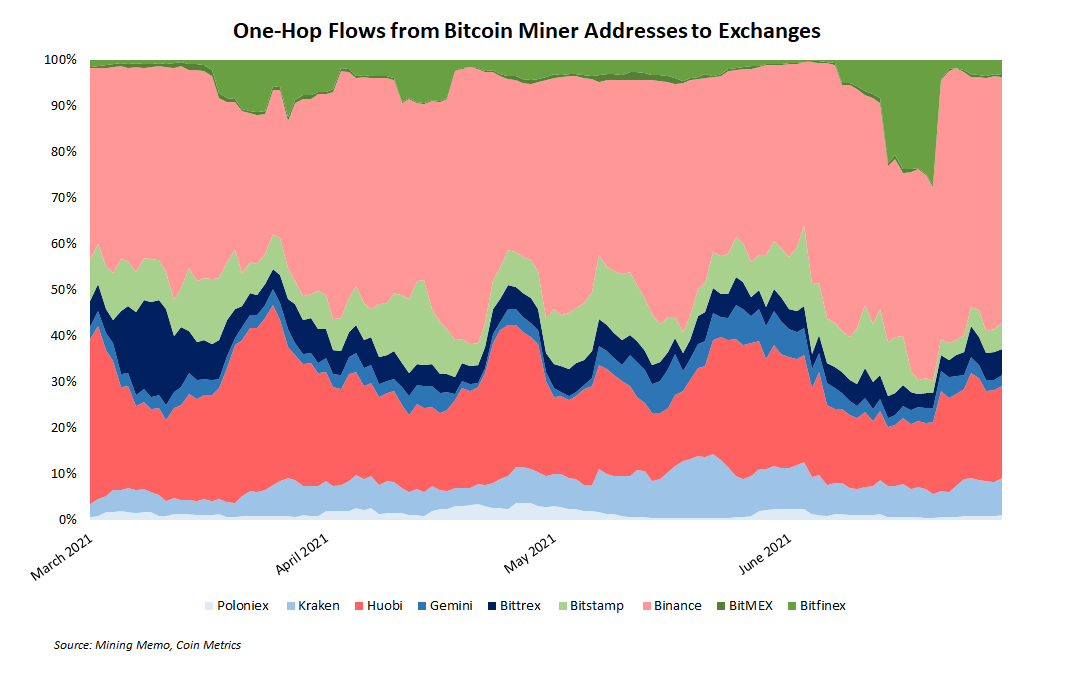

Miners aren't deterred from depositing funds on Binance and Huobi despite a wave of notices against the exchanges by financial regulators.

The two exchanges still account for an estimated 60% of all mined coins hitting exchange wallets out of exchanges surveyed by Coin Metrics data. (Coinbase data is excluded due to wallet obfuscation techniques.)

Over the last 90 days, the UK’s Financial Conduct Authority, Japan’s Financial Services Authority and other regulatory bodies have issued various legal letters to Binance. Huobi has also shut down much of its operation in China following the general crackdown. But the market share of miner transfers for the two exchanges has largely remained constant.

Exchange pools losing hashrate

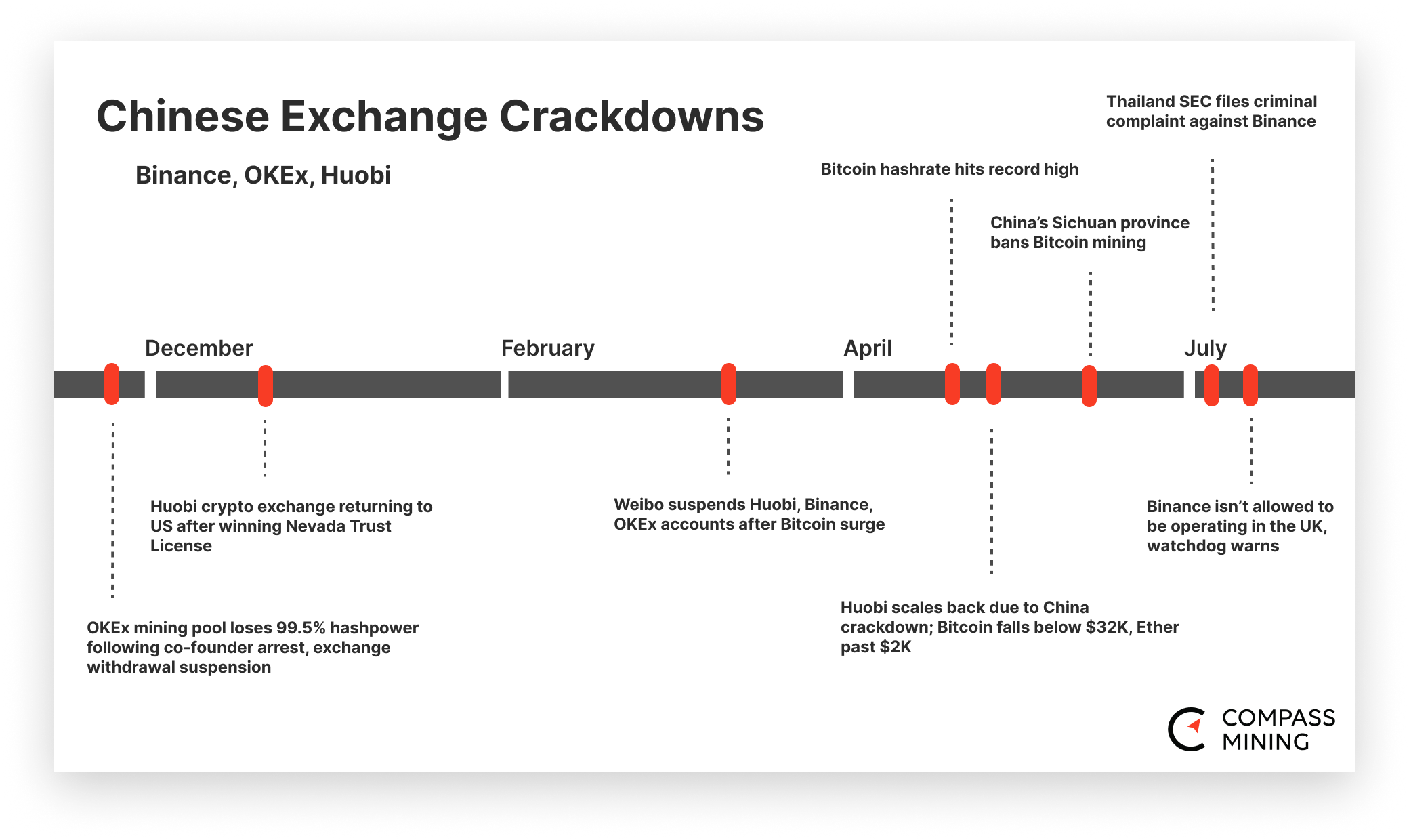

Crypto exchange mining operations arn't benign to the greater market, though. For example, OKEx's mining pool lost 99.5% of its hashrate last fall after co-founder Mingxing "Star" Xu was taken into police custody. The exchange halted withdrawals, prompting miners to point their machines to other pools.

This time around, Asian exchange pools are losing hashrate just like any Asian-based miner.

Want more mining insights like this?

- Binance Pool remains a top pool, but has lost about 50% of its total hashrate. It’s down from a March 2021 high of ~19 EH/s to ~1000 PH/s currently.

- Huobi's hashrate has gone down more dramatically, from around 16 EH/s in early March to around 1160 PH/s currently.

- OKEx's pool started gathering steam again after last year's incidents. Before the China ban news, they had an estimated 1.5 EH/s under management.