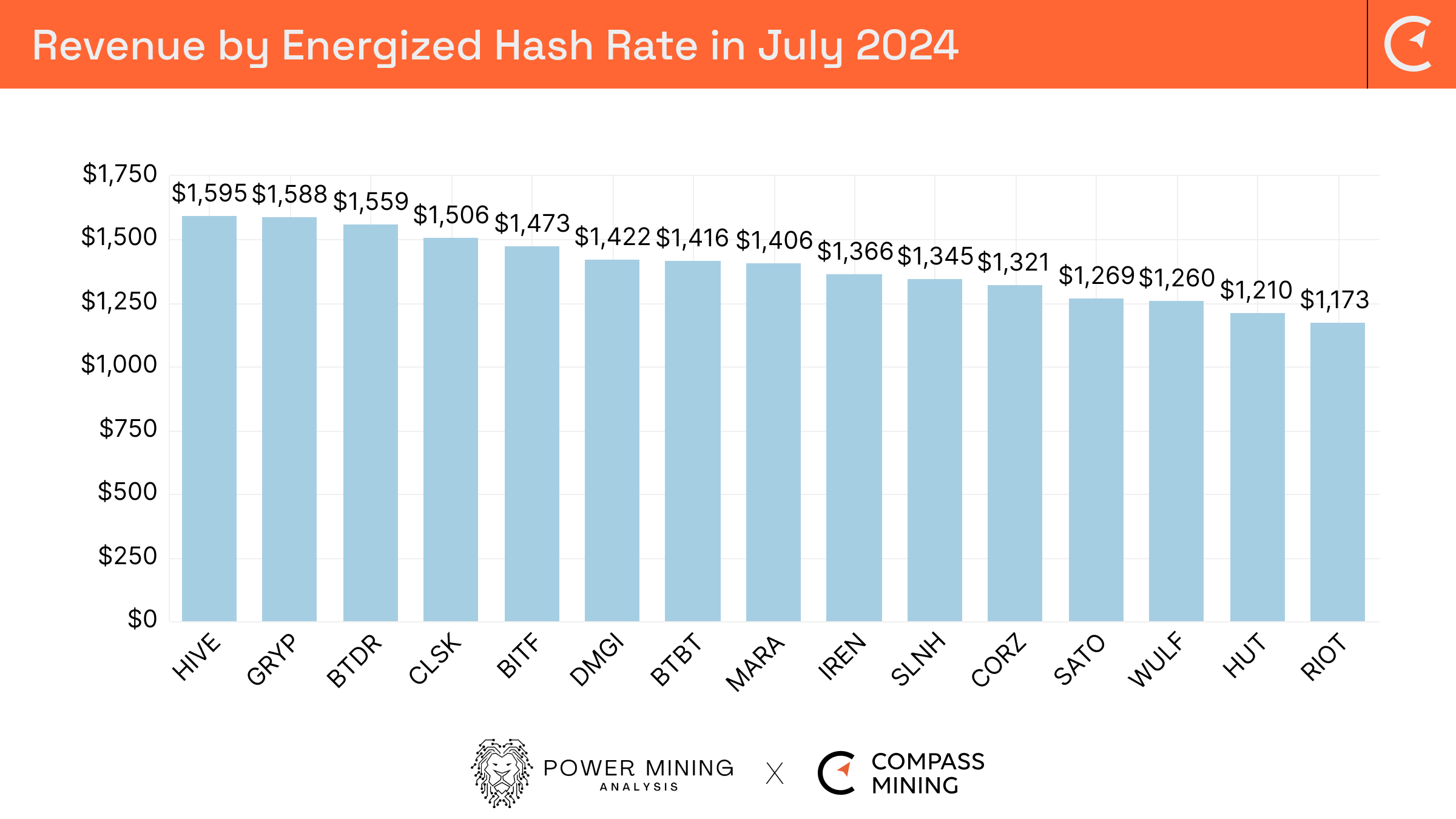

Gryphon Mining produced 21.4 Bitcoin in July at an average daily rate of 0.7 Bitcoin per day, a reduction of 5.9% on the rate achieved in the previous month. With a monthly average hash of 871 PH/s the company achieved the highest utilization of 99%, fully powered by zero-carbon hydroelectric energy.

Gryphon Mining CEO, Rob Chang, highlighted the company's consistent operational performance in July, noting strong production and efficiency levels, effectively achieving $1,588 in revenues per PH/s during July. The company sold 16 Bitcoin representing 77% of production and held 21 Bitcoin in its treasury, valued at $1.4 million as at July 31, 2024.

The company continues to explore growth opportunities, focusing on securing low-cost power to ensure long-term viability in Bitcoin mining and high-performance computing. Gryphon Mining has evaluated over 25 opportunities, conducting thorough due diligence, and is eager to pursue options that align with its stringent selection criteria, prioritizing impactful and accretive growth.

Hive Digital Technologies (HIVE)

Hive Digital has recently entered into definitive agreements for developing a 100 MW digital asset mining operation in Paraguay, utilizing green energy from the Itaipu hydroelectric dam. The agreements include a share purchase with W3X SA and a construction deal with a local contractor. The company aims to build an additional 6.5 EH/s Bitcoin mining infrastructure, increasing its global capacity to 12.1 EH/s.

In July, Hive Digital mined 116 Bitcoin at an average daily rate of 3.7 Bitcoin per day, a reduction of 5.7% on the rate achieved in June, utilizing an operational hash rate of 4.7 EH/s and producing the second highest production per EH in the table above.

The company announced the purchase of 9,500 next-generation ASIC miners, including 7,000 Bitmain S21 Antminers and 2,500 S21 Pro Antminers, adding 2 EH/s of Bitcoin mining capacity. As of now, 8,400 miners are installed, bringing total capacity to 5.5 EH/s with a fleet efficiency of 24.5 J/TH. Hive may downclock older models for improved efficiency, potentially varying hashrate month-to-month. Chief Operating Officer, Luke Rossy, reported minimal production impact in July despite a heatwave and maintenance activities.

The company sold 79 Bitcoin representing 68% of their production and increasing their treasury hodl to 2,533 Bitcoin with a value of $164 million as at July 31, 2024.

Hut 8 Corp. (HUT)

Hut 8 produced 88 self-mined Bitcoin during the month of July, at an average of 3.6 Bitcoin per day, the same rate the company achieved during the previous month.

The company is now starting to see the benefits from its continuous improvement program within its self-mining business, according to CEO Asher Genoot. The company's average energy costs have significantly decreased since the Salt Creek site became operational and the deployment of curtailment software was completed. Additionally, Hut 8 is enhancing its data science platform to drive further efficiencies and expand margins.

Hut 8 also announced the first conversion from its energy capacity pipeline, securing a site in the Texas Panhandle with 205 megawatts of available power adjacent to a wind farm. The site can draw power directly from the ERCOT grid when the wind farm is not generating. Hut 8 now manages energy infrastructure with access to 1.3 gigawatts of power capacity. Further details will be shared during the second quarter 2024 earnings call on August 13th.

In terms of treasury, the company sold 91 Bitcoin representing 103% of the total month production and has 9,102 Bitcoin in its hodl, with a valuation of $588 million as at July 31, 2024.

IREN (IREN)

IREN produced 222 Bitcoin during July at an average daily rate of 7.2 Bitcoin per day, a reduction of 7.8% on the rate achieved during June. The company’s average operating hashrate was impacted by planned outages for Phase 1 substation upgrades and Phase 2 substation energization, as well as performance issues with T21 miners due to a batch production defect, for which Bitmain is currently replacing all affected units.

Increased electricity costs in July were primarily due to higher energy hedge pricing during the summer at Childress, coupled with lower-than-expected energy market volatility, which limited trading opportunities. The company is currently reassessing its future energy pricing strategies.

The current fleet efficiency of 24 J/TH is anticipated to improve to 17 J/TH by the end of next month as part of the expansion to 20 EH/s, which is on schedule. As of August 5, 2024, 10.5 EH/s is installed, with S21 Pro miner shipments, deliveries, and racking underway to support the company's expansion goals.

AI Cloud Services have seen significant growth, with a 17% revenue increase compared to June and a 42% increase compared to May, driven by the full utilization of its fleet of 816 NVIDIA H100 GPUs. The service has successfully catered to six end-customers across both reserved and on-demand markets. Looking ahead, the company plans to launch a GPU pilot at its Childress facility in the second half of 2024.

Riot Platforms (RIOT)

Riot Platforms produced 370 Bitcoin in July at an average daily rate of 11.9 Bitcoin per EH/s, which marked a significant increase as the company increased daily Bitcoin production by 40.4% over June and completed the acquisition of Block Mining, expanding its operations into Kentucky.

The facility’s immersion systems and MicroBT miners are expected to further enhance output as commissioning completes. The Block Mining acquisition immediately added 1 EH/s of self-mining capacity, with plans to reach 5 EH/s in Kentucky by year-end.

Additionally, Riot Platforms continued to participate in ERCOT's Four Coincident Peak Program to optimize power usage and achieve cost savings. The Corsicana Facility is expected to reach a total of 1 GW in developed mining capacity, with 16 EH/s added by the end of 2024. Following these developments, Riot has since raised its 2024 hash rate guidance to 36 EH/s, with an anticipated 56 EH/s by 2025.

The company sold no Bitcoin in July, thereby increasing their hodl to a new high of 9,704 Bitcoin with a valuation of $627 million as at July 31, 2024. Riot Platforms has continued to purchase Bitfarms stock and remains the largest single investor, having purchased a total of 81,040,216 shares, representing 18% of the total common shares.

SATO Technologies Corp. (SATO)

SATO Technologies mined 11 Bitcoin during the month of July at an average daily rate of 0.5 Bitcoin per EH/s, a reduction of 3.2% on the rate achieved during the previous month. This was due in part to the increased month on month network difficulty.

After a recent incident reported at their facility in Quebec in June, which impacted their hash rate, the team initiated, has nearly completed the reconstruction of the affected section and began acquiring additional new-generation mining hardware (S12 Pro) for the 11 PHs currently in operation.

To optimize Bitcoin production while managing energy consumption during high temperatures, the company adjusted their mining hashrate. Utilizing both our proprietary in-house software and advanced external tools, they maintained peak operational efficiency, maximizing mining output.

SATO Technologies sold 21 Bitcoin during July, representing 191% of their monthly production and have a current hodl of 45 Bitcoin, which when added to their cash held of $610,816, provides a total Treasury of $3,521,03.

Soluna Holdings (SLNH)

Soluna Holdings mined 17 Bitcoin during July at its self-mining facilities, at an average daily rate of 0.5 Bitcoin per day, a reduction of 3.2% on the rate achieved in the previous month with an operational hash rate of 731 PH/s.

On July 11, 2024, Soluna Holdings made a significant announcement regarding its subsidiary, Soluna Cloud. The company is now offering AI cloud services tailored for enterprise customers and Generative AI Labs. Notably, these services feature 512 H100 SXM GPUs, specifically designed to handle demanding AI workloads.

This strategic move aligns seamlessly with the company's recent projection of generating $38 million to $80 million in revenue over the next three years. By leveraging cutting-edge GPU technology, Soluna Holdings aims to position itself as a key player in the AI cloud services market.

In addition to this expansion, Soluna Cloud secured an additional $1.25 million in funding, bringing its credit facility to a total of $13.75 million. The funding, advised by BitOoda Technologies and Imperial Capital, underscores Soluna’s commitment to sustainable AI solutions powered by renewable energy sources.

The company also announced the successful closure of a $30 million financing round led by Spring Lane Capital (SLC) to fund the 48 MW expansion of its flagship Project Dorothy (Dorothy 2) data center. This investment will double the facility's capacity, furthering Soluna's mission to provide sustainable Bitcoin hosting. SLC expressed confidence in Soluna's model as a groundbreaking solution at the intersection of AI, computing, and climate.

TeraWulf (WULF)

In July, TeraWulf mined 195 Bitcoin, averaging 6.3 Bitcoin per day, an increase of 6.6% on the rate achieved in June, helped by the increase in operational hash rate, which reached 8.0 EH/s.

The company’s self-mining installed capacity reached 10 EH/s, a 100% increase year-over-year. The average cost per Bitcoin mined was $36,346, at a rate of $0.047/kWh, excluding expected demand response benefits. The Lake Mariner facility curtailed over 3,400 MWh in demand response activities, reducing power costs by approximately $0.013/kWh, equivalent to the value of 31 Bitcoin.

Sean Farrell, SVP of Operations, highlighted the installation of 10,000 Bitmain S21 and S21 Pro miners, boosting capacity to over 10 EH/s. Construction has begun on Building 5 at Lake Mariner, expected to add 50 MW of capacity.

Additionally, TeraWulf is advancing AI/HPC projects, including a 2 MW proof-of-concept project and a 16 MW colocation building, set to demonstrate high-density computing capabilities by Q4 2024.

Monthly and year-to-date (YTD) metrics

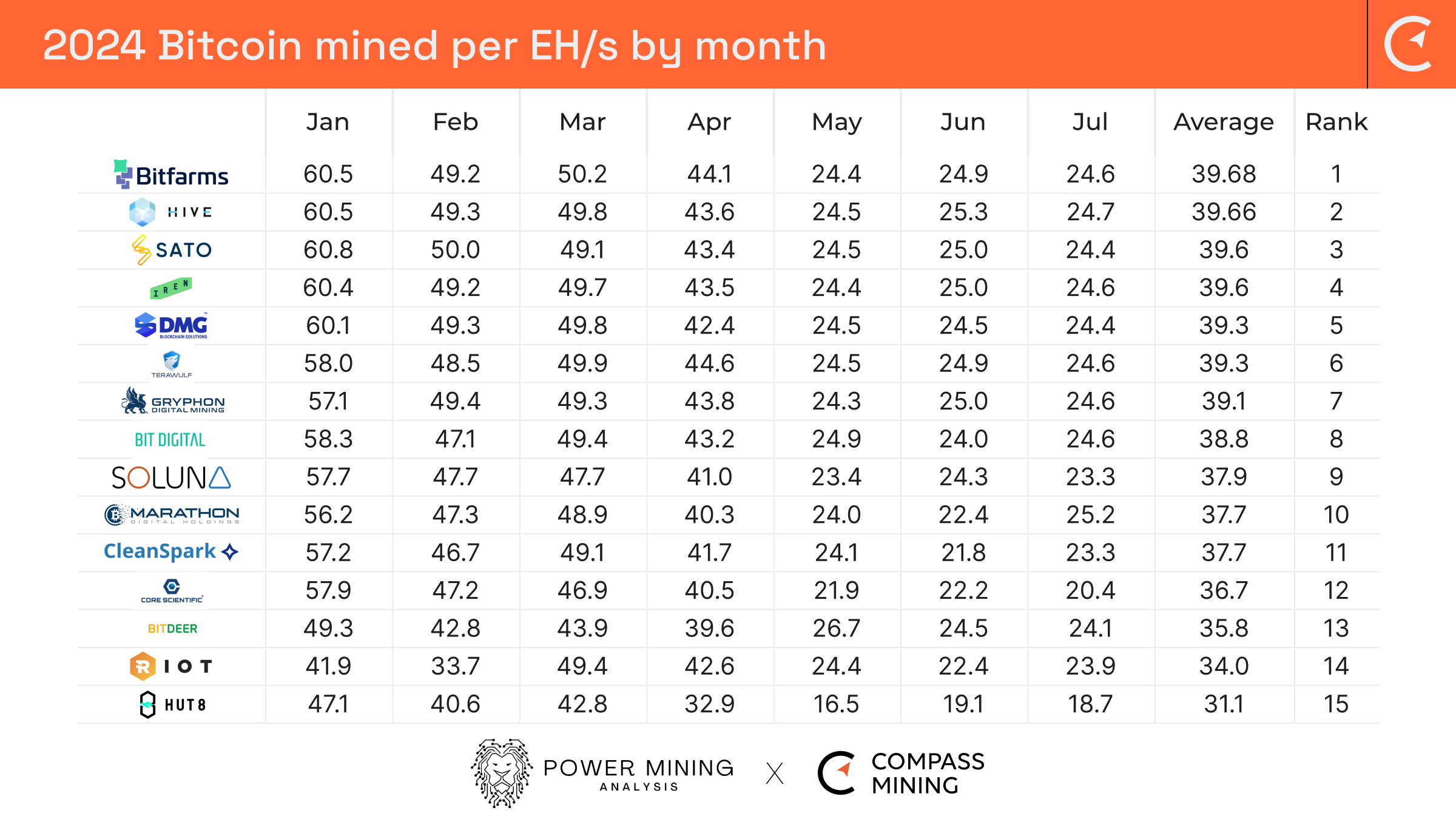

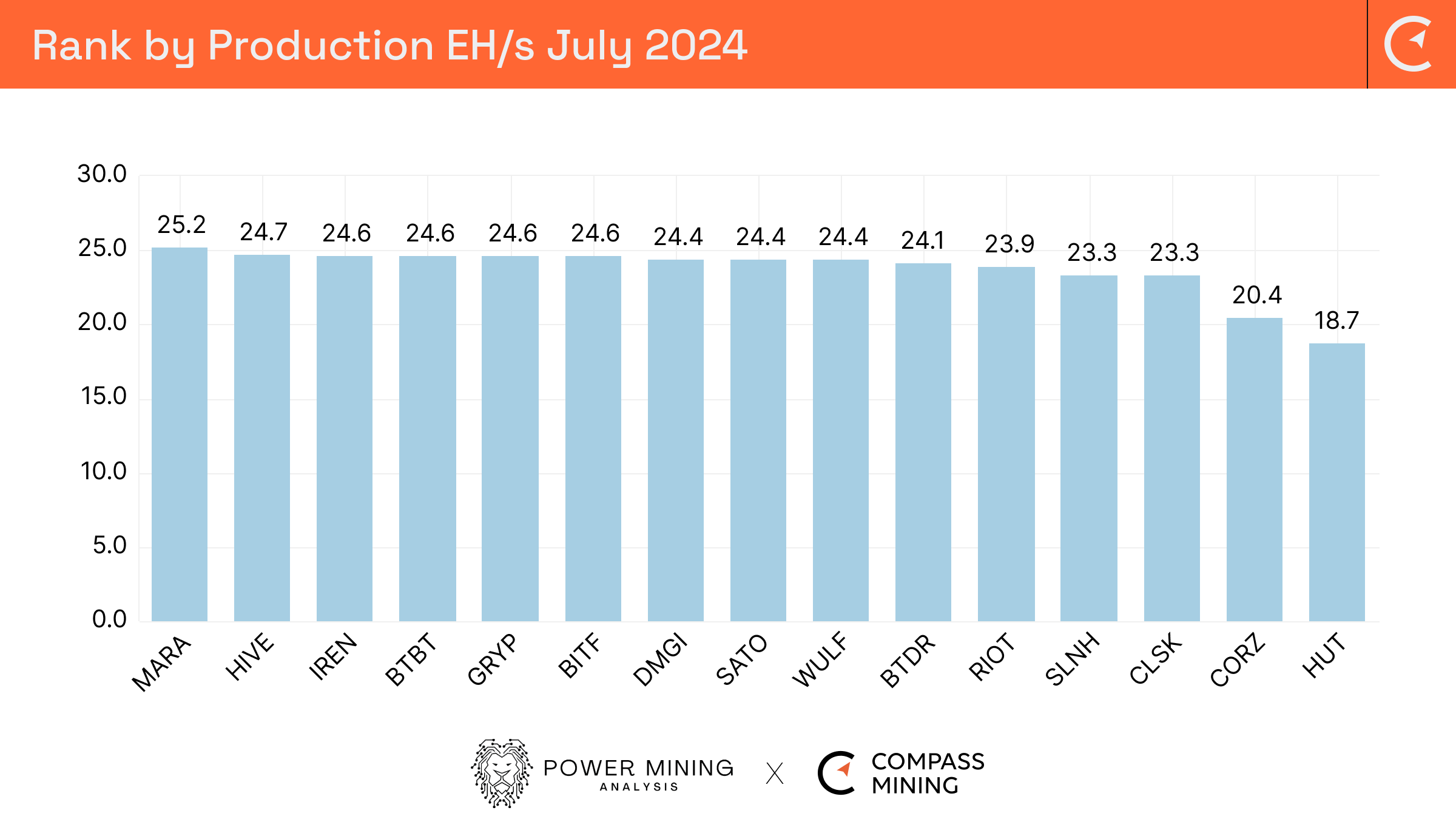

In June, Marathon Digital (MARA) topped the productivity charts, for the first time since December 2023, by achieving a total of 25.2 Bitcoin per EH/s, setting the benchmark for the industry. Close contenders included Hive Digital, IREN, Bit Digital, Gryphon Mining and Bitfarms.

From a year-to-date (YTD) perspective, Bitfarms continued its position as the most consistent North American miner, in terms of production by EH/s, though Hive Digital has now closed the gap to fractions of a percentage. SATO Technology, and IREN remaining 3rd and 4th, indicating a dynamic shift in market positions.

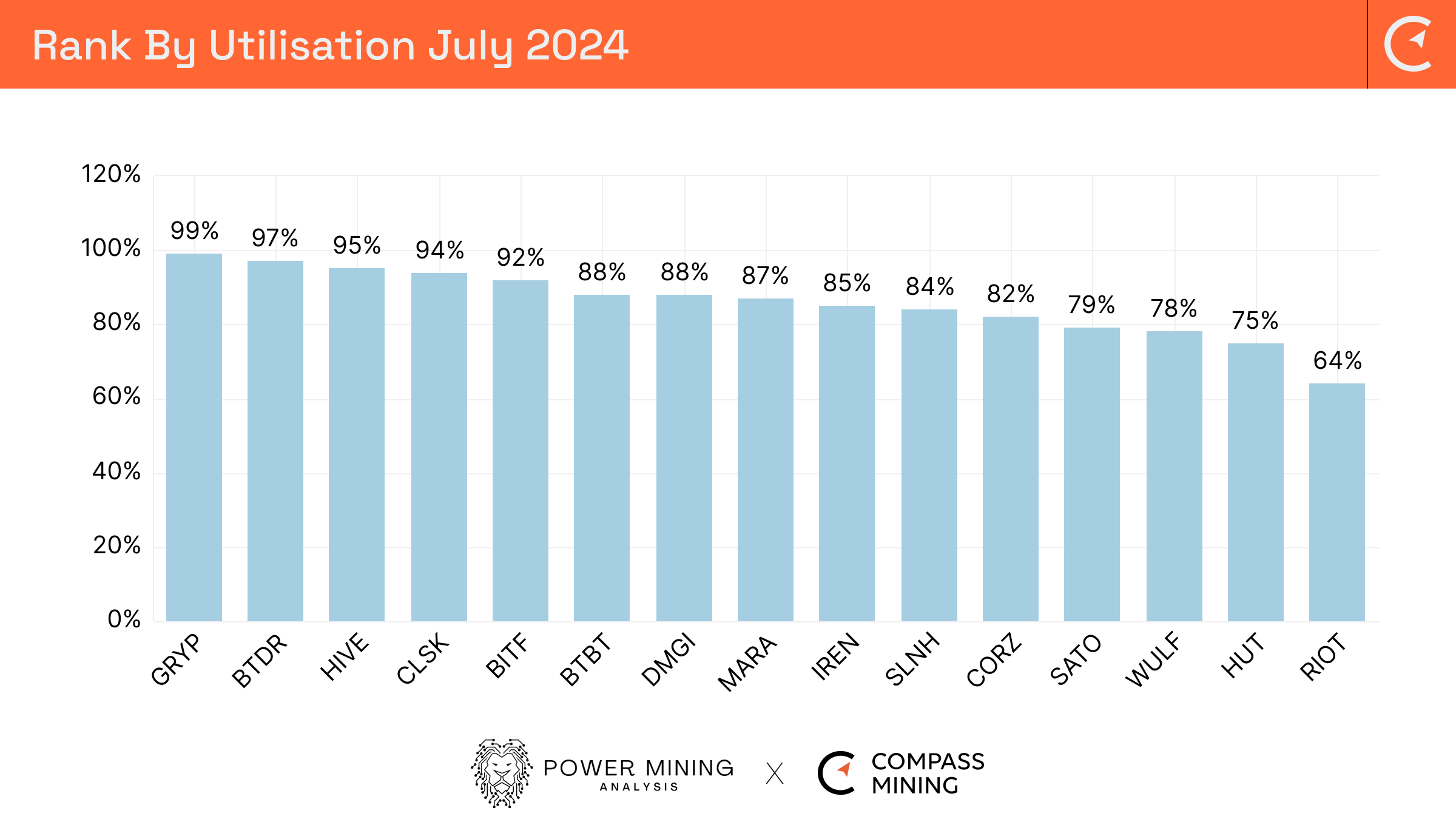

In terms of the Utilization metric, Gryphon Mining achieved 99% with Bitdeer Technologies providing the closest position with 97%. Hive Digital, CleanSpark (CLSK) and Bitfarms all achieved above 92%, respectively.