Is the bottom in for ASIC prices?

This question has been asked a lot during the past several weeks as the mining sector has continued to grabble with the fallout from China’s crackdown on its domestic bitcoin mining industry. The answer is: it depends on bitcoin’s price.

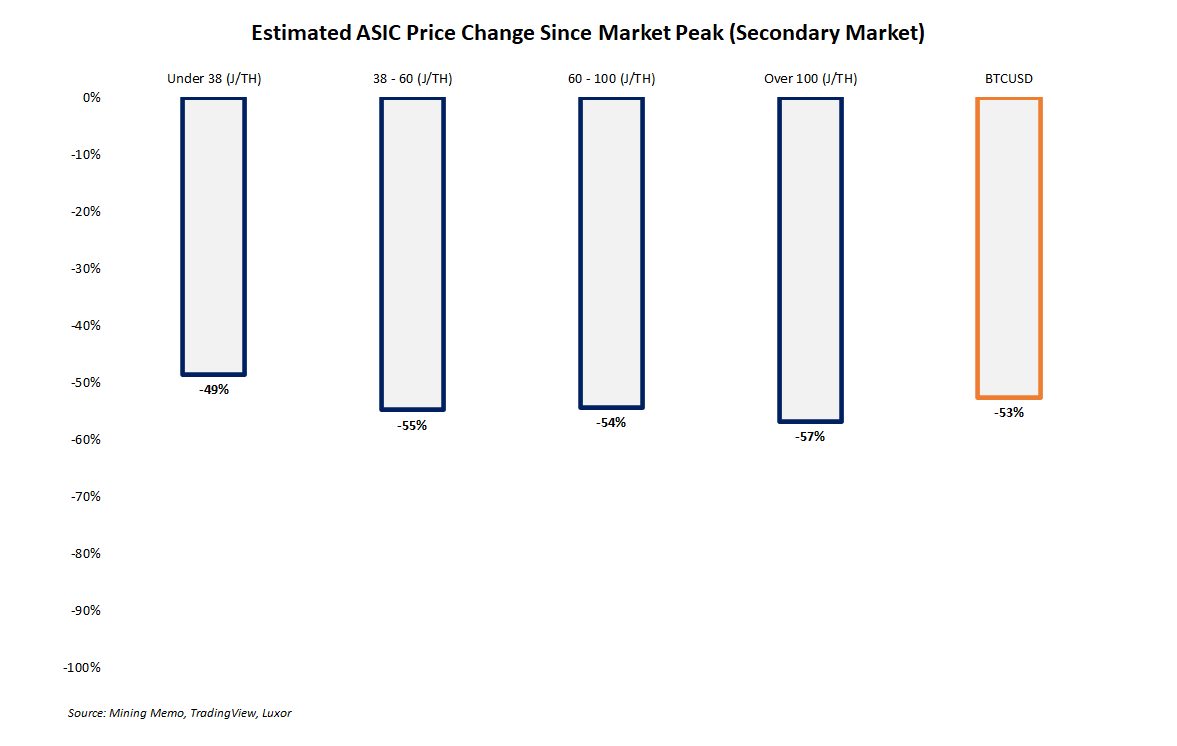

Since the market’s peak in late April and early May, downward price movements for ASICs have nearly matched bitcoin’s drop, although not at the same time or speed.

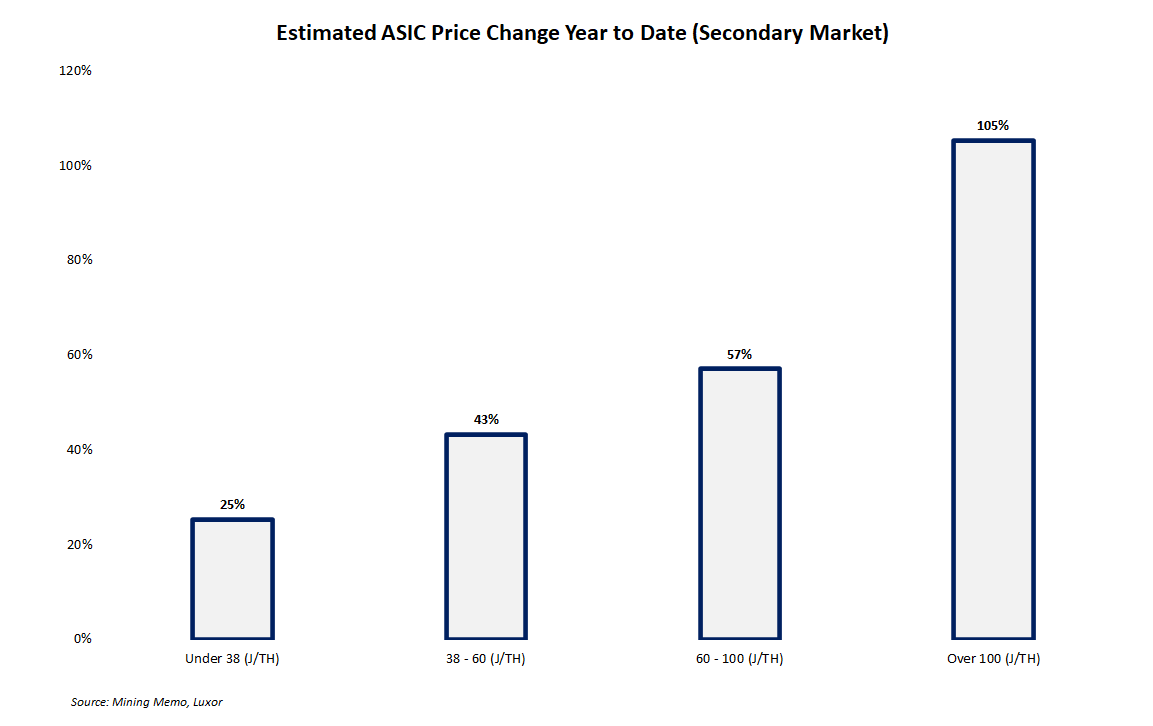

Here’s the good news. ASIC prices are still up by double- and triple-percentages, according to secondary market pricing estimates. Curiously, the less efficient the machine, the more significant its price appreciate has been year to date on a percentage basis.

Want more mining insights like this?

While ASICs with efficiency of 38 or fewer joules per terahash (J/TH) are still up 25% on the year, machines with over 100 J/TH are up 105% over the same period.

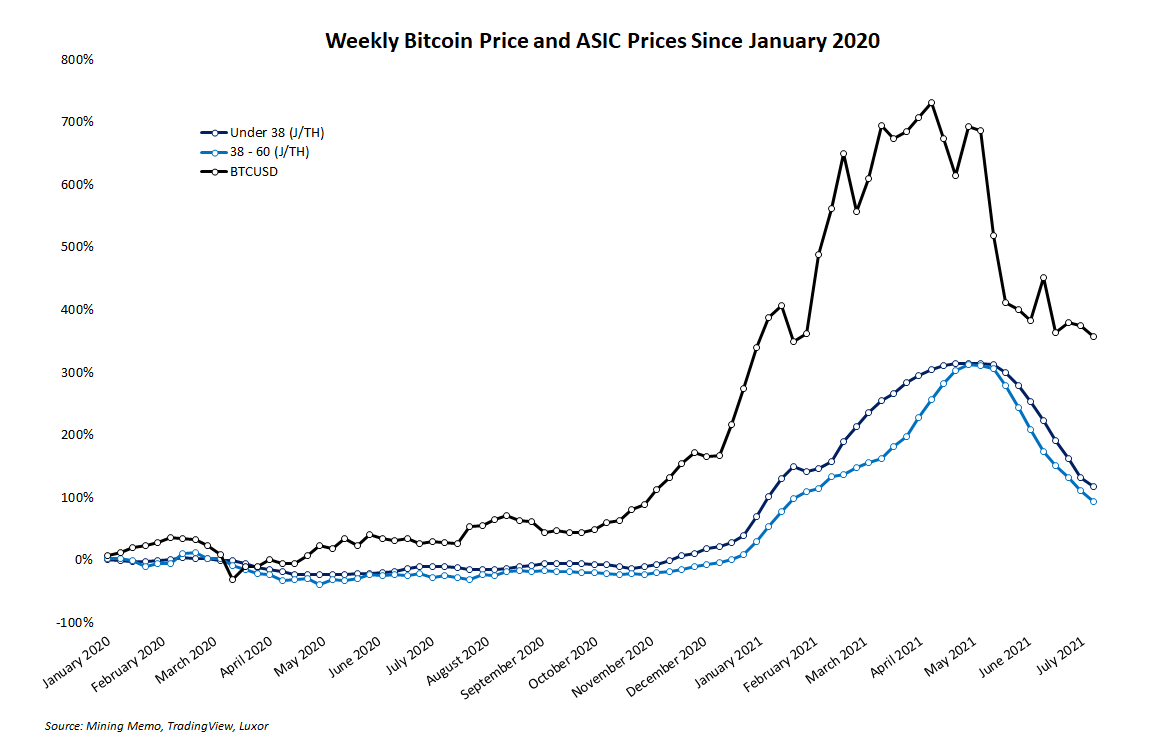

At the time of writing, bitcoin is trading in the upper $30,000s range. Where it goes from here is anyone’s guess, but ASIC prices will most likely follow. Zooming out, the relationship between bitcoin and ASIC prices is very apparent.

For more information on the nuances of mining hardware markets, Vincent Vuong, Compass’ head of sales and procurement, recorded an episode of the Compass podcast to breakdown why now is the golden era of bitcoin mining and what that means for buying and selling ASICs.

Listen here: