The cooler weather in September contributed to less curtailment for the North American Bitcoin miners. Although the mining difficulty ended up at an all-time-high of 57.12 T as of September 30th, the average mining difficulty was actually 0.2% lower than the start of the month. This, along with an increase of 4% in the Bitcoin price, helped the majority of miners to achieve increased production and greater mining revenues.

Share Performance

It has been encouraging to see the performance and movement of the Bitcoin miner share prices since the start of 2023 in comparison to the price of Bitcoin. Having reached an annual low in December 2022, the Bitcoin price has since recovered by 68% year to date. The average Bitcoin miner share price, however, has increased by nearly 200%, with Core Scientific (CORZQ) recovering by 821% and Cipher Mining (CIFR) increasing by 338%. Only two miners did not outperform the Bitcoin price during this period, with one of these, Argo Blockchain (ARBK), failing to achieve a positive increase year to date.

When you review the same price data over the last 3 months in comparison to the Bitcoin price, it highlights how much volatility that the Bitcoin mining stocks have.

On July 13, 2023 the majority of the Bitcoin miners in the graph below achieved their year to date share price high. In the 12 weeks following, the Bitcoin price dropped by 12%, whereas the Bitcoin mining stocks fell by an average of 49%.

TeraWulf (WULF) has had the biggest share price fall, at 71%, followed by Argo Blockchain (60%). SATO Technology, one of the smaller Canadian mining stocks, only achieved a share price fall of 1% over the same period.

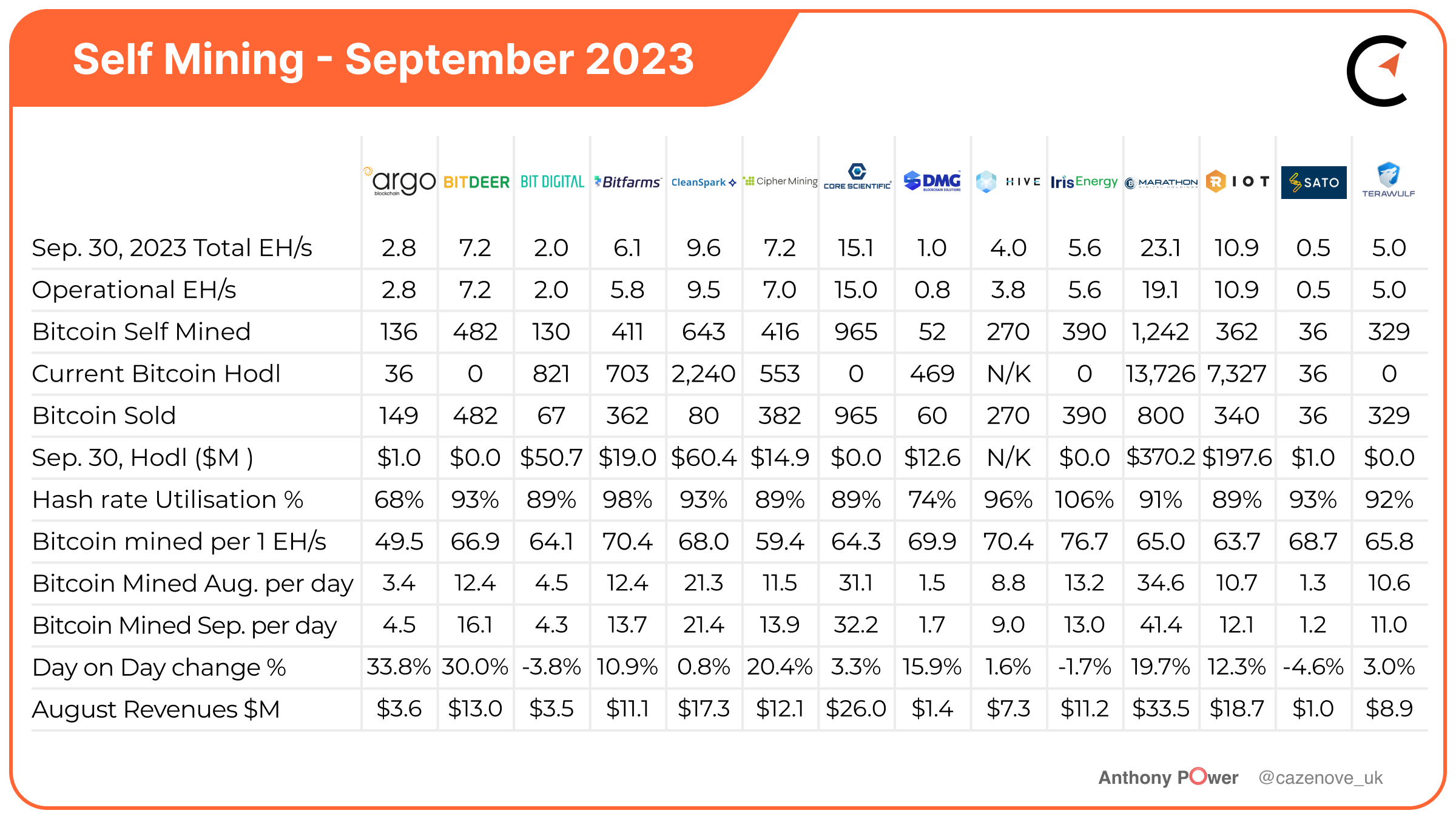

Bitcoin Self-Mining Monthly Performance

Argo Blockchain (ARBK)

Argo Blockchain mined 136 Bitcoin, during the month of September at an average rate of 4.5 Bitcoin per day, a 33.8% increase on the rate achieved during the previous month. This was due to the lower requirement to curtail energy in September. The company continued to benefit from using an energy strategy and curtailing, where economical to do so, for the receipt of power credits.

The Company completed the deployment of its BlockMiner machines at its Quebec facilities, adding approximately 0.3 EH/s of hashrate capacity, taking the company’s total operational hashrate capacity to 2.8 EH/s.

As of September 30, The company has a current hodl of 32 Bitcoin, indicating a sale of 149 Bitcoin during the month.

Bitdeer Technology Group (BTDR)

Bitdeer had its first full month operating at 7.2 EH/s and produced 482 Bitcoin at an average daily rate of 16.4 Bitcoin per day, an increase of 30% on the daily rate achieved during August.

Although the company has yet to highlight the benefits of implementing economic energy strategies in Texas, it is assumed they were fully participating based on their monthly updates, as seen by neighboring miner, Riot Platforms.

The company also has 2 other services generating revenues. Their Cloud Hash Rate service, controls 1.5 EH offering hash rate subscription plans, where mining income is shared with customers. Their more traditional hosting service, currently managing 12.5 EH/s, provides deployment, maintenance, and management services for efficient cryptocurrency mining.

Bitdeer is continuing to build its 175 MW immersion cooling data center at their facility in Tydal, Norway, which is expected to be completed in 2025.

Bit Digital (BTBT)

In September, Bit Digital produced 130.2 Bitcoin at an average rate of 4.3 Bitcoin per day, a drop of 3.8% when compared to the previous month. This was caused by a reduction in active hash rate that occurred towards the end of the month.

A power utility mandated outage meant that 600 PH/s of miners went offline from September 26, 2023, to October 6, 2023. A further 250 PH/s of machines stopped mining at the end of September, as the contract came to an end. The company is currently in the process of relocating those miners to alternative hosting sites.

Bit Digital sold 67 Bitcoin in September and earned staking rewards of 44.9 Ethereum as it continued to build its Treasury holdings. The company currently holds 821.1 Bitcoin and 13,783.4 Ethereum, providing a total value of $50.7 million, along with cash and cash equivalents of $20.8 million as of September 30, 2023. This should provide the company a number of options should any opportunities present themselves, as the halving approaches.

Bitfarms (BITF)

Bitfarms provided another good monthly update, mining 411 Bitcoin, at an average daily rate of 13.7 Bitcoin per day, an increase of 10.9% on the daily rate achieved in August. This increase was helped by installing 4,600 new miners at their Rio Cuarto site in Argentina, increasing total sel-mining hash rate during the month to 6.1 EH/s.

Although the company has missed their planned Q3 target of 6.3 EH/s, effectively caused by electrical delays at their Baie-Comeau, Québec facility, they anticipate full installation by the first few weeks of October.

Bitfarms sold 362 Bitcoin and transferred the remaining 49 into the treasury, taking the total hodl to 703 Bitcoin with a value of $19 million. The company also continued to pay down its debt, during the month, by a further $1.9 million, providing a remaining debt balance of $9.9 million. The company also held $46 million in cash and cash equivalents on their balance sheet as at September 30, 2023.

In terms of mining performance Bitfarms had an excellent month, achieving second place to Iris Energy in terms of the following mining metrics:

- Bitcoin mined by EH/s

- Bitcoin mining utilization

- Revenue earned by energized self mining hash rate

Cipher Mining (CIFR)

Cipher Mining produced 416 Bitcoin in September, at an average daily rate of 14.3 Bitcoin per day, an increase of 20.4% on the daily rate achieved during August. This increase was due to the completion of the buildout of the operations at its Odessa facility, which now accommodates 70,000 miner machines, providing 7.2 EH/s and is capable of mining 16.4 bitcoin per day.

The company also continued to receive power credits for utilizing its energy strategy, equivalent to 33 Bitcoin. Cipher Mining sold 382 of its production in September, adding an extra 34 Bitcoin to its treasury, now totalling 553 Bitcoin, with a value of $14.9 million as at September 30, 2023.

CleanSpark (CLSK)

CleanSpark mined 643 Bitcoin, at an average daily rate of 21.4 Bitcoin per day, an increase of 0.8% on the daily rate achieved in August. This increase was in part due to the additional 0.3 EH/s added during the month, taking the current total operational hash rate to 9.6 EH/s. Work continues on plan at the Sandersville site and with no delays currently reported, the construction remains on course to be completed by the end of 2023.

The company sold 80 Bitcoin during the month to pay for operational costs and placed the remaining 563 in the treasury, taking the total held to 2,240 Bitcoin. CleanSpark have obviously altered their ‘hodl’ strategy, and in the last four months have accumulated 1,789 Bitcoin, representing an increase of 400% on the Bitcoin hodl held as at May 31, 2023.

Core Scientific (CORZQ)

Core Scientific continued its mining operations in September whilst under Chapter 11 of the United States Bankruptcy Code which allows the company to remain in business and restructure its obligations, and aims to merge from this process in the final quarter of 2023.

The company mined a total of 965 Bitcoin during the month, at an average rate of 32.2 Bitcoin per day, an increase of 3.3% on the average daily rate achieved in the previous month. Although there was downtime at the Grand Forks data center, the company maintained its level of mining throughout the month.

Core Scientific sold a total of 1,040 Bitcoin during the month to pay for capital and operational costs and debt repayments. The company’s mining fleet has a current efficiency of 28.96 J/TH and having recently secured a further 27,000 new, more efficient miners, this will only benefit the company in terms of growth, but more importantly, in readiness for the Bitcoin halving due to occur in April 2024.

DMG Blockchain (DMGI)

DMG Blockchain produced 52.4 Bitcoin in September at an average rate of 1.7 Bitcoin per day, an increase of 15.9% on the rate achieved in the previous month. Whilst the company did increase its production, there are still ongoing heat issues restricting the company to operate at close to 75% of its total installed hash rate. As the weather starts to get cooler and with further new miners expected, DMG Blockchain fully anticipates an increase in the October operational hash rate.

The company sold 60 Bitcoin during the month and has a current hodl of 469 Bitcoin with a value of $12.6 million.

HIVE Digital (HIVE)

Hive Digital produced 269.5 Bitcoin in the month, at an average rate of 9 Bitcoin per day, an increase of 1.6% on the average daily rate achieved in August. This increase was achieved by growing their operational ASIC and GPU hash rate, in the month, to a new high of 3.98 EH/s, an increase of 8%.

The company also announced the acquisition of 1,000 Bitmain S19k Pro miners, with an efficiency of 23 J/TH and 120 TH/s per machine, as they continue to prepare for the halving.

For the second consecutive month, Hive Digital failed to disclose their Bitcoin holdings and sales for the month. In terms of monthly performance Hive Digital continued their consistency and were third in terms of Bitcoin production, Utilization and Revenue earned by energized self mining hash rate.

Hive Digital is in the process of converting the 38,000 Nvidia data center GPU cards (GPUs), previously used to mine Ethereum into an on-demand GPU cloud service, and expect to have 3,200 GPUs up and running in the High Performance Computing (HPC) and Artificial Intelligence (AI) space by the end of the month. The company is currently generating 15x more revenue in their HPC and AI services than Bitcoin on a per-megawatt basis.

Iris Energy (IREN)

Iris Energy had a great mining month, producing 390 Bitcoin at a daily rate of 13 Bitcoin per day, just 1.7% lower than the previous month. However, the company also achieved $948,000 of power sales, equivalent to an additional 36 Bitcoin, through its energy strategy.

Work is progressing well at the Childress site in texas and on plan to complete Phase 1 (1st 100 MW) with concrete foundations for second and third data centers complete, and primary steel structure for second data center also complete.

By including the equivalent Bitcoin earned through its energy strategy, Iris Energy have effectively earned 1st place in the ‘Triple Crown’ of mining metrics for September 2023:

- 1st - Bitcoin Mined per EH/s

- 1st - Equivalent Rank By Utilisation

- 1st - Self Mining Revenue by PH/s

The company announced on October 6, 2023 that they purchased 1.4 EH/s of latest-generation Bitmain S21 miners, which when installed will increase their self-mining hash rate by 25% to 7.0 EH/s. The most efficient miners currently available on the market with 17.5 J/TH efficiency, were purchased for $19.6 million, equating to $14 per TH. These miners are expected to be delivered to the Childress site in early 2024, in readiness for the halving.

Iris Energy is now targeting an increased operating hash rate capacity of up to 9.4 EH/s (previously 9.1 EH/s) and will continue to monitor further opportunities.

Marathon Digital Holdings (MARA)

Marathon Digital were just 3 Bitcoin short of their record month of production, mining 1,242 Bitcoin during September, at an average rate of 41.4 Bitcoin per day. An increase of 19.7% on the previous month. The increase in production was due to improved uptime and decreased curtailment activity in Texas.

The company has 19.1 EH/s energized with an additional 4.0 EH/s installed at the facility in Garden City, Texas and based on recent updates, these miners should come on line during the current month.

The joint venture in Abu Dhabi has a currently operational hash rate of 1.4 EH/s and during the month, mined a total of 50 bitcoin in September, with 10 bitcoin reflecting the companies 20% stake. Construction at the second, larger site, is nearing completion, when the full 7.0 EH/s is expected to be on line before the end of 2023, providing Marathon Digital with 1.4 EH/s.

Marathon Digital sold 800 Bitcoin in September and added 442 to its treasury, creating a new hodl of 13,756 Bitcoin with a current value of $370.2 million as at September 30, 2023. The company also has cash and equivalents of $101.2 million, providing a significant amount of ‘cash runway,’ in readiness for the next halving.

Riot Platforms (RIOT)

Riot Platforms produced 362 Bitcoin from self-mining during the month of September at an average daily rate of 12.1 Bitcoin per EH/s, an increase of 12.3% on the average achieved from the previous month. The increase was due to the operations teams beginning installation of replacement dry coolers in Building G, and hash rate has started to ramp back up. Once the building, which utilizes immersion cooling technology, is fully energized, the hash rate will return to 12.5 EH/s.

The company continued to implement its energy strategy, by strategically curtailing their energy, throughout the month, achieving $11.0 million in power credits and $2.5 million in demand response credits from participating in ERCOT’s ancillary services program. This represented a total equivalency of 511 Bitcoin, of which 332 is apportioned to self-mining.

The company sold a total of 340 Bitcoin to cover operational costs and added 22 Bitcoin to its treasury taking the total held to 7,327 Bitcoin with a current value of $197.6 million as at September 30, 2023.

SATO Technology (SATO)

SATO Technology mined 36 Bitcoin, totaling $954,010 in revenues, at an average rate of 1.2 Bitcoin per day, a small drop of 4.6% on the average rate achieved in August.

The company sold 36 Bitcoin to cover operational costs during the month and has a current hodl of 36 Bitcoin with a value of $970,845 as of September 30, 2023.

TeraWulf (WULF)

TeraWulf produced 329 Bitcoin in September at an average of 11.0 Bitcoin per day, an increase of 3% on the daily rate achieved in August. The increase was attributable to optimized performance at the Lake Mariner and Nautilus facilities, during the month, due to enhanced miner repairs.

Terawulf continues to operate with low energy costs, achieving a gross mining margin of 63% in September, with an average energy cost of $9,880 per Bitcoin.

The company remains on track to complete the 43 MW expansion at Lake Mariner by the end of 2023.

Equivalent Rank by Utilization

When you consider the energy strategies adopted by a number of the North American listed miners, the equivalent Bitcoin achieved through self mining needs to be taken into consideration. Iris Energy effectively achieved a greater benefit by curtailing their energy in September, than if it had actually mined Bitcoin.

Bitfarms and Hive Digital achieved 98% and 96% respectively and the cooler weather during the month meant less curtailment was required, than in previous months, to support the grid.

CleanSpark, Bitdeer Technology, SATO Technology and TeraWulf all achieved greater than 90% utilization, during the month.

Bitcoin Production by EH/s

The one metric that every miner looks for each month is the amount of Bitcoin mined per EH/s. Iris Energy benefited from its energy strategy adopted at the Childress site in Texas, effectively achieving 76.7 Bitcoin per EH/s. Bitfarms and Hive Digital again had good months with both mining 70.4 Bitcoin per EH/s and DMG Blockchain made good use of the operational hash rate available, making up the top 4. Although Argo Blockchain achieved 49.5 Bitcoin per EH/s they benefited from the energy strategy at the Helios site in Texas, but have yet to disclose in their monthly updates any power credits received.

Self Mining Revenue by PH/s

A new metric that considers the amount of revenues/benefits achieved by each miner through their self mining energized hash rate. This metric considers the Bitcoin mined and the benefits earned for various energy strategies. In the month of September Iris Energy achieved $2,051 from their sales of mined bitcoin and unaudited power credits from curtailing their energy.

A strong month of revenues per EH/s was also achieved by Bitfarms, Hive Digital and Cleanspark.

Bitcoin sold as a % of Production

It's evident that all the miners are currently using a strategy of selling a large proportion of their mined Bitcoin to pay for capital growth and operational costs, with a number of Bitcoin miners actually selling 100% of their production each month.

CleanSpark, however, over the last 3 months have only sold 166 Bitcoin from a total production of 1,877 mined and have taken their Hodl to 2,240. This will certainly aid their financial position, with a convertible cash runway to get through the halving.

Bit Digital have also been building their hodl of cryptocurrency, currently valued at $50.7 million.

Bitcoin and Bitcoin equivalent mined

The table below articulates the amount of Bitcoin earned through self mining and the amount of equivalent Bitcoin earned through utilizing energy strategies. Riot Platforms, Cipher Mining and Iris Energy are the only Bitcoin miners to have actually reported the financial benefit associated with curtailing energy and receiving power credits. Bitdeer Technology and Argo Blockchain are also taking part in energy strategies at their sites in Texas, but have yet to disclose the financial benefits achieved.

A great month for Marathon Digital, achieving close to a monthly record. If they are able to energize the remaining 4.0 EH/s at their Garden City site in Texas, as planned, the record monthly total should be reached in October.

Bitcoin mined per EH/s per month

This table highlights the consistency of the top miners, in terms of production by EH/s, over the first 9 months of 2023. Bitfarms have actually had the highest performance of Bitcoin miners per EH/s in the majority of months this year, closely followed by Hive Digital and Iris Energy.

As miners are getting more and more consistency with output, the top 7 miners are only separated by 5.8%.