Prices for bitcoin mining machines have been trending upward over the past few weeks. A combination of factors are responsible for more expensive ASICs, including bitcoin’s price increase and miners hoarding machines.

Want more mining insights like this?

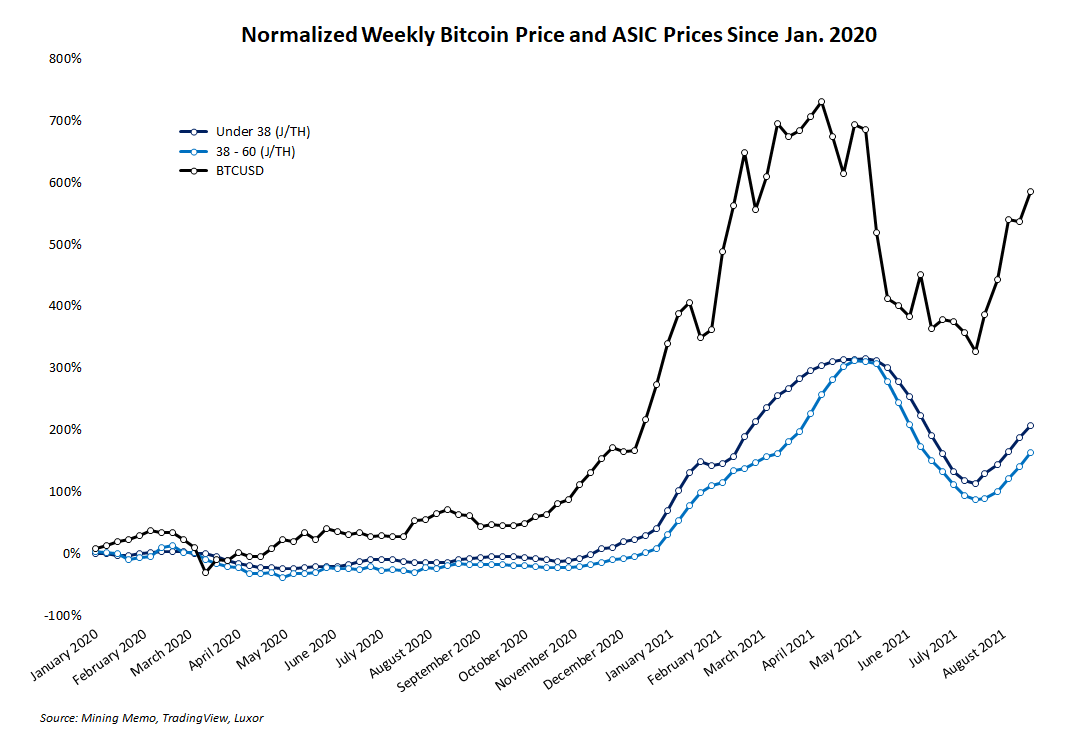

Although prices haven’t fully recovered from the market’s drop in April and May, aggregate prices for ASICs on secondary markets have rebounded significantly in July and August.

- Machines with efficiency under 38 J/TH are selling in the mid-to-upper $80 per terahash range.

- Machines with efficiency between 38-65 J/TH are back above $60/TH.

Bitcoin’s price is rebounding too.

It’s no secret that when bitcoin’s price goes up, ASIC prices follow. Bitcoin’s rally from the end of July through August that briefly pushed its price above $50,000 has pulled the price of ASICs up with it.

- At its recent monthly highs, Bitcoin gained nearly 30%.

- Over the same period in August, prices for ASICs (at least 38 J/TH) rallied over 25%.

Miners are hoarding machines.

Beyond the price, Chinese miners are also affecting the market value of mining machines by withholding a large number of machines from the market. Due to China’s recent mining crackdown, these miners are unable to use their ASICs.

Although some miners have successfully relocated since China's ban, many have not. Of those who haven't, some large miners are choosing to simply sit on their machines instead of selling them, risk flooding the market, and result in a loss. In short, hoarders are hoping that the prices for bitcoin and ASICs continue to appreciate, giving them the ability to slowly sell their machines for a profit or find available hosting space for relocation.

Compass’ Director of Procurement Vincent Vuong explained this market dynamic in a recent article, describing how many miners affected by China’s recent ban are opting to hoard instead of sell their machines.

“I know there is supply available. I talked to a lot of people. They all have thousands of units but nobody is willing to sell them,” Vuong said.

ASIC hoarding was also described in some detail on a recent Compass livestream. As Austin Storms of Great America Mining says, not all miners leaving China are relocating or selling. Some are just sitting on lots of machines, and this behavior is affecting ASIC markets.

If bitcoin’s price starts to dip significantly, ASIC prices will most likely follow despite the hoarding habits of some miners. But exactly how many and for how long these miners will choose to sit on so many machines is impossible to predict.