Bitcoin mining is still a small industry, and like other sectors in the cryptocurrency space, most players share a familiarity with each other. So, when a new market participant enters the scene, everyone notices. When that new participant starts gobbling up companies and mining assets, everyone really notices.

500 .com is that new participant.

Founded in 2001, 500 .com is an Asia-based public company that offers online gambling services. Over the past three years, the company’s market value dwindled from around $800 million to $115 million in December 2020, according to YCharts.

But in the first two months of 2021, 500 .com reclaimed every bit of that lost ground and then some with its total market capitalization breaking above $1.1 billion in mid-February 2021.

What caused the rebound? Bitcoin mining. But unlike most companies that gradually wade into the often-uncertain waters of industrial-size cryptocurrency operations, 500 .com plunged headfirst.

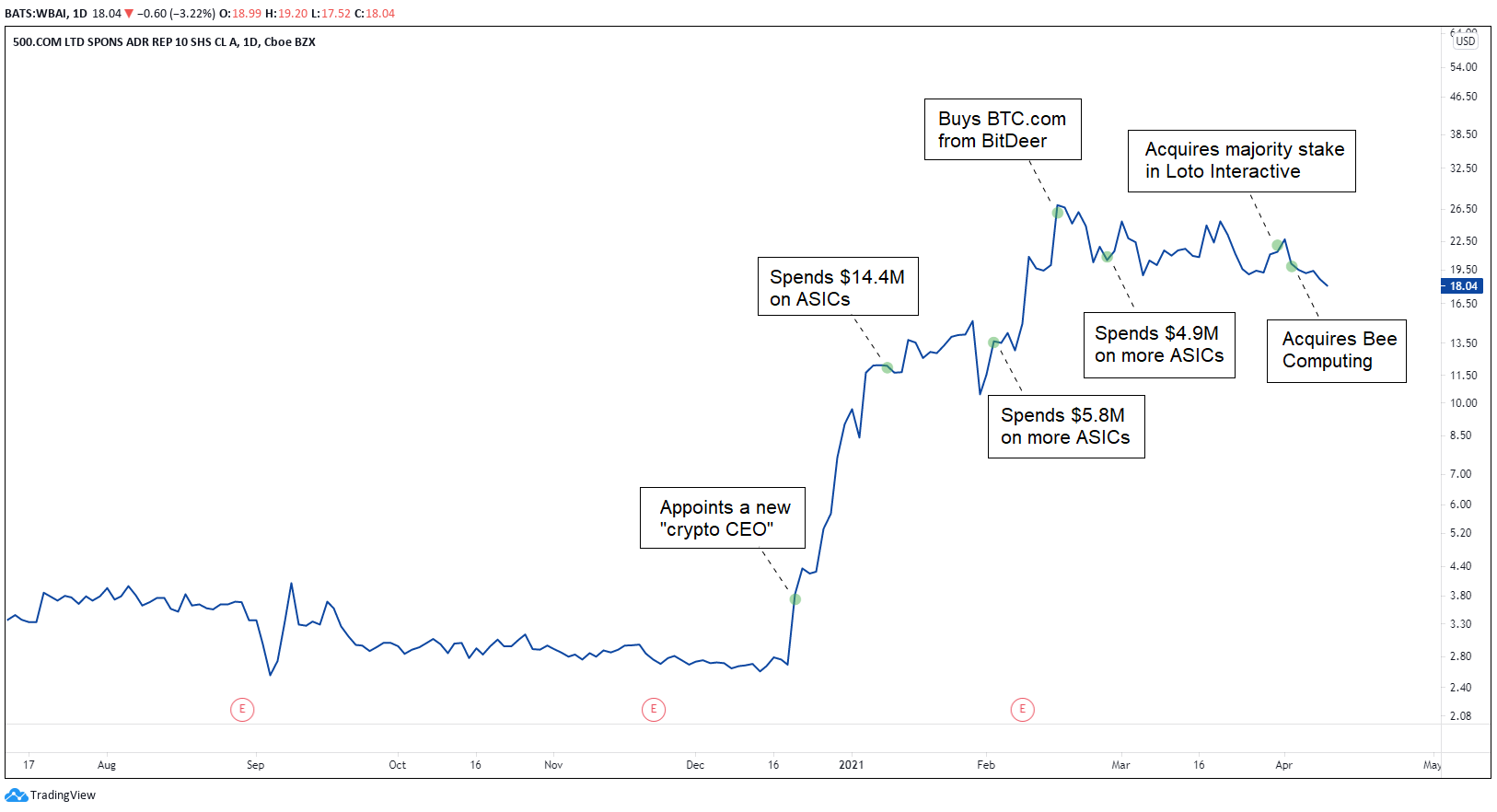

- In December 2020, the company named Xianfeng Yang as its new CEO, noting his “extensive experience” in the cryptocurrency industry. The old CEO stepped down over accusations of bribery.

- In January, the company spent $14.4 million on an undisclosed amount of bitcoin mining machines.

- In February, the company paid another $5.8 million for 5,900 machines.

- Later in February, the company bought the mining pool BTC.com and its assets from BitDeer.

- A week later, the company paid $4.9 million to BitDeer for 1,932 more mining machines.

- In March, the company bought a majority stake (54.3%) in Loto Interactive, which owns and operates three mining farms, for $13.5 million.

- In April, the company acquired mining machine manufacturer Bee Computing.

As the chart below illustrates, shareholders have responded to these decisions positively. Some of the magic seemed to wear off toward the end of the year’s first quarter. But year to date, the re-branded gambling company has almost perfectly matched bitcoin’s performance of roughly 85%.

Aside from its mining buying spree, 500 .com is immersing itself in cryptocurrency in other ways.

- The company received 356 BTC as payment for a private placement deal that also included $11.5 million in cash.

- The company’s website is decked out with cryptocurrency widgets, including real-time pricing for bitcoin and ether and a “Blockchain Zone” featured on its navigation bar.

- The company also relocated from Shenzhen, China to Singapore, a global hub for cryptocurrency firms.

As of February 23, the company also stopped referencing itself in press releases as “an online sports lottery service provider in China,” language it had used for years prior. Instead, it switched to “a China-based enterprise committed to developing cryptocurrency mining businesses.” And after relocating to Singapore, the language was tweaked to: “a leading cryptocurrency mining enterprise.”

In 500 .com’s new business strategy, bitcoin stands front and center.

Want more mining insights like this?

And they’re not alone. A bunch of other conventional businesses with no prior connections to cryptocurrency mining are piling into the sector. Here are just a few:

- The9—a Shanghai-based online game operator—announced its move into mining in January.

- Sino-Global Shipping—a Nasdaq-listed international shipping company—announced its move into mining in February.

- Graystone Company—a longevity, wellness, and fertility company in Florida—announced its move into mining in April.

500 .com stands head and shoulders above these other companies, however, due to the sheer size and pace of its entrance into mining.

So, why bitcoin mining?

The reasons behind 500 .com’s acute interest in bitcoin mining are an open question. Beyond press releases, the company offers almost no insight into its motivations for entering the sector.

A gaming company heavily diversifying into bitcoin mining is a reasonably unexpected business decision. But pairing gambling and cryptocurrency isn’t entirely unorthodox.

Regardless, 500 .com has quickly acquired a formidable portfolio of mining assets, and as an industry player they’re here to stay. What mining assets they’ll buy next is anyone’s guess.