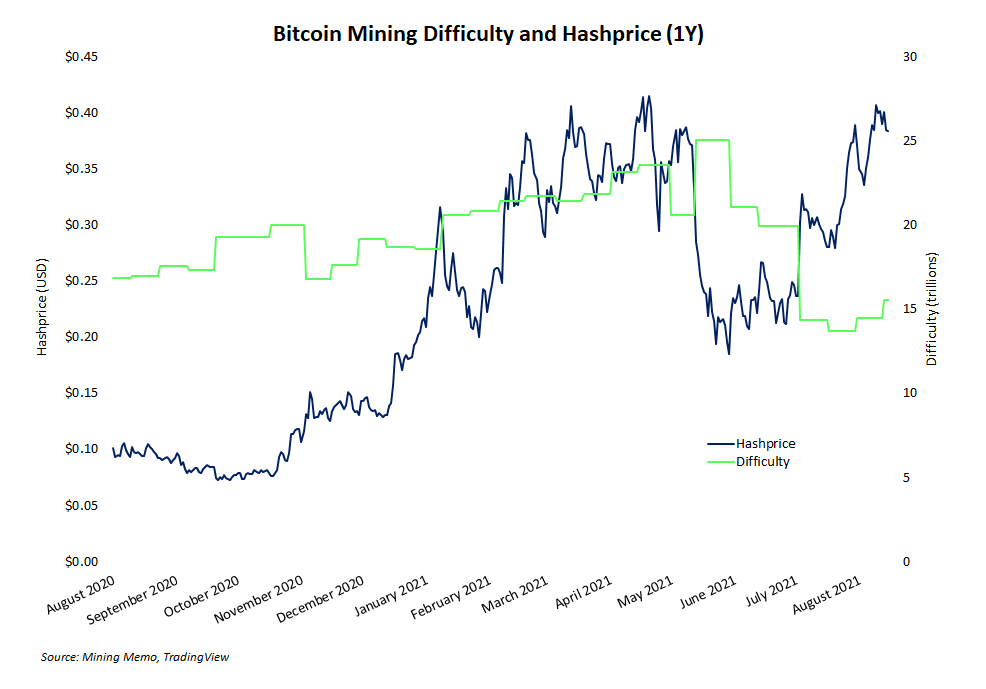

Bitcoin miners forced to leave China are slowly bringing their machines back online. North American miners are also rapidly expanding their mining capacities. As a result, mining difficulty is gradually increasing.

But mining profitability – measured by hashprice – is still climbing. This article explains why.

Want more mining insights like this?

Previous articles have explained the nuances of what determines a miner’s hashprice. In short, current difficulty and bitcoin’s price set hashprice, and the two factors often work against each other. Difficulty may increase, making hashprice cheaper. But bitcoin’s price may also increase, reversing the depreciation caused by difficulty.

In fact, that is exactly the effect playing out in the market now. Although bitcoin mining’s difficulty levels have started to gradually increase, bitcoin has rebounded over 40% from its lows in July, causing hashprice to appreciate significantly.

Last week, bitcoin miners saw the Bitcoin network’s difficulty upward by the third largest percentage increment this year. After the change, difficulty now sits at 15.5 trillion.

Difficulty and hashrate have a lot of ground still to cover before fully paring their significant drops earlier this year, to be sure. But even as the network begins to regain some of its lost hashrate, the unusually high profitability enjoyed by miners with machines still online isn’t dissipating thanks to bitcoin’s price rally.

Whether or not bitcoin’s price will continue to “moon” isn’t clear. But what is known is miners are continuing to enjoy the current “golden era” of bitcoin mining.