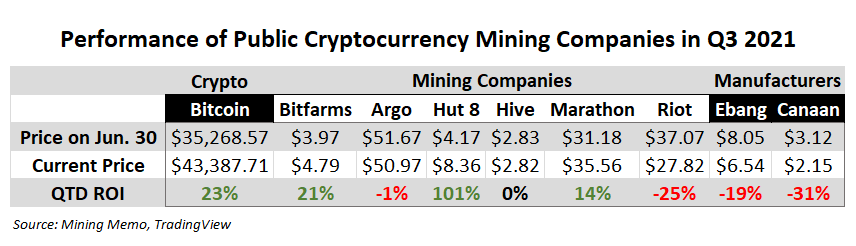

Most public cryptocurrency mining companies are having an extremely underwhelming third quarter as the fiscal year comes to an end and investors prepare for autumn.

- All top mining companies except Hut 8 are underperforming bitcoin this quarter.

- On a percentage basis, Riot dropped nearly as much as bitcoin gained this quarter.

- Manufacturers Ebang and Canaan suffered another quarter of double-digit percentage drops in share prices.

Want more mining insights like this?

Mining stocks are generally viewed as a high beta investment play relative to Bitcoin (and sometimes other leading cryptocurrencies). When bitcoin goes up, mining stocks usually go up more. And when bitcoin drops, the effect reverses. But nearly all top mining stocks failed to outperform bitcoin as it jumped 23% this quarter.

Bitcoin dropped significantly at the start of Q3. And for the past several weeks, the leading cryptocurrency has traded in a range near the low $40,000s. While bitcoin has moved sideways, some mining stocks have seen substantial gains; but most returns are mediocre at best.

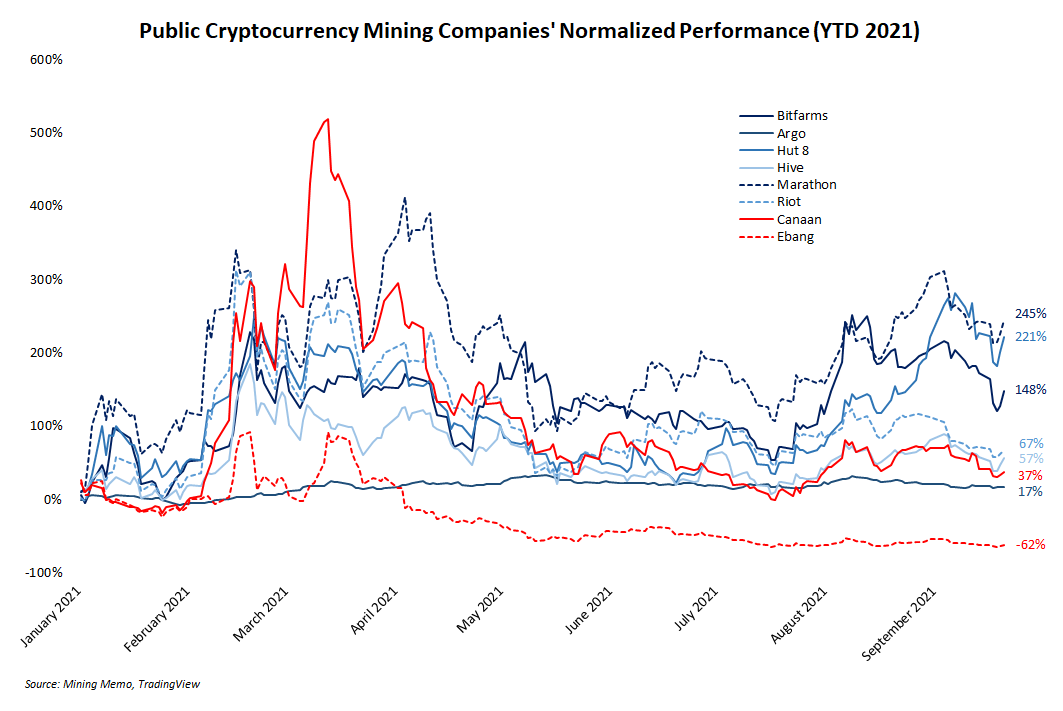

Third quarter returns for mining stocks aren’t representative of the larger year-to-date trend from this sector of traditional equity markets. In 2021, nearly all mining companies have seen double- and/or triple-digit percentage gains in share prices.

Notable outliers are Ebang, which has dropped 62% in 2021, and Argo, which hasn’t even gained 20% this year, a mediocre performance relative to its competitors.

Most bullish cryptocurrency investors expect the fourth quarter to see a sharp upward trend return to the market. If this happens, mining stocks may return to their usual role as high beta plays for bitcoin. If the market turns bearish, mining stocks may drop faster than bitcoin.