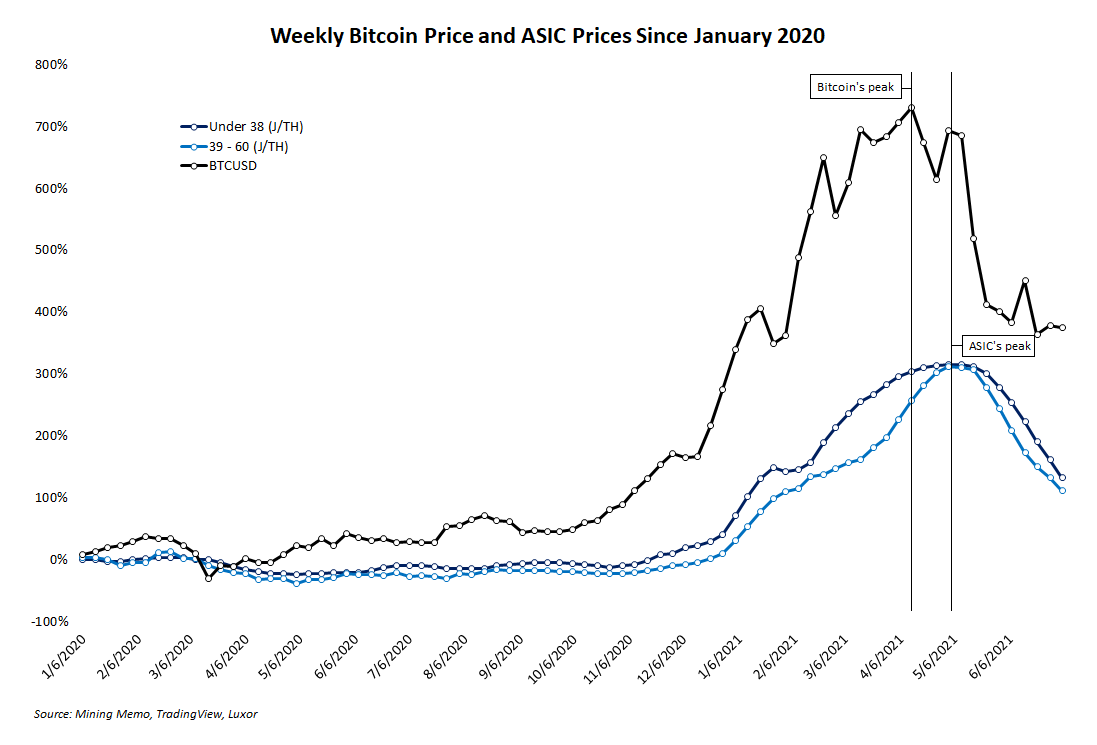

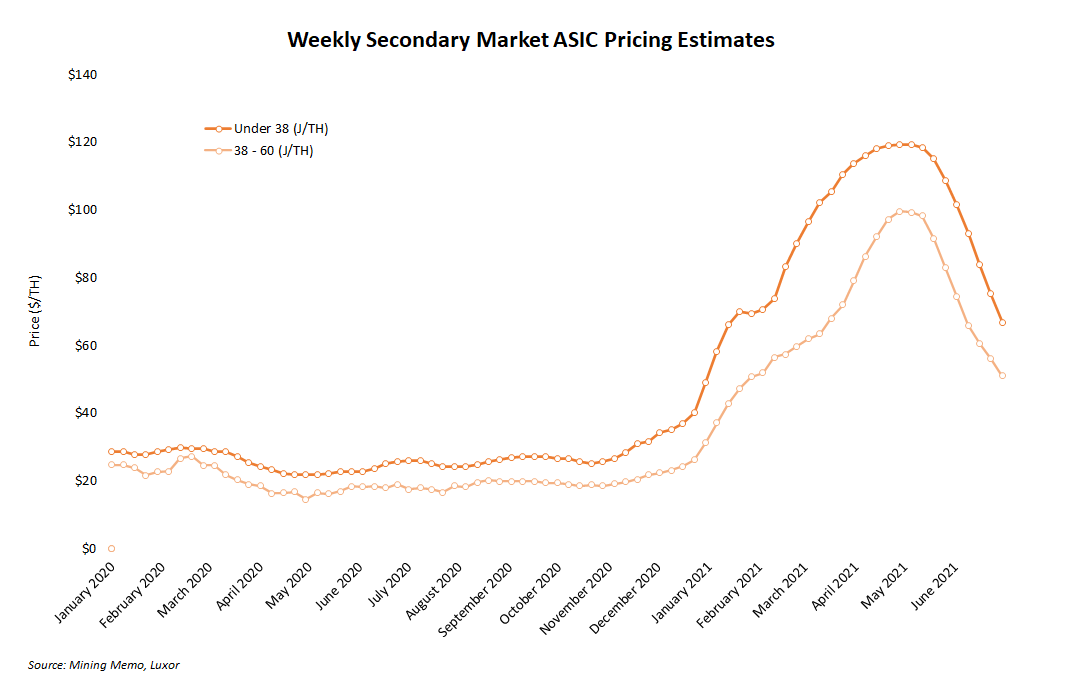

ASIC prices matter to miners just as much as bitcoin’s price. Since the market’s peak in mid-Q2 2021, prices for both commodities (BTC and ASICs) have dropped considerably. But observing the relationship between the two prices offers an interesting insight into the mining sector’s reaction to bitcoin’s price action.

Although the price declines for bitcoin and mining ASICs have been roughly equal, the downward trends did not start or progress in sync with each other. The weekly chart below shows bitcoin’s peak in the middle of April 2021 while prices for the top two efficiency tiers of ASICs didn’t peak until roughly a month later in early-to-mid May 2021.

Two key reasons explain the lag between ASIC and bitcoin prices.

For one thing, since hashrate is already known to lag behind bitcoin’s price movements, ASIC prices not similarly lagging behind would be surprising. The unplugging and liquidation of ASICs during downward price action or the accumulation and deployment of ASICs during bullish price action tracks with (and also intuitively explains) hashrate’s relationship to price.

Want more mining insights like this?

Put differently, after the price starts going up, more miners come online causing creating higher hashrate levels and triggering more demand for ASICs, which boosts prices. After the price starts dropping, some miners become less active, which depresses hashrate levels and erodes buy-side demand for new machines.

ASIC prices also lag bitcoin’s price because miners are often reluctant to sell their “money printers.” Between the capital expenses, operational costs, and general bullish thesis required to enter the mining sector, miners are by far the most heavily leveraged long participants in the bitcoin market. Thus, when the price starts to dip, miners – even those with exceptionally thin profit margins – are almost never eager to liquidate their hardware.

Sustained downward price action can eventually force hardware sales, however. But slight dips in bitcoin’s price is usually insufficient pressure to part a miner from their machines.

When either market – bitcoin or mining machines – will recover is an open question. More downward movement from bitcoin is sure to trigger lower prices for ASICs. Another possibility for cheaper ASICs involves frustrated Chinese miners capitulating and liquidating their hardware after unsuccessfully searching for new hosting space, which is in short supply.

Whichever direction bitcoin takes next though, ASIC prices are almost sure to be affected, but prices won’t follow immediately.