Bitcoin’s price is setting new all-time highs, and bitcoin miners are hodling (for the most part).

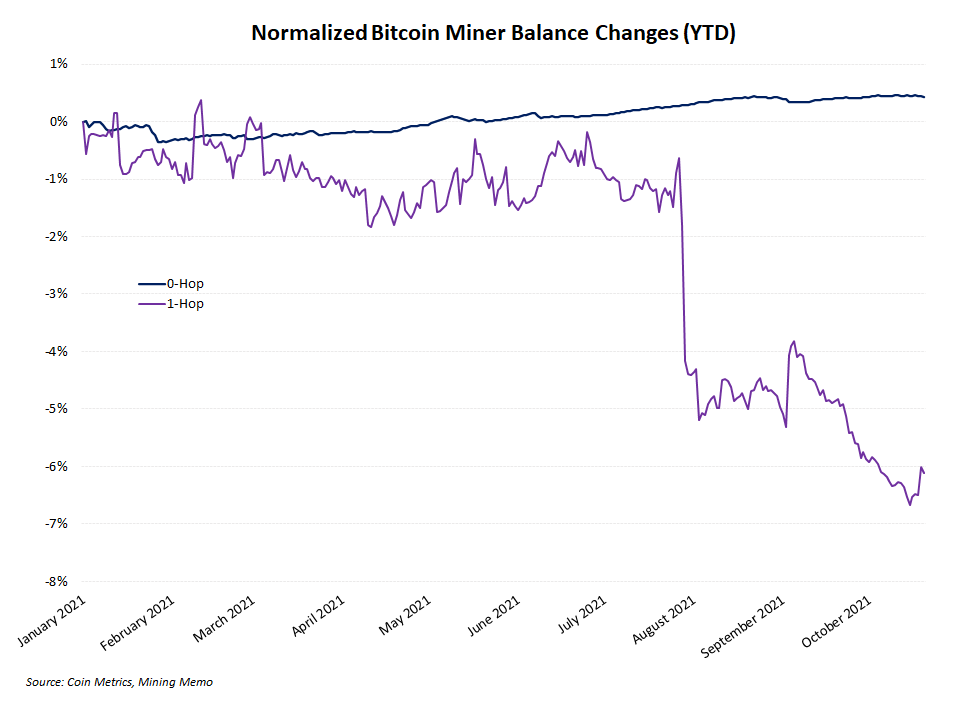

Data from Coin Metrics shows that addresses zero hops from mining entities (or the mining entities’ own addresses) have seen an aggregate balance increase of nearly 0.5% in 2021. Addresses one hop from mining entities (or another party that the mining entity transferred to either for payouts or payments of some other kind) have seen an aggregate holdings decrease of roughly 6% over the same period.

Want more mining insights like this?

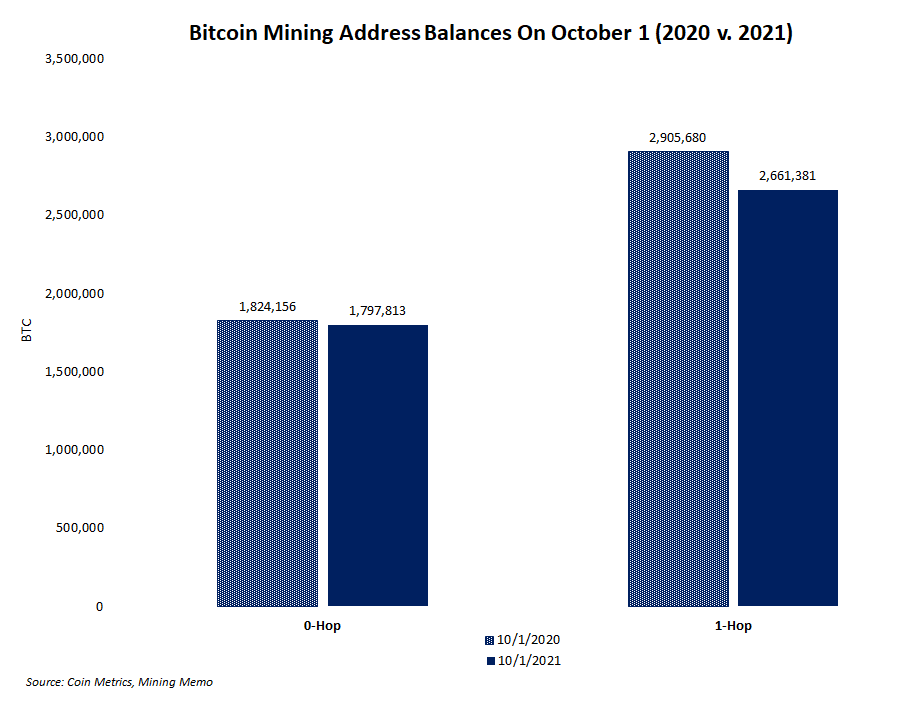

Current bitcoin miner balances:

- 0-hop addresses: 1,798,003 BTC

- 1-hop addresses: 2,655,983 BTC

As with all on-chain data analysis, connecting real-world entities to on-chain addresses cannot be done with absolute certainty. All on-chain data should be regarded within a “best effort, reasonable estimate” analytical framework.

The chart below shows total balances for 0-hop and 1-hop addresses on Oct. 1, 2021 and the same date one year prior.

In short, mining entities still hold massive amounts of bitcoin.

Although 1-hop addresses have been slowly shedding small amounts of bitcoin, balance fluctuations over the past 2 years are almost entirely uncorrelated to bitcoin’s price action. Although some of the coins have undoubtedly been sold, assuming all of them have been sold at market is an unreliable assumption and ignores miners’ inherent bias to hodl instead of sell.

The chart below visualizes the changes in aggregate holdings by 0-hop and 1-hop addresses in 2021.

Not much market insight can be gained by analyzing miner balance fluctuations, and miners selling coins rarely (if ever) moves the market price of bitcoin. However, continued accumulation by some miners coupled with very mild transferring or selling by other mining addresses signals that the Bitcoin network is healthy and secure. Miners continuing to hodl can make every other investor feel safer and maybe a bit more bullish too.