White House Digital Assets Summit

The White House Digital Assets Summit on March 7, 2025, hosted by President Trump, brought together key cryptocurrency industry leaders and senior government officials to discuss the future of digital assets in the U.S. The event was positioned as a major step toward making the U.S. a global leader in crypto policy.

A central highlight was the President’s Executive Order, signed on March 6, establishing a Strategic Bitcoin Reserve, a 200,000 Bitcoin stockpile (worth approximately $17 billion) sourced from government-seized assets. The administration also created a Digital Asset Stockpile for other cryptocurrencies like Ethereum and Ripple. Trump committed to holding these assets long-term but ruled out taxpayer-funded Bitcoin purchases, disappointing some industry advocates.

The summit featured discussions on crypto regulations, with the President vowing to roll back restrictive policies from the previous administration. While the event was seen as a symbolic win for crypto’s legitimacy, it lacked concrete policy announcements, and Bitcoin’s price fell 3.4% post-event. Overall, the summit signaled a pro-crypto shift but left many questions about implementation and regulation unanswered.

Contrary to expectations, the cryptocurrency market experienced a decline over the weekend, once again falling below its 200-day moving average. Should Bitcoin fail to recover and surpass this threshold, analysts suggest that the next significant support level to observe is the 1-year moving average, currently at $75,000.

Historically, this level has proven to be a pivotal benchmark for Bitcoin during its bull market cycles. A breach below this point has consistently signaled the conclusion of bullish trends throughout Bitcoin's price history. Conversely, maintaining a position above this level has typically indicated the continuation of a bull market.

Global Hash Rate, Mining Difficulty and Bitcoin Price

In February 2025, the Bitcoin network saw significant shifts in hash rate and mining difficulty, reflecting its ongoing self-regulation. The month started with a difficulty of 108.11 trillion (T) and a hash rate of 774 EH/s, following a late-January decline due to weather-related disruptions. However, by February 9, the network rebounded with a 5.61% increase in difficulty, reaching a record 114.17 T as the hash rate surged to 817 EH/s, a sign that mining activity was recovering.

On February 25, the difficulty adjusted downward by 3.2% to 110 T, responding to a temporary decline in computational power. Despite this late-month dip, February still saw a 1.7% net increase in difficulty compared to January, reinforcing the network's resilience. However, a 4.4% drop in Bitcoin’s average price and a 6.1% decline in transaction fees led to a 6% decrease in USD hashprice, making it a challenging period for miners.

CoreWeave Secures $11.9 Billion AI Infrastructure Deal with OpenAI Ahead of IPO

CoreWeave, a leading AI startup backed by Nvidia, has signed a five-year, $11.9 billion contract with OpenAI, providing AI infrastructure ahead of its anticipated 2025 IPO. As part of the agreement, OpenAI will receive $350 million in CoreWeave shares through a private placement at the time of the IPO.

The deal strengthens CoreWeave’s position as it aims for a $35 billion valuation. In 2024, revenue surged to $1.92 billion from $228.9 million in 2023, despite widening net losses. The agreement highlights growing AI infrastructure demand and positions CoreWeave as a major player in the sector.

This is a positive outcome for Core Scientific, who currently have a 12 year High Performance Computing (HPC) contract, delivering Hosting facilities for 590 MW of compute power, delivering $10 billion over the period of the contract.

Bitdeer Technologies Group (BTDR)

In February, Bitdeer produced 110 Bitcoin, at an average daily rate of 3.9 Bitcoin, a reduction of 3.3% due to the increased mining difficulty. The company has continued to grow their 'Hodl' which now stands at an impressive 1,039 Bitcoin with a value of $88 million, as at February 20, 2025.

Bitdeer is finalizing the mass production of SEALMINER A1 mining rigs, totaling approximately 3.7 EH/s, with all remaining units expected to be shipped by March 2025. Production of SEALMINER A2 is progressing, with 35 EH/s slated for completion by October 2025, including 7 EH/s allocated for external sales. Due to lower Bitcoin prices, some customers have requested deferred payments and alternative purchase options. To mitigate idle inventory, Bitdeer plans to redirect these units to self-mining but remains confident in selling the full allocation.

Infrastructure expansion is progressing across multiple locations. The 40 MW expansion in Tydal, Norway, is in the final approval phase, while the 100 MW hydro-cooling conversion in Rockdale, Texas, is set to begin phased energization in March 2025. Construction at the 500 MW Jigmeling, Bhutan, site remains on schedule. In addition, Bitdeer has completed a $9 million share repurchase and authorized an additional $20 million buyback program through February 2026. The company remains committed to advancing its chip roadmap and leveraging its 2.6 GW power portfolio for HPC/AI opportunities.

Bitdeer has also completed successful testing of its latest Bitcoin mining chip, SEAL03, following tape-out. The chip demonstrated an exceptional power efficiency ratio of 9.7 J/TH in low-voltage, ultra power-saving mode, achieving its targeted performance as outlined in the SEALMINER technology roadmap. Developed in collaboration with TSMC, a leading semiconductor foundry, SEAL03 leverages one of the most advanced process nodes available. Research & Development for SEALMINER A4 remains on track to achieve approximately 5 J/TH, with initial tape-out expected in Q3 2025.

Matt Kong, Chief Business Officer at Bitdeer, emphasized the significance of the milestone, stating that the company’s continued investment in research and development enables it to deliver innovative solutions that enhance mining efficiency. SEAL03 will be integrated into Bitdeer’s SEALMINER A3 series mining machines, with mass production set to begin in the latter half of the year. With a specialized team of R&D engineers, Bitdeer remains focused on advancing mining technology and supporting the security of the Bitcoin decentralized network.

Bitdeer Technologies completed a $9 million share repurchase under its $10 million program approved in September 2024. Following this, the board of directors has authorized a new $20 million share repurchase program, effective February 28, 2025, through February 28, 2026. This initiative reflects Bitdeer’s commitment to enhance shareholder value and optimize capital allocation.

Under the new program, Bitdeer may repurchase Class A ordinary shares through open market transactions, private agreements, or other legally permissible methods in compliance with federal securities laws, including Rule 10b5-1 and Rule 10b-18 of the Exchange Act. Repurchase timing and volume will depend on market conditions, trading volume, and business needs. The company will fund repurchases from its existing cash balance, ensuring minimal impact on share price while aiming for long-term shareholder returns.

Bitfarms (BITF)

Bitfarms released its latest monthly production report, highlighting key strategic developments. CEO, Ben Gagnon, confirmed the company remains on track to acquire Stronghold Digital Mining (SDIG) following strong shareholder approval. Additionally, the planned sale of its 200 MW Yguazu data center in Paraguay is expected to close in Q1 2025, reinforcing Bitfarms’ transition into a North American energy and compute infrastructure leader.

The company also appointed Craig Hibbard as SVP of Infrastructure to support its expansion into HPC/AI. Meanwhile, SVP Alex Brammer reported a 6% increase in operational hashrate, reaching 16.1 EH/s in February, which helped the company produce 213 Bitcoin, at an average daily rate of 7.6 Bitcoin, an increase of 17% on the rate achieved during January. Bitfarms sold 75 Bitcoin, adding 108 Bitcoin to their 'Hodl', now totalling 1,260 Bitcoin and valued at $106.3 million, as at February 28, 2025. The company also transferred 30 Bitcoin to a third party as collateral for active option contracts during the month.

Cipher Mining (CIFR)

Cipher achieved robust Bitcoin production in February, successfully navigating a brief, planned shutdown at its Odessa site for annual high-voltage electrical maintenance. The maintenance was completed efficiently, thanks to the Operations team’s strong coordination and discipline.

In February 2025, Cipher produced 176 Bitcoin, at an average daily rate of 6.3 Bitcoin, a reduction of 11% on the rate achieved during the previous month.

As part of its treasury management strategy, the company sold 235 Bitcoin, closing the month with a total Bitcoin balance of 1,032 Bitcoin, valued at $87.1 million, as at February 28, 2025.

Core Scientific (CORZ)

Core Scientific announced on February 19, 2025 that it is expanding into Auburn, Alabama, with a new high-performance computing facility housed in the AU§1Bix data center. The company plans an initial $135 million investment, with total project costs exceeding $400 million, including future partnerships. The 16-megawatt facility has potential for further expansion.

Core Scientific has leased the Samford Avenue facility and plans to purchase it, retaining 11 full-time employees and expanding to at least 20 staff members. Governor Kay Ivey and local leaders praised the investment, highlighting Alabama’s growing role in digital infrastructure. This expansion adds to Core Scientific’s nine U.S. data centers, reinforcing its national presence in high-performance computing.

Core Scientific has strengthened its collaboration with CoreWeave, securing an additional $1.2 billion in contracted revenue at its Denton, TX facility. This agreement increases CoreWeave’s total HPC infrastructure with Core Scientific to 590 MW across six sites, reinforcing Core Scientific’s leadership in high-density AI computing.

The 70 MW expansion at Denton raises its total IT load to 260 MW, contributing to Core Scientific’s 1.3 GW of contracted power. The company will fund $104 million in capital expenditures, while CoreWeave will cover additional expansion costs. With $10 billion in potential revenue, Core Scientific continues scaling its HPC data centers, positioning itself as a premier provider for AI and advanced computing workloads.

Core Scientific mined 215 Bitcoin, at an average daily rate of 7.7 Bitcoin and bringing its year-to-date total to 471 Bitcoin. Hosted mining at its data centers earned a further 16 Bitcoin during the month.

As of February 28, 2025, Core Scientific operated approximately 166,000 Bitcoin miners, with a total energized hash rate of 19.4 EH/s. Its self-mining fleet accounted for 159,000 miners (96% of operations), generating 18.4 EH/s. Additionally, the company provided hosting services for 7,000 customer-owned miners.

Core Scientific also contributed to grid stability, reducing power consumption and delivering 50,373 MWh back to local electrical grids.

DMG Blockchain Solutions (DMGI)

On February 24, 2025, DMG Blockchain announced it had signed a memorandum of understanding (MOU) to acquire infrastructure for a 10-megawatt air-cooled prefabricated data center (PDC) designed to meet Sensitive Compartmented Information Facility (SCIF) specifications, typically required for military and secure government operations. The company will conduct due diligence over the next 90 days before finalizing a definitive agreement.

If completed, DMG Blockchain will make an initial $5 million payment, with the remaining balance tied to revenue from Generative AI off-take agreements. The modular PDC can be deployed across multiple locations but requires additional power distribution and computing systems. CEO Sheldon Bennett emphasized the deal’s strategic importance, accelerating AI deployment and positioning DMG for premium SCIF-compliant AI opportunities.

DMG Blockchain mined 27 Bitcoin during February, at an average daily rate of 1.0 Bitcoin, a reduction of 3.6% on the rate achieved during the previous month, aligning with the shorter month and three days of non-firm power curtailment. The company’s hashrate averaged 1.71 EH/s, slightly down from 1.75 EH/s in January. In terms of their treasury position, DMG Blockchain added 12 Bitcoin and increased their total held to 443 Bitcoin, valued at $37 million, as at February 28, 2025.

CEO Sheldon Bennett highlighted significant progress in DMG’s Core+ strategy and Generative AI initiatives, noting Systemic Trust's qualification as a Digital Asset Custodian and the company’s focus on onboarding new customers.

HIVE Digital (HIVE)

HIVE Digital mined 89 Bitcoin in February, bringing its 'Hodl' position, within the Treasury, to 2,620 Bitcoin, valued at approximately $221 million as of February 28, 2025. However, Bitcoin reserves declined month-over-month as the company strategically sold a portion of its holdings to reinvest in capital assets, including Bitfarms’ 200 MW hydro-powered mining assets in Paraguay.

The company maintained an average mining capacity of 5.6 EH/s, with a fleet efficiency of 20.9 j/TH. HIVE Digital achieved a peak Bitcoin-only hashrate of 6.2 EH/s and a Bitcoin-equivalent hashrate of 6.4 EH/s. February’s daily production averaged 3.2 Bitcoin, representing a 3.4% decrease from January, equating to 15.9 Bitcoin per EH/s.

Frank Holmes, Executive Chairman of HIVE Digital, reiterated the company’s commitment to Bitcoin mining and AI-driven HPC. He highlighted the recent appointment of Craig Tavares as President and COO of Buzz HPC, whose 20+ years of experience in digital infrastructure will support HIVE’s $100 million GPU cloud services revenue target.

Aydin Kilic, President and CEO of HIVE Digital, announced the 300 MW expansion in Paraguay will increase hashrate from 6 EH/s to 25 EH/s by September 2025. The first 100 MW at Yguazú and 100 MW at Valenzuela are set for energization in Q2 2025, with an interim 18 EH/s target by June 30, 2025.

Luke Rossy, COO of HIVE Digital, shared insights from a site visit to Bitfarms’ Yguazú facility, confirming strong construction progress. Meanwhile, the 100 MW Valenzuela facility remains on track for energization by June 2025, with civil and foundation works nearing completion.

Hut 8 Corp. (HUT)

Hut 8 made notable advancements in February across its Power, Digital Infrastructure, and Compute layers, securing 592 acres in Louisiana for its River Bend campus, part of a 430 MW AI data center development initiative. The site is expected to support a 300 MW utility-scale power asset, with 200 MW dedicated to IT load.

The Vega development, (image below), remains on track for Q2 2025 energization, with miner deliveries underway for Hut 8’s in readiness for their 15 EH/s ASIC Colocation agreement with BITMAIN. The company is preparing for energization by building out operational infrastructure and onboarding site management.

Hut 8’s ASIC fleet upgrade is progressing, with new miners arriving at Salt Creek and Medicine Hat. The company is actively deploying new hardware and relocating efficient ASICs to Alpha to enhance fleet performance. These upgrades align with Hut 8’s goal of reaching a ~10.3 EH/s post-upgrade hashrate and 20.5 J/TH fleet efficiency.

During February the company mined 46 Bitcoin, at an average daily rate of 1.6 Bitcoin, a reduction of 21.6% on the rate achieved in the previous month. Hut 8 sold 17 Bitcoin and increased their 'Hodl' to 10,237 Bitcoin, valued at $864 million as at February 2025.

IREN (IREN)

IREN mined 459 Bitcoin during the month of February, at an average daily rate of 16.8 Bitcoin, a small reduction of 2.5% on the rate achieved in January. Despite Bitcoin production declining in February due to fewer days in the month, IREN continues to operate with sector-leading fleet efficiency and low electricity costs, ensuring strong and resilient margins, the highest of all the public miners as reported in their recent earnings update and achieving 70% during the month of February.

IREN’s Bitcoin mining operations remain robust, with the company on track to expand to 50 EH/s within the next four months. Co-Founder and Co-CEO Daniel Roberts emphasized that this growth is expected to generate annualized operating cash flows of approximately $600 million, based on current market conditions.

In addition to Bitcoin mining, demand for IREN’s AI and HPC services continues to rise. The company’s AI Cloud Service approached full utilization by month-end, driven by strong interest in NVIDIA H100/H200 GPUs and the upcoming air-cooled Blackwell models, resulting in revenue for AI Cloud Services increasing by 39% in February, whilst achieving hardware margins of 96%. This was driven by new contract wins and with fleet utilization nearing full capacity, additional contracted revenue is expected to materialize in March, further strengthening IREN’s position in the AI and HPC sectors.

The Horizon 1 development, at the Childress site, is progressing well, with customer demand far exceeding its initial 75MW capacity. Workstreams are advancing through technical due diligence, pricing negotiations, and letters of intent.

Riot Platforms (RIOT)

In February, Riot Platforms mined 470 Bitcoin, at an average daily rate of 16.8 Bitcoin, a small reduction on the rate achieved in January, considering production was impacted by planned maintenance, increased curtailment due to higher power prices from colder weather, and the shorter month. Despite these challenges, daily Bitcoin production declined by only 1.3% compared to January, reflecting ongoing improvements in utilization and operational efficiencies across the company’s facilities.

Beyond Bitcoin mining, AI and HPC remain Riot Platform’s top strategic priorities. The company is seeing strong market demand and is actively advancing its AI/HPC initiatives. The Corsicana Facility (image above), a key component of this strategy, presents a significant opportunity with potential access to 1.0 gigawatt of power by 2026. Located near the Tier 1 data center market in Dallas, Texas, the site is well-positioned for future expansion.

Riot Platforms remains focused on maximizing the value of its assets, leveraging both its Bitcoin mining operations and AI/HPC growth opportunities to drive long-term success. The company currently 'Hodl' 18,692 Bitcoin in its treasury with a valuation of $1.58 Billion as at February 28, 2025.

Soluna Holdings (SLNH)

Soluna Holdings mined 10 Bitcoin in the month of February. At an average daily rate of 0.4 Bitcoin, an increase of 10.7% on the rate achieved during the month of January, helped by an increase in the self ming hash rate to 701 PH/s. The company’s hosting business also saw an increase in their hash rate to 1.45 EH/s despite the fact that Project Sophie, operating under a Power Purchase Agreement (PPA), which contractually limits its capacity factor to 83%.

Operations at Project Dorothy have stabilized following the substation interconnection in January, with minimal curtailments due to favorable weather conditions. Deployments for Project Dorothy 1A are nearing completion, with the final 2 MW of S21 miners received and in the process of being installed.

ERCOT has confirmed that all regulatory requirements have been met, granting approval to energize the next 50 MW of Project Dorothy 2. Phase 1 commissioning is now underway, with successful completion of grid telemetry and network installation. Hosting customer contracts are being finalized, and coordination on deployment timing is in progress. Meanwhile, mechanical construction for Phase 2 has commenced.

A third-party engineering report has validated Project Grace’s efficiency, confirming a Power Usage Effectiveness (PUE) of 1.13 and a Power Factor of 0.99. Atlas Cloud launched its new Deepseek offering on February 28, powered by 128 NVIDIA H100 SXM Infiniband GPUs. The company’s AI pipeline now exceeds 1,800 NVIDIA H100 GPUs.

Substation repairs for Project Sophie were completed ahead of schedule in mid-February, restoring the site to full capacity. A 2 MW customer deployment is in progress to upgrade the existing fleet. The Phase 1 (83 MW) substation upgrade scope for Project Kati has been finalized, with above-ground electrical installation planned for April. Procurement of long-lead equipment is ongoing, and the construction bidding process for Phase 1 Bitcoin Hosting has begun.

Soluna Holdings has successfully deployed S21 and S21+ miners at Project Dorothy as part of its expanded partnership with Bit Digital.

Monthly and year-to-date (YTD) metrics

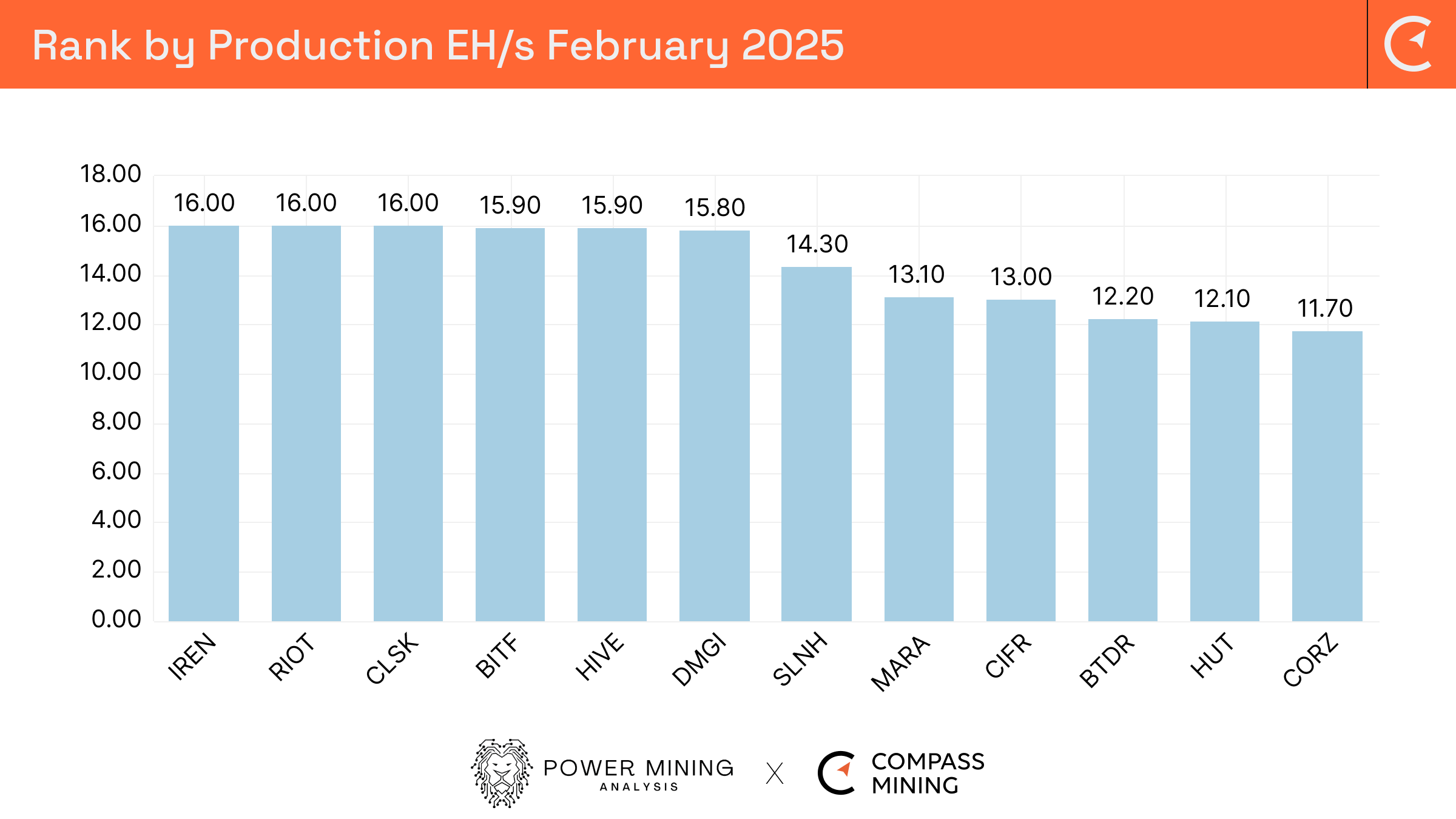

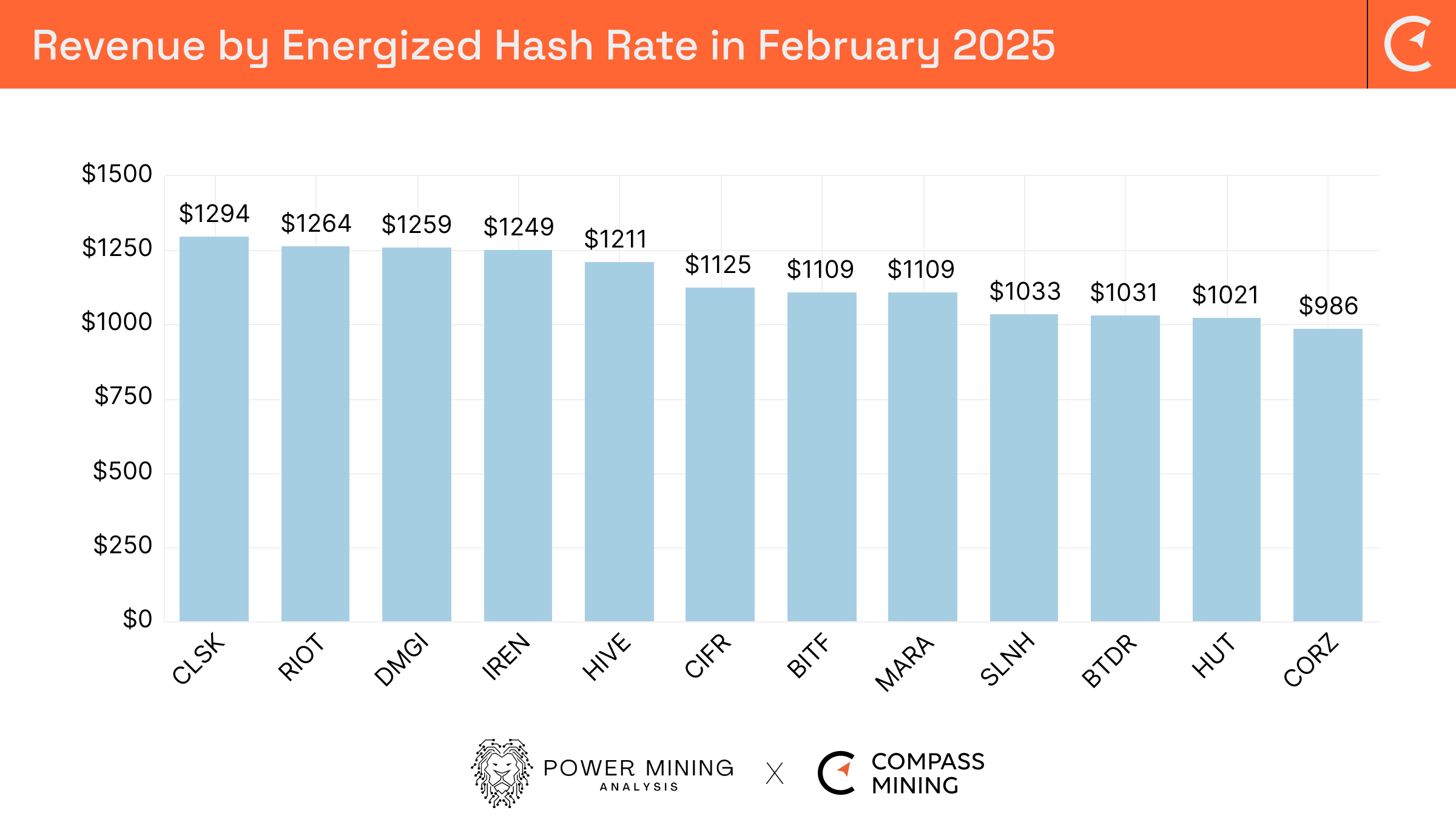

February witnessed a repeat of the top 3 miners from January, at the top of the table, in terms of production by EH/s, with IREN (15.99), Riot Platforms (15.99) and CleanSpark (15.96). Bitfarms (15.90) and HIVE Digital (15.89), who have previously finished the last 4 years in the top two positions, make up the top 5 and 1.3% separating the top 6 Bitcoin miners.

During the colder months, more miners are curtailing their energy to help the domestic use . However, Cleanspark still managed to achieve 90% utilisation followed by DMG Blockchain (88%) IREN ( 87%) Hive Digital (84%), and Riot Platforms (82%).

The Bitcoin mined per MW is a metric used for assessing operational efficiency and resource utilization. IREN achieved 0.90 Bitcoin per MW, followed by HIVE Digital (0.70), Marathon Digital (0.69), CleanSpark (0.68) and Core Scientific (0.54).

The year-to-date metrics in terms of Bitcoin mined per EH/s sees Riot Platforms achieve overall 1st, closely followed by CleanSpark, IREN, Bitfarms and HIVE Digital.