The three largest publicly listed Bitcoin miners – Core Scientific (CORZ), Marathon Digital (MARA) and Riot Blockchain – released facts and figures pertaining to May operations over the last few days. Defined as miners with hashrate in excess of 3.5 EH/s, these three firms are “monster” Bitcoin miners in terms of current and future potential growth.

All three miners have all benefited from the ability to raise significant amounts of capital over the past 18 months to enable their planned growth strategies to be on a much larger scale than the majority of peer miners. And each miner plays a large role in the Bitcoin ecosystem by both securing the network and hodling or selling mined Bitcoin.

Still, what markets see is that being the biggest miner does not necessarily mean the best. Each miner’s share prices have dropped considerably from the November 2021 highs, with MARA down 90%, RIOT losing 88% and CORZ selling off 83%. The table below summarizes May mining activity:

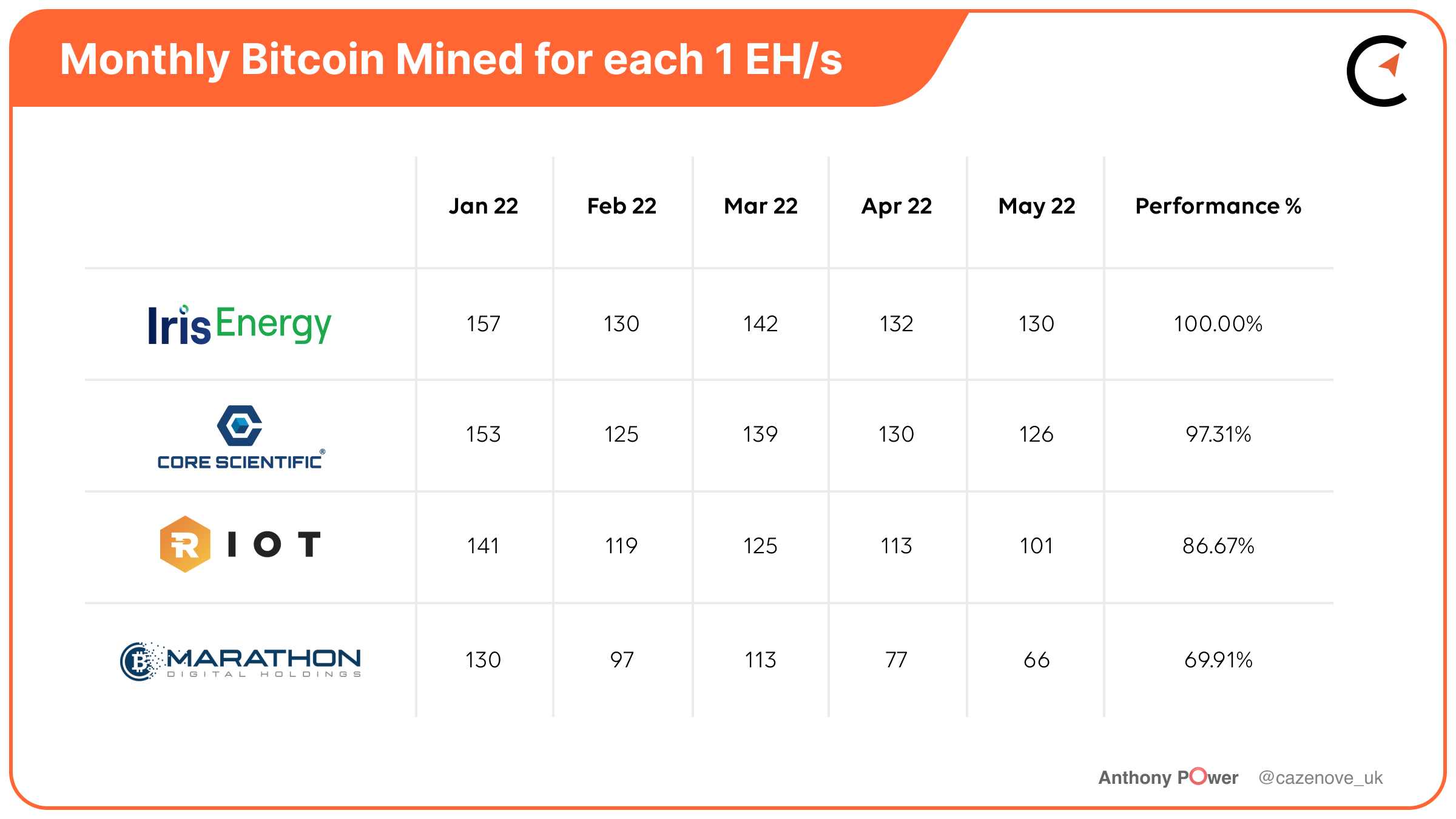

The table below then highlights the year to date production of each of the above miners in comparison to Iris Energy (IREN) who claim to be the top Bitcoin producer year-to-date.

Let’s consider each firm’s update in more detail.

Marathon Digital

Marathon expects all 199,000 miners, producing approximately 23.3 EH/s, to be installed and energized by early 2023. The firm continues to expect its mining operations to be 100% carbon neutral by the end of 2022.

Marathon has not sold any Bitcoin and has increased their total Bitcoin holdings to 9,941 with a market value of $316 million, with additional cash and available credit facilities of approximately $86 million.

Marathon now has 19,000 miners, or approximately 1.9 EH/s, that have been installed and ready for energization at various Compute North locations. An additional 9,000 units, representing 0.9 EH/s, are at Compute North’s first major facility in West Texas.

This first major facility is being completed in four stages. Stage one is already complete. The facility, which is expected to house approximately 68,000 of Marathon’s miners, will be fully constructed with all miners installed by the end of the third quarter of 2022.

The Las Vegas-based firm continues to experience delays in energization at Compute North’s facilities in Texas. Marathon Chairman and CEO Fred Thiel said in the investor note that miners should start to come online in June. Marathon continues to work closely with Compute North to gain more insight into the energy provider’s timeline.

Marathon’s Hardin, Montana site has also negatively impacted Marathon’s bitcoin production over the last 12 months. The firm garnered approximately 47% less Bitcoin in May than what would have been expected based on the network’s hash rate during the month. Marathon believes that their production results will improve over time as they move forward with their deployment plan and energize our miners installed in Texas.

Marathon maintains its growth to 13.3 EH/s by end of Q3 with the Compute North 280 MW facility expected to be fully constructed by the end of the third quarter 2022, housing approximately 68,000 of Marathon’s miners, representing 6.8 EH/s. Based on construction schedules, Compute North has informed Marathon that miners are expected to be installed at this facility as follows:

- June 2022: 19,000 miners (includes the 9,000 miners already installed)

- July 2022: 21,000 miners

- August 2022: 28,000 miners

Riot Blockchain

Riot anticipates a total self-mining hash rate capacity of approximately 12.6 EH/s, assuming full deployment of approximately 116,150 Antminer ASICs by the end of January 2023. This hashrate does not include any of the potential benefits of the 200 megawatts (MW) of infrastructure utilizing immersion cooled tech. The company currently also provides hosting facilities of 200 MW of institutional Bitcoin mining clients.

In terms of Bitcoin hodl, Riot holds approximately 6,536 Bitcoin, all produced from self-mining operations. Riot did sell 250 Bitcoin in May, or approximately $7.5 million. A number of miners also sold their Bitcoin in May, to help cover their operational and capital requirements.

Riot has continued to make progress on the ongoing expansion of their Whinstone Facility in Rockdale, Texas, and have reported that their immersion building is now filled with approximately 23,000 S19 series miners, 7,000 of which are staged in the immersion-cooling tanks and are anticipated to be deployed pending installation of the final requisite components, providing and increase in hashrate to 5.4 EH/s.

Riot also confirmed that they are refurbishing their fleet of S17-Pro Antminers to improve their overall hash rate and efficiency, and have been temporarily decommissioned and therefore the hashrate of 225 PH/s is no longer counted towards their hashrate capacity figure. To offset this figure, Riot received an additional 1,701 new S19j Pros, deployed approximately 1,086 S19j Pros in its immersion-cooled building with an additional 7,855 miners staged for deployment. The company expects to have a total of 51,313 miners deployed with a hashrate capacity of approximately 5.4 EH/s.

Core Scientific

Core Scientific currently operates over 170,000 owned and colocated ASICs servers in the Company’s five data centers, and produced 1,138 self mined Bitcoin, more than any public company in North America last month. As well as increasing their self-mined hashrate by 300 PH/s to 9.2 EH/s, they also provide data center colocation services, technology and operating support for a growing, diverse group of customers representing 7.9 EH/s. The miner lowered its 2022 hashrate guidance to 30-32 EH/s from its previous outlook of 40-42 EH/s, and now sees total power of about 1 gigawatt versus previous guidance of between 1.2 and 1.3 gigawatt (GW).

“Our scale and balance sheet provide the flexibility to continue to invest in our growth and pursue opportunities that may arise from the recent market and industry dislocation,” Core Scientific Chief Executive Officer Mike Levitt said in a release.

During the month, the Austin- based firm powered-down a portion of its data center operations in Texas on 13 occasions for a total of 1,218 megawatt hours. This is a common occurrence with all miners who continue to work with the communities and utility companies in which they operate to enable and ensure electrical grid stability.

Earlier in May, Levitt said the company is not interested in issuing equity at these market conditions and may sell some of its mined coins this year.

“We will continue to do everything in our power to maintain a stable strong financial position and continue to invest in our growth,” Levitt said. “We currently hold over 10,000 self-mined Bitcoins. That said, we have sold digital assets this year and we expect that will continue to be the case,” he added.

As at the end of May the company held 8,058 bitcoins produced from operations, having sold 2,698 Bitcoin, in month.

Notably, Core Scientific co-founder and co-chairman Darin Feinstein made the following stock trades during the last month:

- On Tuesday, May 31st, Feinstein sold 1,124,147 shares of Core Scientific stock, at an average price of 3.65, for a total value of $4,103,136.55.

- On Friday, May 27th, Feinstein sold 450,000 shares of Core Scientific stock, at an average price of 3.70, for a total value of $1,665,000.00.

- On Thursday, June 2nd, Feinstein sold 500,000 shares of Core Scientific stock, at an average price of 3.07, for a total value of $1,535,000.00.

- On Thursday, June 2nd, Feinstein sold 2,909,679 shares of Core Scientific stock, at an average price of 3.07, for a total value of $7,797,940.00.

Following these transactions, Feinstein currently owns 30,483,592 shares in the company.

Closing thoughts

Each miner listed above operates one of the largest mining operations in the world, each with its own upsides and tradeoffs. For Marathon, significant issues with their Hardin site and the decision to relocate to other sites caused severe underperformance against other miners but gave them the ability to be “carbon free” by the end of the year. Riot had had issues with the curtailment of power at their Whinstone facility and also problems with their S17 miners. However, their 200 MW immersion cooling facility is currently going live and the potential benefits have not been included in any forecasts. And Core Scientific refuses to slow down from its first place position with some 17 EH/s of self-mined and hosting services.

All three have impressive growth strategies to meet in the next six-nine months. Given changes in the macro-environment, the next few months could push any of these miners to make sizable moves to capitalize on their size. Be on the watchout for buyouts of smaller miners, new facility launches or further capital raises.

Disclaimer: This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any investment or to adopt any investment strategy. This information is for educational purposes only and is as of the date of that particular presentation. Compass does not guarantee profits from mining activity. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a mining product, service or strategy. Changes in the rates of exchange of cryptocurrencies, hashrate, difficulty, network transaction fees, hosting and other fees may cause the efficiency and returns of mining to diminish or increase. Individuals are responsible for their own decisions regarding cryptocurrency mining, including all financial and operational risks.