Ethereum is inching toward the Eth 2.0 finish line this coming spring. And with it comes a multitude of concerns Ethereum’s users have merely speculated about over the previous 6 years.

One problem top of mind for Ethereum miners going into The Merge? Not getting rug pulled by Ethereum pool operators beforehand.

Want more mining insights like this?

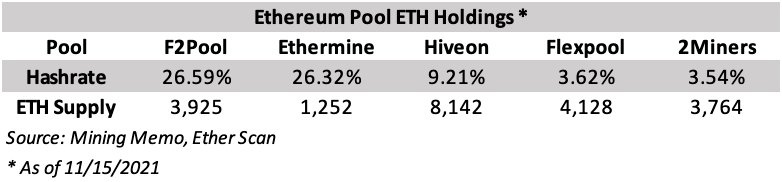

Some 150,000 ETH worth $675 million currently resides in Ethereum mining pool wallets, ready for distribution to Ethereum miners. The number is fairly small compared to active miner wallets, holding about 23 million ETH worth an estimated $103 billion.

Ethereum mining – and therefore pool services – won’t exist after The Merge. The hundreds of thousands of graphics cards will have to find new employment, such as for-rent- computation. Of course, many pools will migrate to new services, such as staking.

Come Merge time, pool subscribers will find themselves on the wrong end of an agency problem: a pool could easily withhold a portion of mined ETH from its clients and simply disappear.

In order to protect themselves, Ethereum miners should be cautious of who they work with ahead of The Merge:

- Mine with pools that have established business lines after The Merge.

- Mine with pools that have physical addresses and community reputations.

- Automate withdrawal requests ahead of time.

Miners received a sneak peek of how quickly a pool service can disband this past September with the closure of SparkPool. The pool closed shop in one week due to Chinese regulatory pressure. Luckily, SparkPool was a good community actor and distributed its held pool funds.

Still, operations security is only as good as its weakest link. Pools remain centralized parties and should be treated as such going into an event like The Merge.