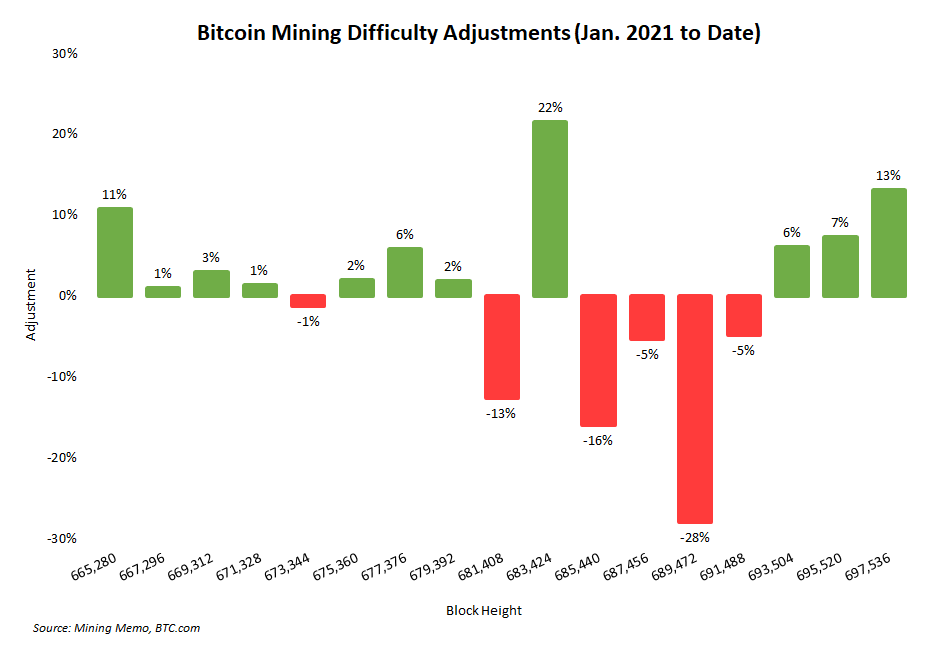

Bitcoin mining difficulty jumped by over 13% this morning, registering the network’s second largest upward adjustment this year. This increase marks the third consecutive difficulty increase for bitcoin miners as new hashrate starts coming online.

The difficulty increase

Difficulty is still slightly below 18.5 trillion, the level it started at in January. But with the most recent adjustment pushing difficulty to above 17.5 trillion, it won’t take much more hashrate to close the gap during the new mining epoch.

Miners should care about this adjustment because even though difficulty is slowly retracing it’s massive drop during Q2 2021, profitability is still unusually high for miners.

The effect on mining revenue

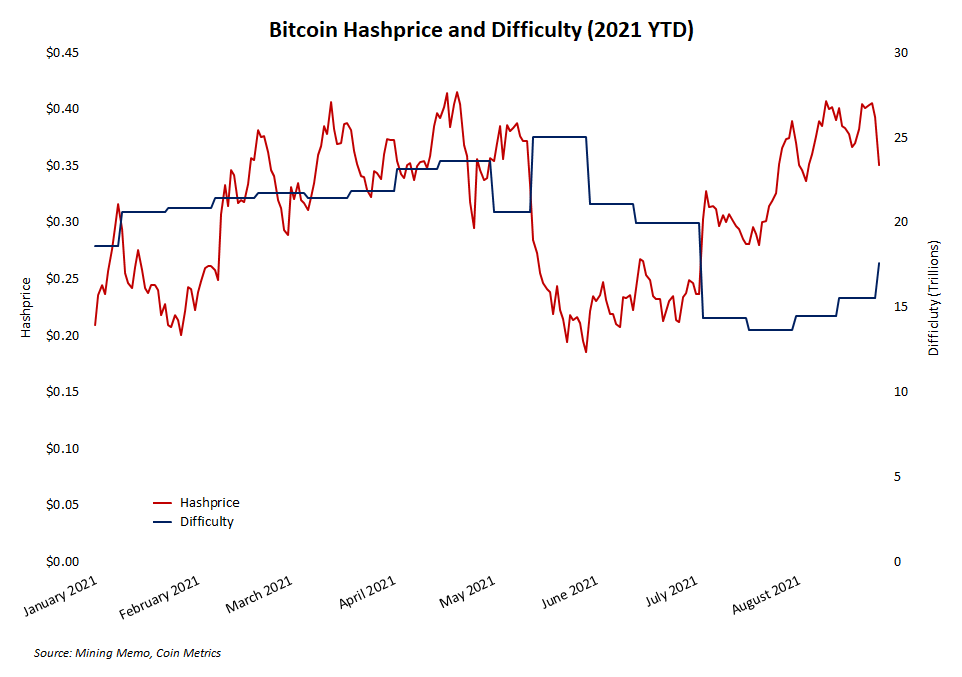

Hashprice – the market value of hashrate units determined by mining difficulty and bitcoin’s price – was sitting just below $0.40 after nearly setting two-year highs earlier this week above $0.41. After the adjustment, hashprice dropped to around $0.35.

In short, the value of hashrate is appreciating because the price of bitcoin is appreciating faster than difficulty is increasing. Now difficulty is starting to catch up although hashprice remains relatively high.

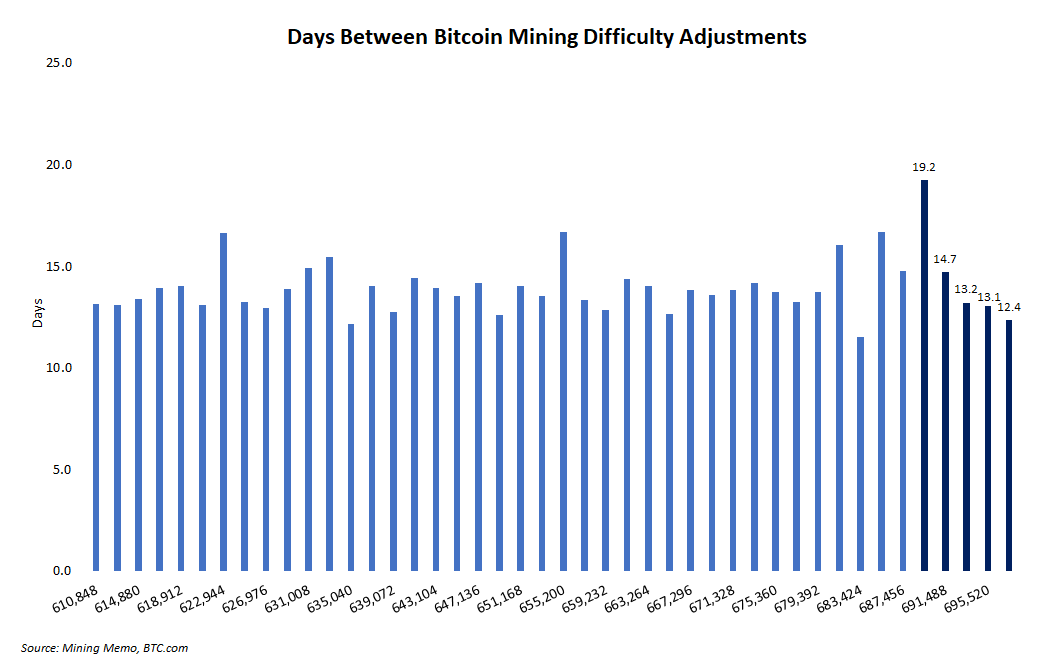

The time between adjustments

The time between several recent difficulty adjustments gives an alternate perspective into the increasing flow of new hashrate to the network that’s pushing difficulty higher.

Since the July 3 adjustment that took the longest to complete since ASIC mining machines entered the market, every subsequent adjustment has noticeably shortened in length. Since every adjustment happens after 2016 blocks, the only way to shorten the timeframe is to solve new blocks faster, which happens when more hashrate comes online.

Want more mining insights like this?

The shortening duration between adjustments is another signal that more hashing power is joining the network.

The road to recovery for hashrate

How long before bitcoin’s hashrate and difficulty set new record highs is an open question. According to at least two full-time miners, hashrate’s recovery over the past several weeks is not surprising. Watch the explanation why in a clip from a recent Compass livestream.

Watch the full livestream about bitcoin hashrate’s road to recovery below.

Hashrate that’s coming online now is different what the ASICs that went offline earlier this year when China banned mining. Continued growth by new mining facilitys faces tight bottlenecks from limited rack space and delays in materials for building out mining farms. Mining companies that started new farms a year ago or more are well on their way to completion, although delays and shortages of electrical materials, labor, etc. affect them too. Newer projects bear the brunt of these disruptions.

In 2022, a large number of currently uncompleted projects should be finished and ready to come online, leading to an explosion in hashrate and a subsequent increase in difficulty. If bitcoin’s price continues to appreciate, mining revenues should soar along with hashrate. But in the meanwhile, hashrate recovery continues to move upward and miners are enjoying a roughly $0.40 hashprice.