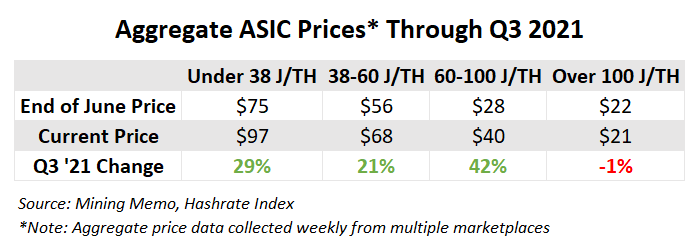

Prices for the most efficient ASICs have jumped over 25% since the start of the third quarter. But pricing data collected from a variety of hardware marketplaces shows that top ASICs haven’t seen the largest price jumps this quarter.

Machines with efficiency of less than 38 J/TH became nearly 30% more expensive since the start of July, according to data aggregated by Hashrate Index. Curiously, their data suggests less efficient machines (60-100 J/TH) saw greater price appreciation on a percentage basis over the same period.

Want more mining insights like this?

The table below shows price changes per efficiency for ASICs.

The data presented above is aggregated across multiple marketplaces. Seeing prices across different categories of ASICs increase between 20-40% this quarter isn’t shocking, given bitcoin’s price rebound over the same period. And the difference between sub-38 J/TH and 60-100 J/TH machines isn’t exceptionally anomalous. But it’s still interesting to note based on available data.

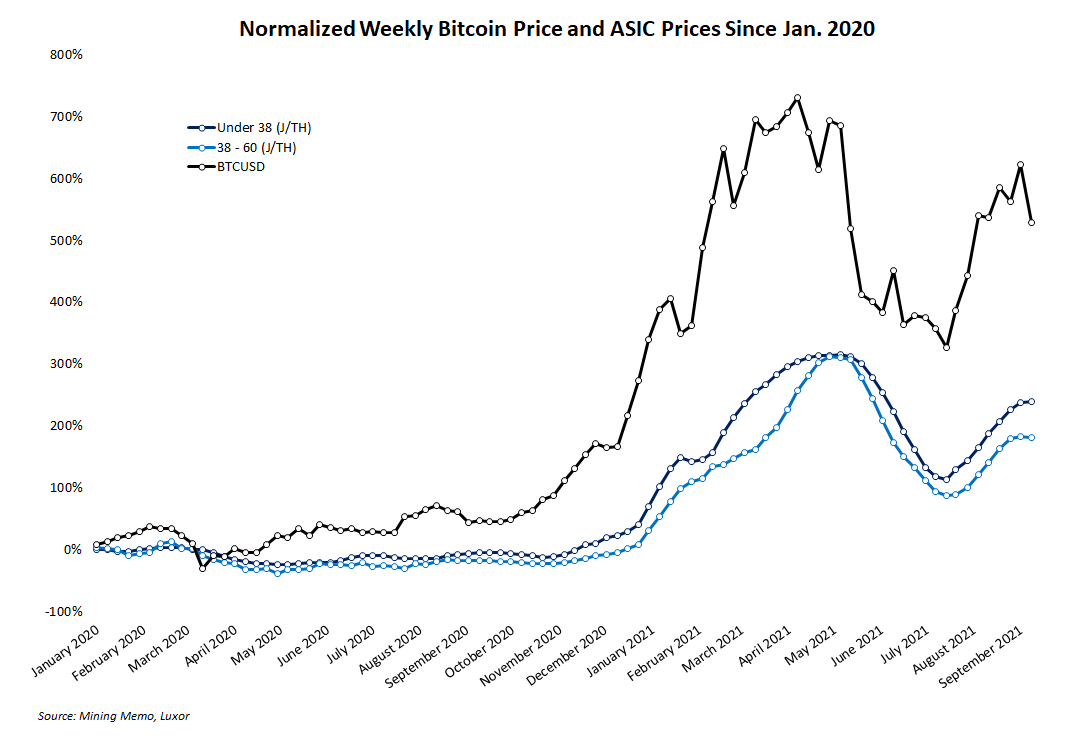

Quarter to date, bitcoin’s price has gained over 40%. At the time of writing, the leading cryptocurrency is trading just above $47,000 after starting July near $34,000.

Obviously, whichever direction bitcoin’s price goes, ASIC prices will follow. Cryptocurrency traders and investors have widely disparate outlooks for the market going into the final quarter of 2021.

Read: An update on ASIC prices and their relationship to bitcoin.

A bullish market would be kind to paper gains on machine values for miners. A bearish outcome could be a nice gift for miners looking to procure more machines.